Getting into any kind of car accident is difficult experience, but hitting a deer can be especially upsetting. Plus, car insurance may not necessarily cover your vehicle damage from hitting a deer depending on the policy you have. According to the Insurance Information Institute, on average in 2018, 1 in every 167 drivers will have a claim from hitting a deer, elk, moose or caribou.

Deer accidents are most common from October through December with the odds of hitting a deer nearly doubled during this time period. Drivers in certain states with higher deer populations are significantly more at risk for hitting a deer while driving. Getting into an accident with a deer can be costly, and being informed on how to be protected in the event of an incident is important.

What states are drivers most likely to hit a deer?

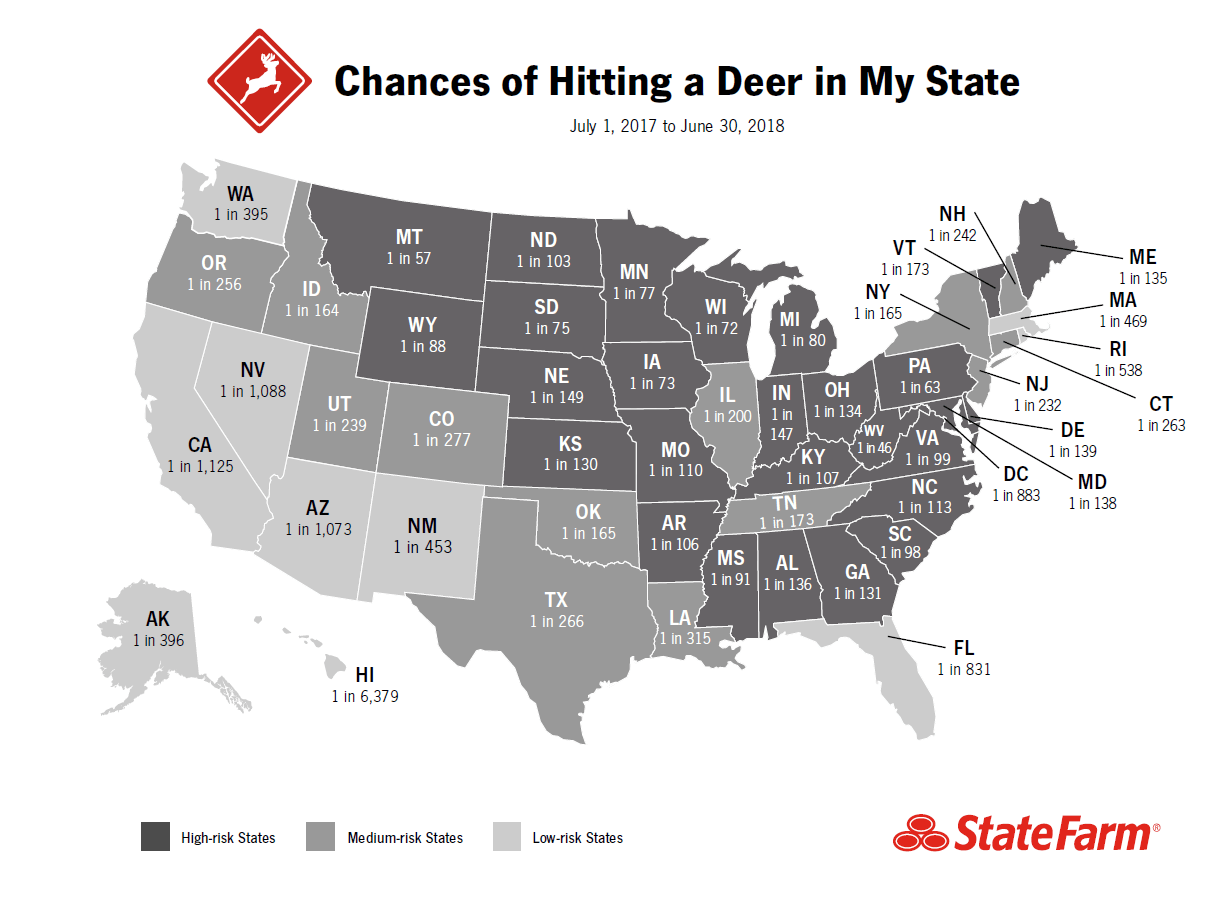

Drivers who live in rural states with higher deer populations are much more likely to hit a deer than drivers in more urban states. West Virginia drivers have a 1 in 46 chance of hitting a deer, the highest in the United States, followed by Montana, where drivers have a 1 in 57 chance. Drivers who live in Hawaii have the lowest chance of hitting a deer at 1 in 6,379, followed by California with the odds at 1 in 1,125, according to State Farm's annual report.

Drivers are most likely to hit a deer around dawn or around dusk, throughout the months of October to December, because those are the deer mating months. If you see one deer, it’s important to slow down and be on the lookout as deer usually travel together and more are likely to be around.

What should I do if I hit a deer?

If you see a deer in front of you on the road, turn on your high beams, and honk your horn in one continuous blast to try to scare the animal away. If possible, try to come to a stop as quickly as possible. Try not to swerve out of the way, as this could cause an accident with another driver.

If you do get into an accident with a deer, it’s important to not touch the animal or try to help it. A wounded animal is unpredictable, and it could end up hurting you or itself more. Call the police to report the accident, and if possible, get your car off the road.

Will my car insurance cover hitting a deer?

Your car insurance will typically cover an accident if you hit a deer as long as you have comprehensive insurance coverage on your policy. Note that collision insurance doesn’t provide coverage for collisions with animals, which is a common misconception. Comprehensive insurance is an optional add-on to your car insurance policy that covers your vehicle in the event its damaged in another way other than a collision. Here’s a list of the types of things comprehensive insurance protects you from:

- Animal damage, such as hitting a deer

- Theft

- Vandalism, or damage from a riot

- Fire

- Falling objects

- Natural disasters

- Windshield and glass damage

Comprehensive insurance isn’t usually required by your state, but it will be by your financing company if you’re leasing or financing your car. If you have comprehensive insurance in place, you will most likely receive some payment for your accident, after paying the deductible you have on your comprehensive insurance. It can help you recover financially after an animal collision — the cost of the average animal collision claim in the U.S. in 2018 was $4,341.

Having the right insurance company when you hit a deer or get into any type of car accident is important, and can help make a bad situation better. See which insurers rank as the top car insurance companies in your area.

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.