You do have to add your dog to your home insurance for your dog to be covered by your home insurance. If you haven’t made your home insurance company aware of your furry friend, they may deny you coverage if you are sued for a dog bite.

Pet owners should take responsibility for their animals. Any owner wants to keep their pet safe, and adding them to one of the customers' choice top ranked insurance companies is an excellent decision.

If you need help looking at home policies that insure dogs, try our free online tool to compare insurance rates.

What You Should Know

- Home insurance will deny dog bite claims if dogs are not on the policy

- Some dog breeds homeowners insurance won't cover

- Training your dog will lessen the likelihood of bites

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Why You Need Home Insurance For Dogs

Increased rates is one of the common consumer homeowners insurance complaints, and adding a dog to your home insurance may result in an increased premium. Most people ask, “do I really have to add my dog? He or she doesn’t bite.” The answer is yes.

Even the best-trained pets can be unpredictable, and you’ll want to make sure you're covered if there is ever an incident or injury caused by your dog.

Approximately 4.5 million people suffer from dog bites each year, requiring medical attention.

Most incidents are 'first timer bites' which means the dog didn’t have a previous bite history. The problem with this is many an owner fall into the camp of never believing their dog would ever bite someone, but if you wait until after the first bite to add them to your policy, it’s too late.

If you don't add your dog to your homeowners insurance, you could be left paying for the injured parties’ medical bills and potentially a lawsuit — all out of pocket. You should ensure you are protected by adding your dog to your homeowners insurance to avoid such conditions.

Cost of Adding a Dog to Homeowners Insurance

How much it costs to add your dog to homeowners insurance depends on several factors, such as your state, dog breed, and more. Take a look at the table below to see how much it costs by state for home insurance and adding a dog, as well as if the state allows breed descrimation.

| State | Monthly Cost | Breed Discrimination | Cost to Add Dog |

|---|---|---|---|

| Alabama | $120 | Allowed | $40 |

| Alaska | $90 | Not Allowed | $30 |

| Arizona | $95 | Allowed | $25 |

| Arkansas | $100 | Allowed | $35 |

| California | $110 | Not Allowed | $30 |

| Colorado | $105 | Allowed | $30 |

| Connecticut | $130 | Not Allowed | $40 |

| Delaware | $115 | Allowed | $35 |

| Florida | $150 | Allowed | $50 |

| Georgia | $115 | Allowed | $40 |

| Hawaii | $125 | Allowed | $40 |

| Idaho | $85 | Allowed | $30 |

| Illinois | $110 | Allowed | $30 |

| Indiana | $100 | Allowed | $35 |

| Iowa | $90 | Allowed | $30 |

| Kansas | $105 | Allowed | $35 |

| Kentucky | $95 | Allowed | $30 |

| Louisiana | $140 | Allowed | $50 |

| Maine | $80 | Not Allowed | $25 |

| Maryland | $120 | Not Allowed | $40 |

| Massachusetts | $130 | Not Allowed | $40 |

| Michigan | $95 | Allowed | $35 |

| Minnesota | $110 | Allowed | $30 |

| Mississippi | $110 | Allowed | $40 |

| Missouri | $100 | Allowed | $30 |

| Montana | $90 | Allowed | $30 |

| Nebraska | $95 | Allowed | $30 |

| Nevada | $105 | Allowed | $25 |

| New Hampshire | $95 | Not Allowed | $30 |

| New Jersey | $115 | Not Allowed | $40 |

| New Mexico | $100 | Allowed | $35 |

| New York | $120 | Not Allowed | $40 |

| North Carolina | $110 | Allowed | $40 |

| North Dakota | $85 | Allowed | $25 |

| Ohio | $95 | Allowed | $30 |

| Oklahoma | $130 | Allowed | $45 |

| Oregon | $90 | Not Allowed | $30 |

| Pennsylvania | $105 | Allowed | $35 |

| Rhode Island | $115 | Not Allowed | $35 |

| South Carolina | $110 | Allowed | $40 |

| South Dakota | $85 | Allowed | $25 |

| Tennessee | $105 | Allowed | $35 |

| Texas | $140 | Allowed | $50 |

| Utah | $85 | Allowed | $25 |

| Vermont | $90 | Not Allowed | $30 |

| Virginia | $100 | Not Allowed | $30 |

| Washington | $95 | Not Allowed | $25 |

| West Virginia | $90 | Allowed | $30 |

| Wisconsin | $90 | Allowed | $30 |

| Wyoming | $85 | Allowed | $25 |

Several states do not allow home insurance companies to reject applicants based on breed.

Learn More: A Practical Guide for Understanding Homeowners Insurance

It will also be cheaper in some states to add a dog, as the monthly cost can be as low as $25 per month, while in other states it's as high as $50 per month.

What is Covered Under Dog Home Insurance

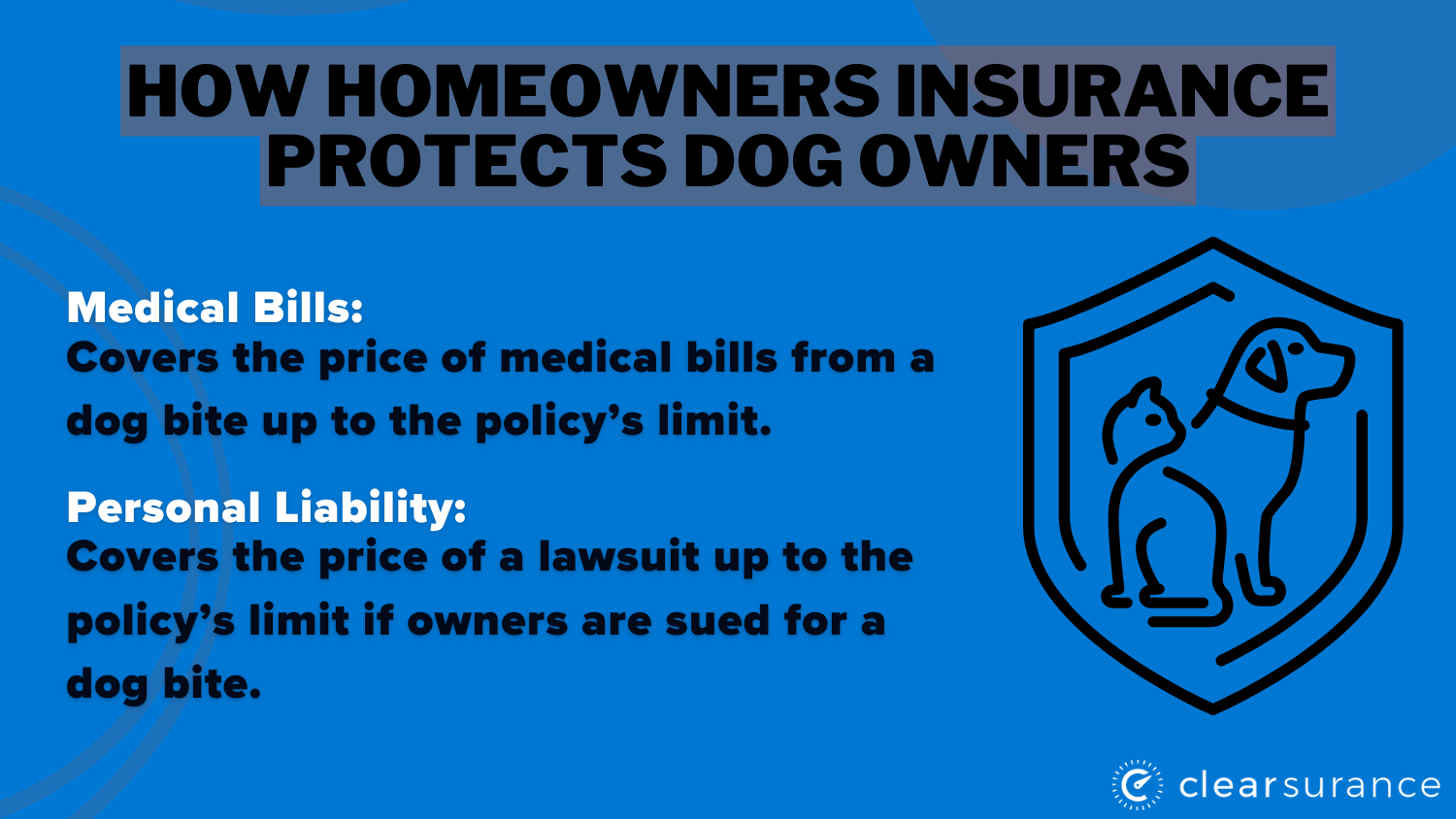

After adding your dog and paying the additional fee to your homeowners insurance, here’s what is generally protected:

With personal liability, if someone files a lawsuit against you for a dog bite, you can file a claim under the personal liability part of your policy. It covers almost all expenses, including the price if they win the suit, up to the policy’s limit.

With medical bills, if your dog bites someone and injures them, this helps cover the price of medical expenses that were incurred. Typically the maximum price for medical bills is $10,000.

Homeowners (and renters insurance) policies typically cover dog bite liability expenses up to a certain price, the limit is usually between $100,000 to $300,000. This includes medical costs.

What is Not Covered Under Dog Home Insurance

Homeowners policies are particular about what is protected against your dog. If your dog causes damage to the structure of your home, like chewing through the drywall or damaging your fence, your insurer most likely won’t reimburse you for the loss.

You also won’t be covered if your dog damages or destroys any of your personal property.

If your furry friend chews a hole in your couch or destroys a brand new pair of shoes, your home insurance won’t cover it. It's usually only bodily injury to another person that is covered, and any subsequent medical payments necessary.

Homeowners Insurance Dog Breed Restrictions

Does breed matter? Yes, the breed of your dog does often matters to your homeowners insurance company. Statistically, certain dog breeds are responsible for a higher number of dog bites and some insurance companies go by the statistics to determine the risk to insure. This is how breed restrictions are created.

Some homeowners insurance companies have a blacklist of dog breeds that won't be covered by a homeowners insurance policy from the company.

The most commonly discriminated dogs that insurance companies refuse to insure or dogs that raise your home insurance are within the Molossers breed group, which are, thick, muscular dogs that include pitbulls, Rottweilers and mastiffs.

They usually tend to be on the larger size, and are generally restricted dog breeds. Restricted means they see a lot of discrimination due to the history associated with such breeds, making it harder to save on homeowners insurance (Read More: Top 3 Ways Customers Say They’ve Saved on Homeowners Insurance).

What to do if Homeowners Insurance Doesn’t Cover Your Dog's Breed

What can I do if my homeowners insurance doesn’t cover my dog's breed? If you have a dog of a breed that's excluded from your homeowners insurance coverage because the company has blacklisted it, you’ll have to find a new homeowners insurance or renters insurance company that doesn’t list your dog as a dangerous breed.

Read More: Homeowners Insurance vs. Renters Insurance

Some insurance companies may offer coverage to your dog’s breed if it has gone through a certain level of pet training. Others may evaluate the dog to determine coverage. There are companies that don't discriminate by the typical restricted breed types.

How to Prevent Your Dog from Biting

Almost all dog owners are certain that their dog will not bite someone. While no one can prevent accidents or unintended injuries, there are many precautions that dog owners can take to prevent it from occurring.

After all, getting a homeowners insurance claims check for medical or legal bills won't be worth it if your homeowners pet insurance triples in price.

Here are a few tips to prevent your dog from harming someone else:

- Educate: Take the time to inform yourself of your dog’s breed.

- Training: Socialize your dog, and be aware of and understand your dog’s body language.

- Daily exercise: It’s important your dog stays healthy, both physically and mentally. You should exercise them daily.

- Distance: You never know what may provoke your dog; it’s safe to keep your dog on a leash to create a certain distance when around strangers or other dogs.

- Neuter: Neutering your pet can lead to a less aggressive dog.

If you are moving with your pet, make sure to slowly introduce them to the new home. It's best to minimize the stressful situations your pet can face when moving.

Finding Dog-Friendly Homeowners Insurance Companies

Do I tell my homeowners insurance that I have a dog? Yes, you should always inform them. When it comes to dogs and home insurance, there can be surprising costs associated with animals.

Unfortunately, sometimes those costs can be associated less than savory conditions, such as bite claims. Fortunately, most homeowners insurance policies cover dog bites and other incidents your furry friend may cause.

When shopping for the best and cheapest homeowners insurance companies that insure dog owners, be sure to get quotes from multiple companies to compare your options.

Enter your ZIP in our free quote tool to jump right into shopping for pet-friendly homeowners insurance.

Frequently Asked Questions

Do I have to tell my homeowners insurance that I have a dog?

Yes, you should inform your homeowners insurance that you have a dog and have them added to your insurance. If you are worried about how pets affect homeowners insurance, in most cases, it is just a slight rate increase.

Can I add my pet to my insurance?

Yes, most homeowners insurance companies will allow you to add your dog to your insurance policy unless they have home insurance dog breed restrictions.

How much does a dog add to home insurance?

How much a dog will add to your home insurance premiums depends on your dog breed and location. One of the things to know about home insurance is that home insurance with dogs will be slightly more expensive than home insurance without dogs.

What are the dogs not covered by homeowners insurance?

The dog breeds insurance blacklist varies among providers and states, as Progressive homeowners insurance dog breed restrictions are going to be different than the Erie insurance restricted dog list.

However, the common dog breeds not covered by home insurance include the Molossers breed group of pitbulls, Rottweilers and mastiffs.

Why does home insurance ask about dogs?

Home insurance asks about dogs because dogs come with some amount of risk. If your dog bites someone, you are liable for medical bills.

Can you get homeowners insurance if you own a pitbull?

Yes, you can get get home insurance if you own a pitbull.However, you may have look a little harder to find pitbull-friendly homeowners insurance, due to breed discrimination. Visit our list of pitbull friendly home insurance companies if you need help finding a company.

Are pets covered under homeowners insurance?

Pets are covered under homeowners insurance only if you inform your insurance company and have them added to your policy. To shop for homeowners insurance with dogs today, use our free quote tool.

Does my homeowners insurance cover dog bites?

Homeowners insurance covers dog bites only if you have your dog on your home insurance policy.

Should dogs be on homeowners insurance?

Yes, dogs should be on homeowners insurance to protect owners from liability issues if their dog bites someone. You may also want to consider getting pet insurance for your dog to cover any potential injuries.

Can homeowners insurance drop you because of a dog bite?

Yes, your home insurance company may choose to drop you after a dog bite or exclude your dog from your policy.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.