Liberty Mutual RightTrack is a telematics program that monitors driving and offers a discount for safe driving. Drivers get a 5% initial discount for signing up and then earn up to a 30% discount based on how well they score.

While Liberty Mutual doesn’t raise rates if you score poorly, you can receive a bill if your discount is less than the 5% sign-up discount.

RightTrack from Liberty Mutual is a good fit for safe drivers or for drivers who want to improve their safe driving skills. It’s also a good option for drivers who may have higher rates due to their demographics, driving records, or credit scores.

Keep reading to learn more about Liberty Mutual RightTrack and how to get the most significant savings. If you're in the market for affordable car insurance, just enter your ZIP code into our quote tool above.

What is Liberty Mutual RightTrack?

Many auto insurance companies offer telematics programs that help safe drivers save money. For example, RightTrack from Liberty Mutual monitors specific driving habits for 90 days and then offers a discount. Drivers get a 5% discount for enrolling and then earn up to 30% off their rates.

Unlike other insurance companies, your RightTrack discount is for the life of your policy. In addition, Liberty Mutual Insurance won’t raise your rates if you score poorly. However, you may have to pay the difference if your savings is lower than the 5% discount offered for participating in the program.

Although Liberty Mutual is available throughout the country, RightTrack isn’t available in all states.

Auto insurance companies use a variety of factors to determine your rates, including your age, driving record, and credit score. For example, your rates are higher if you’re a young driver, have tickets or accidents on your record, or have a low credit score. Therefore, RightTrack is a great way to lower high auto insurance rates for those drivers.

It’s also great for drivers who want to improve their driving skills since the app offers immediate feedback. This feedback points out areas where you can improve.

Don’t worry if other drivers on your policy don’t want to participate in the program. While your discount is higher if more drivers enroll in RightTrack, it’s not mandatory.

How does RightTrack work?

Like most telematics programs, RightTrack monitors specific driving behaviors that lead to accidents. However, each company looks at different habits to determine discounts.

As we mentioned above, RightTrack isn’t available everywhere. And the state that you live in determines how RightTrack works. For example, Liberty Mutual mails New York drivers a tag that attaches to their windshield. The tag works alongside the RightTrack app to monitor your driving. Once your 90-day trial ends, detach the tag and send it back to Liberty Mutual so they can calculate your discount.

The Liberty Mutual RightTrack app is all that is needed for drivers in other states to participate in the program.

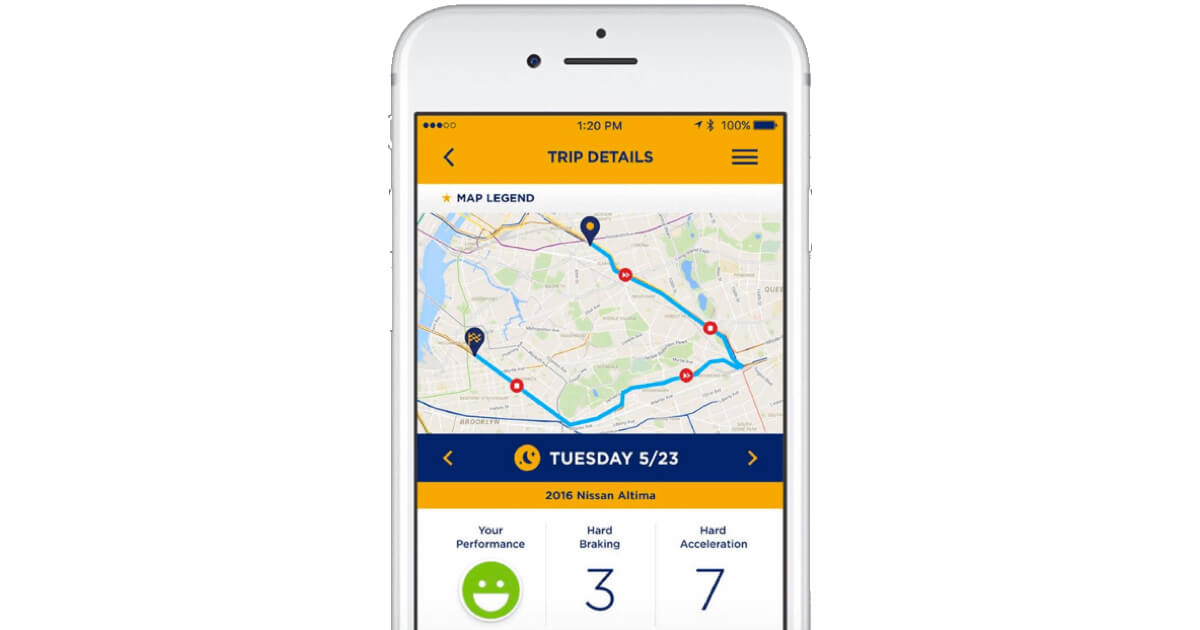

Once you download the app, it runs in the background on your phone. However, you can see your trips and estimated discount. Keep in mind that you can’t improve your score after your trial. You only get one chance to earn your discount.

While there are many pros, there are some cons to using RightTrack.

First, since RightTrack records your drives, privacy can be an issue. In addition, Liberty Mutual states it can use your data for accident investigations and other research.

Next, the app uses your battery by continually running in the background. While battery usage is minimal most of the time, it increases during drives. So charge your phone during long drives to avoid your battery dying.

Finally, the app uses your data. As with battery usage, the app shouldn't significantly impact your data. But, data usage also increases during drives. So, be aware of your data plan while using RightTrack.

Fortunately, RightTrack only monitors your driving for 90 days, limiting the impact on your privacy, battery life, and data usage.

What habits does RightTrack monitor?

RightTrack monitors specific driving behaviors known to cause accidents or make it more likely for you to be in an accident.

RightTrack from Liberty Mutual monitors:

- Miles driven. Drivers who spend more time behind the wheel are more likely to be in accidents. RightTrack records your mileage and location of each trip but doesn’t share your information unless required by law.

- Hard braking and acceleration. Hard braking and quick acceleration show aggressive driving and a lack of attention. Although you can’t always help it if someone pulls out in front of you, Liberty Mutual dings you for consistent hard braking and acceleration.

- Time of day. Driving late at night, early in the morning, or during rush hours means a higher chance of an accident. RightTrack monitors how often you drive during risky times.

Unlike other telematics programs, RightTrack doesn’t monitor distracted driving. So, if you use your phone while driving, you won’t get a lower score.

RightTrack also can tell if you’re the driver or passenger. So, your score won’t decrease if you aren’t driving. If the app gets it wrong, you can adjust it in the app.

For example, if you ride with a co-worker during rush hour, the drive shouldn’t be recorded with you as the driver. Instead, check the app often to ensure everything is correct and get feedback on your driving.

The Bottom Line: Is Liberty Mutual RightTrack worth it?

When you’re looking for ways to get cheap car insurance, be sure to check out RightTrack. RightTrack from Liberty Mutual is free and easy to use. Most drivers can simply use the app to monitor driving. However, New York drivers have to use a windshield tag along with the app.

With RightTrack, your driving is monitored for 90 days. Behaviors used to calculate your discount include how many miles you drive, hard braking and acceleration, and the time of day you drive.

While Liberty Mutual claims you can get up to a 30% discount, most drivers see considerably fewer savings. In addition, if your discount is less than the 5% sign-up discount, you’ll be charged the difference.

The good news is that Liberty Mutual won’t raise your rates if you score poorly. You’ll also get your discount for the life of your policy. Unfortunately, however, you don’t get a second chance to earn a higher discount.

Drivers should also be aware of concerns, such as privacy, battery life, and data usage during the trial period.

RightTrack from Liberty Mutual is a good fit for drivers who may have high rates for other reasons, like a bad driving record or low credit score. It also helps parents see how their teen driver is doing.

The app provides immediate feedback on drives, allowing drivers to adjust unsafe driving habits.

Since RightTrack is free and Liberty Mutual won’t raise your rates, there’s not much downside to trying to program. Searching for new car insurance? Just enter your ZIP code into our free quote tool below to compare rates.