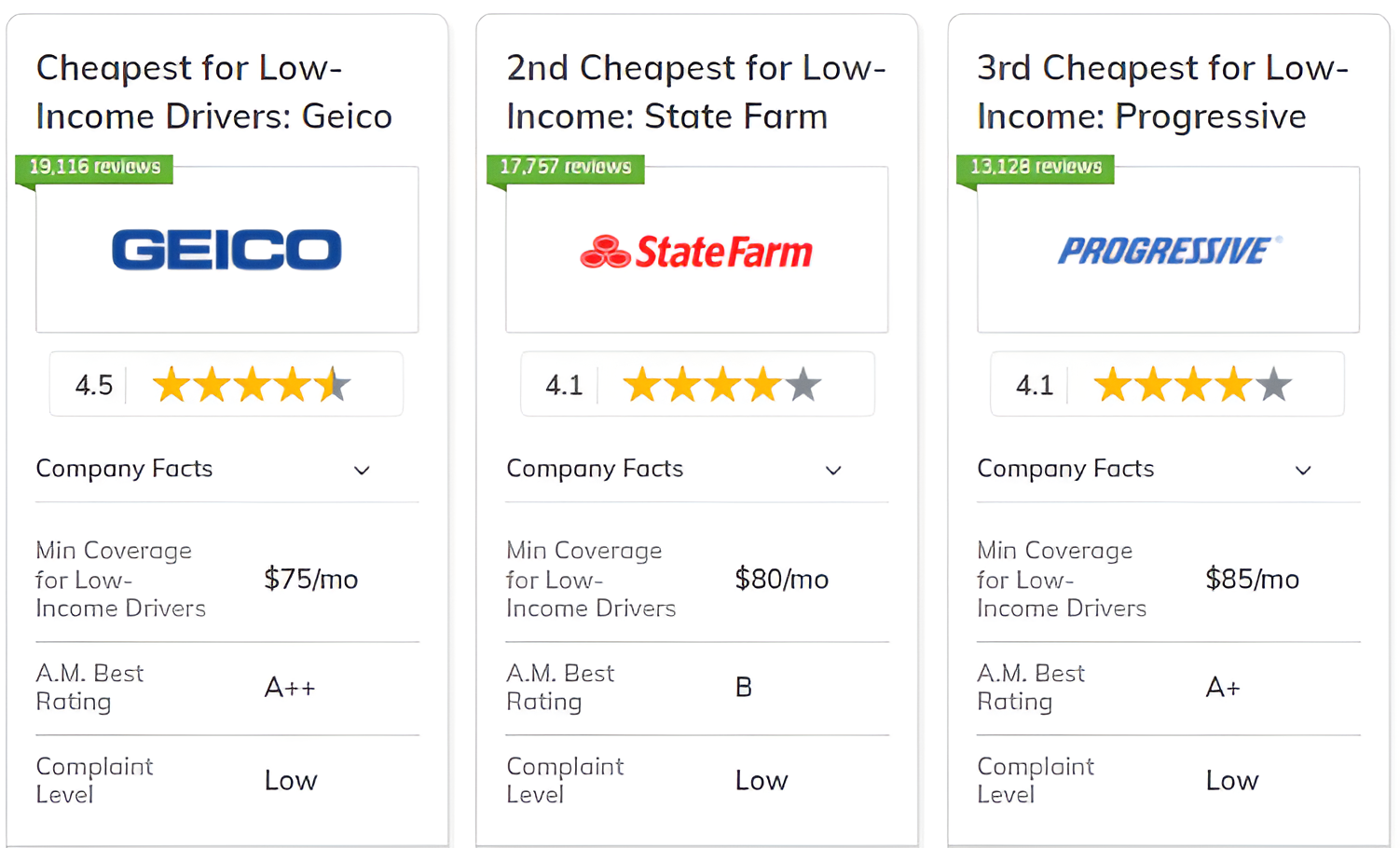

Geico, State Farm, and Progressive have the cheapest car insurance for low-income drivers. The cheapest company is Geico, which has monthly rates starting from $75.

Young drivers with low income get the best rates and discounts with State Farm, while Progressive has the Name Your Price tool that enables drivers to choose premiums based on their income.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $75 | A++ | Cheap Rates | Geico | |

| #2 | $80 | B | Young Drivers | State Farm | |

| #3 | $85 | A+ | Dynamic Pricing | Progressive | |

| #4 | $86 | A++ | Military Benefits | USAA | |

| #5 | $90 | A | Customer Loyalty | American Family | |

|

#6 | $91 | A+ | Risk Assessment | Nationwide |

| #7 | $93 | A++ | Rideshare Coverage | Travelers | |

| #8 | $95 | A+ | Low-Mileage Drivers | Allstate | |

| #9 | $96 | A | Insurance Discounts | Farmers | |

|

#10 | $100 | A | Tailored Coverage | Liberty Mutual |

Scroll down to compare the best car insurance companies for low-income drivers. Learn how to get the most out of the discounts and government car insurance programs available near you.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

What You Should Know

- Geico is the cheapest car insurance for low-income drivers at $75/month

- State Farm helps young low-income drivers save through the Steer Clear program

- Some states provide government assistance for car insurance to lower rates

#1 – Geico: Top Overall Pick

Pros

- Lowest Monthly Rates: Geico provides the lowest minimum coverage rates for low-income drivers at only $75 a month.

- Federal Employee Discount: There are some extra savings to be had for low-income drivers working for the government.

- Defensive Driving Discounts: Affordable online classes, such as defensive driving courses, are available to low-income drivers and offer discounts on their rates.

Cons

- No Gap Insurance: Low-income drivers with auto loans may face higher out-of-pocket costs if their car is totaled.

- Multi-Car Discount Advantage: Low-income drivers with just one car may miss out on some savings from having multiple vehicles on a policy.

#2 – State Farm: Best for Young Drivers

Pros

- Steer Clear Program: Young, low-income drivers under 25 can complete this course to earn discounts.

- Vehicle Safety Discounts: Low-income drivers with older, safety-equipped cars can still benefit from reduced rates.

- Accident-Free Discounts: Low-income drivers maintaining a clean record can see their premiums decrease over time, as highlighted in our State Farm car insurance review.

Cons

- Strict Underwriting for High-Risk: Low-income drivers with poor credit or driving records may face higher rates or coverage denials.

- Limited Alternative Fuel Discounts: Low-income drivers may find State Farm's discounts in hybrid or electric cars less competitive.

#3 – Progressive: Best for Dynamic Pricing

Pros

- Name Your Price Tool: Low-income drivers can enter their desired premium to find suitable coverage, as detailed in Progressive car insurance review.

- Deductible Savings Bank: Low-income policyholders can gradually reduce their deductible over time.

- Pet Injury Coverage: Low-income drivers with pets receive protection for their furry family members at no extra cost.

Cons

- Higher Minimum Coverage Rate: Progressive's base rate is $10 more than the cheapest option which may be expensive for low-income drivers.

- Snapshot Privacy Concerns: Drivers with lower incomes might be reluctant to share their driving info, which could keep them from saving money.

#4 – USAA: Best for Military Benefits

Pros

- Vehicle Storage Discount: Low-income service members stationed overseas can significantly lower their insurance premiums while their vehicles are being stored.

- Military Installation Discount: Low-income service members living on base can access additional savings, as explained in our guide to best military car insurance.

- New Vehicle Replacement: Low-income military members with auto loans on newer vehicles can benefit from this protection.

Cons

- Limited Usage-Based Options: Low-income drivers might see that USAA's options in this regard are not as robust as those of some rivals.

- Transition Coverage Gaps: Veterans with low incomes who are leaving the military might have a tough time keeping their USAA coverage going.

#5 – American Family: Best Loyalty Rewards

Pros

- Generational Discount: Helps make insurance more affordable for low-income drivers across generations, as noted in our review of American Family car insurance.

- Early Bird Discount: Low-income drivers who switch to American Family before their current policy expires can save money.

- MyKey Teen Discount: Low-income drivers with young drivers can access savings through this program.

Cons

- Limited Rideshare Coverage: Low-income drivers supplementing their income through rideshare work may find this coverage limited.

- No Gap Insurance: American Family doesn't provide this protection for loans held by low-income drivers.

#7 – Travelers: Best for Ride-Sharing Insurance

Pros

- Rideshare Coverage: Low-income drivers can get specialized protection for rideshare work, a feature explored in our Travelers car insurance review.

- Accident Forgiveness: Low-income drivers can avoid rate increases after their first qualifying accident.

- Early Quote Discount: Low-income drivers who get a quote before their current policy expires can save money.

Cons

- Limited Local Agent Availability: Drivers with low incomes who like in-person help might have trouble getting the individual attention they need.

- Limited Usage-Based Insurance Options: Low-income drivers may find Travelers' usage-based offerings somewhat limited.

#8 – Allstate: Best for Low-Mileage Drivers

Pros

- Deductible Rewards: Low-income drivers can earn $100 off their deductible for every year of safe driving, up to $500.

- Milewise Pay-Per-Mile: Low-income drivers who don't use their vehicles frequently can benefit from this program, as detailed in our Allstate car insurance review.

- Safe Driving Bonus: Low-income drivers can earn a bonus every six months if they remain accident-free.

Cons

- Expensive Full Coverage: Low-income drivers who need more than basic coverage might find Allstate's rates prohibitive.

- Privacy Concerns With Telematics: Drivewise may not be something that drivers with low incomes are willing to give up the details on.

#9 – Farmers: Best Car Insurance Discounts

Pros

- Incident Forgiveness: Every three years, low-income drivers will have one minor violation (such as a speeding ticket) forgiven.

- Alternative Fuel Vehicle Discount: Our Farmers car insurance review stresses that low-income drivers with hybrid or electric vehicles can get additional savings.

- Customizable Coverage Options: Low-income drivers can choose policies that suit them and their budgets.

Cons

- Limited Availability: Some drivers with low incomes may not have many Farmers' insurance coverage choices in some areas.

- Price Increase: If low-income drivers file a claim, farmers could raise their insurance rates.

#10 – Liberty Mutual: Best for Tailored Coverage

Pros

- Better Car Replacement: Low-income drivers can receive a newer car with 15,000 fewer miles if theirs is totaled, as explained in our car insurance review of Liberty Mutual.

- Multi-Policy Discounts: Low-income drivers can maximize savings by bundling auto insurance with other policies.

- Alternative Energy Vehicle Discount: Low-income drivers of hybrid or electric cars can find extra savings.

Cons

- Highest Minimum Coverage Rate: Liberty Mutual’s starting price is $25 higher, which could make it harder for people with low incomes to find cheap car insurance.

- Inconsistent Customer Service: Low-income drivers may experience varying levels of support quality.

Cheap Car Insurance Options for Low-Income Drivers

The table below shows the monthly rates for minimum and full coverage from the top 10 major insurers on our list:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $95 | $180 | |

| $90 | $170 | |

| $96 | $182 | |

| $75 | $155 | |

| Liberty Mutual | $100 | $190 |

|

$91 | $171 |

| $85 | $161 | |

| $80 | $160 | |

| $93 | $173 | |

| $86 | $165 |

Finding cheap car insurance for low-income drivers starts with understanding the basics of coverage. Liability insurance is the most affordable and covers damages to others when you're at fault, but it won’t cover your own vehicle.

Drivers with older cars might consider skipping comprehensive and collision coverage to save money. For more information, check out our guide on what kind of car insurance you really need.

State Car Insurance Programs for Low-Income Drivers

Some states provide car insurance programs for low-income drivers. These programs help them find ways to afford coverage. Here are a few of the options available:

- California CLCA, New Jersey SAIP & Washington Basic Auto Insurance: Provides affordable basic liability insurance for drivers with low incomes who qualify.

- Florida Low-Income Pool: Supports access to affordable healthcare, indirectly helping with car-related costs.

- State Assistance Programs: A lot of states have programs and local non-profits that can help low-income folks get car insurance.

If you want to find the best choice for your needs, it's smart to talk to your state's insurance department or check their website to learn about the programs they have.

Read More: Best and Cheapest Car Insurance in California

Getting Cheap Car Insurance Discounts for Low-Income Drivers

When searching for cheap car insurance for low-income drivers, taking advantage of available discounts is essential. Many top providers offer various ways to reduce premiums, such as good driver discounts, multi-policy savings, and more.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Safe Driver, New Car, Good Student, Smart Student, Anti-Theft System, Early Signing, Pay-in-Full | |

| Multi-Policy, Loyalty, Good Student, Young Driver Training, Safe Driver, Auto Safety Equipment, Early-Bird, Low Mileage | |

| Multi-Policy, Safe Driver, Good Student, Signal (Usage-Based), Homeowner, Mature Driver, Alternative Fuel Vehicle, Anti-Theft System | |

| Multi-Policy, Safe Driver, Good Student, Military, Federal Employee, Defensive Driving, Anti-Theft System, Vehicle Safety Features | |

|

Multi-Policy, Safe Driver, Early Shopper, Good Student, Newly Married, New Car, Online Purchase, Alternative Energy, Military |

|

Multi-policy, SmartRide (usage-based), Good Student, Accident-Free, Anti-Theft System, Vehicle Safety Features, Paperless Billing |

| Multi-Policy, Snapshot (Usage-Based), Good Student, Pay-in-Full, Continuous Insurance, Homeowner, Online Quote | |

| Multi-Policy, Safe Driver, Good Student, Driver Training, Anti-Theft System, Vehicle Safety Features, Accident-Free | |

| Multi-Policy, Safe Driver, Good Student, New Car, Hybrid/Electric Vehicle, Continuous Insurance, Payment Frequency | |

| Multi-Policy, Safe Driver, Good Student, Military, Defensive Driving, Vehicle Storage, New Car |

Low-income drivers can also save on car insurance by maximizing discounts such as good driver and bundling discounts.

Programs like Progressive Snapshot also help drivers earn lower premiums by tracking safe driving habits. Learn more about car insurance companies that use tracking devices.

Comparing Cheap Car Insurance for Low-Income Drivers

Geico, State Farm, and Progressive sell the cheapest car insurance for low-income drivers. Geico provides competitive rates in all 50 states.

State Farm offers personalized coverage and strong customer service. Progressive features the Name Your Price tool for budget-friendly options.

Be sure to evaluate your coverage needs to avoid overpaying. To learn more, check out how to switch car insurance companies.

One of the best ways to secure cheap car insurance for low-income drivers is by comparing quotes from multiple providers. Enter your ZIP code into below to find the best policy for you.

Frequently Asked Questions

Who is known for the cheapest car insurance for low-income drivers?

Geico is well-known for offering the cheapest car insurance for low-income drivers, with monthly premiums starting at $75, particularly for liability-only coverage.

What is the cheapest form of car insurance?

Liability car insurance is the cheapest form, as it only covers damages you cause to others. For low-income drivers, liability coverage meets state minimums at affordable rates, like Geico's starting at $75 per month.

What is the cheapest category for car insurance?

The cheapest category for car insurance is typically liability coverage, especially for low-income drivers who need minimal protection. This type of insurance fulfills legal requirements at the lowest cost.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What is the most basic form of car insurance?

Liability-only is the most basic form of car insurance, covering only damages to others if you're at fault. It's ideal for low-income drivers seeking the cheapest coverage option.

Which is the most expensive form of car insurance?

Full coverage insurance, which includes liability, collision, and comprehensive protection, is the most expensive form of car insurance, particularly for newer or higher-value vehicles.

Read More: A Practical Guide For Understanding Car Insurance

What age is car insurance the lowest?

Car insurance tends to be lowest for drivers aged 25 and older. Younger drivers, especially those under 25, may see higher premiums, though State Farm's Steer Clear program helps reduce costs for young, low-income drivers.

What's the cheapest insurance for new drivers?

Geico and State Farm often provide the new driver car insurance, with Geico offering rates starting as low as $75 per month. State Farm’s Steer Clear program also helps new, young drivers save money.

Is there government car insurance for low-income drivers?

Many states, including California and Washington, offer government-funded car insurance plans to low-income drivers who qualify.

Which type of vehicle insurance is best?

For low-income drivers, liability insurance is often the best choice as it provides the minimum required coverage at the lowest price. However, drivers with newer vehicles may want to consider comprehensive or collision coverage.

What is the cheapest car insurance group?

Insurance groups are based on vehicle models, and cars in group 1 tend to have the cheapest insurance rates. These are typically smaller, lower-powered cars that are less expensive to repair. Enter your ZIP code below to compare auto insurance costs by vehicle.

What is the lowest level of car insurance?

The lowest level of car insurance is liability-only coverage, which meets the legal requirements but doesn’t cover damage to your own vehicle.

What car is cheapest to insure for a first-time driver?

Smaller, less powerful cars like the Honda Fit or Toyota Corolla are often the cheapest to insure for first-time drivers, due to their safety features and lower repair costs.