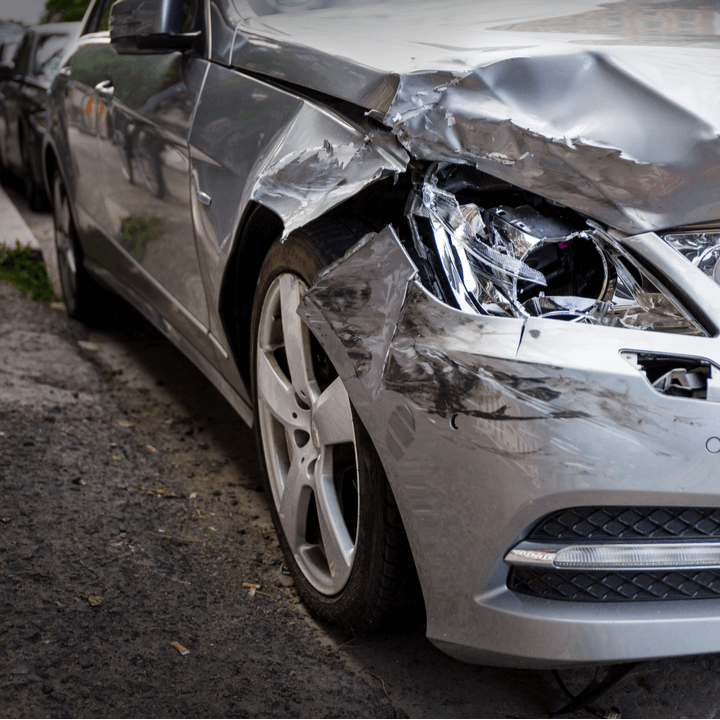

Property damage liability is a type of coverage included in a car insurance policy. Property damage liability coverage protects policyholders from damage they cause to another person’s property (typically the other driver’s vehicle, but it also includes a guard rail, fence or other structure) in an at-fault accident.

Property damage liability insurance is a required car insurance coverage in nearly every state, though the minimum coverage required can vary by state.

It’s important to know that property damage liability doesn’t cover your own vehicle from damage in an accident you’re found at-fault for. If you want to protect your vehicle in this scenario, you’ll need to purchase collision insurance.

What does property damage liability insurance cover?

Auto repairs: If you’re found at fault for a car accident that caused damage to another driver’s vehicle, property damage liability insurance will cover the repair costs for that vehicle, up to your policy’s limits. The expenses also include replacement parts and labor costs at the auto repair shop.

Property damage: Similarly, if a collision involving your car has been proven to cause damage to someone’s property, then repair costs for that damage can be claimed from property damage liability insurance. For example, if you collide with the garden wall or fence of someone’s residential property, expenses to repair or replace the damaged wall/fence will be paid for by your car insurance. Other objects, such as trees, lamp posts, houses, stores and so on that get damaged can also be covered by your property damage liability insurance.

Legal fees: Because claiming property damage liability insurance requires proof that you caused the damage, this could lead to court proceedings, and you needing to hire a lawyer. All legal fees, including court charges and lawyer’s fees can be claimed from property damage liability insurance. It’s always better to check with your car insurance company if the policy covers legal fees before you buy the policy.

Other expenses: The damage to property or a vehicle could lead to other expenses that could recur over a period of time. These recurring expenses can also be claimed from a property damage liability insurance if covered by your policy.

How does filing a property damage liability claim work?

If you’ve been involved in a car accident that requires a claim, you should contact your insurance agent or auto insurance company. You’ll be required to provide various paperwork and fill out various documents to start the claims process.

Remember, your car insurance will cover up to your policy's limit, but anything above that will be an additional expense on you. For this reason, it’s important to think carefully before deciding on your property damage liability limit. Selecting simply the minimum coverage may leave you underinsured in the event you total the other car or damage someone else’s property.

What is the minimum property damage liability coverage required in each state?

As noted above, each state has its own minimum limits of liability coverage. States usually require you to have the minimum property damage liability coverage and bodily injury coverage, though it's wise to consider purchasing higher limits. Bodily injury liability is also required in nearly every state, so you'll typically see them listed together.

You may see liability insurance limits listed as 100/300/50. The order of liability limits, using the example above, are:

- Bodily injury liability limit per person ($100,000 in the example)

- Bodily injury liability limit per accident ($300,000 in the example)

- Property damage liability limit per accident ($50,000 in the example)

Below is a table of the minimum amount of property damage liability required in each state, with the final number in each representing the property damage liability limit:

| State | Minimum liability limits |

|---|---|

| Alabama | 25/50/25 |

| Alaska | 50/100/25 |

| Arizona | 15/30/10 |

| Arkansas | 25/50/25 |

| California | 15/30/5 (1) |

| Colorado | 25/50/15 |

| Connecticut | 25/50/20 |

| Delaware | 25/50/10 |

| Florida | 10/20/10 (1) |

| Georgia | 25/50/25 |

| Hawaii | 20/40/10 |

| Idaho | 25/50/15 |

| Illinois | 25/50/20 |

| Indiana | 25/50/25 |

| Iowa | 20/40/15 |

| Kansas | 25/50/25 |

| Kentucky | 25/50/25 (1) |

| Louisiana | 15/30/25 |

| Maine | 50/100/25 |

| Maryland | 30/60/15 |

| Massachusetts | 20/40/5 |

| Michigan | 20/40/10 |

| Minnesota | 30/60/10 |

| Mississippi | 25/50/25 |

| Missouri | 25/50/25 |

| Montana | 25/50/20 |

| Nebraska | 25/50/25 |

| Nevada | 25/50/20 |

| New Hampshire | 25/50/25 |

| New Jersey | 15/30/5 (2) |

| New Mexico | 25/50/10 |

| New York | 25/50/10 |

| North Carolina | 30/60/25 |

| North Dakota | 25/50/25 |

| Ohio | 25/50/25 |

| Oklahoma | 25/50/25 |

| Oregon | 25/50/20 |

| Pennsylvania | 15/30/5 |

| Rhode Island | 25/50/25 |

| South Carolina | 25/50/25 |

| South Dakota | 25/50/25 |

| Tennessee | 25/50/15 (1) |

| Texas | 30/60/25 |

| Utah | 25/65/15 (1) |

| Vermont | 25/50/10 |

| Virginia | 25/50/20 |

| Washington | 25/50/10 |

| Washington, D.C. | 25/50/10 |

| West Virginia | 25/50/25 |

| Wisconsin | 25/50/10 |

| Wyoming | 25/50/20 |

(1) Drivers are able to meet liability requirements with a policy with a combined single limit. Limits vary by state. (2) These limits are for a standard policy. Drivers also have the option of choosing a basic policy with limits of 10/10/5.

How much does property damage liability insurance cost?

The amount you pay for property damage liability insurance will depend on your unique driving profile. Some of the factors that impact car insurance rates includes your claims history, where you live, your age, your coverage limits and other factors.

If you’re interested in finding cheaper car insurance rates, check out our guide on how to find cheap car insurance.

While you don’t want to pay too much for auto insurance, it’s also important to find a reputable, highly rated car insurance company. To help in your search, see which insurers other drivers have had the best experiences with on our rankings of the top auto insurance companies.

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.