Root Insurance proclaims itself to be a different kind of insurance company, “founded on the relentless pursuit of fairness.”

How is Root different?

While most insurance companies use demographic information such as where you live, your age, and in some states even whether you are married or not, to determine what your car insurance rates will be, Root prioritizes how you actually drive.

Every insurance company has their own algorithm that helps determine your car insurance rate. For Root’s algorithm, while the other factors may still be in play, how good of a driver you are is one of the main driving factors behind the price you pay for a policy.

So, what do customers think of Root’s different approach to car insurance? We analyzed Clearsurance reviews and evaluated the feedback customers have given.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

How does Root insurance work?

If you want to get Root car insurance, you download an app that monitors your driving behaviors for a 30-day test drive. If you do not have an active car insurance policy at the time that you start the Root test drive, Root may offer you temporary car insurance for the test drive period.

During this test drive, the Root insurance app monitors and measures data such as how you brake, your turns, and how focused your driving is. After the initial 30-day assessment period is over, you’ll be provided with a revised rate — or, if your driving patterns are deemed to be too risky, Root will let you know that they cannot insure you.

By screening out and rejecting riskier drivers, Root is aggressively managing its pool of insured drivers. Less risk means fewer claims, which can keep rates low for Root auto insurance customers.

How low are those rates?

Well, it primarily depends on your driving, but just like other insurance companies, Root does also use some demographic information, such as where you live. So, even if you are a very safe driver, if you live in an urban area where traffic accidents are more likely, your rates will be affected.

Root Insurance reviews

The Root insurance reviews on Clearsurance are quite mixed. With an overall rating of 3.02 stars out of five, reviewers seem to be very divided — either very happy, or, quite unhappy. At the time of this writing, 44.5 percent of reviews provided rated the insurance as “excellent,” while 27.9 percent rated it as “poor,” reinforcing the observation that people have strong opinions about Root car insurance. However, on average, more customers are happy with Root than unhappy.

Reviews from happy Root customers

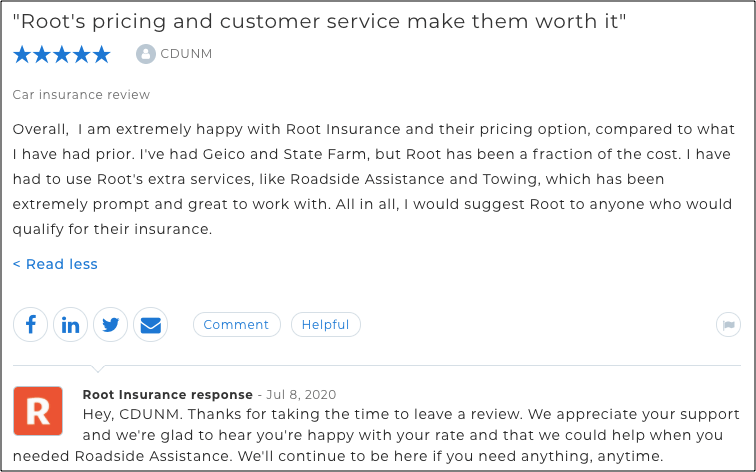

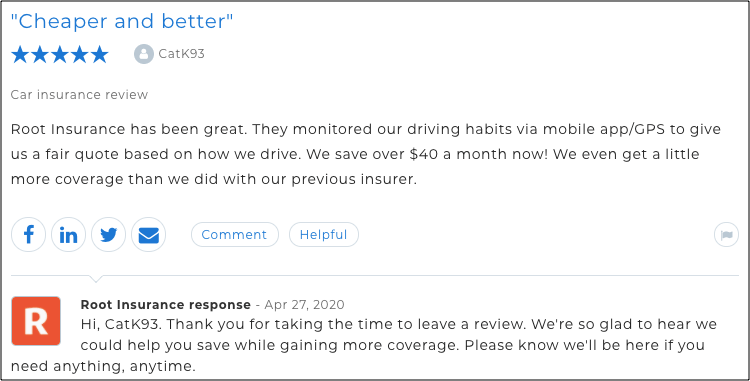

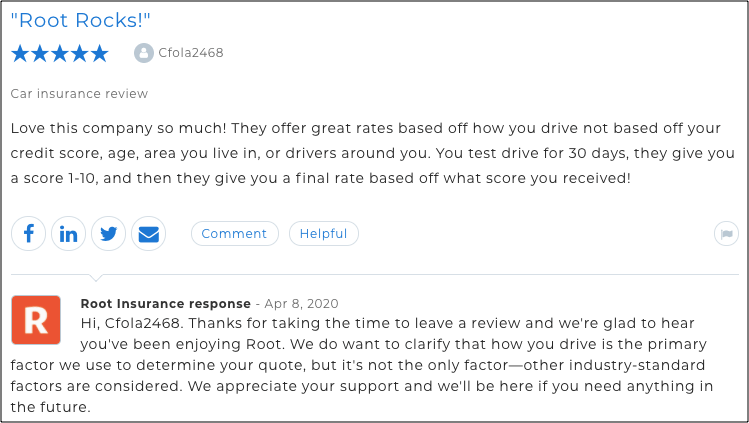

Most of the positive reviews of Root auto insurance focus on pricing and services received. Here are some excerpts of positive feedback:

The above Root Insurance review was written by user CDUNM on Clearsurance.com.

The above Root Insurance review was written by user CatK93 on Clearsurance.com.

The above Root Insurance review was written by user Cfola2468 on Clearsurance.com.

Read all Root Insurance reviews on Clearsurance.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

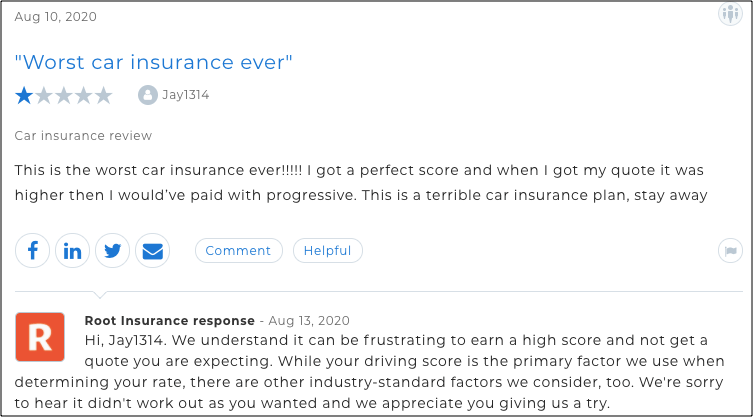

Reviews from unhappy Root customers

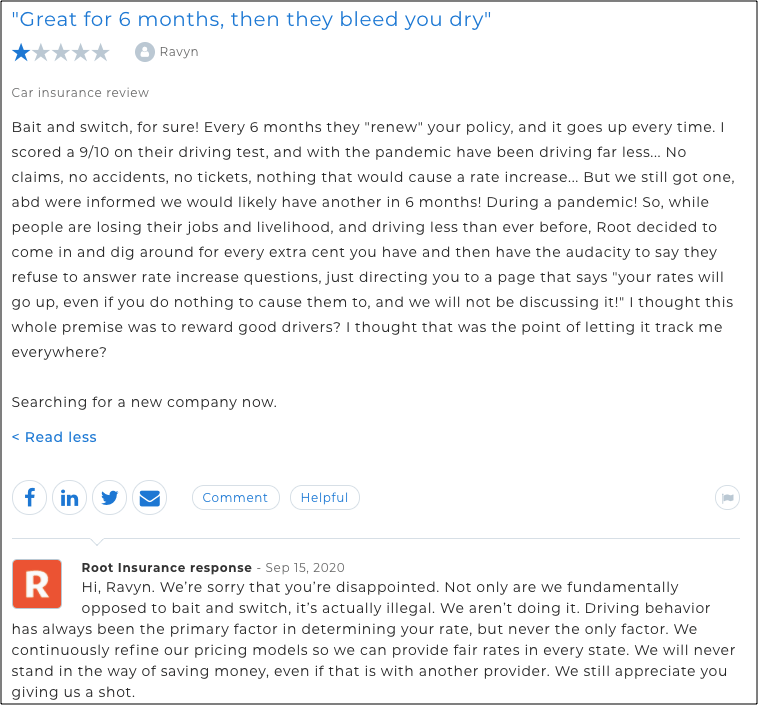

As with the happy customers, most negative reviews discuss pricing, with the dominant complaint being increased rates. Here are some excerpts from negative reviews of Root auto insurance:

The above Root Insurance review was written by user Jay1314 on Clearsurance.com.

The above Root Insurance review was written by user Ravyn on Clearsurance.com.

Read all Root Insurance reviews on Clearsurance.

It’s important to do your research and consider your options when you are shopping around for car insurance.

While Root places an emphasis on your actual driving behavior by tracking through the Root insurance app, they still take other factors into consideration that could affect your rates. This is the case even if you’re a good driver. And, on the other hand, if you are a driver with riskier driving behaviors, such as hard braking and speeding, you could see higher rates — or Root could decide not to cover you at all.

Root car insurance policies may not be a good fit for everyone. If you’d like to explore the best car insurance options available to you, you can visit Clearsurance’s car insurance rankings page. This page ranks the companies that customers say are the best in your area in Clearsurance reviews.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Image source: MilanMarkovic78/shutterstock.com

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.