If you're asking yourself, do I need uninsured motorist coverage if I have health insurance? The answer is yes. Uninsured motorist coverage can seem like a waste of money if you have good health insurance coverage.

But this kind of car insurance goes beyond covering medical expenses. It offers important protection in accidents where the other driver doesn't have insurance. And it will only cost you less than $100 monthly.

Health insurance only covers your personal injuries, while uninsured motorist coverage extends protection to your passengers and property. Some states require this kind of coverage to register your car.

Let’s look at what uninsured motorist coverage is, when it’s required, and why it’s a smart addition to your auto insurance policy. Ready to find affordable car insurance? Get started today by entering your ZIP code above into our free comparison tool.

What You Should Know

- Uninsured motorist coverage protects in accidents with uninsured drivers

- Uninsured motorist coverage offers full protection unlike medical insurance

- Uninsured motorist coverage is typically under $100 monthly

You May Still Need Uninsured Motorist Coverage Even if You Have Health Insurance

Uninsured motorist coverage is a smart addition to your car insurance and health insurance policies. It goes beyond paying for your personal medical expenses to offer per-person and per-accident limits for injuries and car damage for you and your passengers when you’re involved in an accident with an uninsured driver.

| Uninsured Motorist Coverage | Health Insurance |

|---|---|

| Per-person and per-accident limits | Annual limits |

| Covers injuries, car damage, and lost wages | Only covers injuries |

| Protects your passengers | Only protects you |

Without uninsured motorist coverage, you’ll have to meet your health insurance policy’s requirements for deductibles and co-pays as you access care for your injuries. You’ll only get coverage for your own injuries, leaving your passengers to rely on their health insurance.

Your health insurance also won’t cover lost wages or damages to your car, both of which you can get covered with uninsured motorist property damage insurance.

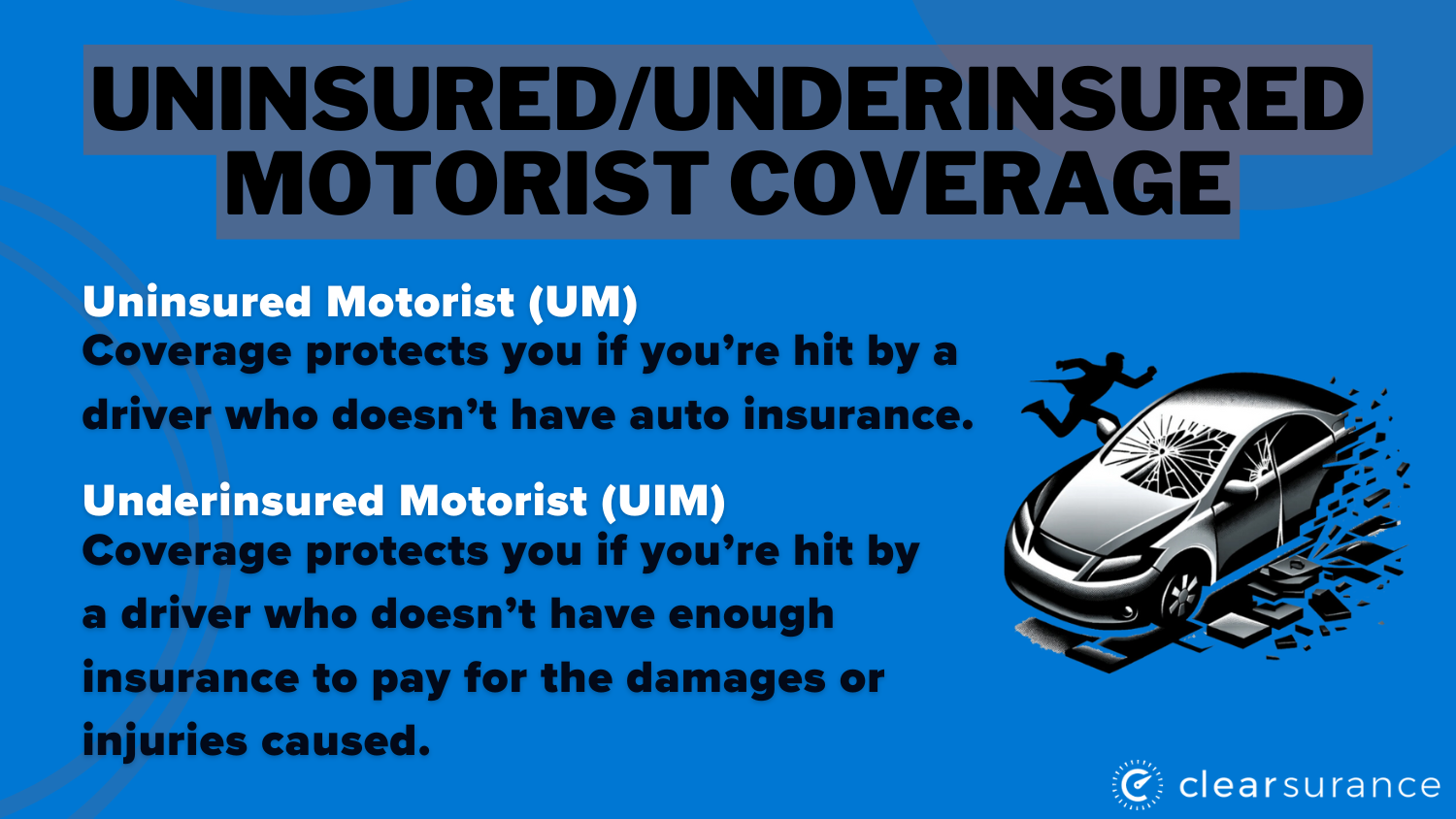

Uninsured Motorist Coverage Defined

Uninsured motorist coverage is a type of car insurance providing protection if you’re in an accident with an at-fault driver who is not insured. It essentially functions as the at-fault driver’s insurance when that driver isn’t covered or identified due to the circumstances of the accident.

You might file a claim under your uninsured motorist coverage in accidents involving:

- Underage drivers

- Drivers under the influence

- Hit-and-run accidents

- Drivers who haven’t purchased insurance of any kind

When adding uninsured motorist coverage to your auto insurance policy, you’ll notice it’s often split into two types of coverage: uninsured motorist bodily injury (UMBI) and uninsured motorist property damage (UMPD).

UMBI coverage pays for medical expenses for you, your passengers, permitted drivers, and lost wages and pain and suffering. In addition, UMPD covers car and property damage after an accident.

Why You Are Required to Have Uninsured Motorist Coverage

Twenty states and Washington, D.C.( Read more about the best and the cheapest car insurance in Washington), mandate uninsured motorist coverage for every driver with a registered car.

These states include Connecticut, Illinois, Kansas, Maine, Maryland, Massachusetts, Minnesota, Missouri, Nebraska, New Hampshire, New York, North Carolina, North Dakota, Oregon, South Carolina, South Dakota, Vermont, Virginia, West Virginia, and Wisconsin, along with the District of Columbia.

| State | Minimum Rates |

|---|---|

| State | Minimum Rates |

| Connecticut | $25,000 per person / $50,000 per accident |

| Illinois | $25,000 per person / $50,000 per accident |

| Kansas | $25,000 per person / $50,000 per accident |

| Maine | $50,000 per person / $100,000 per accident |

| Maryland | $30,000 per person / $60,000 per accident |

| Massachusetts | $20,000 per person / $40,000 per accident |

| Minnesota | $25,000 per person / $50,000 per accident |

| Missouri | $25,000 per person / $50,000 per accident |

| Nebraska | $25,000 per person / $50,000 per accident |

| New Hampshire | $25,000 per person / $50,000 per accident |

| New York | $25,000 per person / $50,000 per accident |

| North Carolina | $30,000 per person / $60,000 per accident |

| North Dakota | $25,000 per person / $50,000 per accident |

| Oregon | $25,000 per person / $50,000 per accident |

| South Carolina | $25,000 per person / $50,000 per accident |

| South Dakota | $25,000 per person / $50,000 per accident |

| Vermont | $50,000 per person / $100,000 per accident |

| Virginia | $30,000 per person / $60,000 per accident |

| Washington D.C. | $25,000 per person / $50,000 per accident |

| West Virginia | $25,000 per person / $50,000 per accident |

| Wisconsin | $25,000 per person / $50,000 per accident |

If you don’t live in a state where uninsured motorist coverage is required, it’s still a good idea to add this coverage to your policy. It's typically inexpensive and can provide a critical safety net in case of an accident. Compare quotes for uninsured motorist coverage to see what protection you can get.

Uninsured Motorist Coverage vs. Health Insurance

Many people wonder, do I need uninsured motorist coverage if I have medical insurance? While medical insurance can help cover your hospital bills after an accident, it often does not address other expenses, such as lost income or suffering.

This raises the question: why do I need uninsured motorist coverage if I have health insurance? Uninsured motorist coverage provides crucial protection against damages caused by uninsured drivers, ensuring you are fully covered in the event of an accident.

Even if you need health and uninsured insurance, it doesn't have to be too expensive for you. You can shop around for affordable health insurance.

Uninsured Motorist Bodily Injury vs. Health Insurance

When considering your options after an accident, you might ask, do I need uninsured motorist bodily injury if I have health insurance? Health insurance primarily covers medical expenses but does not address other damages, such as lost income or suffering.

This leads to another common question: if you have health insurance, do you need uninsured motorist coverage? Is uninsured motorist coverage worth it?The answer is yes, as uninsured motorist bodily injury coverage offers essential financial protection, filling in the gaps left by health insurance when dealing with uninsured drivers.

Why Uninsured Motorist Coverage Complements Your Health Insurance

Even if you have health insurance, adding uninsured motorist coverage can give you extra protection and peace of mind about you, your car, and your passengers. You shouldn't have to worry about the at-fault driver’s insurance covering injuries and damages with this type of auto insurance.

Learn More: What Kind of Car Insurance Do You Really Need?

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

Frequently Asked Questions

What is the difference between uninsured motorist stacked and unstacked?

The difference is that stacked uninsured motorist coverage combines the limits of multiple vehicles on your policy for higher coverage. Unstacked coverage applies limits to each vehicle individually.

What is uninsured underinsured motorist coverage?

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you're in an accident with a driver without insurance or insufficient coverage. It helps cover medical expenses, lost wages, and other damages. If you are looking for a good provider, State Farm uninsured motorist coverage is a good choice.

Learn More: State Farm car insurance review

How does under insurance work?

Underinsurance works by covering the gap when the at-fault driver's insurance isn't enough to pay for your damages. Your underinsured motorist (UIM) coverage pays the difference up to your policy limits.

What is the difference between PIP and uninsured motorist?

Personal Injury Protection (PIP) covers your medical expenses and lost wages regardless of fault in an accident. Uninsured motorist (UM) coverage protects you in an accident with an uninsured driver, covering medical costs and damages the at-fault driver cannot pay.

Do I need uninsured motorist coverage in Florida if I have PIP?

You should consider uninsured motorist (UM) coverage in Florida, even with Personal Injury Protection (PIP). PIP covers your medical expenses, but UM provides additional protection against costs from accidents with uninsured or underinsured drivers.

Is full coverage car insurance required in Texas?

No, full coverage car insurance is not required in Texas. The state only mandates liability insurance, which covers damages you cause to others. However, full coverage, including collision and comprehensive, is recommended to protect your vehicle.

What happens if the person at fault in an accident has no insurance in Texas?

If the at-fault driver in an accident has no insurance in Texas, you may rely on your insurance. Uninsured motorist (UM) coverage can help cover your medical expenses and damages.

If you don't have UM coverage, you may need to pursue legal action against the uninsured driver, which can be challenging. You might also wonder if an accident is not your fault, does your insurance go up? The answer is, unfortunately, yes.

Does uninsured motorist coverage stack in Texas?

Yes, uninsured motorist (UM) coverage can stack in Texas. This allows you to combine the UM limits from multiple insured vehicles for greater financial protection in an accident. You must choose this option when purchasing your policy.

How do I reject uninsured motorist coverage in Colorado?

To reject uninsured motorist (UM) coverage in Colorado, you must provide a written rejection to your insurance company. This usually involves signing a form indicating you do not want UM coverage, and it should be done when purchasing or renewing your policy.

Who has the cheapest car insurance in Texas?

The cheapest car insurance in Texas varies by individual factors like driving history and location. Companies such as Geico, State Farm, and Progressive (Read more Progressive car insurance review ) often offer competitive rates. It's advisable to compare quotes from multiple insurers to find the best option for your needs.

What is the statute of limitations for uninsured motorist claim in Texas?

The statute of limitations for filing an uninsured motorist (UM) claim in Texas is generally two years from the accident date. This applies to bodily injury and property damage claims, so filing within this timeframe is important.

Will my insurance go up if someone hits me in Texas?

In Texas, your insurance rates generally should stay the same if someone else hits you and they are at fault. However, your rates might increase if your insurer has to cover the claim because the other driver is uninsured or underinsured. Always report the accident and provide as much information as possible to avoid any complications with your claim.

What happens if I reject uninsured motorist coverage in Florida?

If you reject uninsured motorist coverage in Florida, you won't be covered for damages caused by an uninsured or underinsured driver. While your health insurance may cover medical expenses, it won't cover lost wages or pain and suffering. So, do I need uninsured motorist if I have health insurance? Yes, it's recommended, as it offers broader protection beyond medical costs.

Do I need uninsured motorist coverage in Texas if I have collision and comprehensive?

Yes, you still need uninsured motorist (UM) coverage in Texas, even with collision and comprehensive coverage.

UM covers medical expenses and lost income that Collision and Comprehensive do not cover. It also protects you against uninsured drivers.

So, should you have uninsured motorist coverage? Absolutely, as it provides essential protection in situations where other types of coverage fall short.

What is the difference between collision and uninsured motorist coverage in Texas?

In Texas, collision coverage pays for damage to your vehicle after an accident, regardless of who is at fault. Uninsured motorist coverage, on the other hand, protects you if you're in an accident with a driver who has no insurance or insufficient coverage.

While collision covers vehicle repairs, uninsured motorist coverage helps with medical expenses, lost wages, and other damages caused by the uninsured driver.

Can you sue an uninsured motorist in Texas?

Yes, you can sue an uninsured motorist in Texas if they are at fault for the accident. However, collecting compensation can be difficult if they don't have sufficient assets. That's why having uninsured motorist coverage is essential—it helps cover your damages when the other driver cannot.

How much is uninsured motorist coverage in Texas?

The cost of uninsured motorist coverage in Texas varies depending on your location, driving history, and the coverage you choose. It can add about $50 to $100 annually to your premium.

What does "uninsured" mean?

"Uninsured" refers to a driver who has no auto insurance. If they cause an accident, they have no coverage for damages or injuries, leaving you to rely on your insurance or uninsured motorist (UM) coverage. Learn more about handling an insured driver in case of an accident in our article about the steps to handle an accident with an uninsured driver.

Do I need uninsured motorist coverage in Florida if I am on Medicare?

Even if you're on Medicare, uninsured motorist coverage in Florida offers protection beyond medical expenses, such as covering lost wages and pain and suffering.

So, if you are asking yourself do I need uninsured motorist coverage in Florida if I have health insurance or If I have health insurance do I need uninsured motorist coverage? The answer is yes, it's still recommended for complete financial protection in case of an accident with an uninsured driver.

Ready to find affordable car insurance? Use our free comparison tool below to get started.