Spring is here and it’s time for flowers and sunshine. You know that if you plant seeds now, whether it’s for your flower garden or your vegetable garden, you’ll see positive results later. The same is true when you take the time to cultivate your financial future. The seeds you plant now, with insurance, can yield positive results later, as part of your financial planning efforts.

If you’re trying to figure out how to fit insurance into your long-term financial planning, this guide will help you make the right moves now so that you can reap the benefits later.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Why is insurance important to my financial future?

When looking at car insurance or life insurance, you might be wondering why it’s so important to your financial future. After all, it costs money today and doesn’t seem to have a practical purpose. However, when you look at a vegetable seed, it doesn’t seem like much. Once planted and cared for, though, it can, in due time, offer you a tangible and useful result.

Insurance is similar. The premiums that you pay now are meant to help protect you in the future. What if your house were destroyed in an unexpected catastrophe? Would you have the money for extensive repairs or to rebuild? The cost of handling this disaster might be more than you can afford, and more than you paid in insurance premiums over time.

The same might be true of car insurance or renters insurance. Life insurance is designed to provide for your loved ones in the event that you pass away in an untimely manner. No matter what the situation is, the reality is that it can be expensive to pay these costs out of pocket. You might not ever need insurance, but the fact of the matter is that it offers some protection from risk at the cost of a smaller, more manageable monthly payment.

What insurance do I need?

What insurance you need depends on your life stage, as well as your situation. Here are the main types of insurance that you should consider.

Health insurance

Health insurance is important to have, no matter what your situation is. If you don’t have affordable health insurance through your work, you might be able to qualify for a tax credit to make it affordable on the health insurance exchange.

Additionally, you might also be able to get catastrophic coverage only. If you are relatively young and healthy, and don’t have many healthcare needs, catastrophic coverage can be inexpensive and at least protect you in the case of an illness or injury that puts you in the hospital.

Car insurance

If you drive a car, you need car insurance. Almost every state requires some level of coverage. However, if your car is inexpensive, or you feel comfortable replacing it, you might only need to get liability coverage. For newer, more expensive cars, adding comprehensive and collision would make sense as well.

For more information about car insurance in your state and to find the companies consumers say are the best, visit Clearsurance’s best car insurance page.

Renters insurance

Renters insurance is an important and valuable coverage to have if you rent an apartment. If you’re living in a rental, this type of insurance can be a good idea, no matter what your age. Purchase enough renters insurance coverage to replace all of your items if they were to get destroyed or stolen. You might be surprised to find out that renters insurance also covers items stolen from your car, not your car insurance.

Young people could rarely afford to replace all of their electronics, furniture and clothing if they were to end up ruined, so it’s a good idea to have renters insurance in place just in case.

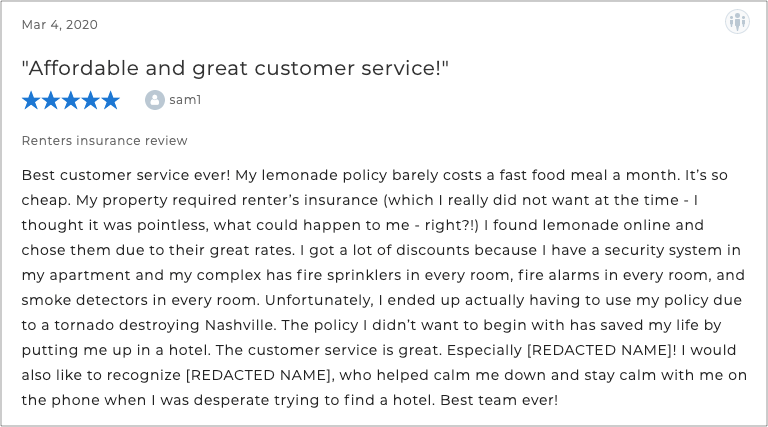

In a recent Lemonade renters insurance review submitted to Clearsurance, a consumer discussed how they didn’t want to purchase renters insurance, but purchased it anyway, and it helped with unexpected loss from the Nashville Tornado.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Homeowners insurance

Maybe you’re a little more established and you have a family and a dog. You’re ready to settle into the community. In this case, it’s time for homeowners insurance. Compare available policies to see whether you could get cash or the replacement value.

If you already have homeowners insurance, spring is the perfect time to review your policy and see if it still meets your needs. With an increased home value or additions, you might need to upgrade your policy so you’re protected.

For the top-rated companies in your zip code according to consumers, you can visit Clearsurance’s best homeowners insurance page.

Life insurance

When engaged in financial planning, life insurance is one of the most important tools, especially for your loved ones. Life insurance is about securing your family’s financial future if you are no longer around. Life insurance is appropriate for those who have dependents, such as a spouse or children, who would struggle if your income disappeared.

Take the time to review your needs and the needs of your family. A term life policy can work well if you expect your children to be grown up and out of the house by the time your policy expires and if you have a plan to save in the meantime. There are other life insurance options, though, so it’s important to carefully review them and figure out if they fit your situation.

A new life insurance option is to obtain a policy from a leading digital life insurance company. These policies are typically term life insurance that are cheaper and faster to get than policies from a traditional life insurance company.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Disability insurance

The best time to get disability insurance is when you have your first job out of school or training. This insurance could help you replace some of your income if you were unable to work. Disability insurance becomes especially important to financial planning when you have a family. You might be able to put it off while you’re single, but once you have a family, review your coverage each spring to ensure that it will still get the job done.

Long term care insurance

Finally, as you approach retirement, it’s a good idea to consider long term care insurance. This insurance is designed to help you cover the cost of being in a facility for assisted living.

However, not everyone needs long term car insurance. This is a type of insurance that you might be able to self-insure for (if your financial planning includes long-term investing to build a large nest egg).

Don’t forget insurance as you spring clean your finances

No matter what your stage of life, you probably need some type of insurance. While you’re spring cleaning your home, planting your vegetable garden, and looking toward your financial future, don’t forget about insurance coverage. It’s the asset protection piece that can keep you from losing everything when something unexpected happens.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.