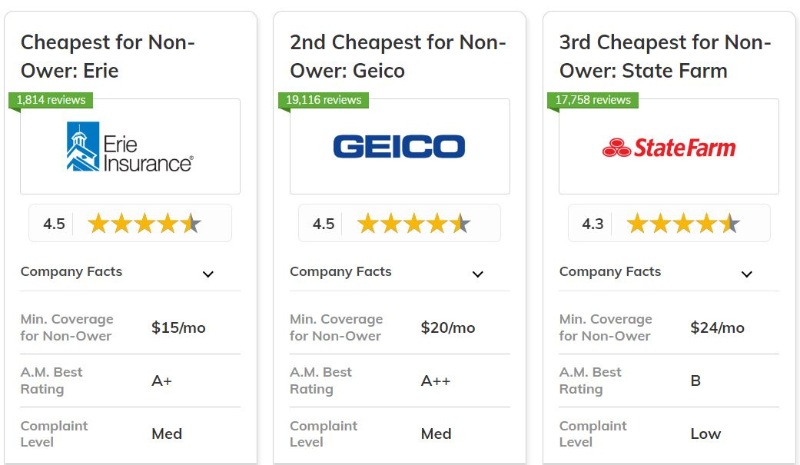

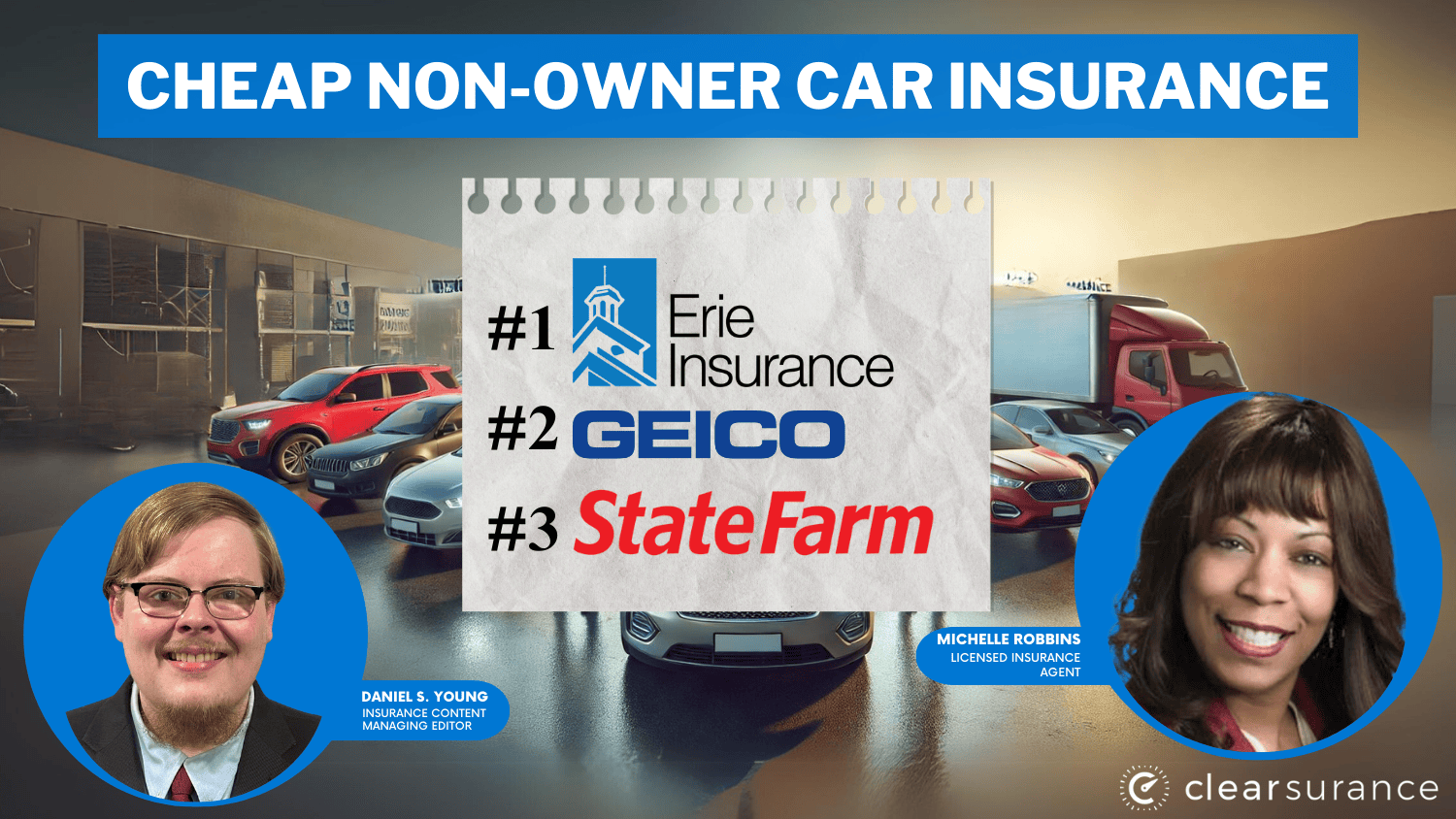

Erie, Geico, and State Farm offer cheap non-owner car insurance plans, with coverage starting at just $15/month.

This article lists the best car insurance companies for those who do not own a car. It identifies the lowest rates, the best features, and the possible downsides.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

|

#1 | $15 | A+ | Affordable Rates | Erie |

| #2 | $20 | A++ | National Coverage | Geico | |

| #3 | $24 | B | Reliable Service | State Farm | |

| #4 | $26 | A+ | Flexible Options | Progressive | |

| #5 | $28 | A | Customer Loyalty | American Family | |

|

#6 | $30 | A+ | Consistent Savings | Nationwide |

| #7 | $32 | A++ | Solid Reputation | Auto-Owners | |

| #8 | $34 | A | Digital Tools | Farmers | |

|

#9 | $36 | A | Comprehensive Discounts | Liberty Mutual |

| #10 | $38 | A | Insurance Add-ons | Mercury |

Keep reading to learn how non-owner car insurance works and which provider has the best option for you. By entering your ZIP code above, you can get instant car insurance quotes from top companies.

What You Should Know

- Erie's the top choice for cheap non-owner car insurance

- Geico non-owner insurance is available in all 50 states

- Non-owner car insurance costs less since it only includes minimum liability

#1 – Erie: Top Overall Pick

Pros

- Affordable Full Coverage: At $15 monthly, Erie offers the cheapest non-owner car insurance. Our Erie insurance review details its budget-friendly options.

- Regional Expertise: As a smaller company, Erie may offer more personalized non-owner insurance services in its operating areas.

- Great Claims Service: Erie car insurance comes with positive reviews from customers who file non-owner insurance claims.

Cons

- Limited High-Tech Features: Erie's cheap non-owner insurance might lack some advanced features offered by larger insurers.

- Limited Availability: Erie non-owner insurance is only sold in 12 states and Washington, D.C.

#2 – Geico: Cheapest in All 50 States

Pros

- Nationwide Availability: Geico offers non-owner car insurance across the country and is one of the car insurance companies that customers recommend.

- Easy Policy Upgrades: Non-owner policyholders can smoothly transition to standard auto insurance if they purchase a vehicle.

- User-Friendly Mobile App: Geico's app provides easy management and claims filing for non-owner car insurance on-the-go.

Cons

- Possible Longer Wait Times: As Geico gets more popular, people without a policy might have to wait longer for help with their insurance questions.

- Potential Upselling: Non-owner policyholders might be targeted more intensely with marketing for extra products because Geico offers a lot of different services.

#3 – State Farm: Best Customer Service

Pros

- Reliable Service: State Farm’s high ratings for customer satisfaction show that their service for non-owner insurance is reliable. Learn more in our State Farm review.

- Comprehensive Online Tools: Non-owner policyholders benefit from robust digital platforms for easy policy management and claims filing.

- Diverse Coverage Options: You can choose from many extra options to make your non-owner insurance just right for you.

Cons

- Regional Price Variations: Non-owner insurance rates might vary significantly by location, potentially being less competitive in some areas.

- Low Financial Ratings: State Farm's A.M. Best rating is lower than other non-owner auto insurance companies.

#4 – Progressive: Cheapest Flexible Options

Pros

- Cheap Flexible Options: They offer a fair price at $26/month for coverage that can be tailored to those without a car. See details in our Progressive insurance review.

- Name Your Price Tool: Use this unique tool to find a non-owner policy fitting your budget and coverage needs.

- Extensive Online Resources: They have easy-to-use websites where you can check your insurance, get price estimates, and learn about insurance.

Cons

- Higher Base Rate: At $26 monthly, Progressive's non-owner insurance is $11 more than Erie's, potentially deterring extremely budget-conscious drivers.

- Potentially Complex Policies: Non-owner policyholders might feel confused by all the different choices and extra options that Progressive offers for insurance.

#5 – American Family: Cheapest With Loyalty Rewards

Pros

- Loyalty Rewards: American Family offers discounts to long-term non-owner policyholders. Read American Family insurance review to learn more.

- Strong Financial Rating: AmFam’s A.M. Best rating gives them confidence with non-owner claims.

- Community Focus: They are involved in the community, which results in a better understanding of the needs for local non-owner insurance.

Cons

- Limited Availability: With geographic restrictions, some consumers may not be able get American Family’s non-owner car insurance in their states.

- Lower National Recognition: American Family has a lower national profile compared to larger insurers, which may cause some non-owner policyholders to hesitate.

#6 – Nationwide: Best for Consistent Savings

Pros

- Savings Opportunities: Nationwide’s $30 monthly rate comes with many non-owner discounts. Check out our Nationwide insurance review to explore options.

- Vanishing Deductible: This feature may be available on non-owner policies, saving out-of-pocket expenses in the future.

- Plenti Rewards: Earn points on your non–owner premiums, which are redeemable for savings on everyday purchases.

Cons

- Limited In-Person Support: In some areas, non-owner policyholders may have fewer face-to-face options than Nationwide's model.

- Less Short-Term Flexibility: Nationwide may be less accommodating than other competitors to non-owner policyholders looking for short-term coverage.

#7 – Auto-Owners: Best for Solid Reputation

Pros

- Strong Financial Stability: If you ever need to file a non-owner insurance claim, you can have confidence in Auto-Owners A A.M. Best rating.

- Personal Automobile Plus Package: This package may offer extra coverage to non-owner policyholders through bundle rates.

- Local Expertise: As a local insurer, Auto-Owners has created policies for non-owners that are specific to the community. To read more, go to Auto-Owners review.

Cons

- Slower Claims Processing: Because Auto-Owners are a smaller company, they may have longer processing times for non-owner insurance claims in certain areas.

- Limited Discount Transparency: Auto-Owners may not advertise all available discounts for non-owner policies as clearly as they could, so you’ll have to ask.

#8 – Farmers: Best for Digital Tools

Pros

- Advanced Digital Tools: Farmers' $34 monthly rate includes innovative policy management features. For details, see our Farmers insurance review.

- 24/7 Claims Service: Support is always available round the clock when non-owner policyholders need it the most.

- Rideshare Coverage: Specialized coverage is available for occasional rideshare company drivers who are not covered by an owner policy.

Cons

- Less Budget-Friendly: These rates may potentially scare away extremely frugal drivers who want the most affordable non-owner car insurance.

- Limited In-Person Support: Depending on where a non-owner policyholder lives, there may be fewer face-to-face interaction options.

#9 – Liberty Mutual: Cheapest With Discounts

Pros

- Extensive Discounts: Take advantage of Liberty Mutual’s discounts, and you can lower the $36/month rate for non-owners. Explore options in Liberty Mutual insurance review.

- Teacher's Auto Insurance: Specialized coverage and discounts are available to non-owner policyholders who are educators.

- Accident Forgiveness: This might protect non-owner policy rates after a first at-fault accident.

Cons

- Complex Discount Structure: Liberty Mutual has a lot of discount options, and non-owner policyholders might struggle to find their way around and make the most of them.

- Poor Claims Satisfaction: Liberty Mutual lags far behind other non-owner auto insurance companies with regard to claims and customer service.

#10 – Mercury: Cheapest Insurance Add-Ons

Pros

- Mechanical Breakdown Coverage: This additional option for non-owner policies provides extra protection beyond standard insurance.

- Cheap Roadside Assistance: Non-owner policyholders can add roadside assistance coverage at an affordable rate.

- RealDrive Program: This pay-per-mile option for non-owner policies potentially offers savings as mentioned in our best low-mileage car insurance companies.

Cons

- Highest Base Premium: For budget-conscious drivers, Mercury's non-owner insurance costs $38 monthly, the most expensive of all, and may deter drivers.

- Limited Availability: You can only get Mercury non-owner car insurance in 11 states.

Non-Owner Car Insurance Coverage Rates

This table provides a side-by-side monthly rate comparison of minimum liability and full coverage insurance. Non-owner car insurance only includes liability coverage, costing much less than a standard policy.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $28 | $38 | |

| $32 | $42 | |

|

$15 | $23 |

| $34 | $45 | |

| $20 | $28 | |

|

$36 | $48 |

| $38 | $50 | |

|

$30 | $40 |

| $26 | $35 | |

| $24 | $32 |

Comparing rates for cheap non-owners car insurance can help drivers find affordable options that suit their needs. It helps you decide if you want to save money or have more protection.

Understanding Non-Owner Car Insurance

Non-owner car insurance is a type of liability coverage designed for individuals who drive vehicles they do not own. It's ideal for occasional drivers who need liability protection without owning a car themselves.

It’s a good deal for those who rent cars often, for those who share rides, and for those who borrow vehicles or travel a lot. But it won’t pay for damage to the car you’re driving or for your own injuries.

How does auto insurance work for car-sharing services? For car-sharing services, it supplements often insufficient provided insurance, and for borrowing cars, it prevents reliance on the car owner’s policy, which could otherwise be problematic.

It is perfect for students who need coverage occasionally. Travelers get a temporary shield, giving them liability protection and financial protection no matter where they drive.

Features to Look for in Cheap Non-Owner Car Insurance

When you’re trying to find affordable non-owner car insurance, think about looking for these important things. Below can help you get the best deal for your money:

- Affordability: Compare monthly premiums and find the lowest rates for the coverage you need.

- Coverage Options: Ensure the policy covers liability, and check if it includes additional options like rental car coverage.

- Customer Service: Pick insurers known for good customer service. They will help with claims and questions about non-owner insurance.

- Discounts: Look for car insurance companies that do not need ownership. Seek out those who provide the discounts. That might help with a clean driving record. You can save more by bundling with other policies.

If you're a non-owner driver, you can get some great discounts from leading insurance companies. Take a look at these deals to get the most value from your coverage while keeping your expenses down.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Loyalty, Good Driver | |

| Multi-Policy, Paid-In-Full, Advance Quote | |

|

Multi-Policy, Safe Driver, Paid-In-Full |

| Multi-Policy, Signal App, Good Student | |

| Multi-Policy, Defensive Driving Course, Military | |

|

Multi-Policy, Safe Driver, Military |

| Multi-Policy, AutoPay, Anti-Theft Device | |

|

Multi-Policy, Paperless, Automatic Payment |

| Multi-Policy, Homeowner, Continuous Insurance | |

| Multi-Policy, Safe Driver, Anti-Theft Device |

For example, Geico’s defensive driving course discount is an excellent way for non-owners to save by demonstrating their safe driving skills.

Similarly, Nationwide’s paperless discount can reduce costs for those who opt for digital communications. Non-owner drivers can save through bundling car insurance discounts, such as combining renters insurance with non-owner car insurance.

Affordable Non-Owner Car Insurance Options

Finding cheap non-owner car insurance is essential for drivers who frequently rent or borrow vehicles. One of the best choices is Erie, which has really low prices and is perfect for people who want to save money.

Geico offers nationwide coverage and easy policy upgrades, which are ideal for those who travel often. State Farm provides reliable service and comprehensive online tools for efficient policy management.

Comparing the rates of these top insurers allows non-owner drivers to secure affordable and effective liability protection. Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Frequently Asked Questions

What is non-owner car insurance?

Non-owner car insurance provides liability coverage for drivers who don’t own a vehicle. It covers damages and injuries you cause when driving a borrowed or rented car.

How much is non-owner car insurance?

Non-owner car insurance typically costs between $15 and $50 per month, depending on the insurer, your driving record, and where you live. Erie offers rates as low as $15 per month.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Does USAA offer non-owner car insurance?

Yes, USAA sells non-owner auto insurance to active and retired military members and their families. Read our USAA insurance review to compare rates and coverage options.

Can you own a car without insurance?

No, most states require vehicle owners to have insurance. However, non-owner insurance is available for individuals who don’t own a car but still drive occasionally.

Read More: Can I register a car in a different state than I live in?

Can you insure a car not in your name?

Yes, some insurers allow coverage for cars not in your name. Non-owner car insurance is better suited for drivers frequently borrowing or renting cars.

What are the advantages of non-owner car insurance?

Non-owner insurance offers liability protection when driving borrowed or rented cars, making it an affordable option for occasional drivers who don't own a vehicle.

What are examples of uninsured drivers?

Uninsured individuals drive without any active car insurance. This includes drivers without traditional or non-owner car insurance who cause accidents while driving someone else’s car.

Read More: What is the penalty for driving without insurance?

What is a non-insurer?

A non-insurer refers to an individual or entity that doesn’t offer or sell insurance products. It applies to anyone not authorized to provide or underwrite insurance policies.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

What is the difference between full coverage and collision?

Full coverage includes both collision and comprehensive coverage. Collision covers your vehicle after an accident, while comprehensive covers non-collision events like theft or natural disasters.

What does comprehensive coverage mean?

Comprehensive coverage protects your vehicle against non-collision damage, including theft, vandalism, or weather-related incidents. It's usually part of a full coverage policy.00:00