What You Should Know

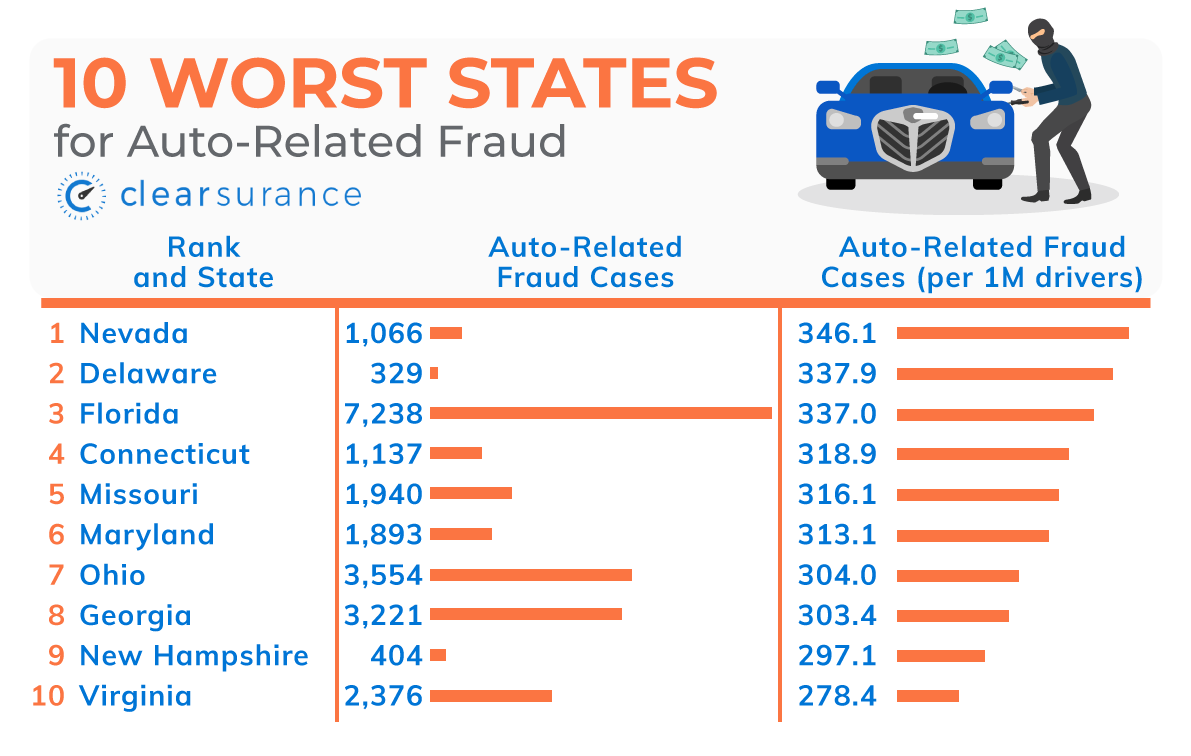

- The 10 top states for auto-related fraud average 315 cases per one million residents

- Many cases of auto-related fraud involve dishonest business practices scamming customers

- The leading businesses behind auto-related deceptive practices and scams are auto maintenance shops, service contracts, and auto dealers

The last thing you want is to be scammed into purchasing a lemon or signing a lease with undisclosed charges when buying a car. However, if you live in one of the worst states for auto-related fraud, you are at risk of being scammed when buying a car or having it repaired.

Even if you know how to get cheap car insurance to save on repairs or a new car, the money saved still might not cover the exorbitant charges a car repair shop might tack onto your bill. To avoid being scammed or falling victim to fraud, it's essential to familiarize yourself with common scams.

That's why in this article, we will cover the following topics in addition to the worst states for car-related fraud:

- Auto fraud and scams in America

- Advice from the experts

- Frequently asked questions

Before you learn about fraud, use our free car insurance comparison tool below to start saving on your insurance.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

If you are ready to find out what the top scamming states are for vehicle fraud, read on.

States with the Most Vehicle Fraud and Scams

Our team of researchers used data from the Federal Trade Commission (FTC) to discover what states had issues with car-related scams and fraud.

Calculating the total number of cases from the percentages given, our researchers then divided the resulting numbers by the number of residents from the Census Bureau to find the rate per one million residents. You can see the final results in the graphic below.

So what are auto-related cases? While not always hard fraud, many auto-related complaints are about soft fraud cases, such as scams and dishonest business practices.

The FTC defines auto-related cases in its data study as the following:

“Misleading or deceptive claims regarding auto prices, financing, leasing or warranties; repair/maintenance issues with newly purchased used or new cars, including dissatisfaction with service provided by auto mechanics; price fixing and price gouging concerns against gas stations and oil companies; etc.”

Many of the things on this list count as deliberate scams, which means these complaints could be filed for unfair and deceptive business acts and practices. While there are laws protecting consumers, consumers aren't always aware they are being scammed.

That's why after we go more in-depth into the states with the most auto-related fraud, we are going to go over common scams and what you can do to protect yourself when buying or repairing a car.

#10 – Virginia

- Annual Auto Fraud Cases: 2,376

- Auto Fraud Cases Per 1M Residents: 278.4

Number 10 on our list is Virginia, with a total of 278 auto-related cases per one million residents. Auto-related fraud and scam cases make up 3% of total fraud cases in Virginia.

Since the majority of fraud cases are identity theft or imposter scams in each state, 3% is a significant percentage of auto-related cases for a state.

#9 – New Hampshire

- Annual Auto Fraud Cases: 404

- Auto Fraud Cases Per 1M Residents: 297.1

New Hampshire has a total of 297 auto-related cases per one million residents, placing it as 9th on our ranking of the worst states for car fraud. While there were only 404 auto-related cases, they made up 4% of total fraud cases in New Hampshire.

#8 – Georgia

- Annual Auto Fraud Cases: 3,221

- Auto Fraud Cases Per 1M Residents: 303.4

The state of Georgia had over 3,200 auto-related cases, making up 3% of total fraud cases in the state. With so many drivers being scammed, it's no surprise that there is a total of 303 auto-related fraud cases for every one million Georgia residents.

Even if Georgia didn't have a high scam rate, it's still important to have the best car insurance in Georgia to cover any pricy auto shop charges.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

#7 – Ohio

- Annual Auto Fraud Cases: 3,554

- Auto Fraud Cases Per 1M Residents: 304.0

Ohio has a total of 304 auto-related cases per one million Ohio residents, which places it as No. 7 in America. With 3,554 cases making up 4% of fraud cases, Ohio residents need to be careful when buying cars and visiting auto shops.

#6 – Maryland

- Annual Auto Fraud Cases: 1,893

- Auto Fraud Cases Per 1M Residents: 313.1

Maryland has 313 auto-related cases per one million Maryland residents. This number placed the state rank as 6th in America for auto-related fraud and scams.

To protect yourself from high auto repair bills, make sure you have good Maryland car insurance coverage and vet auto repair shops before bringing your car in.

#5 – Missouri

- Annual Auto Fraud Cases: 1,940

- Auto Fraud Cases Per 1M Residents: 316.1

Missouri ranks as 5th in America for auto-related scam cases. With almost two thousand auto fraud cases in a year, Missouri had a total of 316 auto-related cases per one million residents.

This is a high rate of auto-fraud cases, so drivers in Missouri should make sure to familiarize themselves with warranties and leases at dealerships before signing.

#4 – Connecticut

- Annual Auto Fraud Cases: 1,137

- Auto Fraud Cases Per 1M Residents: 318.9

Connecticut drivers should make sure they are reading the fine print or leases and auto-shop bills, as there is a total of 319 auto-related cases per one million Connecticut residents. With over a thousand reports of possible auto-related fraud, Connecticut ranks as No. 4 on our list.

#3 – Florida

- Annual Auto Fraud Cases: 7,238

- Auto Fraud Cases Per 1M Residents: 337.0

Florida drivers have more to watch out for than just alligators crossing the road. Drivers need to be aware of scams that might happen at their local dealerships or auto repair shops.

With over seven thousand auto-related cases in just one year, there are plenty of scam artists waiting to take advantage of Florida drivers. Per just one million Florida residents, there are 337 auto-related cases of fraud.

Watch out for fraud, regardless of the vehicle you drive. Owners of RVs can encounter fraud as well. Even if you rent an RV in Florida and need emergency repairs or help, being scammed is possible. Make sure to talk with your RV rental organization — regardless of whether you rent from RV rental companies vs. marketplaces — to see what insurance coverages they offer to keep you covered in case of fraud.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

#2 – Delaware

- Annual Auto Fraud Cases: 329

- Auto Fraud Cases Per 1M Residents: 337.9

Delaware comes in at 2nd with an average of 338 auto-related fraud cases per one million residents. Because Delaware is such a tiny state, these many auto-related cases mean that residents should take the time to background check dealerships.

Hopefully, most of these complaints are related to just a few auto shops and dealerships, not the majority in Delaware.

#1 – Nevada

- Annual Auto Fraud Cases: 1,066

- Auto Fraud Cases Per 1M Residents: 346.1

The state of Nevada ranks as No. 1 on our list of the worst states for vehicle-related fraud. With almost 350 cases of auto-related fraud per one million Nevada residents, Nevada has quite a few scammers.

Nevada drivers should keep this in mind when leasing new cars or getting car repairs. Check reviews and recommendations before visiting a dealership or auto repair shop, and always read what you are signing.

Beware! Auto Fraud and Scams Across America

Auto fraud and scams happen all across America, not just in the 10 worst states for auto fraud. In 2020, there was an estimated 2,670,873 auto cases related to fraud and scams in America.

How are drivers scammed out of their hard-earned money? Take a look at the graphic below to see the most common types of scams that drivers fall victim to every year.

The two most likely ways that drivers get scammed are through auto repair shops or car dealerships. Unless you are a savvy mechanic or lease expert, it is easy for scammers to slip in confusing technology to add on fraudulent charges.

For example, most car manufacturers do the vehicle prep work of preparing a car for sale, such as performing road tests, vacuuming and washing the car, and removing protective plastic. The cost of the service is usually included in the price of the car, but some dishonest dealerships will charge for this service as if they did it themselves.

While this isn't illegal, it's not a great sign that a dealership is charging a customer twice for a service. Unless you can be sure that a dealership did the prep work themselves, you might want to consider buying a car elsewhere if you see this charge tacked onto your bill.

The best way to avoid being scammed is to do your research beforehand. Read reviews and ratings to see what other customers think about a company's service and prices, or check Better Business Bureau (BBB) ratings if available.

If an auto shop or dealership has any history of hiking up prices or fraudulent dealings, doing a bit of research beforehand will usually reveal this. It's also prudent to familiarize yourself with the financial aspects, such as fair interest rates and terminology.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Avoiding Fraud at Auto Repair Shops and Dealerships

To help you feel confident when shopping for a car or visiting a mechanic, we collected advice from various experts. Read on for tips from automotive experts to insurance providers and from founders of vehicle valuation companies to owners of car-buying apps.

"Mileage fraud is probably the most common scam. To prevent mileage fraud, it is extremely important to know the actual odometer readings on your vehicle and check that it was not rollbacked. This is a critical thing to do when choosing your next car. Unspotted mileage fraud can result in unpredictable running and maintenance costs.

It is likely that a buyer of such a car will inevitably have issues with reliability. Also, based on the latest studies, an average of 16.6% of cars have a rolled mileage. Moreover, the studies show that a rolled mileage can inflate the car’s value by 25%. That’s why it’s always important to check the car’s history before buying it.

Hidden defects are also a common scam. For example, the car can be damaged and repaired, and the seller won’t say a thing about it, but a car history report can show the truth.

Sometimes drivers try to sell a stolen car, so it’s always important to investigate the car and check the paperwork. In addition, some cars were used as taxis or rental cars, but sellers dishonestly hide this information.

There are many other scams. Some criminals claim there is too much interest in the car from various buyers and may demand payment upfront, just to keep the car for that particular buyer. They usually disappear after the advance payment.

There are other schemes to steal money without even having a real car, so it’s important to keep an eye on that also. Prevention technology is advancing, but so are the crooks."

Matas Buzelis is an automotive expert at CarVertical.

CarVertical provides detailed car history reports via VIN lookup.

What should new owners of used or new cars check to ensure there are no repair or maintenance issues being hidden from them?

“Look at the vehicle’s odometer to get a general understanding of the vehicle’s wear. If the odometer reading is low, you should expect little wear and tear. You should also make sure no one has tampered with the odometer reading.

Turn everything on and off to make sure it works. Pay attention to the air conditioner, defroster, heater, lights, power door locks, seats, turn signals, and windows. You often use these components, and if they don’t work, they can be pricey to repair.

It is crucial to look for dirt, mud, or rust underneath carpet or seats, as those could be signs of flood damage. Flood damage should be avoided, as it could lead to other problems with car parts and electronics.”

How can drivers make sure they are getting a fair price for auto mechanic services?

“An honest mechanic will generally be eager to provide an estimate or guarantee of their work. Use the quotes or written contracts to shop around, but understand you’re paying more for parts and the work. You should also trust the competency and professionalism of the mechanic.

Shop through your auto insurance company’s direct repair program or network. A direct repair program is a group of repair shops and dealerships that work with your insurance company to provide a higher level of service. They are often heavily vetted by insurance companies and may also see a lot of repairs.”

What are some of the main scams to watch out for when buying a car?

“When buying a used car at a dealership or online, pay attention to any add-ons or additional fees. Often, you don’t need the add-ons and may pay too much as a result.”

What are some of the main scams to watch out for when getting a car repaired?

“Be skeptical if your repair shop is unwilling to provide a written contract or warranty on parts they install.

Make sure previous mechanics completed repairs or installed replacement parts correctly. Most major car parts, such as bumpers, doors, or fenders are labeled with the car’s VIN. The VIN listed on the sticker should match all the other parts and the VIN of the car you’re purchasing. Replacements will typically be labeled with the letter R.”

What should drivers do if an auto repair shop or dealership has scammed them? To whom should drivers report the possible scam?

“If you have a warranty issue, check to see if the car manufacturer backs the warranty. If so, you can work with the car manufacturer instead of the repair shop or dealership. They may also be able to resolve some disputes or issues."

Rick Chen is the spokesperson for Metromile.

Metromile is a pay-per-mile auto insurance provider.

“When in doubt about whether you really need a certain maintenance issue performed on your vehicle, check the owner manual. It should spell out exactly how often services are required on your car.

Ask for an itemized quote of services, then do your research. Look up how much those services typically cost for the type of vehicle you brought in. I’ve found auto repair forums and car forums to be pretty useful on this front.

When you’re buying a car online, you need to be extremely cautious about internet scammers who try to get your money before you’ve seen the car in person.

Watch out for 'sellers' who give you a sob story about how they have to sell their vehicle immediately to pay an expense and offer you a mind-blowing rate to take it immediately.

Listen to your gut: if it’s too good a price to be true, then it probably is. Always make sure you see the car and give it a test drive before you commit to purchasing it.

A common scam employed by untrustworthy auto repair shops is to sell you used replacement parts that are priced as if they are new. You should always ask to see the part yourself so you can inspect it and ensure you’re getting what you’re paying for.

If you end up falling for a scam, try filing a claim with the FTC or your state’s consumer protection bureau. Make sure you have documentation of all the exchanges, with photos if possible.”

Daivat Dholakia is the Director of Operations at Force by Mojio.

Force by Mojio provides GPS fleet tracking for small businesses.

“Most people are familiar with CarFax, which is a database that dealers and the public use to identify accidents that get reported as insurance claims. However, fraud is still a widespread issue for car buyers and owners. In addition to CarFax, there are a few resources and things to remember that will keep you from getting scammed.

In 2005, the National Insurance Crime Bureau created a database that identified vehicles that have been totaled as the result of a flood. These vehicles should have the words 'flood vehicle' on the title, but dishonest sellers would frequently go to states with very relaxed title regulations and 'wash' the title.

In some states, you could ‘lose’ the title and simply re-apply for another. The new title would not have the designation of a 'flood vehicle' on it. Thankfully, you can now search any VIN# in VINcheck and determine if it was totaled in a flood.

In addition to VINcheck, there is also a National Motor Vehicle Title Information System, which is a database that requires salvage operators and insurance companies to report total losses.

As of November ‘19, the system had records for 96% of vehicles in the U.S. (according to the Federal Highway Administration).

Currently, 46 states participate in this system, according to the Insurance Information Institute.

One other source of potential fraud is the repair shops. Most insurance companies will allow you to use the repair shop of your choice if you are in an accident, but if you don’t use someone on their list, there is a higher likelihood that the repair garage may inflate the cost of the accident, which can increase your rates.

Using shops on your insurance company’s preferred vendor list helps keep the repair shops accountable since they stand to lose a lot of business if they are dishonest about a claim and are no longer in good standing with that insurer.

If you think your repair shop has overcharged for your claim, you should report it to your insurance company immediately. Insurance companies pay for the overwhelming majority of auto repairs, and even though they are the ones that cut the check, fraud hurts all of the customers in the form of higher premiums due to higher claims payouts.”

B. Shane Page is the president of Piedmont Insurance Associates.

He’s also the Chief Strategy Officer at Smart Insurance Services.

“When the car salesperson introduces you to the finance/business manager to do the paperwork, they’re introducing you to the money-extracting machine of the car dealerships and this person is not just going to tally up everything and send you on your merry way in a hurry!

Get comfortable, because this person is going to try and sell you everything from the Brooklyn Bridge to warranties that cover absolutely nothing along with the window etching, pinstriping, rust-proofing, paint sealant, etc., that will only end up siphoning all the money out of your wallet.

This is where the most money is made on just about every deal. Don't be pressured into something you’re not certain you will need. Before you know it, your car payment can quickly turn into a mortgage payment.

These finance people all work on commission and to make their quota they must sell on average $900 to $1,200 in accessories, as well as bump up your interest rate to total somewhere around $3,000 in extra profit. So guess why it takes so long to sign everything. They must go through their mandatory pitch.

They will try to make it sound like if you don’t take these coverages, you may be at risk of forking out thousands of dollars if something goes wrong.

Another way they try to convince you is to tell you, ‘You don’t have to pay for it all upfront. You can conveniently put it in your monthly payment to spread out the cost for only a few dollars more.’

This is when they jack up the cost without you knowing, in some cases making you pay almost double! Save yourself some time and money. If you really want these extras, you can easily buy them on the outside for a fraction of the cost.

Price is always key to buying a car, but if you don't have to know how to go about it the right way it's very easy for car dealers to steer you in the wrong direction.

Buyers should use tools that help them uncover the TIP or True Invoice Price, rates, and hidden incentives dealers try not to disclose. These amounts can save buyers hundreds to thousands of dollars below the actual invoice price.

Here are some fake fees that often get added unnecessarily to car transactions:

- Documentation fees $100 to $800+

- Processing fees $200 to $700+

- Delivery fees $300 to $1,000+

- Destination fees $500 to $1,300+

In addition, high interest rates can also be a scam, forcing you to pay more for your car than it is worth.”

Paul Maloney owns the car buyer’s advocate, Car Leasing Concierge.

His site offers a DIY app, true invoice pricing, and auto buying & leasing experts.

“Try not to assume the worst of a new mechanic. Dishonesty is not exclusive to the car repair industry, nor is it the norm. It’s good to be cautious when you take your car into a shop, but it’s also important not to be overly defensive.

Even with something as simple as an oil change, most shops will probably do a quick inspection of your entire vehicle to see if there’s any other maintenance that needs attention.

Of course, additional maintenance means more money for the mechanic, but this overall inspection is generally considered to be a courtesy to the car owner and most mechanics would never recommend services that aren’t needed.

If you’re ever concerned about whether the recommended service is really needed, you can always ask to see the issue. An honest mechanic will be more than happy to take you to your vehicle and point out and explain the evidence of the issue.

Pay attention to their body language here. If a mechanic begins to make excuses and claim for any reason that they can’t show you what they’re seeing on your vehicle, that may be an indication that they’re suggesting unnecessary repairs.

If your mechanic freezes up, avoids eye contact, or shuffles their feet, you might want to take your vehicle somewhere else for a second opinion at the very least. But you won’t always be present at the shop when your vehicle has been diagnosed. If you get a call describing the problem, you can always ask for an estimate of cost before they start the work.

If you’d like to take the time to google the average cost of this repair before giving an answer, you can do that. But keep in mind, mechanics are busy and the shop is likely trying to move cars in and out as quickly as possible, so try not to keep them waiting too long.”

Jake McKenzie is the Content Manager at Auto Accessories Garage.

This family-owned business sells automotive parts and accessories.

"Buying a used car has a lot of information asymmetry, meaning that the seller has all the information and the buyer has limited information. There are numerous things car buyers can look into to learn more about the used car to make a better buying decision.

Some ways to make sure you are making a quality purchase include buying Certified Pre-Owned (CPO) used cars from dealerships or getting a mechanic to inspect your vehicle.

Used car buyers have a plethora of options in 2021, and you can use the tried and true Carfax reports, which give a high-level overview of the accident history of a vehicle, or even newer reports like Keemut, which automatically pulls data from vehicles for sale.

Aside from the reports, having a mechanic inspect a used car is a good option to get an understanding of the current condition. Make sure that the mechanic uses an OBD reader which gives the engine codes to find any engine-related issues.

To ensure that the mechanic is reputable, buyers can review shops at RepairPal.com and get information on pricing and more.

If you have to get a vehicle repaired, some of the common scams are parts replacement, overcharging, and charging for work not done. Parts replacement is common for shops that are doing work on common cars, where they can swap parts such as headlights, tires, or other high replaceable parts.

Manufacturers will post the recommended maintenance hours for any job which are published in repair manuals like Chilton’s and dealership manuals. Ask for the recommended hours for each job. If the repair shop does not provide this information, you can easily find it online.

To avoid being charged for work that is not done, ask for the original parts. Make the request in writing in the initial quote job paperwork so it can be referenced at the end of the job. If this is too much of a hassle, a Certified Pre-Owned (CPO) purchase may be the best option.”

Faheem Gill is the co-founder of Keemut.com, a vehicle valuation company.

He is an automotive executive, inventor, and mobility speaker.

Frequently Asked Questions: Car Theft, Purchases, and Repairs

When it comes to car fraud and scams, a lot of people have questions about stolen vehicles. After all, a customer may unwittingly buy a stolen car or a car with stolen parts. Read on to see what the most common questions are about car fraud and stolen vehicles.

#1 – What state has the most stolen vehicles?

California. As one of the largest states in America, it makes sense that California has the most stolen vehicles. With so many drivers in California, there are plenty of cars for thieves to snatch.

#2 – What city in the US has the highest rate of car theft?

What city has the most carjackings? In our study of the 10 most stolen cars in America, we found that the metropolitan area with the highest rate of car theft was Albuquerque, New Mexico.

#3 – How many days do you have to cancel a car purchase?

You should always check the contract you sign, as it will state how many days you have to return the vehicle if there's a major issue (usually 2-3). You may have to pay extra to add this return period to your contract.

Asking about the car's return policy is vital, as a car starts losing value the instant you drive it off the lot. If you miss the return window, the car will be worth less than what you bought it for.

#4 – Why do car dealers rip you off?

Car dealers try to rip customers off to earn more in profits. They may try to pressure you into buying unnecessary services or signing up for a high interest rate. It's important to remember there are plenty of cars and plenty of dealerships that have better prices.

If you feel pressured, walk away, especially if you live in one of the most scammed states in America.

#5 – Can you sue an auto repair shop?

You can sue an auto repair shop if the work they did was defective and caused injury to you or other people. It is best to talk to a lawyer to see if you have a case before embroiling yourself in suing an auto repair shop.

Methodology: Finding the Worst States for Vehicle Fraud

To find the states with the most vehicle-related fraud, our team of researchers looked at 2020 FTC data released in 2021.

Since the FTC only listed percentages, not the exact number of auto-related fraud cases by state, our team calculated the number from the listed percentage and the total number of fraud cases for each state. This allowed us to get an accurate number of auto-fraud cases for each state rather than using percentages.

Because larger states with more residents will naturally consistently rank first as the worst states for auto fraud, our team pulled resident data from the United States Census Bureau to calculate the rate of auto-related cases per one million residents. This allowed for a more accurate depiction of which states have the highest rate of auto-related scams.

Regardless of where you live, it's essential to keep an eye out for suspiciously high pricing and shady contracts. If something seems off to you, don't use the shop or buy the car. It's better to have to spend some more time shopping around than being scammed out of your hard-earned money.

Now that you've learned about auto fraud in the United States, compare car insurance quotes to find the best option for the cheapest price. Enter your ZIP code into our free comparison tool below.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

References:

Image source: David Tadevosian/ shutterstock.com