If you know what to do if your California home insurance is canceled, you can quickly get another policy. Start by getting quotes and asking for recommendations from neighbors and the state Department of Insurance. As a last resort, you can get coverage through the California FAIR plan.

With more destructive wildfires, it’s likely more California homeowners policies could be dropped by their insurance provider. In areas prone to wildfires in California, your home insurance company will likely either increase your home insurance rates when it comes time for you to renew or not renew your policy.

If your California homeowners insurance cancels you, find out how to shop for home insurance in California. Don't leave yourself unprotected. Shop for California home insurance today with our free quote tool.

What You Should Know

- Step #1: Get California Home Insurance Quotes – Other CA Companies May Insure You

- Step #2: Ask Neighbors for Recommendations – See Who Insures Your Neighbors

- Step #3: Contact California Department of Insurance – Ask for Assistance

- Step #4: Purchase FAIR Insurance if Necessary – California FAIR Plan Insure Homes

4 Steps to Follow if Your California Home Insurance is Canceled

It can be difficult for California homeowners to find home insurance in areas at risk of wildfires and other natural disasters. What can you do if your home insurance company drops you? If your California home insurance company has dropped you, you’ll need to start looking for new coverage online ASAP to avoid being uninsured.

Read More: Homeowners Insurance Companies With the Best Buying Process

If you have a mortgage contract, your mortgage company requires homeowners coverage and will not accept insurance cancellation as a valid reason for your home to be uninsured.

Read on for the four things you can do if your California homeowners company has canceled your policy.

Step #1: Get California Home Insurance Quotes

If you’ve received a notice of cancellation or nonrenewal notice by your homeowners insurance company in California because of the wildfire risk in your area, you may be able to find another company to insure you. All insurance companies have different standards to determine who to insure.

To start, go through our list of the cheapest and best homeowners insurance in California, as rated by customers, to find the best companies according to consumers and get quotes.

Make sure you try to get quotes from many different companies. Home insurance rates in areas of high fire risk are pricey, so this can help you find the best price for your policy. If you previously used a home insurance agent, you can see if your agent can help you get quotes.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Step #2: Ask Neighbors for Recommendations

You can turn to your neighbors and others who live in your area to see which home insurance company they have to protect their home. See if they’ve been dropped by their insurance company or if they’ve had luck with any company in particular. This can help you find a home insurance company that may be able to cover your home despite your risk.

You can also ask neighbors what home insurance agent they use and find out if the agent was an expert in finding policies for your specific risk.

Step #3: Contact California Department of Insurance

The California Department of Insurance can provide you with insurance help and resources. The department may be able to provide you with a list of insurance companies that sell policies in your area or offer you information about other options for high-risk homeowners that live in wildfire risk areas.

You can call the California Department of Insurance at 1-800-927-4357. Contact them as soon as possible for assistance with finding a new provider.

Step #4: Purchase FAIR Insurance if Necessary

The California FAIR plan is a last resort for California homeowners who need insurance. It stands for California’s Fair Access Insurance Requirements plan. If you’re unable to get insurance from the voluntary insurance market in California, you can get home insurance through the FAIR plan.

The FAIR plan is an insurance pool. It covers damage to your home caused by fire, riot and windstorm.

California FAIR Plan does not cover personal liability, theft, flood, earthquake, hail or vandalism, so you won’t have the same level of coverage as your previous insurance. In California, FAIR plan insurance covers damage and destruction from brush fires.

Before you try to get coverage with the FAIR plan, make sure you’ve tried to get home insurance quotes from many California private homeowners insurance companies. Once you’ve exhausted all other options, you can apply for homeowners insurance through the FAIR plan. Make sure you meet the submission guidelines before applying.

There are requirements in order to get insurance through the FAIR plan. You may be asked to make improvements to your home to better protect it from fire, theft, water damage or more. Some examples include updating your electrical wiring or repairing your roof.

Learn More: Home Improvement Projects and Your Homeowners Insurance Policy

If you end up getting coverage from the California FAIR Plan, you should shop again in six months to see if you can secure coverage in the voluntary market. You’ll have limited coverage and higher insurance rates with the California FAIR Plan, so it's best to switch to a private insurer as soon as possible.

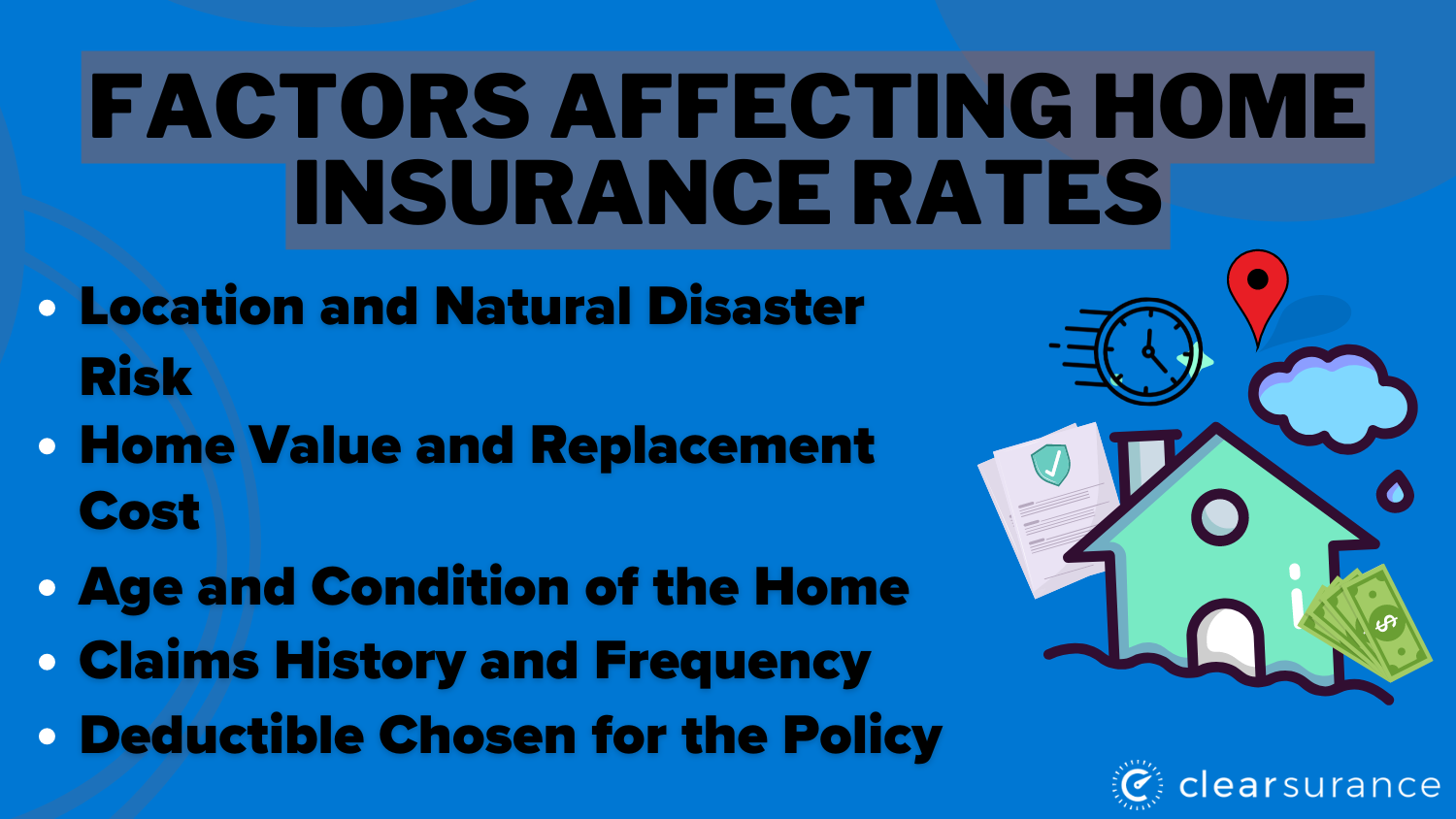

Cost of California Home Insurance

When shopping for California home insurance policies, you can expect to pay a bit more due to the increased risk of fire damage, which is a major factor affecting your home insurance rates.

Average monthly home insurance costs at popular California home insurance companies are listed below.

| Insurance Company | Monthly Rates |

|---|---|

|

$130 |

| $105 | |

| $115 | |

|

$120 |

| $95 | |

|

$98 |

| $102 | |

| $110 | |

|

$125 |

| $85 |

USAA will have the cheapest home insurance rates for California homeowners, but you won't be able to get coverage unless you are a veteran or active military member. Other popular choices with lower rates are Nationwide and Mercury.

Learn More: Top 3 Ways Customers Say They’ve Saved on Homeowners Insurance

If you live in a higher risk area in California, though, you may have to go with a more expensive choice, as not all companies may be willing to insure your home.

California Home Insurance Laws

Living in a high risk area is one of the main reasons homeowners insurance companies drop policyholders from coverage. But there are still California insurance cancellation laws that companies have to follow before they cancel your coverage in California.

Gov. Gavin Newsom signed legislation into law that requires California homeowners insurance companies to give 75 days notice of non-renewals, rather than 45 days that went into effect on July 1, 2020.

While home insurance cancellation laws by state vary by state, California insurance companies have a two year moratorium against canceling policyholders after a disaster, including a wildfire. This means that your insurance company can’t drop you after a covered loss for two years after it happened.

So if you filed a claim for your roof after a fire, you won't lose coverage right away (Read More: Does homeowners insurance cover roof damage?). However, after this, home insurance companies can drop you for living in a high-risk area.

Even if your insurance company doesn’t cancel your coverage, it may increase your rates significantly. In California, insurance companies need to get approval from insurance regulators before increasing your rates. This helps avoid extreme rate increases, though your rates can still increase significantly.

Insurance Companies Dropping California Homeowners Because of Fires

More than 348,000 California homeowners insurance policies in wildfire risk areas have been dropped since 2015, according to data released by the California Department of Insurance. Wildfires can cost California insurers billions of dollars, and as a result, they are one of the common reasons companies are increasing their rates or dropping high-risk homeowners policies.

The Camp Fire in 2018 is the most destructive California wildfire to date. It destroyed more than 153,000 acres and nearly 19,000 structures. In just one year, California experienced more than 8,000 fires that caused more than $18 billion in damage.

Learn More: How have wildfires affected California’s homeowners insurance rates?

As many California policyholders across the state are experiencing non-renewal from their home insurance carrier or dramatic price increases, which companies are the ones dropping customers?

We searched social media threads, online forums and news articles to see what California residents have reported. Note: this is by no means a comprehensive listing of companies, simply anecdotes we found in our research.

You can see numerous complaints about price increases and policy cancelations because of fires in California in the comments of our Facebook post about how the fires have affected California home insurance increases. The comment below is from a California homeowner who was dropped by AAA after 20 years.

In an interview with the Ventura County Star, two homeowners complained of non-renewal notices from their insurance companies last year. One homeowner had AAA and the other had Liberty Mutual. These policy cancelations are said to be a result of the insurers determining their homes too much of a fire risk because of their closeness to brush-heavy areas.

Paul Abate, a homeowner canceled by AAA after having a policy for 28 years, said to the VC Star, “I called the underwriter and he said that they changed their underwriting guidelines to state that any home within 1,000 feet of brush is an unacceptable risk.”

The VC Star reported that homeowner Jim Harrison was dropped by Liberty Mutual and was taken by surprise. The VC Star wrote that Harrison “received a non-renewal notice from Liberty Mutual earlier in the summer and was blindsided by the news, as the brush was not on his property.”

Even California residents who weren’t directly affected by any wildfires have seen an increase in homeowners insurance rates, as you can see in the Reddit post below.

Homeowner Insurance Rate?

byu/LearningHowToPlay inElkGrove

Even if you’ve had your insurer for many years, you could still be canceled and need to find a new insurer. Frances Mann Craik told CBS News that her homeowners insurance policy was canceled and she had the same coverage for 18 years prior.

Are you one of the hundreds of thousands of residents dropped by your home insurance company? Let us know if you were able to find California home insurance coverage and how you did it in the comments section below. Or share your story in a review of your insurance company.

Finding California Home Insurance After Cancellation

Knowing what to do if your California home insurance is canceled will help you avoid going without protection for an extended period of time. If you can't find an insurance company to insure you after getting quotes and asking for recommendations, contact the California Department of Insurance for assistance.

Carrying home insurance in California is vital, due to the increased risk of wildfires destroying your home (Read More: Does homeowners insurance cover wildfires?). To quickly find a home insurance policy in California, enter your ZIP in our free quote finder.

Frequently Asked Questions

What do I do if my homeowners insurance gets canceled?

If your homeowners insurance is canceled in California, shop around immediately to see if you can find a new insurance company to insure you. If you are unable to find an insurance company even after contacting the California Department of Insurance, you can get coverage through the California FAIR plan.

Are insurance companies canceling homeowners insurance in California?

Yes, home insurance companies are canceling California home insurance policies due to the high financial risk of insuring California homes.

Why are insurance companies pulling out of California?

Insurance companies canceling policies in California in 2024 and pulling out of the state are doing so because of heavy insurance losses due to fire claims (Read More: COVID-19 and Weather Events Drive Catastrophic Homeowner Insurance Losses).

Is State Farm canceling homeowners insurance in California?

Yes, State Farm is canceling homeowners insurance policies in high-risk areas of California. If you have home insurance with State Farm, you may receive a cancelation notice in the mail.

What happens if you can't get homeowners insurance in California?

You will have to buy coverage through the California FAIR plan if you can't find a home insurance provider willing to insure your home. This should be a last resort, as plans through the California FAIR Plan are expensive and offer limited coverage for your home.

What happens to your mortgage if homeowners insurance is canceled?

Your mortgage lender will require you to get new home insurance immediately. If you don't, you must pay for an expensive, mandatory insurance that will be put on your mortgage. Sudden cancelations like these are among the top 5 most common consumer homeowners insurance complaints.

Is it hard to get insurance after being dropped?

Yes, it can be hard to find home insurance after being dropped, as you must find an insurance company willing to insure a high-risk property.

How long does canceled home insurance stay on record?

Generally, canceled home insurance stays on record for at least five years. If you canceled your own home insurance coverage and didn't have a coverage lapse, however, it won't go on record.

What is the best homeowners insurance company in California?

Mercury Insurance Group is one of the top providers of the home insurance in California.

What is the grace period for homeowners insurance in California?

The California grace period for missed payments is 60 days. This means you have 60 days to make your missed payment before your home insurance coverage is canceled.

What is the average homeowners insurance cost in California?

Average rates start at $85/mo for a home insurance policy in California. To find the best California home insurance rate, use our free quote finder tool.

Who is California's largest home insurer?

Currently, State Farm Insurance is the largest company operating in California; however, because it's reducing its CA home insurance plans, another company may soon take its place as the largest provider in California.

What not to tell the home insurance adjuster?

When talking to a home insurance adjuster, make sure not to admit fault. You also shouldn't underestimate the damage to your home.

What is the 80% rule in insurance?

It means that as long as you have purchased home insurance that covers at least 80% of your home's value, insurance will pay the replacement cost of your home.

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.