Do you need insurance on a car that doesn’t run? If you have a car that isn’t operational, it might seem unnecessary to maintain an auto insurance policy for it. Having car insurance may seem unnecessary if the vehicle isn’t in use or you don’t plan to drive it. However, it's essential to review options with the best car insurance companies to make informed decisions.

But should you carry insurance on a car that does not run? The answer depends on where you live and whether your vehicle is registered.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code above into our free comparison tool to see rates in your area.

What You Need to Know

- If your car isn’t running but is registered, you likely need liability insurance

- Comprehensive coverage for a non-operational vehicle averages $15-$20/month

- Consider suspending or canceling insurance if you don’t drive your car

Car Registration and Insurance: What You Need to Know

If you have registered your car with your state’s department of motor vehicles, you may be required to carry auto insurance on the car. This is because your car has a license plate and could be repaired and ready to drive at any time.

Any vehicle that is not registered and does not have a license plate does not legally have to carry a car insurance policy. So, for this reason, any vehicle you have that’s registered but not currently running could be unregistered, allowing you not to have to carry insurance on the car.

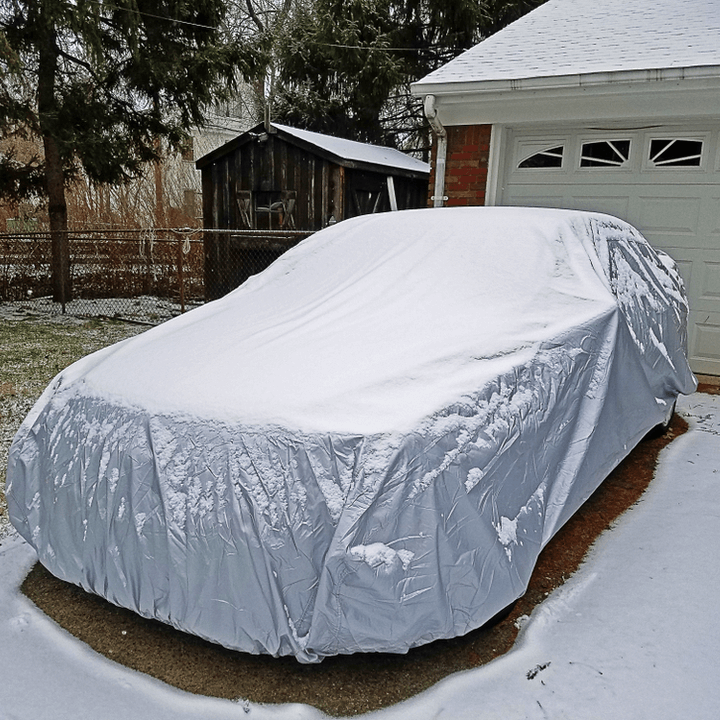

If your vehicle is not registered but is stored, and you do not plan to drive it, you do not have to carry any insurance on the car. Still, you may want to carry a comprehensive insurance coverage on the vehicle to protect it from weather damage, theft, and other things.

Does a car need insurance if it doesn’t run?

You must carry a car insurance policy on any registered vehicle with a corresponding license plate in most states. So even if your car doesn’t run, if it is registered in your state, you will likely need at least a cheap liability car insurance policy on the vehicle. What to do with a vehicle that doesn't run? You might be wondering what your options are for storage and insurance.

First, where can I store a car that doesn’t run? Many people choose to store non-running vehicles in garages, storage units, or even on their property, but it’s important to ensure the vehicle is protected from weather, theft, or other damage. Once your vehicle is stored, you may ask yourself, do I need insurance if I don’t drive my car?

While you technically don’t need insurance for an unregistered vehicle, keeping a comprehensive insurance for a car that doesn’t run could be a smart move. This type of coverage protects the vehicle from non-driving risks, like natural disasters or vandalism. Another common concern is, can I take insurance off my car if I’m not driving it, or even, can I cancel my car insurance if my car is broken?

You might be tempted to cancel the insurance altogether, but if your car is still registered, many states require you to keep at least liability insurance. Failing to do so could lead to penalties or higher premiums in the future. So, do I have to keep insurance on a car I don’t drive? If your car is registered, the answer is usually yes.

Do cars need insurance even if they’re not on the road? In most cases, they do, unless you cancel the vehicle's registration. This ensures you avoid any coverage gaps that could make it harder or more expensive to insure the car later on.

What kind of car insurance do I need on a car that isn’t working?

If you have not registered the car with your state or live in a state that does not require a registered vehicle to be insured when it's not being driven, you may still want to consider carrying insurance on your car.

The most notable option for car insurance on a car that isn’t running is comprehensive coverage. This insurance option will cover your vehicle in the following scenarios:

- Theft

- Vandalism

- Natural disasters

- Hail

- Falling debris

- Fire

- Hail

- Flood

- Animals

A vehicle might become inoperable due to being involved in an accident or sustaining other types of damage. If this happens, there are five steps to take after a car accident to ensure proper handling of the situation. If this is your situation, you should also consider a comprehensive insurance policy on the vehicle while you have it repaired. If your car doesn't work, you may wonder whether you still need to pay for car insurance. This question arises especially if you're not driving the vehicle or it's non-operational.

The short answer is that car insurance for non-operating vehicles is still necessary in certain situations, particularly if the vehicle is registered. Many states require at least liability insurance for registered cars, regardless of whether you're driving it. You might also need to consider insurance for cars not driven often, like a comprehensive-only policy, which protects the vehicle from damage like theft or weather-related incidents.

The Risks of Driving an Unregistered Vehicle and Why Proper Coverage Matters

If your vehicle is completely out of commission and you don’t want to maintain insurance, you could cancel your vehicle registration, though this means you can't legally drive until it's re-registered. To learn more about this process, check out how to cancel your car insurance. If you plan to drive occasionally, be aware of the risks involved.

Driving with insurance but no registration is illegal in most states and could result in hefty fines. In some cases, driving without registration can lead to penalties, and the fine for driving an unregistered vehicle can vary by state, often reaching several hundred dollars.

If you're involved in an accident, even if you're not at fault, the other driver’s insurance may not cover damages. That’s why understanding the truth about uninsured motorist coverage is crucial, as it can protect you if the at-fault driver lacks insurance.

Also, in case of an accident that wasn't your fault, you might be asking, "Should I get a lawyer for a car accident that wasn't my fault?" While it’s not always required, getting legal advice can be beneficial to ensure you're fully compensated.

What is a coverage gap?

In terms of car insurance, a coverage gap insursance refers to a specific timeframe in which you owned a car registered in your name when you did not carry insurance on the vehicle. Gaps in insurance coverage are the main reason canceling insurance on a car that doesn’t run can be bad.

| Aspect | Details |

|---|---|

| Coverage Options | Comprehensive or storage insurance for non-running cars. |

| Liability Requirement | Not needed if car isn’t driven |

| Comprehensive Coverage | Covers theft, fire, or vandalism |

| Storage Insurance | Cheaper coverage for cars in storage |

| Registration Requirement | Only in CA, NY, TX, FL, IL, PA, NJ & MI |

| Temporary Suspension Option | Offered by some insurers like: State Farm, Allstate, Progressive, Nationwide & Geico |

| Cost Consideration | Cheaper due to lower accident risk |

While you are not likely to get in much legal trouble for canceling your auto insurance on a registered car that doesn’t run, you may find that purchasing a car insurance policy on the vehicle in the future is exceptionally difficult.

When insurance companies see a gap in coverage — anywhere from a few weeks to months or even years — the companies are less willing to provide insurance coverage. Gaps in coverage signify many issues, such as missed payments or car accidents, so it's essential to know the six steps to handling an accident with an uninsured driver to protect yourself in such situations.

Unfortunately, these events give insurance companies plenty of reasons not to offer a policy. However, you can do a few things to avoid a gap in auto insurance coverage on your vehicle.

How can I avoid a coverage gap?

To avoid significant increases in your auto insurance rates in the future, it’s essential to maintain continuous coverage whenever possible. This is one of the top ways customers have saved money on car insurance rates.

The easiest way to avoid having a gap in your insurance coverage is to maintain a car insurance policy. If you have a vehicle you don’t drive, this could be as simple as having a liability-only policy or even a comprehensive-only policy.

If you don’t want to continue paying for car insurance on a vehicle you don’t plan to drive, you can speak with your insurance company to see if you can suspend your policy. Suspending a car insurance policy allows you to maintain a current account with your insurance company that you will begin paying for as soon as your vehicle is up and running.

You can speak with your insurer, or price options with other insurance companies, about purchasing a storage insurance policy. This type of policy will likely carry specific requirements regarding how you store your car, but it could provide the coverage you need at a low price.

A suspended policy can help you save some money on coverage, but you will have to pay for repairs out of your pocket if your car is damaged by theft, natural disasters, or anything else.

Your last resort for avoiding a gap in car insurance coverage is to cancel your vehicle’s registration. Of course, this will mean you will need to re-register your vehicle if and when you ever decide to drive it again. Still, it will help you avoid any gaps in coverage or legal ramifications for not carrying the proper insurance.

The Bottom Line: Should I insure my car that isn’t running?

You should try to maintain some level of coverage on your vehicle even if it isn’t running. This is especially true if your car is registered in your state and is only temporarily out of order.

You may opt not to have insurance on your vehicle; however, it's essential to consult your state's motor vehicle department first. Typically, this decision requires you to cancel your car's registration. For a comprehensive overview of car insurance, consider referring to a practical guide for understanding car insurance.

Avoid overpaying for your car insurance by entering your ZIP code below in our free comparison tool to find which company has the lowest rates.

Frequently Asked Questions

What should I do with a car that doesn't run?

If you have a car that doesn't run, consider storing it in a garage or storage unit to protect it from the elements. You may also want to assess whether repairs are feasible or if it's time to sell or junk the vehicle.

Does a car need to be insured?

Yes, a car typically needs to be insured if it is registered with your state's Department of Motor Vehicles (DMV). Insurance requirements may vary by state, so it's essential to check local regulations.

What should I do with a vehicle that doesn't run?

When deciding what to do with your car, consider options like repairs, storage, selling, or disposing of it. Explore options such as fixing, storing, selling, or disposing of the car, ensuring it is kept in a secure location to protect it from damage or theft, while also considering whether car insurance covers repairs.

Do you need car insurance on a non-operational vehicle?

You may not need car insurance on a non-operational vehicle if it is unregistered. However, if the vehicle is registered, you will likely need at least liability insurance, even if it's not being driven.

Does my car need insurance if I'm not driving it?

If your car is registered, you will generally need to maintain some level of insurance, such as liability coverage, even if you are not currently driving it. Enter your ZIP code below to compare rates from the top providers near you.

What should I do if the other car doesn't have insurance?

If you’re involved in an accident and the other driver doesn’t have insurance, you may have limited options for recovering damages. It’s beneficial to have uninsured motorist coverage on your own policy for such situations.

If I don't drive my car, do I need insurance?

Yes, if your car is registered, you typically need to keep insurance active. Check your state's requirements to confirm what is necessary in your situation.

Can I cancel insurance on a car I don't drive?

You can cancel insurance on a car you don’t drive, but be cautious. If the vehicle is still registered, doing so could result in penalties or future difficulties obtaining insurance.

Where can I store a car that doesn’t run?

You can store a non-running car in various places, including your garage, a storage unit, or a secure outdoor area. To safeguard your vehicle from possible weather damage and theft, follow these five steps to take after your car is broken into.

Can someone drive my car if they are not on my insurance?

In most cases, if someone else drives your car, they may be covered under your insurance policy. However, coverage can depend on your specific policy terms and the driver’s circumstances, so check with your insurance provider.

What type of car insurance do I need if I’m not driving?

If you're not driving your vehicle, you might consider comprehensive insurance, which protects against non-driving risks, such as theft or weather damage, particularly if the vehicle is registered.

What happens if my vehicle registration expires?

If your vehicle registration lapses, you may face fines and be barred from legally driving until it is re-registered. Moreover, insurance requirements could change, making it essential to rectify the expired registration quickly. What is the penalty for driving without insurance? This is another important consideration, as driving without valid insurance can lead to significant consequences.

Do I need car insurance if my car is off the road?

Yes, if your car is registered and off the road, you usually need to maintain at least liability insurance to comply with state regulations. Use our free quote comparison tool below to find the cheapest coverage in your area.

When must your vehicle have valid insurance coverage?

Your vehicle must have valid insurance coverage whenever it is registered, regardless of whether it is being driven. This ensures compliance with state laws and protects you financially.