USAA, Geico, and State Farm are the best military car insurance, with rates starting at $43 a month and exclusive military perks like deployment flexibility.

USAA offers perks like deployment flexibility and storage discounts, while Geico gives a 15% discount to military members. State Farm also has great deals, especially for those in Louisiana.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A++ | Member Benefits | USAA | |

| #2 | 25% | A++ | Online Discounts | Geico | |

| #3 | 17% | B | Cheap Rates | State Farm | |

| #4 | 10% | A+ | Flexible Options | Progressive | |

|

#5 | 25% | A | Custom Packages | Liberty Mutual |

|

#6 | 20% | A+ | Safe Drivers | Nationwide |

| #7 | 20% | A | Regional Rates | Farmers | |

|

#8 | 5% | A+ | Bundled Savings | The Hartford |

| #9 | 25% | A+ | Driver Programs | Allstate | |

| #10 | 25% | A | Family Focused | American Family |

This article breaks down how the best car insurance companies make life easier for service members with exclusive discounts and flexible options.

Get the best deal on military auto insurance with our free comparison tool now.

What You Should Know

- USAA offers the best military car insurance with exclusive perks and flexible options

- Geico provides a 15% discount for active and retired military members

- State Farm caters to military needs with special rates for service members in Louisiana

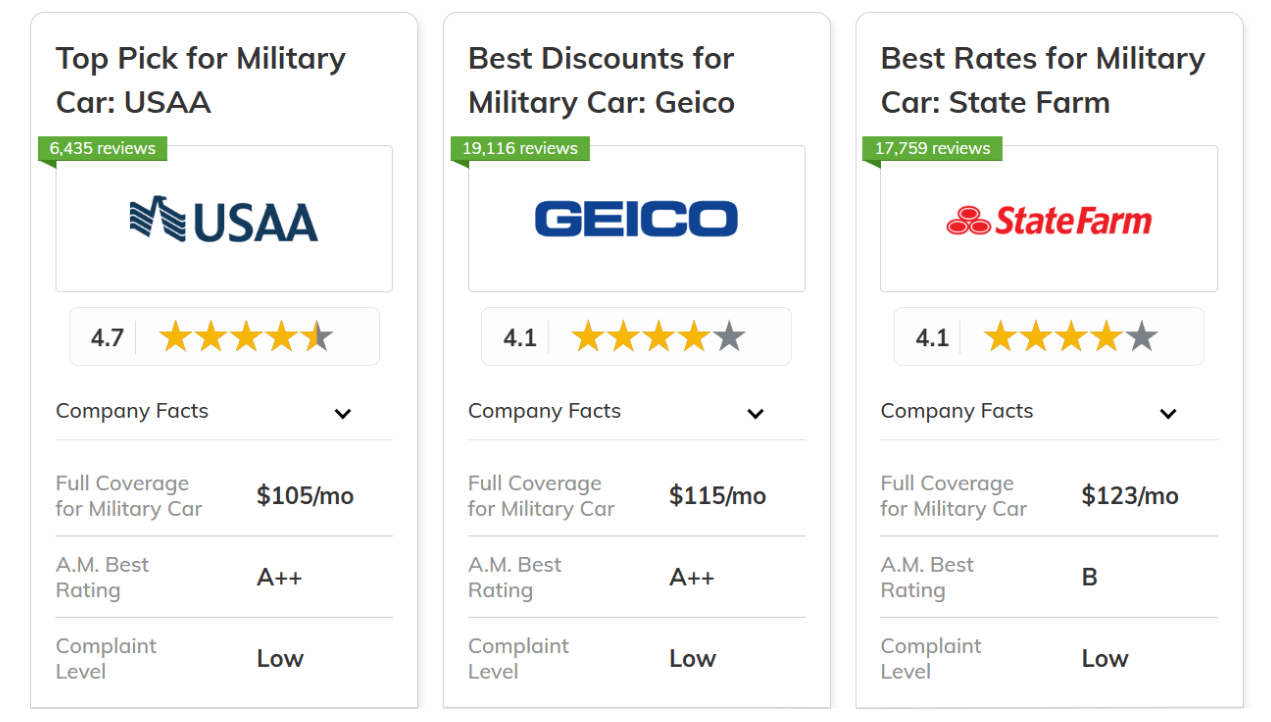

#1 – USAA: Top Overall Pick

Pros

- Awesome Military Perks: USAA gives military members benefits like deployment flexibility and storage discounts.

- Super Reliable: With an A++ rating, USAA is a rock-solid choice for military families. Read USAA insurance review for more info.

- Discount Packages: Military people can get a 10% discount if they put together car insurance with either homeowners or renters insurance.

Cons

- Limited Access: Only military members, veterans, and their families can join.

- Fewer Local Offices: Military members who prefer face-to-face service might not have many locations nearby.

#2 – Geico: Best for Online Discounts

Pros

- Military Discounts: Geico gives a 15% discount for active and retired military members. Learn more about car insurance claims ratings.

- Strong and Reliable: Geico’s A++ financial rating means military members can count on them.

- Easy Online Tools: Manage your policy and claims quickly online—perfect for busy military families.

Cons

- No Deployment Perks: Geico doesn’t offer specific military benefits for deployments like some others do.

- Less Personalization: If you want more tailored coverage, Geico’s military options might feel a bit basic.

#3 – State Farm: Best for Cheap Rates

Pros

- Low Rates: Great prices, especially for military members in Louisiana. Get more details in our State Farm insurance review.

- Family Discounts: Special deals for spouses and dependents of military members.

- Quick Claims: Fast claims, ideal for military folks who move a lot.

Cons

- State Limits: Military discounts can change depending on where you’re located.

- Lower Financial Rating: Rated B, which might not feel as solid for military members.

#4 – Progressive: Best for Flexible Options

Pros

- Military-Friendly Options: Progressive offers flexible policies that fit the needs of military members. See average monthly rates in our Progressive car insurance review.

- Strong Financial Assistance: Having A+ rating, Progressive is trusted option for military families.

- Big Discounts: People in military can save up to 10% if they combine their auto insurance with other types of insurances.

Cons

- Slightly Higher Rates: Progressive’s premiums might be a bit higher compared to USAA or Geico for military members.

- Limited Deployment Perks: Doesn’t offer many benefits specifically for active deployment.

#5 – Liberty Mutual: Best for Custom Packages

Pros

- Custom Packages for Military: Liberty Mutual lets you tailor your policy to fit your needs.

- Reliable Financial Strength: An A rating ensures military members can count on solid financial support.

- Huge Savings on Bundles for Military Personnel: When you combine your car insurance with additional policies, you might save as much as 25%.

Cons

- Higher Rates: Liberty Mutual’s premiums might be on the higher side for military families.

- Fewer Military Perks: Doesn’t have as many military-specific benefits compared to USAA. Unlock details in our Liberty Mutual review.

#6 – Nationwide: Best for Safe Drivers

Pros

- Discounts for Military Safe Drivers: Get rewarded for keeping a clean driving record. Check out our Nationwide car insurance review to find out more.

- Financial Stability: With an A+ rating, military families can count on Nationwide for reliability.

- Valuable Bundle Offers for Service Members: You can save 20% on your car insurance when you combine it with other policies.

Cons

- Fewer Military Perks: Lacks some of the extras that make life easier for military members, like deployment benefits.

- Less Flexibility: Coverage options might not be as flexible for specific military needs.

#7 – Farmers: Best for Regional Rates

Pros

- Military Discounts: Farmers offers solid regional rates with good savings for military members.

- Stable and Reliable: With an A rating, military members can trust Farmers to have their back.

- Bundling Savings: Military members can save up to 20% by bundling their policies together.

Cons

- Rates Vary by Location: Your premium might change depending on where you’re stationed as a military member.

- Fewer Military Perks: Not many extras for deployment or active duty. See our Farmers car insurance review for more information about the coverage.

#8 – The Hartford: Best for Bundled Savings

Pros

- Bundling Discount: Military members can save up to 5% by bundling their insurance. Learn more in our review of The Hartford

- Strong Financial Rating: An A+ rating means military members can rely on The Hartford.

- Great Customer Support: Known for friendly service, which is a plus for military families.

Cons

- Smaller Discount: The bundling discount isn’t as big as some other companies.

- Limited Deployment Perks: Doesn’t have many benefits for those on active duty.

#9 – Allstate: Best for Driver Programs

Pros

- Military Savings: Get a 25% discount when you bundle your policies with Allstate.

- Driver Programs: Military members can join programs to help lower their rates. Explore more discount options in our Allstate car insurance review.

- Solid Financial Strength: With an A+ rating, Allstate is a safe bet for military families.

Cons

- Higher Rates: Even with military discounts, premiums might still be on the higher side.

- Fewer Military-Specific Perks: Not as many tailored benefits for military life.

#10 – American Family: Best for Family Focused

Pros

- Family Discounts: Military families can get a 25% bundling discount to save more.

- Dependable Coverage: With an A rating, American Family is a solid option for military families.

- Family-Oriented: Policies are designed with military families in mind. Check out our full American Family review for details.

Cons

- Not Available Everywhere: Coverage might not be offered in all areas military families are stationed.

- Limited Military Perks: Doesn’t offer many extras for deployment or active duty.

Comparing Monthly Premiums for Military Coverage

When you search best military car insurance, is important to see both minimum and full coverage options that match special needs of military people. These policies need be flexible for deployments and moving places while keeping monthly payments affordable. Here’s a quick look at what different companies offer.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $63 | $143 | |

| $58 | $138 | |

| $61 | $145 | |

| $48 | $115 | |

|

$62 | $140 |

|

$59 | $133 |

| $57 | $130 | |

| $53 | $123 | |

|

$68 | $150 |

| $43 | $105 |

USAA offers the lowest rates, with $43 for minimum coverage and $105 for full coverage, making it a great pick for military members. Geico isn’t far behind, with $48 for minimum and $115 for full coverage, plus perks like deployment discounts. State Farm also keeps it affordable with $53 for minimum and $123 for full coverage.

| Insurance Company | Available Discount |

|---|---|

| Military Discount, Safe Driver, Multi-Policy | |

| Military Discount, Bundling, Loyalty | |

| Military Discount, Good Driver, Homeowner Discount | |

| Military Discount, Defensive Driving, Multi-Vehicle | |

|

Military Discount, Vehicle Safety, Bundling |

|

Military Discount, Good Student, Anti-Theft |

| Military Discount, Continuous Insurance, Snapshot | |

| Military Discount, Drive Safe & Save, Multi-Line | |

|

Military Discount, AARP, Safe Driver |

| Military Discount, Safe Driver, Loyalty, Bundling |

If you’re after more comprehensive coverage, Allstate and Farmers offer full coverage at $143 and $145 a month, but they’re on the pricier side. This guide for understanding car insurance helps you find the policy that fits your budget and needs.

Exploring Military Car Insurance Options

If you're a member of the military, you want to have peace of mind that your insurance company will take care of you and your family with flexible options while you're deployed or at home. Exploring the top ways customers have saved money on car insurance rates can help you make the most of your policy.

Make sure you consider car insurance companies that offer exclusive benefits to military members. Talk to a local insurance agent today to see which military car insurance option is best for you and your family.

USAA Military Car Insurance

USAA is the most popular option for military car insurance. It earned the No. 1 spot for best car insurance company on Clearsurance’s yearly ranking. It sells auto insurance policies exclusively to active and retired military members and their families.

Adult children and spouses of USAA members are eligible for USAA’s benefits. In addition to military car insurance, USAA offers many other lines of insurance, banking and other benefits.

USAA says that its customers save an average of about $59 per month on their car insurance premium when they switch to USAA. Military members can also earn additional savings with a number of discounts available for good students, safe drivers, low-mileage drivers and more. It offers discounts for military personnel with cars in storage or garaged on base.

Military members also have access to overseas auto insurance coverage with USAA. If you have a permanent change of station (PCS) overseas or you plan to drive your car internationally, you can work with USAA to make sure you have adequate USAA international auto insurance to protect your car.

A few perks to a USAA military car insurance policy include a policy that's easy to manage and flexible payment options. USAA has a mobile app that allows you to manage your policy on your phone. You can get car insurance quotes, request your military car insurance ID cards, and more from the app or online from anywhere.

USAA offers a six-month policy or a 12-month policy. You have the ability to pay either policy in full upfront or monthly with no money down. With the six-month policy, you could also pay four consecutive monthly instalments with money down, or for the 12-month policy, you could pay nine consecutive monthly instalments with money down.

In addition to military car insurance, USAA also offers homeowners and renters insurance policies for military members and their families. If you bundle homeowners or renters insurance with USAA military car insurance, you may earn a discount of 10% off your homeowners or renters insurance policies.

Esurance Military Car Insurance

Unlike USAA, Esurance doesn't sell exclusively to military members, but it does offer some benefits to those serving our country. Esurance makes it easy for you to handle your car insurance during a deployment or while relocating.

With an Esurance military car insurance policy, you can easily cancel and reinstate your car insurance policies. Typically if you do this, you likely face an increase in your car insurance rates because of a lapse in car insurance coverage. But Esurance won't charge you higher rates for doing this.

If you're preparing for a military deployment and want to cancel your military car insurance policy temporarily while you won't be using your car, you need to notify Esurance ahead of time before your deployment. If you might drive while deployed, like on leave, don’t cancel your policy to avoid being uninsured.

If you're reassigned to a different location within the U.S., Esurance can also help you with that. Be sure to contact Esurance to update your policy with your new zip code. If Esurance doesn't offer military car insurance in your new area, it will help you find a new policy. Esurance doesn't offer any car insurance military discounts.

Esurance also offers homeowners and renters insurance. Be sure to check out Esurance reviews to see what policyholders have to say about the company.

Available Discounts for Military Car Insurance

If you're an active or retired military member looking for car insurance, be sure to check for military discounts so you can save money on your car insurance policy. For additional savings, refer to our guide to switching car insurance companies and saving money.

There are multiple car insurance companies that offer military discounts at various stages of your military career, including while you're deployed or while you're retired. Check out the following companies that offer various types of car insurance military discounts.

USAA Military Car Insurance Discount

In addition to being an insurance company that only offers coverage to active and former military members, USAA also offers military car insurance discounts.

Do you live on a military base? USAA's Military Installation Discount offers military members up to 15 percent off their comprehensive car insurance coverage when you garage your car on base. This discount applies to your comprehensive car insurance coverage except in California where it applies to collision as well.

Note: The Military Installation Discount is not available in New York.

USAA also offers a Vehicle Storage Discount to customers who put their car in storage. This discount can be worth up to 60 % off your car insurance premium.

Geico Military Car Insurance Discount

Retired or active military, National Guard, and Reserves members are eligible for a military auto insurance discount of up to 15 % off their policy from Geico. This discount applies to your car insurance policy at all times, not just when you're deployed, making it easier to file car insurance claims when needed.

Geico also offers an Emergency Deployment Discount. This discount is available to military members who are deployed to imminent danger pay areas and store their car under one of Geico's approved storage protection plans.

According to the Defense Finance and Accounting Service, imminent danger pay areas are designated by the Department of Defense (DOD) and approved by Congress. Geico's emergency deployment discount has restrictions and limitations to certain locations and military operations. It isn't available in every state.

State Farm Military Car Insurance Discount

State Farm offers a military discount to customers in Louisiana who are active-duty service members. In order to qualify for this discount, you must be on active duty and based in Louisiana or deployed overseas, or out of state with a spouse and/or dependents living in Louisiana. This makes it one of the best car insurance in Louisiana for military personnel.

Military family members in Louisiana can also qualify for this discount if you're a spouse or dependent of an active military member. Dependents must live in the same household as the military member and be either under 18 or an unmarried full-time student under 24 years old.

State Farm is one of the most popular car insurance companies in the U.S. Check out State Farm insurance reviews to learn about the experiences people have had with the company and find out if they would recommend it.

Liberty Mutual Military Car Insurance Discount

Liberty Mutual offers military car insurance discounts for active, retired, and Reserve members, and is proud to be a Military Friendly Employer. For more insights on their offerings, check out the Liberty Mutual RightTrack review to see how the program can help military members save even more.

Liberty Mutual also gives back to the military community with grants to support organizations for veterans and other community service. If you’re interested in learning more about the company, you can check out Liberty Mutual reviews to learn about the experiences others have had with the company.

Direct General Military Car Insurance Discount

Direct Auto & Life Insurance Company, also known as Direct General, offers a generous military car insurance discount of up to 25% off car insurance for active military service members of the U.S. Armed Forces.

To qualify for Direct General's car insurance military discount, you must be an active service member with proof you're on active service. Proof can include documentation proving you're on active service including a copy of your current order.

Direct General’s car insurance military discount is offered in Alabama, Arkansas, Florida, Louisiana, Missouri, South Carolina and Texas. Be sure to check out Direct General reviews.

Arbella Military Car Insurance Discount

Massachusetts Arbella customers can receive a 10 % Military Away Discount on their car insurance policy. This discount applies to military members who are currently deployed on active duty.

In order to be eligible for the Military Away discount from Arbella, active military members must be at least 100 miles away from where their car is garaged or not have access to their car regularly.

Although Arbella sells car insurance in Connecticut and Massachusetts, the Military Away Discount is only available to Massachusetts customers. If you want to learn about what customers have to say about car insurance with Arbella, you can read Arbella insurance reviews.

Exclusive Benefits for Military Members

USAA, Geico, and State Farm are the top picks for best military car insurance, offering great perks for service members. USAA has the lowest rates at $43 a month and flexible deployment options, Geico gives a 15% discount for military members, and State Farm keeps it affordable, especially in Louisiana.

Veterans can take advantage of these benefits to get the coverage they need. To find the best deal, compare quotes online and see which company works best for you. While comparing, it’s helpful to understand how do insurance companies make money, so you can see where your premiums are going.

Make sure you know all of your coverage options before taking out a car insurance policy. Talk to your local insurance agent or use our free quote comparison tool found to compare auto insurance rates from the best companies.

Frequently Asked Questions

What is the best car insurance for veterans?

One option that helps veterans is USAA, which provides them with customized benefits, competitive rates, and discounts that are specific to their military.

Which companies offer the best car insurance for military members?

Insurance companies that stand out for their military savings, flexible coverage, and policies that are deployment-friendly include State Farm, USAA, and Geico.

What is military discount car insurance?

Discount auto insurance for military personnel is available through organizations like USAA, which provides savings of up to 60% for stored vehicles. Another ways to get cheap car insurance is to bundle coverage and keep a clean driving record.

Who provides the best car insurance for National Guard members?

Geico and USAA are top providers for National Guard members, offering discounts and flexible policies designed for those frequently deployed.

What is Armed Forces temporary car insurance?

Temporary car insurance for the armed forces provides coverage for short-term needs, ideal for deployments or vehicle storage. Options are available from USAA and Esurance.

Who are the top 3 auto insurance companies for military and veterans?

USAA, Geico, and State Farm rank as the top choices for military and veterans thanks to their tailored discounts, flexible coverage, and features like the State Farm Drive Safe and Save Review, highlighting its potential for reducing premiums based on safe driving habits.

What is military-friendly car insurance?

Military-friendly car insurance caters to the needs of service members with discounts, flexible payment plans, and storage options, as USAA and Geico offer.

Which is better, Liberty Mutual or Esurance, for military car insurance?

Liberty Mutual offers discounts for active and retired personnel, while Esurance provides deployment flexibility. The best choice depends on your needs.

Where can I get military auto insurance quotes?

You can get quotes tailored for military personnel from providers like USAA, Geico, and State Farm through their websites or local agents if you're eligible for USAA insurance as an active-duty member, veteran, or family member.

How does USAA compare to Esurance for military insurance?

USAA focuses exclusively on military families and offers tailored discounts, while Esurance provides flexibility during deployments but lacks military-specific perks.

Who offers cheap car insurance for military personnel?

Car insurance for military members may be quite affordable with companies like USAA and Geico. Monthly premiums can be as low as $43, and major discounts are available.

What is Air Force car insurance?

Air Force car insurance is tailored for Air Force members, offering perks like deployment discounts and flexible coverage from companies like USAA and Geico.

Are there renters insurance discounts for veterans?

Veteran-specific discounts are available on the best renters insurance from providers like USAA and Liberty Mutual, offering tailored coverage and savings for military personnel.

Is USAA car insurance only for military members?

Yes, USAA car insurance is exclusively available to active military members, veterans, and their eligible family members.

Does State Farm offer a military discount?

Military families and active-duty service members can take advantage of State Farm's military discounts in some locations, such as Louisiana.

Which is better, USAA or State Farm, for military car insurance?

USAA specializes in military-focused coverage and discounts, while State Farm offers deployment-friendly policies and a military discount in certain states.

Who is the best auto and home insurance company for military members?

USAA is the top choice to buy car insurance and home insurance, offering bundled discounts, military-specific perks, and comprehensive coverage options.

What makes USAA military car insurance unique?

USAA offers exclusive benefits for active and retired military personnel, such as storage discounts, flexible payment options, and overseas coverage.

What are the benefits of Geico military insurance?

Geico offers up to 15% off for military members, plus emergency deployment discounts for those stationed in imminent danger areas.

What is the USAA auto insurance phone number?

You can reach USAA auto insurance by calling 800-531-8722.

Enter your ZIP code to find cheap full coverage insurance near you.