Car insurance deductibles are the amount you agree to pay towards repairs after a covered claim. Your insurance company will pick up the rest of the repair bill, minus the deductible, up to your policy limit.

Having a higher deductible on your insurance policy will decrease your insurance rates, so it’s one of the top tips for how to get cheap car insurance. However, you'll have to pay out of pocket if you need to file a claim.

Continue reading to learn more about how car insurance deductibles work, average deductible amounts, how deductibles affect your car insurance, and much more. Then, enter your ZIP to compare car insurance rates in your area.

What You Should Know

- Your deductible is the portion you pay after a claim before your coverage kicks in

- Average car insurance deductibles range between $100 and $2,000

- Your deductible affects your monthly insurance costs

How Auto Insurance Deductibles Affect Your Monthly Premium

Many factors affect the cost of car insurance, some of which might surprise you. The most well-known factors include your age, the type of vehicle you drive, and where you live.

One of the most impactful factors on your monthly rates is your insurance deductible. For example, a $2,000 car insurance deductible comes with lower monthly rates.

Understanding your deductible’s role in your monthly insurance rates is crucial in picking the right deductible for you. Check below to see average car insurance rates by deductible to get an idea of how much your monthly costs can change.

| Deductible | Minimum Coverage | Full Coverage |

|---|---|---|

| $100 | $120 | $250 |

| $500 | $95 | $200 |

| $1000 | $80 | $175 |

| $2000 | $60 | $140 |

As you can see, there’s a significant difference between the highest and lowest auto deductibles. Combined with the fact that you’ll see a lot of variation in rates from different companies, it’s clear why experts recommend comparing quotes.

Luckily, comparing quotes is easy. Most insurance companies offer a free quote request form on their websites. It takes some personal information like your VIN and driver’s license number, and between 10 and 15 minutes to fill out.

Fill out request forms from multiple companies to get an idea of which provider has the cheapest rates for you. Alternatively, you can enter your information into a quote-generating tool once to look at multiple companies instantly.

Car Insurance Deductibles Explained

How do deductibles work in car insurance? Basically, an auto insurance deductible is the monetary amount you agree to pay in a covered claim. You can usually choose the deductible amount you want on your different insurance coverages.

Naturally, the more you raise your deductible, the less you will pay for your auto insurance policy, as you take on some of the financial risks. While you save money by upping your deductible, you may pay more than you end up saving if you set your deductible too high on an insurance policy. If you need to lower your car insurance rates, you can look at things like the best low-mileage car insurance and other car insurance discounts.

How Car Insurance Deductibles Work

When you sign up for insurance, you get to set the deductible amount you want for each coverage. You may choose to have no deductible if your insurance company offers that option, but you will have higher insurance rates. You can also choose different deductibles for different coverages, depending on your personal preferences and risks.

For example, you may choose no deductible for collision insurance because there is a high rate of car crashes in your area, making it more likely that you’ll file a claim in the future.

While having no deductible will increase your rates, you may save on a different coverage. You might choose a $500 comprehensive insurance deductible, for instance, because the weather and animal collision risks are relatively low in your area.

Varying your auto insurance deductibles among different coverages based on your risk of filing a claim can help you keep your car insurance policy affordable. You can also change your deductible as needed, but bear in mind that you can’t change it right before filing a claim to try to avoid paying a higher deductible.

Most of the best car insurance companies will allow you to change your deductible during your policy term (as long as you don’t have an impending claim) or during your policy renewal, although this depends upon the individual insurance company.

How Fault Affects Insurance Deductibles

Fault matters when it comes to who is responsible for paying for the accident repairs, but it won’t affect whether you pay a deductible or not when you file a claim with your insurance company.

If someone else has caused the accident that damages your car, for example, their insurance will take care of paying for your repairs, in which case you don’t need to file a claim and pay the deductible.

If you caused the accident, however, then you’ll have to file with your insurance company and pay the deductible on your coverage. If the fault for the accident is shared, then you may end up having to file with your insurance company as well and pay the deductible.

Since filing a claim will increase your insurance rates, learning when to file a car insurance claim is crucial. If your repairs will cost less than your deductible, many experts suggest skipping filing a claim.

Average Deductibles and Their Effect on Car Insurance Rates

If you've ever wondered why car insurance is so expensive, part of the reason is that you may have the wrong deductible. Now that you know how car insurance deductibles work, we want to go over what common options are available to you for insurance deductible amounts.

One of the most synonymous terms in #insurance is deductibles. But what is a #deductible and what are common deductible amounts? Check the @clearsurance blog -> https://t.co/XMRI7XFrR4 #carinsurance #autoinsurance #homeinsurance #homeownersinsurance #rentersinsurance #blog pic.twitter.com/G7wFJRI1pM

— Clearsurance (@clearsurance) May 14, 2018

The average insurance deductible is $500, but you can usually opt for an amount that is lower or higher than the average deductible.

With each deductible increase, your monthly premium can drop anywhere from a few dollars to about $100. However, make sure you calculate the overall savings compared to the monthly amount saved. While raising your deductible over $1,000 may save you $20 a month, you may end up paying more than you saved after an accident.

When choosing a deductible amount, you should also consider your personal risk. If you have been in multiple crashes or live in a high-risk area, it makes sense to keep your deductible lower even if your monthly rates are higher.

However, if the chance of you getting into a car crash is low, it can make more sense to choose high deductible car insurance for lower monthly rates.

As always, make sure you only raise the deductible to an amount you can afford to pay. Otherwise, you run the risk of not being able to afford to fix your car after an accident. Then, you will not be able to drive until you’ve saved up the money, or you will have to go into debt paying for repairs.

Choosing a Car Insurance Deductible

One of the most impactful factors in your monthly premiums is your insurance deductible, meaning you'll want to choose yours carefully.

Naturally, the most important factor is how much you are willing to pay towards car repairs after an accident. If you can’t afford to pay $1,000 for car repairs, don’t pick a $1,000 deductible. Instead, choose one more in your price range, such as a $500 or $250 deductible.

The other factors that you need to take into consideration include the following:

- Cost vs. Savings: Consider the percentage you will save by increasing your deductible amount. If it is just a small amount of money, then it may be better to keep your deductible low. But if it’s significant, you can raise your deductible as long as you can afford the out-of-pocket costs.

- Coverage Type: If you are more likely to file a collision claim than a comprehensive claim, then you could go higher on the deductible for your comprehensive coverage and put the extra money saved towards a lower collision deductible.

- Likelihood of Filing a Claim: Consider how likely you are to file a claim. You are at a lower risk if you’re a safe driver and have a clean driving record.

- Your Vehicle’s Value: If your car is expensive to repair due to hard-to-find parts or other factors that raise expenses, you may want to consider a lower deductible so that your policy pays more for the repairs.

- Out-of-Pocket Costs: Consider how much you are willing to pay out of pocket. While you may be able to afford to pay a higher deductible after an accident, you may not want to put that much money into your car because of other expenses.

Make sure to consider how much a deductible will save you on auto insurance rates versus how much you would save on accident repairs with a lower deductible. If you would save more when filing a claim by having a lower deductible than what you would save in monthly payments, it may be smarter to choose a lower deductible.

For example, if you wouldn't save $1,000 dollars in car insurance payments within a few years by changing your deductible to $1,000, you may want to keep just a $500 deductible — especially if you are at a higher risk of filing a claim with your insurance company.

Additionally, you should periodically compare rates with other companies to ensure you're getting a fair price for the deductible you want. Learning how to switch car insurance companies can help you save a significant amount of money.

Zero-Deductible Car Insurance

Zero-deductible insurance means you don't have to pay anything out of pocket when you file a covered insurance claim. Your insurance company covers the full cost of the repairs or damages up to your policy limits.

The key features of zero-deductible auto insurance include:

- No Upfront Cost: When you file a claim, your insurance company will cover 100% of your repair costs after a covered accident.

- Policy Requirements: A zero-deductible option isn’t available for every type of insurance. Many companies only offer a zero-dollar option for comprehensive coverage.

- Availability Limitations: Finding a zero-deductible option isn’t always easy. Many companies don’t offer one, while some only offer it in a few states. While zero-deductible insurance usually sounds appealing, there are things to consider before you sign up.

Knowing what kind of car insurance you really need is important before you decide on a zero-deductible. This insurance option is more suited for people looking to avoid unexpected repair costs or drivers who file frequent claims.

Vanishing Deductible Programs

Many drivers worry about being able to afford their insurance deductibles. To help mitigate those worries, many companies offer a vanishing deductible program.

A vanishing deductible – also called a diminishing deductible or disappearing deductible – gradually reduces what you pay for a claim. The most common type of vanishing deductible reduces your deductible for every year you spend claims-free. Some companies offer a reduction of a specific amount, like $500, while others will cover your entire deductible.

While many car insurance companies offer a vanishing deductible, Allstate and Nationwide are two of the most popular companies. Read our Allstate car insurance review and Nationwide car insurance review to compare the programs.

See How Deductibles Affect Your Car Insurance Rates Today

Higher car insurance deductibles can significantly reduce your monthly auto insurance rates, but it is important that you don’t increase your deductible beyond what you are willing to pay out of pocket.

You also want to consider how much you’ll save over time with a higher deductible versus how much you’ll save with a lower deductible when filing a claim.

While deductibles play a significant role in your insurance, shopping with the car insurance companies that customers recommend can help you find low rates. To find the best rates in your area, enter your ZIP into our free comparison tool today.

Frequently Asked Questions

What’s the difference between deductibles and premiums?

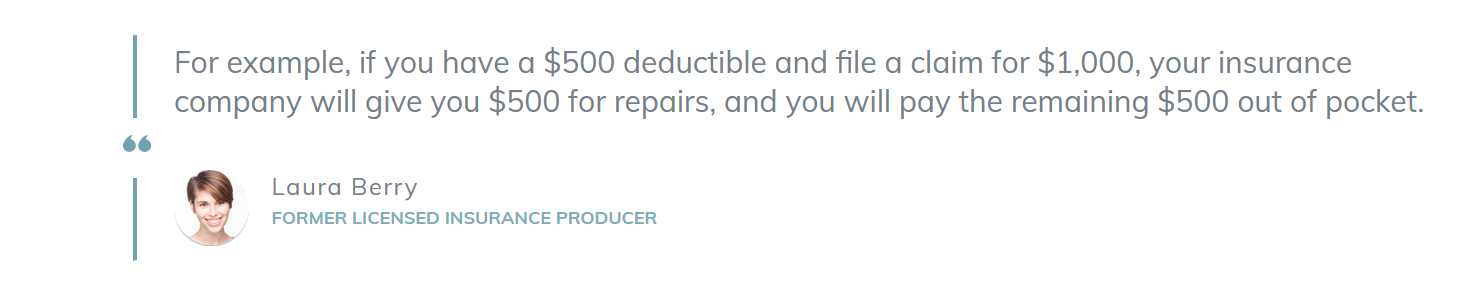

A car insurance deductible is an amount that you agree to pay towards car repairs in a covered claim. For example, if you have a $500 deductible and your car repairs will cost $1,500, your insurance company will give you $1,000 for repairs.

Premiums, also known as car insurance rates, are the amount you pay for auto insurance coverage. Raising and lowering your car insurance deductible will affect the cost of your auto insurance premiums. To find the best company for your needs, make sure to compare consumer car insurance claims ratings and multiple car insurance quotes.

What if the deductible is more than the cost of repairing the car?

If the deductible is more than the cost of repairing the car, then you should skip out on filing a claim and pay out of pocket for repairs. This way, you don't face increased car insurance rates for having a claim on your record.

For example, let’s say you back up into your mailbox. The cost to repair the dent in your car would be $400, but you have a $500 deductible on your collision insurance. In this case, the repairs are less than your deductible, so insurance wouldn't give you anything for car repairs.

Does every car insurance policy have a deductible?

No, there aren’t deductibles on every auto insurance policy. Liability insurance coverage doesn’t have deductibles, so if you carry just liability, you won’t have a deductible to pay. You may also be able to choose a zero or minimum deductible on other insurance coverages, depending on the insurance company.

When do you have to pay a deductible?

You pay your deductible anytime you make a car insurance claim. Most insurance companies simply deduct the deductible amount from the amount they pay you in a claim, so you don’t necessarily have to pay it right away if you can wait to get your car fixed until you can save up the money.

Sometimes, you won't have to pay a deductible at all. For example, some states require that insurance companies offer zero-deductible glass repairs or replacements. If you choose this option, the best car insurance companies that cover car windows won't charge you a deductible if you need your windshield replaced.

Do you pay your car insurance deductible before or after your car is fixed?

Typically speaking, you'll pay your deductible after your car is fixed. A popular way for car insurance companies to handle claims is to pay repair shops directly. If this is the case for your company, you'll owe your mechanic the amount of your deductible when repairs are done. However, this isn't always the case. Check with a representative of your company if you need to file a claim.

Is a $1,000 deductible good for your car insurance?

An insurance deductible by definition is neither good nor bad. A $1,000 deductible may be the perfect amount for one driver and terrible for another. It simply depends on your budget, both for your monthly insurance premium and how much you can afford if something happens to your vehicle.

Is it better to have a $500 deductible or $1,000?

That depends on your budget. If you want to have lower monthly rates, a $1,000 deductible might be better. If you want to protect yourself from paying a lot of money in case something ever happens, a $500 deductible could be ideal. You should also consider other factors, like your age. Insurance for young drivers is typically expensive, but they can lower their costs by choosing a higher deductible. If you shop at the best car insurance companies that decrease rates after you turn 21, you can decrease your deductible as you get a bit older.

Do you have to pay your deductible if you're not at fault?

The meaning of insurance deductibles is that it's something you pay when you file a claim on your policy. If you can file a claim against an at-fault driver, you won't have to pay a deductible because your insurance won't get involved. However, you'll have to pay a deductible if the other driver doesn't have insurance or they hit-and-run and you want to file an uninsured motorist or collision insurance claim.

If you are at fault and find yourself wondering, "Do I pay a deductible if I hit a car?, that depends. If you want to file a collision claim for the damage to your vehicle, you'll need to pay a deductible.

What happens if you don't pay your deductible?

Again, that depends on your insurance provider. If your company pays the mechanic directly, the shop won't release your vehicle until it's paid. If your company expects you to pay your deductible first, your claim won't move forward until you do.

What is a vanishing deductible?

A vanishing deductible is a program some insurance companies offer that reduces your deductible over time. Every company has different requirements, but the most common way to reduce your deductible is to remain claims-free for a certain number of years. If you want to find the company that has the best vanishing deductible for you, enter your ZIP into our free comparison tool.

Do other types of insurance have a deductible?

Most other types of insurance have deductibles. For example, knowing what your health insurance deductible is is crucial to your health care. However, other deductibles in insurance may not work the same as car insurance.