Geico, Safeco, and State Farm are the best companies for cheap liability car insurance. Geico’s low rates of $58/month are especially attractive for budget-conscious drivers.

These companies provide the best balance of affordability and customer service, making them top choices for drivers looking for minimum coverage.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $58 | A++ | Low Rates | Geico | |

| #2 | $60 | A | Competitive Pricing | Safeco | |

| #3 | $62 | B | Wide Availability | State Farm | |

| #4 | $63 | A++ | Reliable Service | Auto-Owners | |

| #5 | $64 | A | Comprehensive Plans | American Family | |

| #6 | $65 | A++ | Good Reputation | Travelers | |

| #7 | $66 | A+ | Flexible Options | Progressive | |

| #8 | $67 | A+ | Strong Discounts | Allstate | |

| #9 | $68 | A | Diverse Coverage | Farmers | |

|

#10 | $70 | A+ | AARP Discounts | The Hartford |

You can find the most affordable liability car insurance coverage near you by comparing these options.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes with your ZIP code.

What You Should Know

- Geico offers cheap liability-only car insurance starting at $58/month

- Safeco and State Farm provide competitive pricing and broad coverage options

- Compare top providers for affordable liability car insurance tailored to you

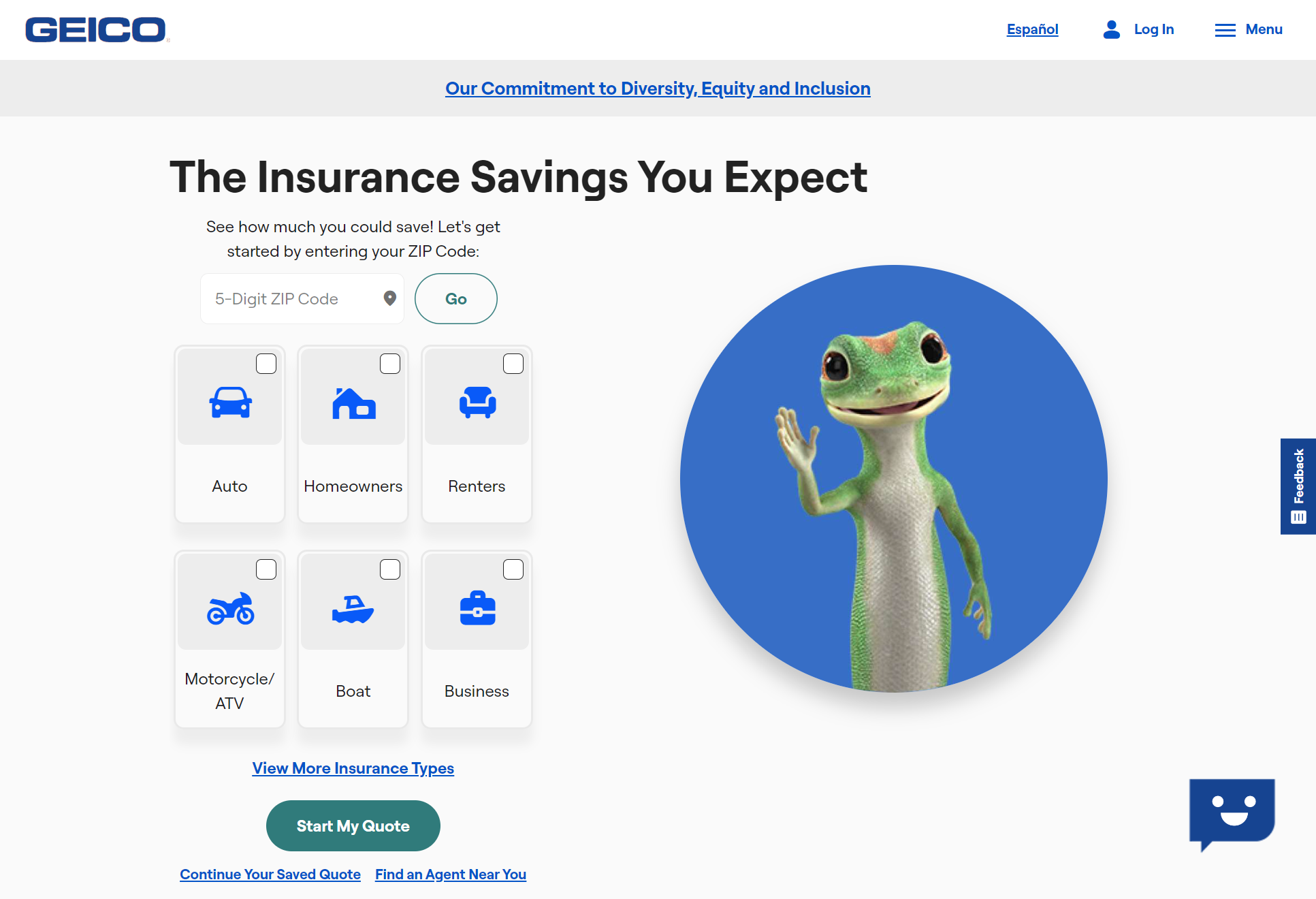

#1 – Geico: Top Overall Pick

Pros

- Pocket-Friendly: Geico's minimum liability coverage is one of the most affordable, beginning at $58 per month.

- User-Friendly: Geico's website and mobile app make it easy to get a quote and manage your liability car insurance policy.

- Plenty of Discounts: Geico provides a range of savings options to help you further reduce the cost of your auto insurance.

Cons

- Basic Coverage: Although Geico's primary goal is to offer reasonably priced liability insurance, other insurers may offer more comprehensive plans.

- Customer Service Issues: Although most of the time Geico offers excellent customer service, some customers have complained about higher wait times.

#2 – Safeco: Best for Competitive Pricing

Pros

- Wallet-Friendly Prices: If you’re looking for affordable liability car insurance, Safeco has you covered with plans starting at just $60 a month for basic protection.

- Discount Flexibility: Our Safeco insurance review shows discounts for safe driving habits or bundling your policies together.

- Manageable Online Tools: Handy online tools that make it simple to manage your coverage and compare different liability auto insurance options.

Cons

- Limited Customization: When it comes to customizing your liability car insurance, Safeco has fewer options compared to some other major insurers.

- High Number of Complaints: Despite having good claims service, Safeco still sees more complaints than other liability insurance companies.

#3 – State Farm: Best for Wide Availability

Pros

- Wide Availability: Liability car insurance is available all over the U.S. Compare rates in our State Farm review starting as low as $62/month.

- Reliable Agent Network: State Farm’s extensive network of agents makes it easy to get personalized assistance with your liability car insurance.

- Discount Programs: State Farm offers various discount programs, including safe driver and multi-policy discounts for liability car insurance.

Cons

- Higher Premiums: State Farm’s liability car insurance premiums can be slightly higher than competitors for similar coverage.

- Limited Online Quote Customization: State Farm’s online platform may offer fewer customization options for liability car insurance compared to other companies.

#4 – Auto-Owners: Best for Reliable Service

Pros

- Trustworthy Service: Auto-Owners is well known for its amiable customer support and simple liability auto insurance claims procedure.

- Reputable Financial Ratings: Auto-Owners has a solid financial rating of A++, so you can be sure that they are in a good situation.

- Great Discounts: They offer some awesome discounts, like savings for bundling policies and rewards for safe driving, making it easier to save on your liability car insurance.

Cons

- Availability Issues: Auto-Owners liability car insurance is not available in every state.

- Limited Online Tools: The online tools for managing liability car insurance are not as advanced as some competitors.

#5 – American Family: Best for Comprehensive Plans

Pros

- Diverse Coverage Options: American Family has a great selection of coverage choices. If you’re just looking for the basics, you can get liability car insurance starting at only $64 a month.

- Excellent Customer Support: They're well-known for their great customer service, especially when it comes to handling liability car insurance policies and claims. Customers tend to be very satisfied.

- Customizable Policies: One of the standout features of our AmFam insurance review is how flexible their liability car insurance is. You can really tweak it to match your personal needs.

Cons

- Higher Starting Rates: It's worth noting that their liability car insurance rates are a bit higher than some other low-cost providers.

- Discount Limitations: You may find fewer discounts available for liability coverage compared to competitors like Geico and State Farm.

#6 – Travelers: Best for Good Reputation

Pros

- Good Reputation: Travelers is well-regarded for its reliability and customer satisfaction when it comes to liability car insurance. You can start your coverage for as little as $65 a month.

- Financial Stability: With an A++ rating, Travelers provides a sense of security for your liability car insurance policy. If you're curious about how they stack up, check out our full Travelers insurance review.

- Flexible Policy Options: Travelers makes it easy to customize your liability car insurance to fit your unique needs.

Cons

- Limited Discounts: One drawback is that Travelers doesn’t offer as many discounts for liability car insurance compared to some other big providers.

- Higher Rates for Comprehensive Coverage: While their liability rates are competitive, if you’re looking for full coverage, you might find the rates a bit higher than you’d expect.

#7 – Progressive: Best for Flexible Options

Pros

- Flexible Coverage: Progressive insurance provides a variety of liability car insurance options with rates starting at $66 per month for minimum coverage.

- Snapshot Discount: Progressive’s Snapshot program rewards good drivers with lower liability car insurance premiums.

- Good Online Tools: Progressive’s online tools make it easy to compare liability car insurance options and get quotes quickly.

Cons

- Higher Starting Rates: Liability car insurance rates are higher than those of Geico and Safeco.

- Customer Service Complaints: Some customers report mixed experiences with Progressive’s customer service for liability car insurance issues.

#8 – Allstate: Best for Strong Discounts

Pros

- Strong Discounts: Allstate offers a variety of discounts, helping reduce liability car insurance rates that start at $67 per month for minimum coverage.

- Safe Driving Programs: Allstate rewards safe drivers with lower premiums on liability car insurance through its Drivewise program.

- Good Availability: Our Allstate review provides liability car insurance in most states across the U.S.

Cons

- Higher Premiums: Allstate’s liability car insurance rates can be higher than competitors like Geico and Progressive.

- Limited Customer Support: Some customers have reported longer wait times for claims processing and customer support.

#9 – Farmers: Best for Diverse Coverage

Pros

- Numerous Coverage Alternatives: Farmers has a large selection of coverage alternatives, with minimum coverage liability vehicle insurance as little as $68 per month.

- Excellent Customer Service: Our Farmers' first-rate claims handling and friendly customer service in our assessment of liability vehicle insurance.

- Opportunities for Discounts: Farmers provides a number of discounts for liability auto insurance, such as multi-policy and safe driver discounts.

Cons

- Higher Prices: Farmers' liability auto insurance starts at $68 a month, which is more than other big carriers' prices.

- Limited Digital Options: In comparison to rivals like Progressive and Geico, Farmers provides less internet options for handling liability auto

#10 – The Hartford: Best for AARP Discounts

Pros

- AARP Member Discounts: he Hartford offers AARP members excellent savings on liability auto insurance, with minimum coverage prices as low as $70 per month.

- Excellent Customer Service: Our analysis indicates that The Hartford is highly known for providing excellent customer service, particularly to senior drivers seeking liability auto insurance.

- Good Financial Stability: The Hartford's A+ financial grade guarantees that liability auto insurance products are well-supported.

Cons

- Greater Starting Rates: The Hartford offers liability auto insurance at a higher starting rate than other companies.

- Limited Availability for Younger Drivers: The Hartford’s best liability car insurance rates are geared toward older drivers, limiting options for younger demographics.

Comparing Liability Car Insurance Rates Across Top Providers

Geico offers the most affordable option for minimum liability coverage at $58 per month, while full coverage costs $112.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $67 | $126 | |

| $64 | $122 | |

| $63 | $120 | |

| $68 | $128 | |

| $58 | $112 | |

| $66 | $123 | |

| $60 | $115 | |

| $62 | $118 | |

|

$70 | $130 |

| $65 | $125 |

Safeco and State Farm follow closely, with minimum coverage rates of $60 and $62 per month. Auto-Owners is another budget-friendly choice at $63 monthly.

Read More: How to Buy Car Insurance

Affordable Liability Car Insurance Coverage Options

Cheap liability car insurance is essential for meeting state requirements. It covers damages or injuries you cause in an accident.

Most states mandate minimum liability car insurance, which covers bodily injury and property damage to others. Drivers can choose basic liability coverage or opt for higher limits for better protection.

When you bundle, you don't have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

For instance, new cars and luxury vehicles need additional coverage with comprehensive and collision insurance, ensuring full protection while still fulfilling mandatory liability insurance obligations.

Save Money With Liability Insurance Discounts

Many top providers offer valuable liability insurance discounts that help drivers reduce the cost of car insurance.

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Early Signing, Anti-Theft Device | |

| Multi-Policy, Safe Driver, Good Student, Home Ownership, Online Quote | |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft Device, Advance Quote | |

| Multi-Policy, Safe Driver, Good Student, Home ownership, Anti-Theft Device | |

| Multi-Policy, Safe Driver, Good Student, Military, Federal Employee, Anti-Theft Device | |

| Multi-Policy, Safe Driver, Good Student, Home Ownership, Online Quote | |

| Multi-Policy, Safe Driver, Good Student, Home Ownership, Anti-Theft Device | |

| Multi-Policy, Safe Driver, Good Student, Drive Safe & Save, Anti-Theft Device | |

|

Multi-Policy, Safe Driver, Good Student, AARP Member, Anti-Theft Device |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft Device, Online Quote |

Unique discounts, such as Geico’s federal employee savings and The Hartford’s AARP member discount, cater to specific groups.

To further save money on liability car insurance, drivers can raise deductibles or utilize online quotes, which some insurers reward with lower rates.

Unlocking the Best Deals on Cheap Liability Car Insurance

Geico, Safeco, and State Farm are the top providers of cheap liability car insurance. Geico stands out with the lowest rates at $58 per month.

Liability car insurance is essential for covering damages or injuries you may cause in an accident, and finding the cheapest option is easier when you compare multiple quotes online.

State Farm offers its Drive Safe & Save program for additional savings, but online tools allow you to instantly compare rates from multiple companies.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

What is cheap liability car insurance?

Cheap liability car insurance provides coverage for damages you may cause to others in an accident at an affordable rate.

How much does cheap liability car insurance typically cost?

Rates vary by provider, but you can find liability car insurance for as low as $58 per month with Geico. Enter your ZIP code to see how much liability-only car insurance costs near you.

What factors affect the cost of liability car insurance?

Factors include your driving history, location, vehicle type, and coverage limits.

Learn More: What is a Driving Record and What Does it Track?

How can I find the cheapest liability car insurance?

Compare rates from multiple providers using online quote tools to find the most affordable options.

Can I get discounts on liability car insurance?

Yes, many providers offer discounts for safe driving, good students, bundling policies, and more.

Does liability car insurance cover damage to my own car?

No, liability insurance only covers damage or injuries you cause to others. Find out how much bodily injury liability insurance you need.

What's the minimum liability insurance coverage required by law?

Each state sets its own minimum liability coverage requirements, so check local laws to ensure compliance.

How do I know if liability insurance is enough for me?

Liability insurance is required, but you may want to consider additional coverage like collision or comprehensive, depending on your needs.

Is liability insurance mandatory in all states?

Yes, almost all states require liability car insurance to legally drive, though the coverage amounts vary.

How do I lower my liability car insurance premium?

You can lower your premium by maintaining a clean driving record, choosing a higher insurance deductible, and taking advantage of discounts.