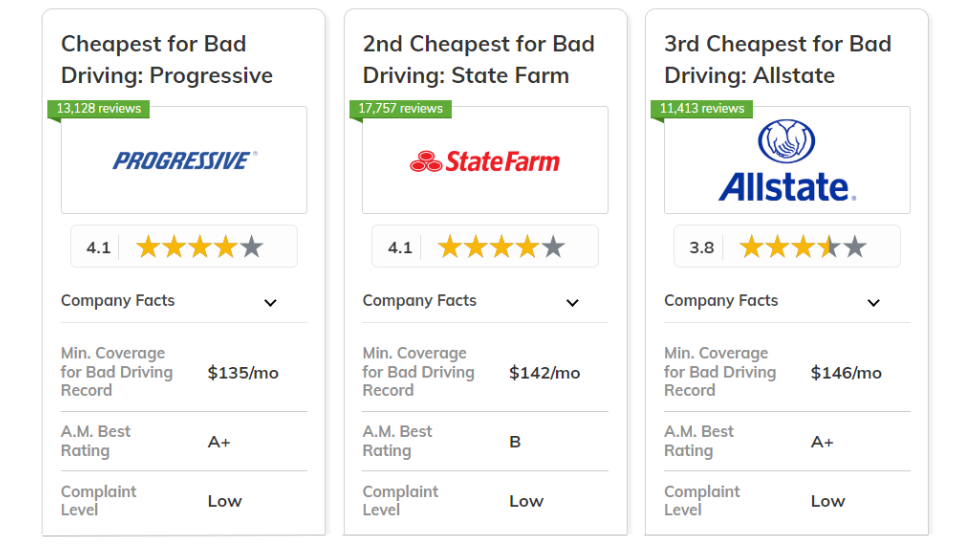

The leading choices for cheap car insurance for a bad driving record are Progressive, State Farm, and Allstate.

These providers offer comprehensive insurance options, discounts for infrequent drivers, and budgeting tools to manage costs, with rates starting at $138/month.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $135 | A+ | Budgeting Tools | Progressive | |

| #2 | $142 | B | Policy Options | State Farm | |

| #3 | $146 | A+ | Infrequent Drivers | Allstate | |

|

#4 | $153 | A+ | Usage-Based Coverage | Nationwide |

| #5 | $158 | A | Many Discounts | Mercury | |

| #6 | $162 | A+ | Foreign Diplomats | Dairyland | |

| #7 | $167 | A | Online Tools | Safeco | |

|

#8 | $173 | A | 24/7 Support | Liberty Mutual |

|

#9 | $179 | A+ | Personalized Policies | Erie |

| #10 | $182 | A++ | Cheap Rates | Geico |

Drivers with a poor record can find affordable insurance by selecting the right provider and utilizing discounts.

Find cheap car insurance quotes by entering your ZIP code above.

What You Should Know

- Progressive offers car insurance for a bad driving record starting at $138/month

- Drivers with bad records can find discounts and flexible coverage options

- Compare providers to secure affordable protection despite past infractions

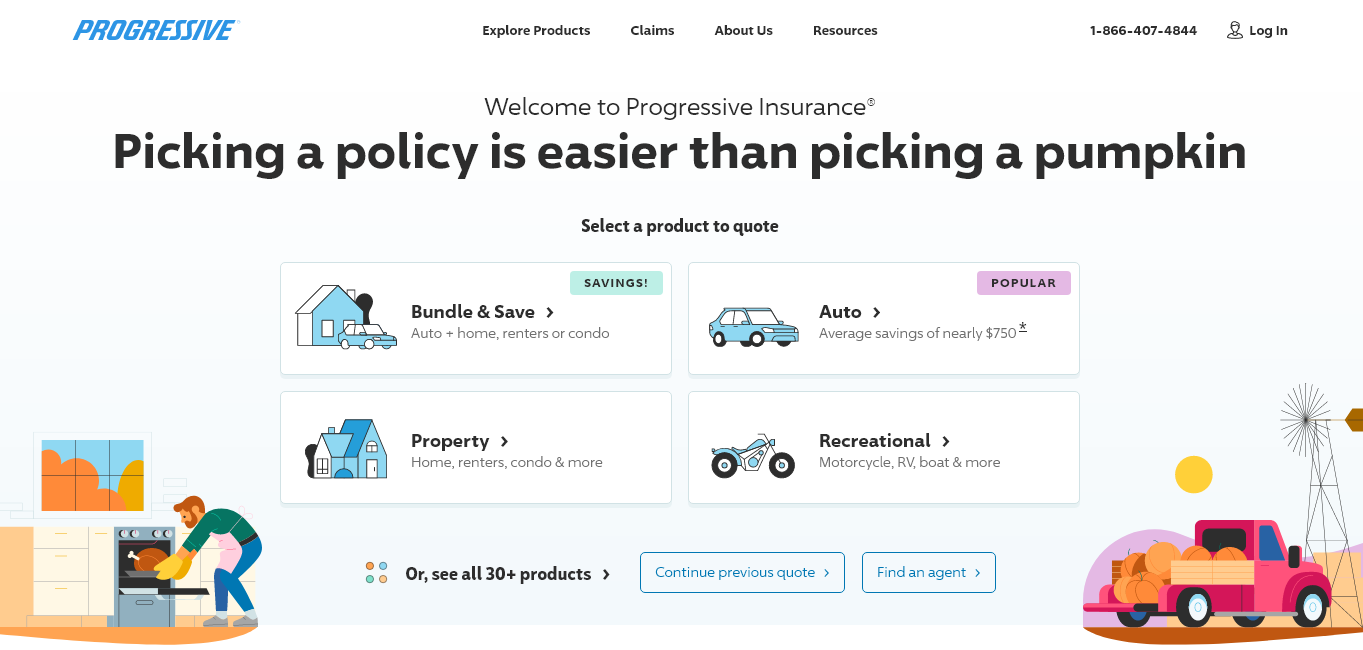

#1 – Progressive: Best for Budgeting Tools

Pros

- Budgeting Tools: Provides tailored budgeting tools specifically for managing car insurance for a bad driving record.

- Snapshot Program: Explore our Progressive reviews to learn how it offers usage-based monitoring to help high-risk drivers improve and lower costs.

- Flexible Payment Options: Customizable payment plans to accommodate those with a bad driving record.

Cons

- Limited Major Violation Coverage: Does not offer as many options for drivers with severe bad driving record offenses like DUIs.

- Steep Price Hikes: Premiums may increase significantly for multiple offenses on a bad driving record.

#2 – State Farm: Best for Policy Options

Pros

- Diverse Policy Options: Offers a wide range of customizable policies for drivers with a bad driving record.

- Drive Safe & Save Program: Rewards improved driving behavior with discounts, even for those with a bad driving record.

- Accident Forgiveness: Discover our State Farm reviews, which highlights how it protects high-risk drivers from significant rate hikes after their first accident.

Cons

- Stricter Approval Process: State Farm may decline coverage for drivers with multiple infractions on their bad driving record.

- Limited Discounts for High-Risk Drivers: Fewer discounts specifically aimed at drivers with a bad driving record.

#3 – Allstate: Best for Infrequent Drivers

Pros

- Milewise Program: Infrequent drivers with a bad driving record can save by paying per mile driven.

- Accident Forgiveness: Helps keep premiums steady after a first accident for bad driving record drivers.

- Deductible Rewards: View our Allstate reviews to see how it rewards drivers with reduced deductibles, even with a bad driving record.

Cons

- Higher Initial Premiums: Allstate’s initial rates may be higher for drivers with a bad driving record.

- Pay-Per-Mile Limitations: Drivers with more frequent usage may find limited savings, even with a bad driving record.

#4 – Nationwide: Best for Usage-Based Coverage

Pros

- SmartRide Program: Usage-based monitoring helps drivers with a bad driving record save by improving driving habits.

- Customizable Policies: Based on our Nationwide reviews, flexible policies are tailored for drivers with a bad driving record.

- Vanishing Deductible: Reduces the deductible for every year of safe driving, even with a bad driving record.

Cons

- High Premiums for Severe Offenses: Drivers with major infractions on their bad driving record may face high premiums.

- Limited Availability of Discounts: Usage-based programs might not be available in all regions for bad driving record drivers.

#5 – Mercury: Best for Many Discounts

Pros

- Bundling Discounts: Offers significant savings for bundling auto insurance with other policies for drivers with a bad driving record.

- RealDrive Program: Provides discounts based on the actual number of miles driven, beneficial for high-risk drivers.

- Good Driver Discounts: See our Mercury reviews, which discusses the discounts for maintaining safe driving habits despite a bad driving record.

Cons

- Fewer National Options: Mercury's coverage is only available in certain states, limiting access for bad driving record drivers.

- Higher Risk Equals Higher Rates: Drivers with multiple offenses on their bad driving record may see steeper rates.

#6 – Dairyland: Best for Foreign Diplomats

Pros

- Specializes in High-Risk Drivers: Provides tailored policies for foreign drivers with a bad driving record.

- SR-22 Filing: Offers assistance with SR-22 filings for drivers with a bad driving record, helping them regain legal compliance.

- Flexible Payment Plans: Delve into our Dairyland reviews to find out how installment options can help drivers manage their premiums.

Cons

- Fewer Discounts: Offers fewer discount opportunities for drivers with a bad driving record.

- Higher Rates for Severe Violations: Drivers with serious offenses on their bad driving record face higher premiums.

#7 – Safeco: Best for Online Tools

Pros

- RightTrack Program: Provides usage-based savings opportunities for improving driving behavior, even with a bad driving record.

- Easy Online Management: Comprehensive online tools allow drivers with a bad driving record to easily manage their policy.

- Accident Forgiveness: In our Safeco reviews, learn how it prevents rate hikes for the first accident, benefiting high-risk drivers.

Cons

- Limited In-Person Support: Less physical branch support for high-risk drivers needing assistance with a bad driving record.

- Fewer Add-Ons: Limited coverage extensions for drivers with multiple offenses on their bad driving record.

#8 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Claims Support: With our Liberty Mutual reviews, discover how it offers constant support for drivers with a bad driving record, ensuring quick help.

- Deductible Fund: Allows bad driving record drivers to earn $100 off their deductible every year without a claim.

- Better Car Replacement: Replaces your car with one that is a model year newer if totaled, even for those with a bad driving record.

Cons

- Higher Premiums: Rates tend to be higher for drivers with severe offenses on their bad driving record.

- Limited High-Risk Discounts: Fewer discount options for drivers with a bad driving record compared to competitors.

#9 – Erie: Best for Personalized Policies

Pros

- Customizable Policies: According to our Erie reviews, it provides highly personalized options for drivers with a bad driving record.

- Rate Lock: Locks in your rate so it won’t increase, even with minor violations on a bad driving record.

- First Accident Forgiveness: Protects drivers with a bad driving record from rate hikes after their first accident.

Cons

- Limited Availability: Erie’s coverage is not available in all states, limiting options for some bad driving record drivers.

- Fewer Online Features: Less robust online management tools for handling bad driving record policies.

#10 – Geico: Best for Cheap Rates

Pros

- Low Base Rates: Renowned for providing solutions on how to get cheap car insurance, even for high-risk drivers with a bad driving record.

- DriveEasy Program: Rewards safer driving behavior, even for those with a bad driving record.

- Extensive Discounts: Offers a wide variety of discounts tailored to drivers with a bad driving record.

Cons

- Limited Add-Ons: Fewer additional coverage options available for bad driving record drivers.

- Premiums May Increase: Drivers with multiple offenses on their bad driving record could see steep rate hikes.

Cost-Effective Car Coverage for Risky Drivers

This table compares monthly auto insurance rates across various companies, detailing minimum and full coverage options. Allstate offers $146 for minimum and $310 for full coverage. Dairyland provides $162 and $345, respectively, while Erie charges $179 and $375.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $146 | $310 | |

| $162 | $345 | |

|

$179 | $375 |

| $182 | $385 | |

|

$173 | $365 |

| $158 | $335 | |

|

$153 | $320 |

| $135 | $280 | |

| $167 | $350 | |

| $142 | $295 |

Geico's rates are $182 for minimum and $385 for full coverage. Other insurers include Liberty Mutual at $158 and $335, Mercury at $153 and $320, Nationwide at $135 and $280, Progressive at $167 and $350, and Safeco at $142 and $295. Beyond just the monthly premiums, it’s crucial to consider the discounts available that can further reduce your costs.

Each insurance company offers unique discounts that cater to various aspects of a driver’s profile and behaviors, such as safe driving habits or multiple policy holdings. Understanding these factors can greatly reduce the cost of car insurance, turning high premiums into affordable investments in your safety and legal compliance.

| Insurance Company | Available Discount |

|---|---|

| Safe Driving Bonus, Defensive Driving Course Discount | |

| Multi-Car Discount, Continuous Insurance Discount | |

|

Accident Forgiveness, Multi-Policy Discount |

| Defensive Driving Discount, Five-Year Accident-Free Discount | |

|

Deductible Fund, Accident-Free Discount |

| RealDrive (Mileage-Based Discount), Good Driver Discount | |

|

Vanishing Deductible, Accident Forgiveness |

| Snapshot (Usage-Based Discount), Accident Forgiveness | |

| Rewind Program Discount, Accident Forgiveness | |

| Defensive Driving Discount, Accident-Free Discount |

This table lists car insurance discounts offered by top providers for drivers with a bad driving record. It details specific savings options such as safe driving bonuses, multi-car discounts, and accident forgiveness from companies including Allstate, Dairyland, Erie, and others.

By carefully comparing both the coverage costs and the discounts for which you qualify, you can navigate the complexities of car insurance and regain control over your driving future. Make informed decisions to not only meet legal requirements but also to protect yourself without breaking the bank.

Premium Dynamics for Risky Drivers

The cost of car insurance is heavily impacted by what is a driving record and what does it track, as insurers closely examine the severity and frequency of driving violations to assess risk.

For instance, major transgressions like DUIs or reckless driving escalate insurance premiums more sharply than minor infractions such as speeding tickets. This differentiation is crucial because it underscores the potential for drivers to mitigate high costs.

Engaging in safer driving practices or participating in defensive driving courses can not only improve one's driving record but also considerably lower insurance premiums over time. Understanding these factors enables drivers to proactively manage and reduce their insurance costs, despite past driving missteps.

Lowering Premiums: Effective Tips for High-Risk Drivers

Navigating car insurance as a high-risk driver requires smart strategies to reduce your rates without compromising coverage. Here are key tips that can help:

- Compare Insurance Quotes Regularly: Ensure you're getting the best rates by comparing different insurers, which also encourages competitive pricing.

- Enroll in Defensive Driving Courses: Many insurers offer discounts for completing state-approved safety courses, directly reducing your premiums.

- Adjust Your Coverage: Tailor your insurance coverage to match your current driving habits and needs, potentially lowering your costs.

- Maintain a Clean Record: Strive for no further infractions to gradually improve your driving history, which can lead to lower insurance rates over time.

By applying these strategies, high-risk drivers can significantly lower their insurance costs while staying covered and financially smart, helping them find the best car insurance for high risk drivers.

Unlock Savings: Discounts for High-Risk Drivers

For drivers with a less-than-stellar driving record, there are still numerous opportunities to save on car insurance premiums. Many insurance companies offer a variety of discounts that high-risk drivers can qualify for, which might not be directly related to their driving history.

data-media-max-width="560">Great costumes. Great driving. What could go wrong? pic.twitter.com/IavMOCoExe

— Progressive (@progressive) January 29, 2024

Bundling auto insurance with homeowners or renters policies can result in significant savings. Additionally, choosing electronic billing and automatic payments can further reduce how much car insurance costs per month by earning additional discounts from insurers.

Another notable option is the low-mileage discount, which benefits drivers who use their vehicles sparingly. Exploring these discounts and actively asking your insurer about potential savings can make a substantial difference in your overall insurance costs.

Insurance Solutions for Drivers With Records

For drivers labeled as high-risk due to previous infractions, finding suitable insurance options can be challenging. However, many insurance companies specialize in providing coverage specifically for those without what is considered a clean driving record.

These specialized high-risk insurance policies consider the unique circumstances and potential improvements of each driver. Such insurers often provide flexible payment options and personalized improvement programs, like safe driving trackers, which can help reduce premiums over time as the driver demonstrates safer behavior.

Moreover, these companies are adept at structuring coverage plans that not only meet state requirements but also offer a pathway to better rates and eventually re-entering standard insurance markets. By exploring these specialized options, high-risk drivers can find viable, cost-effective solutions for their car insurance needs.

Steering Clear: Smart Insurance for Risky Drivers

Securing affordable car insurance with a bad driving record is achievable with the right strategies. Understanding the factors that impact premiums for high-risk drivers, exploring specialized insurance options, and actively reducing rates can make a significant difference.

Consistently getting car insurance quotes online, using discounts, and improving driving habits are effective ways to save and secure better insurance terms. Being persistent and making informed decisions allows drivers to manage costs and improve road safety.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Frequently Asked Questions

What is the cheapest insurance for a bad driving record?

The cheapest insurance for a bad driving record depends on various factors like your location and driving history. However, companies like Geico, Progressive, and State Farm are often known for offering competitive rates for high-risk drivers.

Discover more by exploring our comprehensive resource on "The Best and Cheapest Car Insurance Companies" for insights and guidance.

What makes you high risk for auto insurance?

Factors that can make you high risk for auto insurance include multiple speeding tickets, DUIs, at-fault accidents, and a history of late insurance payments. Drivers with these issues usually face higher premiums.

What is the best insurance for high-risk drivers?

Progressive, State Farm, and Allstate are often regarded as some of the best insurance companies for high-risk drivers. They offer various discounts and flexible coverage options to help reduce premiums for those with a bad driving record.

For a comprehensive understanding, refer to our in-depth analysis titled "Car Insurance Companies for High-Risk Drivers" for more insights.

What is the cheapest car insurance for high-risk drivers?

The cheapest car insurance for high-risk drivers varies, but Geico, Progressive, and Nationwide tend to offer affordable options with flexible coverage for those with a bad driving record.

Is Nationwide good for high-risk drivers?

Yes, Nationwide is a good option for high-risk drivers. It offers customizable policies and usage-based programs like SmartRide to help reduce premiums for drivers with a bad driving record.

What type of things can reduce a driver's insurance premium?

Safe driving habits, bundling policies, low mileage, installing a dash cam, and participating in a defensive driving course can all help reduce a driver's insurance premium, especially for those with a bad driving record.

For valuable insights, consult our extensive guide titled "Top ways customers have saved money on car insurance rates" for more tips.

Should I insure my car if I don't drive it?

Yes, it's a good idea to maintain insurance on your car even if you don't drive it. Comprehensive coverage can protect you against theft, fire, or other non-driving-related damage.

Who is cheaper, Geico or Progressive?

Both Geico and Progressive offer competitive rates, but the cheaper option depends on your personal factors such as driving history and location. Drivers with a bad driving record may find one company cheaper than the other.

For detailed information, check out our comprehensive report titled "Geico vs. Progressive" for further insights.

What car insurance is best with a bad driving record?

Progressive, Geico, and State Farm are commonly recommended for drivers with a bad driving record. They provide flexible policies and discounts to help mitigate higher premiums.

What is the uninsured driver promise?

The uninsured driver promise ensures that if you’re hit by an uninsured driver, your insurance policy will cover damages and injuries, helping protect you financially even if the other driver isn’t insured.