What you should know

- Renters insurance often includes loss-of-use coverage — this means that if your home is unsuitable for living due to unexpected peril, your renters insurance may cover the cost of a hotel stay

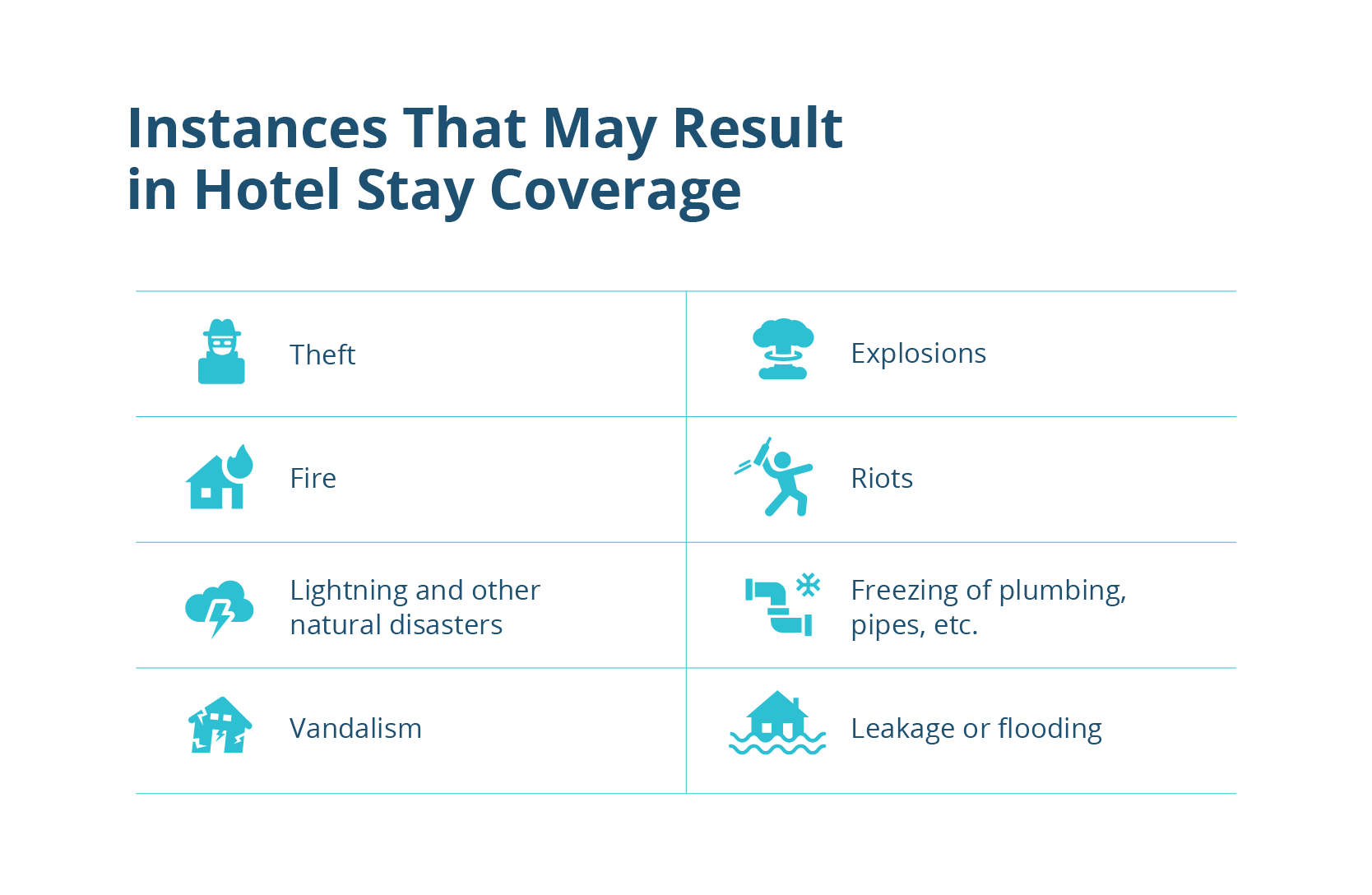

- Policyholders may qualify for additional coverage in the event of theft, fire, natural disasters, vandalism, and more

- In some cases, policyholders may be required to pay a deductible — this will depend on the insurance policy of the provider

As we all know, it’s better to be over-prepared than underprepared.

Have you ever thought about where you would go if you and your family were temporarily displaced from your home? It's important to know and fully understand the details of your renters insurance and know the difference between homeowners insurance vs. renters insurance, so you’re ready if and when disaster strikes.

Renters insurance often includes loss-of-use coverage, providing you the funds to live elsewhere in case of unexpected peril. Depending on your coverage plan, your insurance could potentially cover your hotel stay.

Whether you’ve recently experienced a natural disaster or are curious to know more about your renters insurance coverage for peace of mind, this guide will explain the ins and outs of using renters insurance to cover hotel stays.

If you need to find renters insurance, you can compare multiple quotes with our free search tool right now.

When am I covered for a hotel stay?

Let’s say your house burned down in a fire, and you have no place to live or store your personal belongings. You want to make sure your renters insurance is going to be there for you if you are no longer able to safely live in your home.

Wherever you temporarily find lodging depends completely on the insurance company and what your coverage includes.

Each insurance coverage plan includes a list of perils, following which you could qualify for temporary housing. Contact your insurance agent or provider to learn more about what’s covered on your unique renters insurance plan. You might qualify for more than you thought.

Know What's Covered

If you aren’t sure whether or not your situation qualifies for a hotel stay, read through your insurance policy or contact your insurance agent to find out more.

If you aren’t sure whether or not your situation qualifies for a hotel stay, read through your insurance policy or contact your insurance agent to find out more.

How long will I be covered?

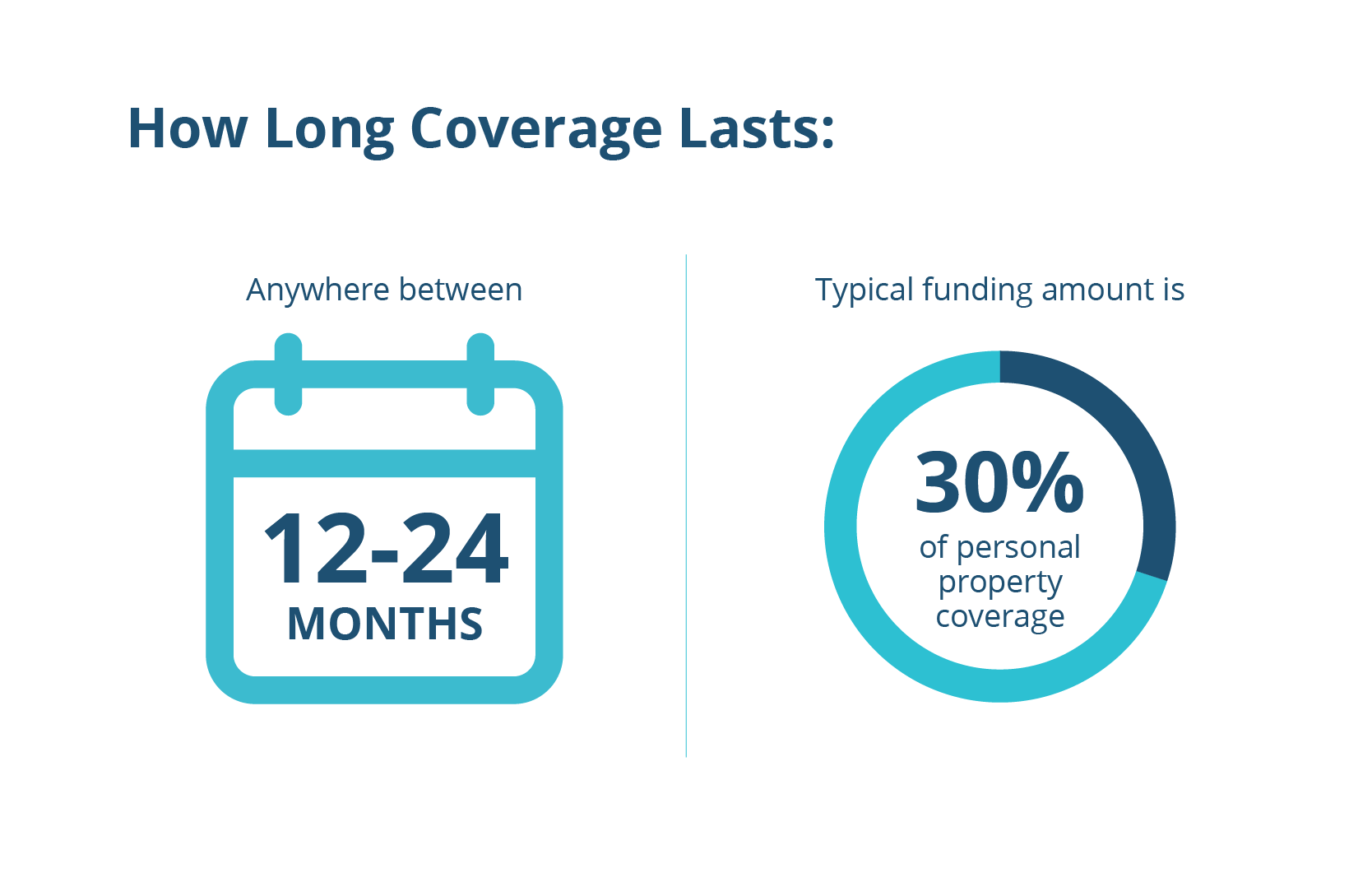

Depending on your renters policy, you might be covered for anywhere between 12 and 24 months. The typical amount of funding insurance companies give is around 30% of your personal property coverage. Anything more than that is extremely rare, so it’s important to budget and keep track of your spending so you don’t continue to incur charges after your dwelling coverage ends.

Depending on your renters policy, you might be covered for anywhere between 12 and 24 months. The typical amount of funding insurance companies give is around 30% of your personal property coverage. Anything more than that is extremely rare, so it’s important to budget and keep track of your spending so you don’t continue to incur charges after your dwelling coverage ends.

Will I have to pay a deductible?

In some cases, yes, but this entirely depends on your unique coverage plan, so make sure to ask your insurance provider whether or not this applies to you.

Remember, a deductible is the amount of money you’ll have to pay out-of-pocket before your insurance company pays your claim. If you do have to pay a deductible, you might want to consider adding additional coverage to your homeowners policy in order to tailor a plan that works better for your individual needs.

In what cases am I not covered?

It is always important to think about what renters insurance does not cover. Remember that your renters insurance will only provide you and your family the funds to lodge elsewhere for perils that are listed under your coverage. Only if your home is uninhabitable will the insurance company pay — and they will make sure that the circumstances call for you to move immediately.

The only other instances in which your insurance company won’t pay for your stay is if you file a false claim or exceed your policy limit.

In the event that you aren’t covered, make sure to have a backup plan and check to see if your landlord will consider paying for your temporary lodging.

How to File Your Claim

If you do need to make a claim, your provider will have you fill out a series of forms stating how much you typically spend on things such as groceries, rent, and transportation. Next, they’ll provide the funds equal to your typical monthly spending prior to the accident.

They might also ask you to provide receipts and/or proof to make sure you aren’t living above your means.

Is loss-of-use coverage really necessary?

Most definitely. A sound policy will give you a safety net when and if disaster strikes.

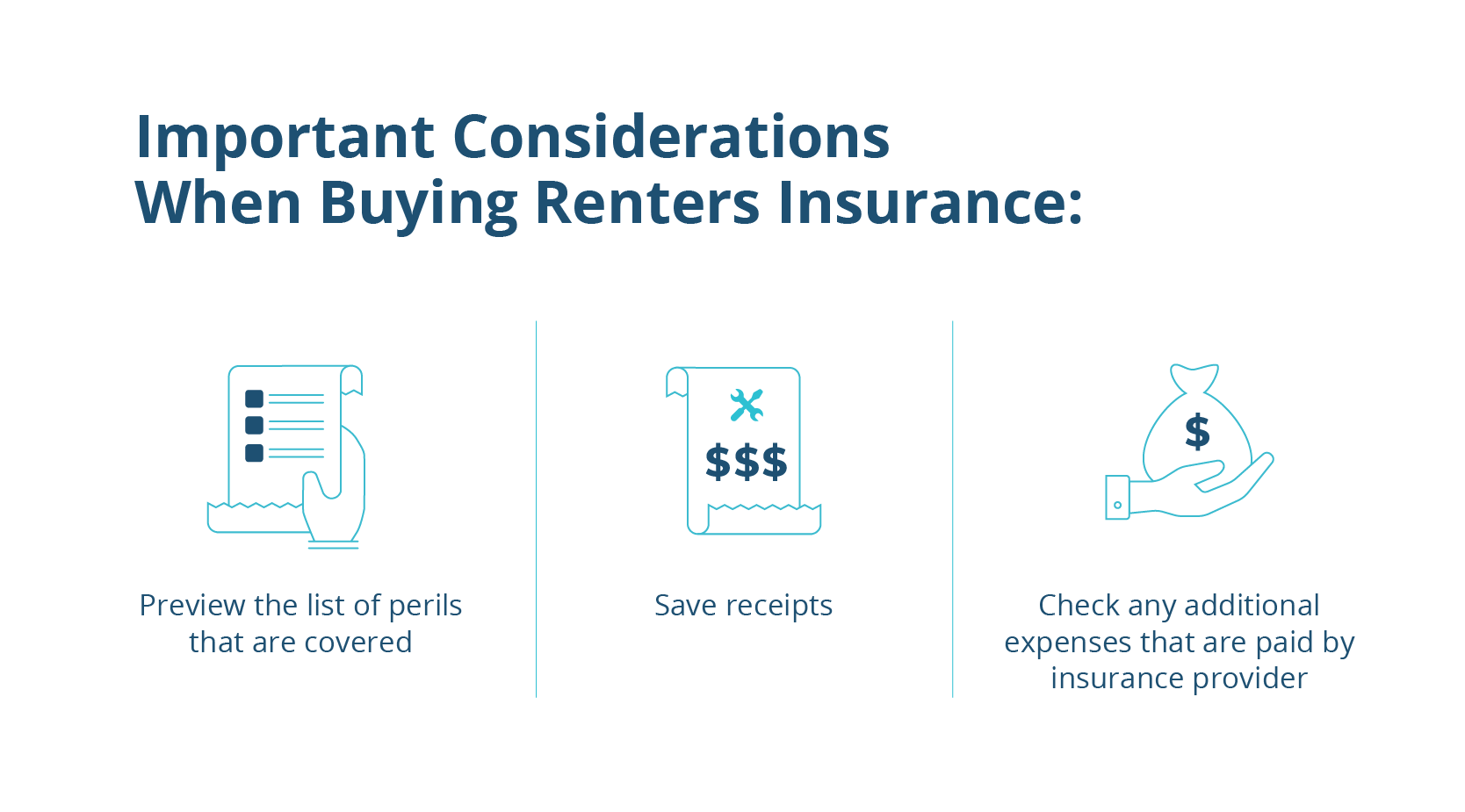

Here are some key points to keep in mind when purchasing your renters insurance:

Double-check the list of perils that are covered on your home insurance plan. What might be perilous to you might not be deemed as such by a home insurance provider. Some companies won’t cover you if something like mold forces you to move out of your home because it doesn’t actually cause structural damage to your house.

Save your receipts. Your provider might want to check and collect your receipts to confirm transparency about your weekly and monthly spending. Their job is to provide you with adequate housing, not luxury accommodations.

Check to see what additional expenses are paid for by your provider. Most people don’t realize that they are covered for a variety of expenses, not just lodging. These dwelling coverage plans could include laundry, restaurants, transportation expenses, rent, and storage.

Your temporary housing insurance plan is there to give you peace of mind and, when chosen wisely, can be a reassuring investment.

Find a Policy That Puts a Roof Over Your Head

Whether your home has just been broken into or your town has been hit by a natural disaster, you'll sleep easier knowing that you and your loved ones will have a place to live temporarily in the case of an emergency.

Your renters policy is there to keep you safe when you need temporary relocation. Preparing for the unexpected and understanding your unique liability coverage plan will help you when life gets hard.

Our insurance information institute is dedicated to helping you save money by comparing different insurance quotes through customer-generated reviews and data. Finding the best renters insurance policy for you has never been easier.

Use our search tool to locate top customer-rated providers who’ll be there when you need them to be.