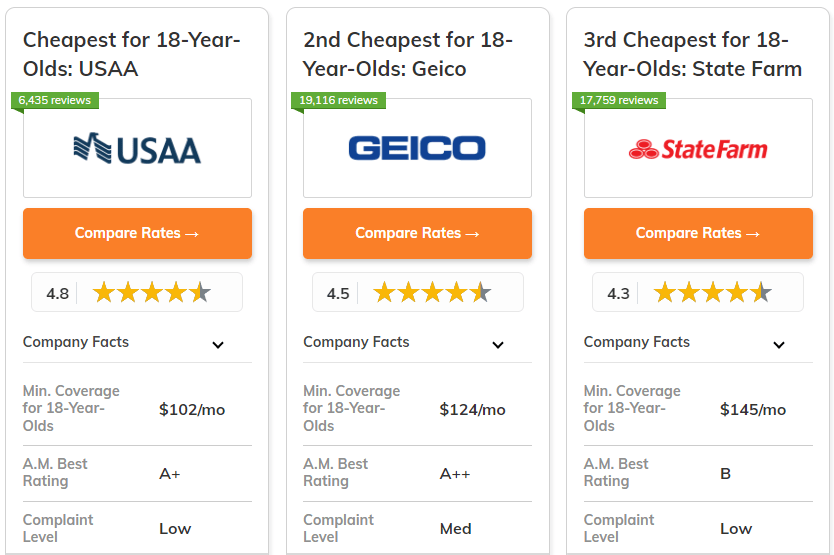

USAA, Geico, and State Farm are the best cheap car insurance companies for 18-year-olds. They offer affordable rates and reliable coverage. USAA is the top pick, providing the lowest rates for eligible young drivers.

Geico and State Farm follow closely, with flexible options and competitive pricing tailored to meet the needs of new drivers. Often considered among the best and cheapest car insurance companies, these companies stand out for balancing affordability, coverage, and customer satisfaction.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $102 | A++ | Military Savings | USAA | |

| #2 | $124 | A++ | Cost Savings | Geico | |

| #3 | $145 | B | Personalized Policies | State Farm | |

|

#4 | $195 | A+ | Accident Forgiveness | Nationwide |

| #5 | $207 | A | Loyalty Discounts | American Family | |

| #6 | $260 | A+ | Local Agents | Allstate | |

| #7 | $316 | A | Safe Drivers | Farmers | |

|

#8 | $325 | A | 24/7 Support | Liberty Mutual |

| #9 | $327 | A+ | Loyalty Rewards | Progressive | |

| #10 | $362 | A++ | Specialized Coverage | Travelers |

Enter your ZIP code above into our free comparison tool to see how much car insurance is for teachers in your area.

What You Should Know

- USAA offers the lowest rates for 18-year-olds, starting at $102 per month

- Geico and State Farm provide flexible, affordable options for young drivers

- Young drivers should compare quotes to find the best coverage at lower prices

#1 – USAA: Top Overall Pick

Pros

- Military Discounts: According to our USAA review, USAA provides significant savings for military families, making it a top choice for cheap car insurance for 18-year-olds with military ties.

- Lowest Monthly Rates: Offering minimum coverage at just $102, USAA stands out as the most affordable option for 18-year-olds.

- Comprehensive Coverage: Despite being low-cost, USAA offers robust coverage options, ensuring young drivers get solid protection.

Cons

- Limited Eligibility: Only military personnel and their families qualify for USAA, which may exclude many 18-year-olds.

- Basic Coverage Options: Some of the minimum coverage plans may lack certain features offered by other car insurance companies for 18-year-olds.

#2 – Geico: Best for Cost Savings

Pros

- Affordable Monthly Rates: At $124, Geico offers one of the best rates for minimum coverage, making it ideal for 18-year-olds on a budget. Refer to our guide ton the top ways customers have saved money on car insurance rates.

- Wide Range of Discounts: Young drivers can access several discounts, allowing them to save even more on their car insurance.

- Customizable Coverage: Geico’s flexible policies make it easier for 18-year-olds to choose coverage that meets their specific needs without overspending.

Cons

- Customer Service: Geico’s customer service experience can be hit or miss, which may be less appealing to young drivers who need more support.

- Higher Full Coverage Costs: While the minimum coverage is affordable, Geico’s full coverage rates may not be as competitive for 18-year-olds.

#3 – State Farm: Best for Personalized Policies

Pros

- Flexible Coverage Options: State Farm allows 18-year-olds to tailor their policies according to their individual needs.

- Competitive Rates: With minimum coverage starting at $145, State Farm provides decent rates for cheap car insurance companies for 18-year-olds.

- Multi-Policy Discounts: The company’s bundling options help young drivers save on car insurance when combining policies like home and auto as noted in many State Farm reviews.

Cons

- Financial Rating: State Farm’s B-rating from A.M. Best may be a concern for those prioritizing financial strength.

- Limited Discount Variety: While discounts are available, they are not as extensive as some competitors, such as Geico or USAA for 18-year-olds car insurance.

#4 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide’s accident forgiveness helps young drivers avoid premium increases after their first accident, which is especially useful for 18-year-olds.

- Reasonable Monthly Rates: With a minimum coverage rate of $195, Nationwide offers affordable car insurance for 18-year-olds seeking accident protection.

- Strong Customer Service: Our analysis of Nationwide review reveals Nationwide is known for providing excellent customer support, giving peace of mind to young drivers.

Cons

- Higher Initial Rates: Nationwide’s starting rates are higher than some competitors, making it less appealing for 18-year-olds looking for the absolute cheapest coverage.

- Discount Availability: While there are discounts, they may not be as generous as those from other car insurance companies for 18-year-olds.

#5 – American Family: Best for Loyalty Discounts

Pros

- Loyalty Rewards: American Family rewards long-term customers, which can help 18-year-olds lower their rates over time.

- Moderate Monthly Rates: With a minimum coverage cost of $207, American Family is a relatively affordable option for car insurance companies for 18-year-olds. Find more details about this provider in our guide: American Family review.

- Flexible Coverage Options: Their policies offer various coverage choices, ensuring young drivers can find a plan that suits their needs.

Cons

- Expensive Full Coverage: Full coverage rates can get expensive, making it less ideal for 18-year-olds looking for more comprehensive insurance.

- New Customer Rates: The best deals are often reserved for loyal customers, so new 18-year-olds may not get the lowest rates right away.

#6 – Allstate: Best for Local Agents

Pros

- In-Person Support: Allstate’s network of local agents makes it easier for 18-year old drivers to get personalized service and advice on their car insurance policies.

- Comprehensive Coverage Options: With Allstate, 18-year-olds can access extensive coverage options, including extras like accident forgiveness.

- Reputable Company: Allstate holds an A+ rating, which ensures that drivers are working with a financially stable car insurance company, as mentioned in many Allstate reviews.

Cons

- High Monthly Rates: At $260 for minimum coverage, Allstate’s rates are on the higher end for cheap car insurance companies for 18-year-olds.

- Fewer Discounts: Allstate’s discounts may not be as competitive as other companies like Geico or American Family, which offer more savings options for young drivers.

#7 – Farmers: Best for Safe Drivers

Pros

- Safe Driver Incentives: Farmers offers rewards for 18-year-olds who maintain a clean driving record, providing valuable savings.

- Comprehensive Coverage Options: Farmers ensures that even its basic plans offer strong protection, which is great for 18-year old drivers looking for peace of mind, read our Farmers review for more information.

- Accident Forgiveness: This feature allows 18-year-olds to avoid premium hikes after their first accident, a common concern for new drivers.

Cons

- Expensive Minimum Coverage: At $316 per month, Farmers’ rates are among the highest for car insurance companies for 18-year-olds.

- Average Customer Service: While the company offers solid policies, its customer service does not stand out compared to competitors like Nationwide.

#8 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Customer Service: Based on our Liberty Mutual insurance reviews, Liberty Mutual provides round-the-clock assistance, making it easy for 18-year old drivers to get help whenever they need it.

- Broad Coverage Options: Their extensive range of coverage options ensures that 18-year-olds can find the right protection for their needs.

- Flexible Plans: Liberty Mutual’s customizable policies are designed to adapt to the changing needs of young drivers.

Cons

- High Monthly Rates: Liberty Mutual’s minimum coverage rate of $325 makes it one of the most expensive car insurance companies for 18-year-olds.

- Limited Discounts: The company doesn’t offer as many discount opportunities as competitors, which may result in higher overall costs for young drivers.

#9 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Discounts: Progressive offers significant rewards to long-term customers, helping 18-year-olds save on their car insurance premiums over time.

- Wide Range of Coverage Options: According to our Progressive insurance customer reviews, Progressive provides a variety of policy options, including unique add-ons like pet injury protection, which can be appealing to young drivers.

- User-Friendly App: The company’s app is easy to use, making it convenient for tech-savvy 18-year-olds to manage their car insurance policies.

Cons

- High Minimum Coverage Rates: At $327 per month, Progressive’s rates for minimum coverage are among the highest for cheap car insurance companies for 18-year-olds.

- Rising Costs for Full Coverage: Progressive’s full coverage can be costly, which may deter 18-year-olds seeking more comprehensive protection.

#10 – Travelers: Best for Specialized Coverage

Pros

- Unique Coverage Options: Travelers provides a range of specialized insurance options, which can be appealing to 18-year-olds looking for specific types of protection.

- Financial Strength: With an A++ rating from A.M. Best, Travelers is one of the most financially stable car insurance companies for 18-year-olds, as mentioned in our Travelers review.

- Accident Forgiveness: Their accident forgiveness program helps keep rates stable after an initial accident, providing valuable peace of mind for new drivers.

Cons

- High Monthly Premiums: Travelers is the most expensive option, with a minimum coverage rate of $362, making it less ideal for cheap car insurance for 18-year-olds.

- Limited Discounts: Compared to other companies, Travelers offers fewer discounts, which might not appeal to 18-year-olds looking for significant savings.

Car Insurance Costs for 18-Year-Olds: A Comparative Analysis

When choosing an auto insurance provider, weighing the cost of minimum and full coverage is essential to make a balanced decision. Different insurers offer a range of options that vary significantly in price.

For example, USAA, known for serving military members and their families, provides some of the most affordable rates, with minimum coverage as low as $102 and complete coverage for just $249. In contrast, Travelers and Progressive stand out with higher total coverage costs, reflecting broader protection but at a steeper price.

Looking more closely, we see significant differences in pricing strategies between providers. Geico emerges as a highly competitive option, with both minimum and full coverage options being notably low. It makes Gieco a popular choice for budget-conscious drivers seeking cheap car insurance companies for teen drivers.

Meanwhile, Farmers and Liberty Mutual tend to price their offerings higher, particularly for full coverage, which may appeal to those seeking extensive protection but could be less attractive to those primarily concerned with cost per month.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $260 | $637 | |

| $207 | $509 | |

| $316 | $773 | |

| $124 | $311 | |

|

$325 | $785 |

|

$195 | $476 |

| $327 | $813 | |

| $145 | $349 | |

| $362 | $909 | |

| $102 | $249 |

Selecting an insurance company involves balancing these price variations against the driver's specific coverage needs. While lower rates for minimum coverage may be appealing, full coverage provides broader protection, which is crucial for many drivers.

Evaluating both options and understanding how they align with your needs is critical to making the right choice.

Ultimately, the right insurance decision is about balancing cost and coverage. Comparing the offerings from different insurers makes it easier to make an informed decision that suits your budget and your security needs on the road.

Maximizing Savings Through Discounts for 18-Year-Olds

Car insurance can be costly for 18-year-olds due to their limited driving experience and higher risk profile. However, taking advantage of available discounts can help lower car insurance premiums.

Many top providers offer savings for young drivers who maintain good grades through good student discounts, which reward responsible behavior in both schools and on the road.

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver Discount, Defensive Driving Course Discount, Good Student Discount, Multi-Car Discount | |

| $Multi-Policy Discount, Low Mileage Discount, Defensive Driving Course Discount, Good Student Discount | |

| $Defensive Driving Course Discount, Safe Driver Discount, Multi-Car Discount, Good Student Discount | |

| $Safe Driver Discount, Defensive Driving Course Discount, Good Student Discount, Multi-Car Discount | |

|

$Multi-Car Discount, Defensive Driving Course Discount, Safe Driver Discount, Good Student Discount |

|

$Good Student Discount, Defensive Driving Course Discount, Multi-Policy Discount, Safe Driver Discount |

| $Multi-Car Discount, Good Student Discount, Safe Driver Discount, Defensive Driving Course Discount | |

| $Defensive Driving Course Discount, Safe Driver Discount, Good Student Discount, Multi-Policy Discount | |

| $Good Student Discount, Multi-Car Discount, Defensive Driving Course Discount, Safe Driver Discount | |

| $Defensive Driving Course Discount, Safe Driver Discount, Good Student Discount, Multi-Car Discount |

Additionally, discounts like defensive driving courses and safe driver discounts can help further reduce premiums when young drivers demonstrate a commitment to safe driving practices. By stacking these discounts, young drivers can save hundreds of dollars annually on their premiums.

It's also essential to get quotes from different insurers. Prices for 18-year-olds vary significantly between providers, even when they offer similar discounts.

By comparing multiple quotes, young drivers and their families can ensure they secure the best possible deal. You can maximize the value of available discounts, leading to substantial savings.

Case Studies: Young Drivers Saving on Car Insurance

Case Study #1 – Maximizing Discounts for a Good Student: Sarah, an 18-year-old high school senior, saved $350 annually by switching to Geico and applying for a good student discount. Her academic performance helped her secure affordable coverage despite her limited driving experience.

Case Study #2 – USAA’s Military Family Advantage: Jake, whose father serves in the military, chose USAA and saved over $400 a year on his policy. The affordable rates and military family eligibility made USAA the perfect fit for his needs.

Case Study #3 – Safe Driving Rewards With State Farm: Aiden, a newly licensed driver, reduced his premium by 20% by enrolling in State Farm’s safe driving program. His commitment to cautious driving allowed him to benefit from low rates and safe driver discounts.

Case Study #4 – Accident Forgiveness With Nationwide: Emily used Nationwide's accident forgiveness program to avoid a premium increase after a minor accident. This feature and her existing discounts helped her maintain low monthly payments.

Case Study #5 – Progressive’s Multi-Policy Discount: John saved over $500 annually by bundling his auto insurance with a renter’s insurance through Progressive. The multi-policy discount significantly reduced his overall insurance expenses.

These case studies highlight how young drivers can achieve substantial savings by choosing the right insurance provider and taking full advantage of discounts.

There are many ways to lower car insurance costs, whether through good academic performance, safe driving habits, or special programs like accident forgiveness—what is considered a clean driving record can also play a crucial role.

By comparing quotes and exploring provider-specific benefits, 18-year-olds can find affordable coverage tailored to their unique needs.

Finding the Right Coverage for Young Drivers

Choosing the right car insurance for an 18-year-old requires balancing affordability with adequate coverage. Providers like USAA, Geico, and State Farm offer great options, while companies like Nationwide and Allstate bring unique features such as accident forgiveness and loyalty rewards.

Comparing quotes, taking advantage of discounts, and tailoring coverage to personal needs are essential to securing the best deal. With careful research and available discounts, young drivers can minimize costs without sacrificing protection on the road.

Frequently Asked Questions

What is the cheapest insurance for an 18-year-old?

Among companies available nationwide, USAA offers the cheapest coverage for 18-year-olds, starting at $102 per month.

At what age is car insurance cheapest?

Experienced drivers typically have fewer filed claims relating to accidents, resulting in lower insurance costs. At Progressive, average premiums decrease significantly for drivers aged 19 to 34, stabilize or slightly decrease for those aged 34 to 75, and then begin to rise after age 75.

What car is the cheapest to insure for an 18-year-old?

For new drivers, some of the cheapest cars to insure include the Volkswagen Polo, Hyundai i10, SEAT Arona, SEAT Ibiza, Skoda Fabia, Toyota Yaris, Ford Fiesta, and Renault Clio.

How much is car insurance for an 18-year-old boy in Texas?

Car insurance in Texas for an 18-year-old averages $240 per month for minimum coverage, reflecting the higher risk associated with younger drivers, who typically pay more than the average Texas driver.

How much is car insurance for an 18-year-old in Louisiana?

The average monthly rate for minimum coverage for teen drivers with Farm Bureau is $144, which is 43% lower than the state average of $253 for 18-year-olds in Louisiana. Thus, Farm Bureau is one of the best and cheapest car insurance options in Louisiana. Additionally, the Farm Bureau offers competitive pricing for teens seeking full coverage insurance.

How much is insurance for an 18-year-old in Virginia?

The cost of auto insurance for teens is significantly higher than for older drivers, primarily due to their lack of experience and increased likelihood of unsafe driving behaviors. In Virginia, drivers under the age of 20 pay an average of $30 monthly for auto insurance.

Which type of car insurance is the cheapest for 18-year-olds?

Fully comprehensive insurance typically offers the broadest coverage options, making it a popular choice among policyholders. While it is often considered the least expensive option, pricing can vary significantly based on individual circumstances.

What is the best car coverage to have for an 18-year-old?

If you want to protect yourself financially, you need car insurance coverage of $100,000 per person and $300,000 per accident for bodily injury liability, considering how much bodily injury liability is needed, along with $100,000 per accident for property damage liability.

Which is the most expensive form of car insurance for 18-year-olds?

Comprehensive insurance is typically the most expensive type of coverage available. It offers similar protection to third-party fire and theft but also allows claims for accidental damage to one's own vehicle regardless of fault in a collision.

What age is car insurance most expensive?

Young drivers between 16 and 24 typically face the highest car insurance premiums due to inexperience. This makes them more susceptible to accidents and insurance claims, so insurance companies often charge these drivers elevated rates to mitigate the risk.

You can get instant car insurance quotes from top providers by entering your ZIP code below.