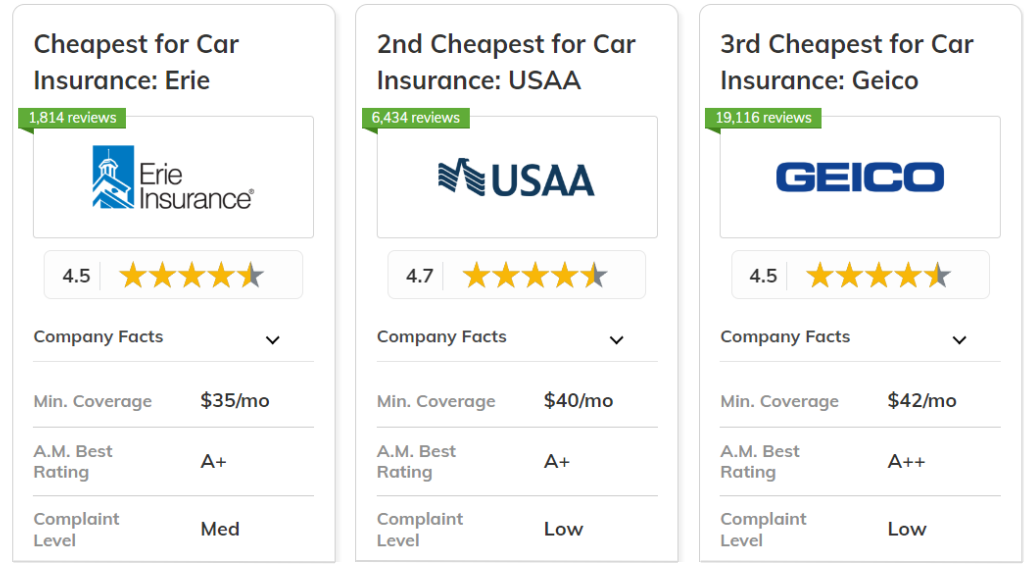

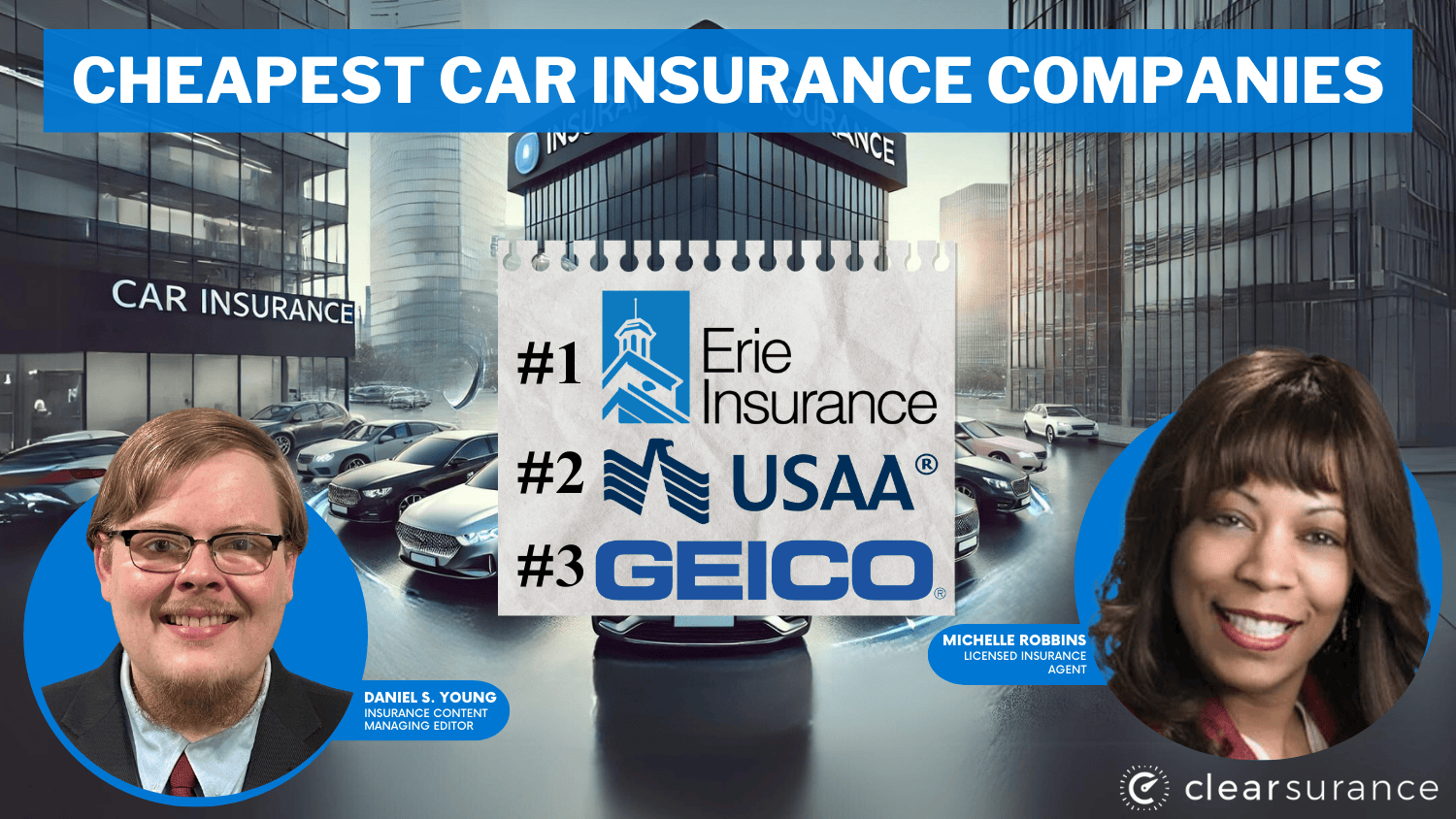

The top providers for the cheapest car insurance companies are Erie, USAA, and Geico, with Erie offering the top overall rates starting at just $35/month.

Erie stands out for its combination of low premiums and great coverage, while USAA provides exclusive military benefits, and Geico offers a balance of affordability and service. For more details, check our full guide titled "Best Military Car Insurance: Companies and Discounts."

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

|

#1 | $35 | A+ | Affordable Coverage | Erie |

| #2 | $40 | A++ | Military Benefits | USAA | |

| #3 | $42 | A++ | Low Rates | Geico | |

| #4 | $45 | B | Nationwide Availability | State Farm | |

| #5 | $47 | A+ | Flexible Options | Progressive | |

| #6 | $50 | A++ | Regional Affordability | Auto-Owners | |

|

#7 | $52 | A+ | Broad Discounts | Nationwide |

| #8 | $55 | A | Family-Oriented Deals | American Family | |

| #9 | $58 | A++ | Comprehensive Packages | Travelers | |

| #10 | $60 | A | Discount Variety | Farmers |

These companies consistently provide the best value based on multiple factors, making them top choices for affordable car insurance.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool above to see affordable car insurance quotes.

What You Should Know

- Top cheap car insurers are Erie, USAA, Geico with rates from $35/month

- Erie is the top pick for affordable coverage and consistently low premiums

- These providers offer low-cost options and customized coverage for drivers

#1 – Erie: Top Overall Pick

Pros

- Affordable Premiums: Erie is one of the top car insurance companies offering low-cost premiums, starting as low as $35/month. Read more in our review of Erie.

- Strong Customer Service: Known for providing excellent customer support among car insurance companies, making it easy to resolve issues.

- Comprehensive Coverage Options: Provides minimum and full coverage, with some of the best prices in car insurance.

Cons

- Limited Availability: Erie is not available nationwide, making it nearly impossible to compare favorably to other auto insurance companies.

- Fewer Online Tools: Erie may offer fewer online tools and services compared to larger car insurance companies.

#2 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: USAA is among the top car insurance companies for offering exclusive deals to military members and their families.

- Exceptional Customer Service: Consistently ranked as a top-rated car insurance company for customer satisfaction, which you can learn about in our USAA review.

- Flexible Payment Plans: Flexible payment plans compared to other car insurance providers.

Cons

- Restricted Eligibility: The eligibility is restricted only to military personnel and their families, which reduces the scope of its customers compared to other car insurance companies.

- Not Available Nationwide: Coverage options are less extensive in certain states compared to other large car insurance companies.

#3 – Geico: Best for Low Rates

Pros

- Competitive Rates: Geico is consistently one of the cheapest car insurance companies, offering low premiums for both minimum and full coverage.

- Wide Availability: One of the largest car insurance companies, available in all 50 states, ensuring broad comprehensive insurance coverage options.

- Easy-to-Use Mobile App: Sends a user-friendly mobile app that has actually won awards and makes Geico one of the most high-tech car insurance businesses.

Cons

- Limited Agent Interaction: Geico primarily operates online, which might be a drawback for those who prefer face-to-face interaction with car insurance companies.

- No Local Offices: Unlike some car insurance companies, Geico does not have local agents in every city.

#4 – State Farm: Best for Nationwide Availability

Pros

- Good Customer Service: Consistently ranks well in customer satisfaction surveys compared to other major car insurance companies.

- Safe Driver Discounts: Offers significant savings for safe driving, a common feature among top car insurance companies. For a complete list, read our State Farm review.

- Local Agents Available Nationwide: Their local agents are very well known, unlike some of the more online-based car insurance companies.

Cons

- Less Innovative Technology: State Farm's online tools and app are not as advanced as other leading car insurance companies.

- No Military-Specific Discounts: Unlike some other car insurance companies, State Farm does not offer specific discounts for military personnel.

#5 – Progressive: Best for Flexible Options

Pros

- Flexible Policy Options: Progressive is one of the most adaptable car insurance companies and provides customers with total control over coverage.

- Usage-Based Discounts: Unique in the industry, it provides savings by offering a use-based discount through its Snapshot program.

- High-Risk Drivers Accepted: Known for being one of the more inclusive car insurance companies for high-risk drivers, which is covered in our Progressive review.

Cons

- Snapshot Program Increases Risk: The usage-based Snapshot program can sometimes lead to higher premiums if driving habits are deemed risky, unlike standard car insurance companies.

- Customer Service Complaints: Some customers report less satisfactory service compared to other car insurance companies.

#6 – Auto-Owners: Best for Regional Affordability

Pros

- Affordable Premiums: Auto-Owners stands out among car insurance companies for its competitive rates in the regions it serves. Learn more in our Auto-Owners review.

- Personalized Service: Being a regional provider, Auto-Owners may be able to give you better service than the national car insurance companies.

- Strong Customer Satisfaction: Auto-Owners car insurance companies typically receive excellent customer service and satisfaction scores.

Cons

- Limited Availability: Many of the national car insurance companies offer coverage across all 50 states, while Auto-Owners is limited to just two dozen.

- Less Technology Focused: Auto-Owners car insurance companies may lack advanced online and mobile app features compared to larger providers.

#7 – Nationwide: Best for Broad Discounts

Pros

- Extensive Discount Options: National car insurance companies provide a wide variety of discounts, from multi-policy and smart driving to safety feature savings.

- Nationwide Availability: Since Nationwide is a large, national insurance company, it covers most of the U.S., making it convenient and more accessible.

- Solid Financial Strength: Nationwide car insurers offer solid financial stability and dependable claims handling, which you can read more about in our review of Nationwide.

Cons

- Inconsistent Customer Satisfaction: Nationwide’s customer satisfaction ratings for car insurance companies can vary by region, with some areas experiencing better service than others.

- Less Personalized Service: Due to its large size, Nationwide car insurance companies may offer less personalized service than smaller regional providers.

#8 – American Family: Best for Family-Oriented Deals

Pros

- Tailored Family Discounts: American Family car insurance offers family discounts and safe driving rewards for teens. Read our American Family review to learn what else is offered.

- Focus on Customer Care: American Family is recognized among car insurance companies for prioritizing customer satisfaction and building long-term relationships.

- Excellent Bundling Options: American Family insurance for cars is often bundled with home, life, and auto coverage to offer discounts on several policies.

Cons

- Longer Quote Process: American Family’s emphasis on tailored customer experiences can slow down the quote process compared to other auto insurance companies.

- Fewer Online Features: American Family’s digital presence, including its app, may not be as advanced as other car insurance companies with nationwide appeal.

#9 – Travelers: Best for Comprehensive Packages

Pros

- Multi-Policy Discounts: Travelers auto insurance companies provide discounts when you combine policies, such as bundling multiple times home and car coverage.

- Strong Claims Satisfaction: Travelers car insurance companies receive good ratings for claims processing and customer service, which you can check out in our Travelers review.

- Comprehensive Coverage Options: Travelers car insurance companies have one of the most extensive arrays of coverage options which match virtually all needs.

Cons

- Higher Rates for Some Drivers: According to some customers, particularly young drivers find that their Travelers car insurance quotes are more expensive than average.

- Limited Digital Tools: Their mobile app and online tools are less comprehensive than those of, say, some top competitors for tech-savvy customers.

#10 – Farmers: Best for Discount Variety

Pros

- Varied Discount Programs: Farmers automobile insurance dealers offer diversified discounts similar to safe driving, multi-policy, and green vehicle savings.

- Innovative Telematics: Farmers has a telematic program called Signal, which helps with as-safe-as-you-drive checks; Unlike other car insurance companies.

- Excellent Claims Service: Farmers car insurance companies receive high marks for claims satisfaction and customer support. Check our Farmers review for a full list.

Cons

- Not as Widely Available: Farmers car insurance companies are not available in all areas, limiting their accessibility.

- Limited Online Features: Farmers’ mobile app and digital tools may lag behind other car insurance companies with more advanced online experiences.

Comparing Monthly Car Insurance Rates: Minimum vs. Full Coverage

Comparing monthly insurance rates for minimum and full coverage, it’s important to review options from various providers to find the best fit for your budget.

The table below displays monthly insurance rates for both minimum and full coverage across various companies. For minimum coverage, Erie offers the lowest rate at $35 per month, while Farmers has the highest at $60 per month. Check out our comprehensive guide titled "Liability vs. Full Coverage: Car Insurance Explained", for more information.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $130 | |

| $50 | $120 | |

|

$35 | $90 |

| $60 | $140 | |

| $42 | $98 | |

|

$52 | $125 |

| $47 | $115 | |

| $45 | $110 | |

| $58 | $135 | |

| $40 | $95 |

For full coverage, Erie remains the most affordable at $90 per month, and Farmers again has the highest at $140 per month. Other notable companies include Geico with $42 for minimum and $98 for full coverage, and State Farm offering $45 for minimum and $110 for full coverage.

Erie always has the cheapest options for minimum and full coverage, but Farmers falls on the high side as detailed in these tables. You should compare these rates to choose the insurance plan which is right option for you.

The Best Car Insurance Discounts from Top Providers

Finding affordable car insurance is easier when you take advantage of the discounts offered by top providers. From multi-policy savings to safe driver rewards, these discounts can significantly lower your premiums.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Loyalty, Good Student, Steer Into Savings, Smart Home, Teen Safe Driver, Auto Safety Device | |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft, Life Insurance, Paid-in-Full, Paperless Billing | |

|

Safe Driver, Multi-Policy, Paid-in-Full, Vehicle Storage, Young Driver, Anti-Theft, Annual Payment |

| Multi-Policy, Safe Driver, Good Student, New Car Replacement, Signal Program, Senior Driver | |

| Multi-Policy, Good Driver, Good Student, Military, Federal Employee, Anti-Theft, Emergency Deployment | |

|

Multi-Policy, SmartRide Program, Accident-Free, Defensive Driving, Good Student, Affinity Group, Paperless |

| Multi-Policy, Snapshot Program, Continuous Insurance, Teen Driver, Pay-in-Full, Good Student, Homeowner | |

| Safe Driver, Multi-Policy, Good Student, Vehicle Safety, Defensive Driving, Accident-Free, Drive Safe & Save | |

| Multi-Policy, Homeownership, Hybrid/Electric Vehicle, New Car, Continuous Insurance, Good Payer | |

| Safe Driver, Multi-Policy, Good Student, New Vehicle, Low Mileage, Family Legacy, Military Garaging |

Progressive offers a discount through its Snapshot program, and USAA provides specific military discounts. Similarly, Nationwide offers SmartRide and Farmers has Signal for comparable savings. These discounts allow drivers to reduce insurance prices through safe driving behaviors, bundling policies and safety features in vehicles.

You have the ability to maximize savings and select only as much coverage you can afford. Use these opportunities to decrease your insurance premiums while still keeping satisfactory coverage. For more information, be sure to check out the complete guide titled "A Practical Guide For Understanding Car Insurance."

Proven Tips to Cut Your Car Insurance Costs Today

Looking for ways to save on your car insurance? Even with affordable companies like Erie, Geico, and USAA, there are simple strategies that can help you lower your premium further. Here are five tips to maximize savings while maintaining great coverage.

- Bundle Policies: You can combine your auto insurance with other policies (such as home or renters) to receive a multi-policy discount from companies like Geico, State Farm, and Erie.

- Increase Your Deductible: A higher deductible (or the dollar amount you pay before insurance begins) can also reduce your monthly obligation and make an affordable policy even more reasonable.

- Maintain a Clean Driving Record: The better your record, the lower you should be able to drive points (and the less likely it is that any driver will cost). Avoid accidents, speeding tickets, and traffic violations to keep as much cash in your pocket as possible. Check out our article, "What is considered a clean driving record?"

- Take Advantage of Discounts: Companies such as USAA, Geico, and Progressive extend discounts to safe drivers, good students, or military personnel.

- Consider Usage-Based Insurance: Savings and safe driving discounts are two examples of how you can save money on your insurance by participating in Geico DriveEasy or Progressive Snapshot, programs that track your driving behavior through apps.

This advice takes just a few minutes to implement, but it can save you hundreds on your next car insurance bill.

Start applying them now and see how much you can save with the right insurer.

Most Affordable Car Insurance Providers: Saving With the Best Companies

Find some savings on car insurance with these tips and by comparing quotes from the best and cheapest car insurance companies. Top providers Erie, Geico and USAA all offer cheap rates of less than $35 per month with Erie on top for both minimum coverage as well as full coverage.

On top of this, you can save a lot on your premiums with things like multi-policy savings and safe-driver rewards. Drivers can redeem time-tested cost-cutting measures and compare quotes to make certain their existing insurance coverage is providing value.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

How can I find the cheapest car insurance rates?

Getting quotes from multiple providers is one of the best ways to secure fair prices. Conducting an online search enables you to compare quotes from the biggest and best companies (like Erie, USAA, Geico) based on your budget.

Do I need to compare quotes for both minimum and full coverage?

Yes, it’s important to compare both. Some companies like Erie may offer affordable minimum coverage but higher full coverage rates. Reviewing both helps you choose the right coverage for your budget.

What factors affect car insurance premiums the most?

Key factors include your driving history, vehicle type, location, and credit score. Comparing quotes helps identify which insurers offer lower premiums based on your profile.

For a thorough understanding, refer to our detailed analysis titled "Car Make and Model: Impact On Car Insurance Rates."

Which companies offer the best discounts for lowering premiums?

Companies like Geico, State Farm, and Progressive offer popular discounts for safe drivers, multi-policy bundling, and military members. Be sure to ask about available discounts when comparing quotes. Find insurance rates today by entering your ZIP code into our free comparison tool below.

Is it safe to switch insurance providers to save money?

Yes, switching providers can save money, especially if you find lower rates elsewhere. Make sure to compare coverage options carefully and avoid lapses in your insurance during the transition.

How can comparing insurance quotes save me money?

Shopping around with lots of companies, you should be able to get your best possible rate — i.e. the cheapest price (while still getting a vehicle specifically suited for what you need). Every insurer offers discounts and different levels of coverage at varying regional prices, so you're encouraged to search around before overpaying.

To expand your knowledge, refer to our comprehensive handbook titled "Why Your Car & Homeowners Insurance Rates Increased."

Can I get lower rates with good driving habits?

Yes, many companies, including Progressive and Nationwide, offer usage-based programs like Snapshot or SmartRide that reward safe driving with premium reductions. Comparing insurers will show who offers these savings.

What are the most affordable car insurance providers?

Based on current data, Erie, USAA, and Geico rank among the cheapest providers, offering rates as low as $35/month. Comparing quotes from these and other companies will help find the best deal. Find for cheap car insurance quotes by entering your ZIP code below.

How often should I compare car insurance quotes?

It's recommended to compare quotes annually or when major life changes occur (e.g., moving, buying a new car). Rates fluctuate, and shopping around can help you capture savings regularly. To gain profound insights, consult our extensive guide titled "How To Buy Car Insurance (Consumer Guide)."

Can I negotiate car insurance rates with providers?

Rates are fixed but you can ask about discounts, increase your deductible and lower the coverage that may save a couple hundred of dollars. You can also ensure you are receiving the best price by comparing multiple quotes.