Not sure how to remove a spouse from your car insurance? You need to make sure you are the primary insured, obtain your spouse's signed consent, and provide proof of new insurance if necessary.

Sharing a car insurance policy with your spouse typically helps you get cheaper rates, as the best car insurance companies for married couples offer discounts for multiple drivers. However, if you're separated, divorced, or planning to live apart for other reasons, you might want to know when and how to remove your spouse from your car insurance.

Read on to find out how to quickly remove a spouse from your auto insurance policy. For those shopping for a new spouse insurance policy, compare rates quickly with our free quote finder tool.

What You Should Know

- Step #1: Check Policyholder Status – Make Sure You are the Primary Insured

- Step #2: Obtain Signature – Get Spouse's Signed Consent

- Step #3: Provide Proof of Insurance – Show New Insurance if Necessary

3 Steps to Remove Your Spouse From Your Car Insurance

There are a few different instances where you may end up excluding your spouse from your car insurance. You’ll usually only remove your spouse from your car insurance if you’re getting separated or divorced, in which case be careful to avoid insurance revenge from your spouse by removing them as quickly as possible.

You may also need to remove your spouse from your auto insurance policy if you’ll be living at two different addresses, even if you’re not formally separating. Read on for each step of removing someone from car insurance.

Step #1: Check Policyholder Status

To take your spouse off your car insurance policy, check with your insurer to confirm the steps you need to take. You will need to establish yourself as the primary named insured on your account to make any changes to the policy.

Step #2: Obtain Signature – Get Spouse's Signed Consent

Before removing your spouse from your policy, most insurance companies require your spouse’s permission. Typically, this means just obtaining your spouse’s signed consent to remove them from the policy.

Step #3: Provide Proof of Insurance – Show New Insurance if Necessary

Companies may also require you to provide proof of replacement auto insurance for your spouse if you are removing them.

Learn More: 3 Ways to Obtain Proof of Insurance

Or, suppose you're not the primary named insured, or your spouse won’t sign the removal request. In that case, you can alternatively remove yourself from the car insurance policy and provide proof of your own separate policy.

What Happens When You Remove Your Spouse From Your Car Insurance

When you remove your spouse from your auto insurance policy, you’ll each be responsible for maintaining coverage and paying your insurance premiums.

Since many insurance companies offer discounts for married couples or multiple vehicles in a household, you may see your rates go up after you remove your spouse from your policy.

| Insurance Company | Age: 25 Male Single | Age: 25 Male Married |

|---|---|---|

| $190 | $171 | |

| $147 | $134 | |

| $180 | $160 | |

| $93 | $83 | |

|

$215 | $193 |

|

$150 | $135 |

| $146 | $131 | |

| $111 | $100 | |

| $116 | $105 | |

| $85 | $77 |

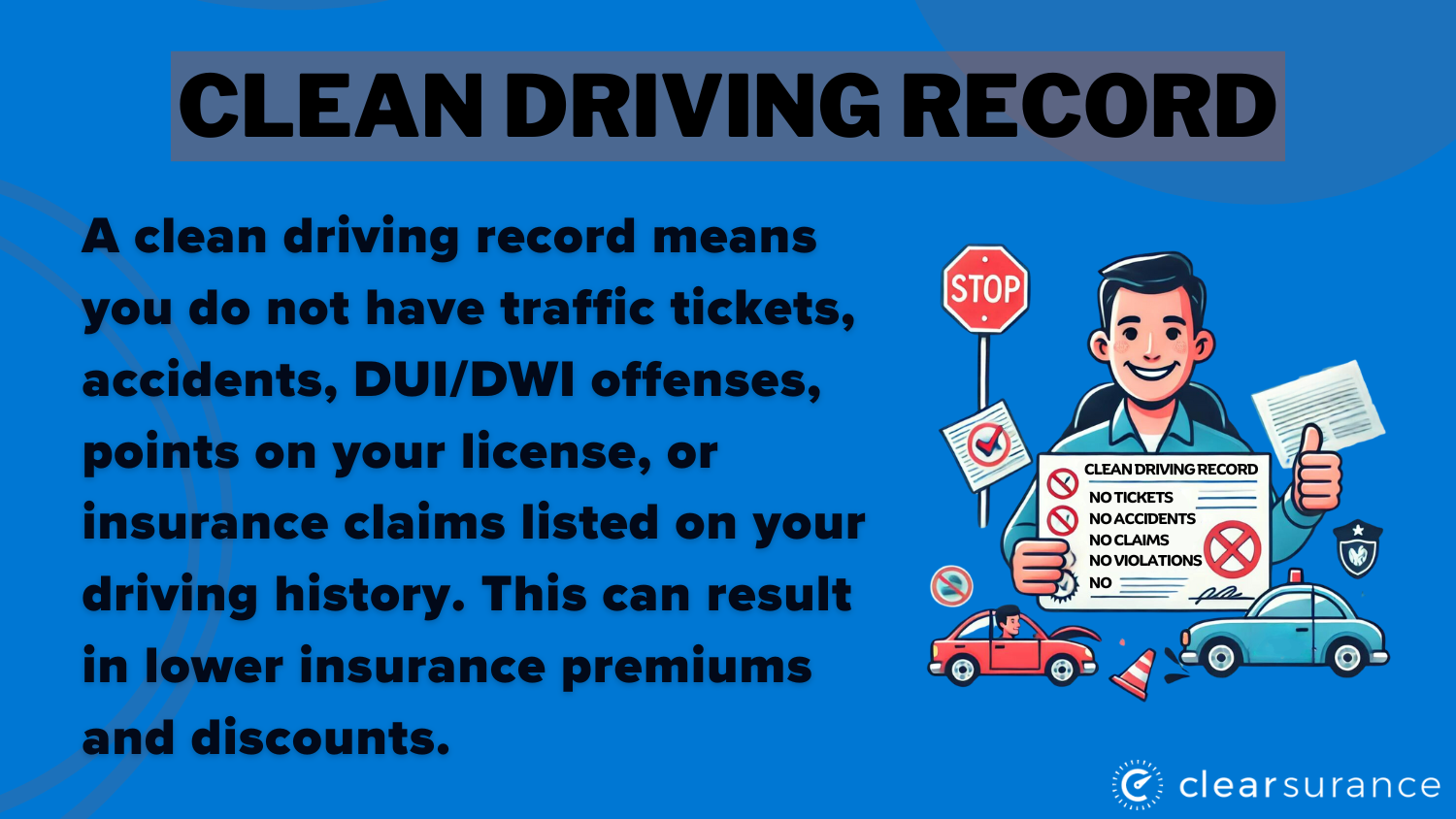

Rates are often cheaper for married couples due to multi-car insurance deals. For most couples with clean driving records, having a policy together makes financial sense.

The only time married couples should consider getting separate policies is if they drive separate cars and one driver has a poor driving record and needs high-risk insurance. In cases like this, it may be better to have separate car insurance policies to save money (Learn More: Hacks to Save Money on Your Car Insurance Rates).

If you need to find a separate car insurance policy from your spouse, shop around and compare car insurance quotes to find the best rates for your current needs (Read More: The Ultimate Guide to Switching Car Insurance Companies and Saving Money).

Car Insurance for Teens When You Remove Your Spouse

If your car insurance policy includes teen drivers, you’ll need to ensure they’re listed on the correct policy when you remove your spouse.

You should list your teen driver on the insurance policy for any vehicles they can access. If they primarily live with you and won’t have access to your spouse’s car, your teenager should remain on your car insurance.

Read More: Cheap Car Insurance Companies for 17-Year-Olds

If your teen has equal access to both vehicles, ensure they're a listed driver on both policies.

Finding The Best Insurance When Removing Your Spouse From Your Auto Insurance

If you need to remove your spouse from your auto insurance policy, taking your spouse off your car insurance is relatively easy with your spouse’s consent.

Need to find a new car insurance policy for your spouse today? Read our car insurance shopping guide to learn how to find great coverage. You can also find affordable coverage by entering your ZIP in our free quote finder tool.

Frequently Asked Questions

Can I remove someone from my car insurance?

Yes, removing a spouse from car insurance is simple. Before you remove a spouse from car insurance, ensure that you are the primary insured and can change the policy. Then, you may need to provide signed consent from your spouse and proof of their insurance to finalize the process.

Can I remove my spouse from my car insurance if we are separated?

Yes, you can remove your spouse from your car insurance during separation as long as you have their consent. If you need to find affordable coverage before removal, enter your ZIP in our free quote tool.

Can married couples have separate car insurance?

Yes, husband and wife car insurance policies can be separate if you do not drive each other's cars. Married couples commonly do this if one driver has a poor driving record and needs high-risk insurance (Read More: Car Insurance Companies for High-Risk Drivers).

Can you remove someone from your insurance at any time?

You can remove someone from your auto insurance policy at any time with their consent.

Can you remove a spouse from car insurance before divorce?

With divorce and car insurance, you do not have to wait until the divorce is finalized to remove a spouse from your car insurance. Simply follow the steps of how to take someone off your car insurance to remove a spouse before divorce.

Can I remove a named driver from my insurance?

Yes, you can remove a named driver from your auto insurance if they no longer live with you or drive your cars. Couples may also do this if one driver has a bad driving record and will only be driving their own car (Learn More: What is a driving record and what does it track?).

Can I exclude my spouse from my car insurance?

Yes, you can exclude a spouse from car insurance when you buy a policy if they do not drive your car. If your spouse does drive your car, you need to have them on your insurance policy as a named driver.

Is my spouse covered on my car insurance?

Your spouse is only covered on your car insurance if you add them as a driver to your policy.

Will my car insurance go down if I remove a driver?

Removing a driver from car insurance will result in a lower rate as you will only be paying for yourself, especially if that driver had a poor driving record (Read More: Top Ways Customers Have Saved Money on Car Insurance Rates.

However, sometimes rates will increase individually for you and the other driver if you had a multi-driver insurance deal.

What are excluded drivers?

An excluded driver is a person who is not covered by your insurance policy, even if they live with you. For example, you may list a spouse as an excluded driver if you are separating auto insurance for divorce.