When we eat at a restaurant or stay at a hotel, we typically leave either satisfied with our experience or unhappy. And for some of us, we may go online after to leave a review of our experience. While car insurance isn’t a one-and-done transaction like a restaurant or hotel, we do generate feelings toward our insurer based on our experiences. And based on the thousands of car insurance reviews from consumers on Clearsurance, we’ve found where you live also contributes to your level of satisfaction with your car insurer.

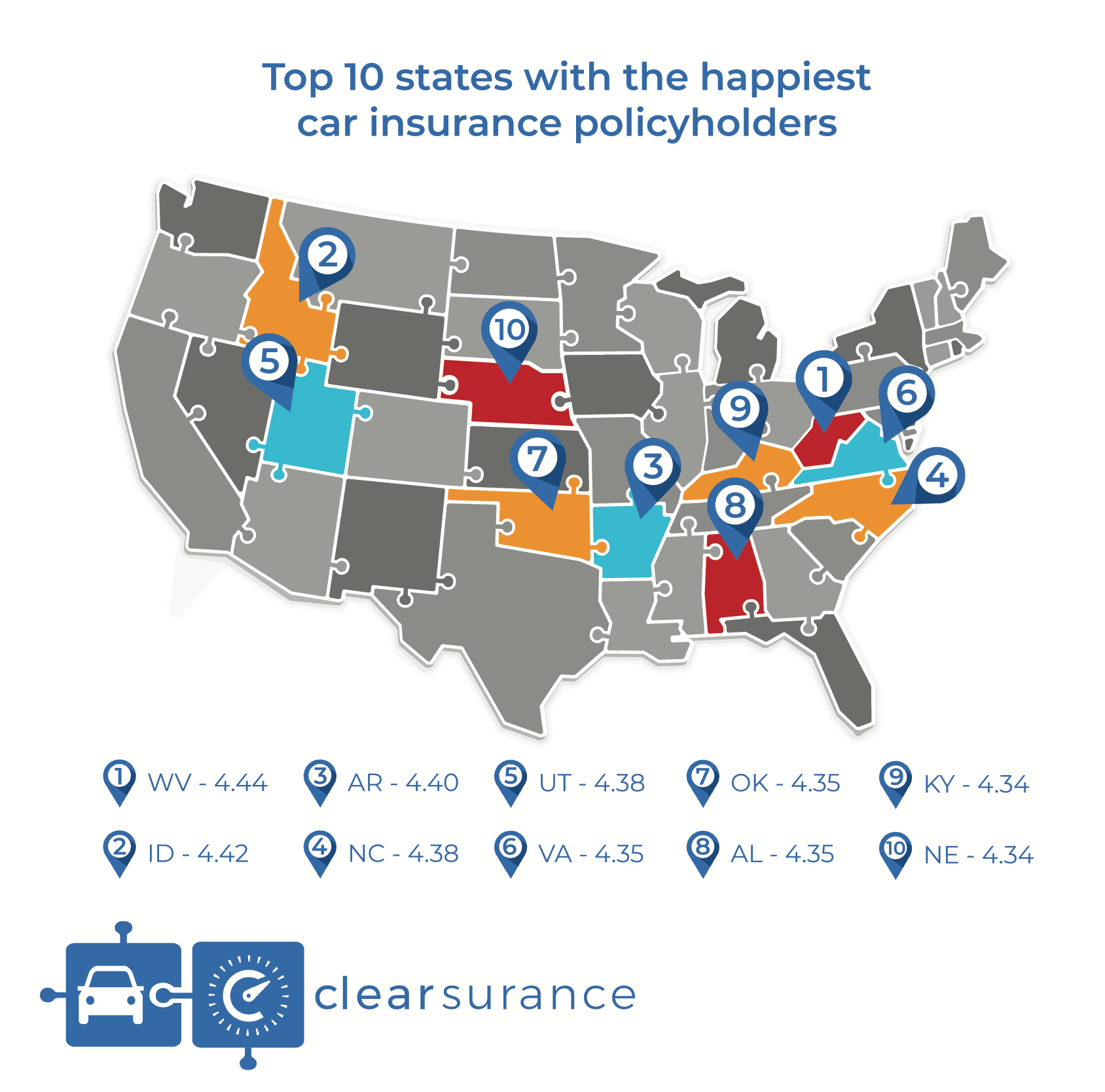

The Clearsurance team has determined which U.S. states have the happiest auto insurance policyholders and which states have the least happy based on the average Clearsurance score of auto insurance carriers by users in that state. Clearsurance scores are determined exclusively by the ratings provided by real insurance customers.

In the tables below, you can find the top 10 happiest states and 10 least happy states, along with the average Clearsurance score in those states. West Virginia earned the highest score to rank as the happiest state while Nevada is the least happy. In addition to car insurance, West Virginia is also the happiest state for homeowners insurance.

| Rank | Happiest states | Clearsurance score |

|---|---|---|

| 1 | West Virginia | 4.44 |

| 2 | Idaho | 4.42 |

| 3 | Arkansas | 4.40 |

| 4 | North Carolina | 4.38 |

| 5 | Utah | 4.38 |

| 6 | Virginia | 4.35 |

| 7 | Oklahoma | 4.35 |

| 8 | Alabama | 4.35 |

| 9 | Kentucky | 4.34 |

| 10 | Nebraska | 4.34 |

| Rank | Least happy states | Clearsurance score |

|---|---|---|

| 1 | Nevada | 4.16 |

| 2 | Washington | 4.21 |

| 3 | Maine | 4.21 |

| 4 | Colorado | 4.22 |

| 5 | Wisconsin | 4.22 |

| 6 | Arizona | 4.23 |

| 7 | Oregon | 4.23 |

| 8 | Michigan | 4.23 |

| 9 | Texas | 4.24 |

| 10 | South Carolina | 4.24 |

Note: Only states with at least 100 reviews were eligible and Alaska, Delaware, Hawaii, North Dakota, Rhode Island, Vermont and Wyoming didn’t qualify. The data is based on reviews from Jan. 1, 2017 to May 31, 2018.

While the least happy states still have decent average Clearsurance scores, there are a few trends that are important to note. We’ve noticed a trend with the level of happiness in a state and the rate increases consumers in those states have experienced. Car insurance rates are one of the primary factors in determining a policyholders’ level of satisfaction with their insurer.

So what causes insurance rates to increase? There are a number of factors that increase your rates that you have control over, such as your driving history or if you pay your premium on time. Unfortunately, there are also many factors that come into play that are out of your control. You may wonder why your premium has increased if you haven’t had any accidents and are free from violations. Faults of other drivers and policyholders in your area can cause an increase in your rates.

Based on data from S&P Global Market Intelligence, we found that in Nevada, the least happy state, 20 percent of its drivers experienced a rate increase of more than 10 percent in 2017. That percentage is high compared to the happiest state of West Virginia, where no drivers have reported a rate increase of at least 10 percent. In fact, the happiest states have very low percentages of people who have had a rate increase of this caliber. Of the happiest states, Virginia and Nebraska have 1 percent of users with this rate increase and Oklahoma and Kentucky have 2 percent.

The happiest states also tend to experience higher percentages of insurance premium decreases in 2017. In seven of the happiest states, more than half of policyholders in each state experienced a rate decrease. West Virginia, the happiest state, has the highest percentage of rate decreases with 73 percent of consumers reporting it. (Rate increase data from S&P Global Market Intelligence was not available for North Carolina and Alabama.)

Another factor that can affect customers’ happiness with their car insurance company is claims service. There is a difference with how users in the happiest states rated companies on their claims service compared to the least happy states. The average Clearsurance score for the top 10 happiest states is 4.30 compared to the average score of the bottom 10 of 4.17. There is also a difference in the price rating of companies in each group, which correlates well with the rate increase data. The happiest states had an average Clearsurance score for price of 4.00 while the least happy states averaged a 3.86.

Earlier this year, WalletHub published its 2018 findings on the best and worst states to drive in. When compared with our own findings of the states with the happiest and least happy policyholders, there is a correlation between WalletHub's best states to drive in and the happiest car insurance policyholders. None of the top 10 happiest states ranked worse than 26th (Utah) in WalletHub's study. West Virginia, which ranked in the middle of the pack in WalletHub's findings, has the second lowest car maintence costs of any state — another way the state's drivers are saving money beyond the rate decreases. WalletHub considered 23 indicators in its research, such as traffic and road quality, to determine the best and worst states.

While Clearsurance's data shows scores by state, within in each state, companies have different ratings from consumers. As you shop for auto insurance, be sure to do your research to find the company that is best for your needs. You can find the best car insurance companies in your state on our car insurance rankings page. And once you’ve narrowed down your list of companies, be sure to read reviews on Clearsurance from consumers to learn from the experiences of other consumers like you.

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.