Country Financial, State Farm, and Allstate offer the best good student car insurance discounts. Students with good grades can qualify for these discounts and save up to 35% on auto insurance.

Insurance providers offer good student discount programs because they view good grades as an indicator of responsible behavior among teen drivers, which leads to cheaper rates.

| Company | Rank | A.M. Best | Good Student Discount |

GPA Required |

|---|---|---|---|---|

|

#1 | A+ | 35% | 3.0 |

| #2 | A++ | 25% | 3.0 | |

| #3 | A+ | 22% | 2.7 | |

| #4 | A++ | 20% | 3.0 | |

| #5 | A | 20% | 3.0 | |

|

#6 | A+ | 18% | 3.0 |

| #7 | A++ | 15% | 3.0 | |

| #8 | A | 15% | 3.0 | |

|

#9 | A | 12% | 3.0 |

| #10 | A++ | 10% | 3.0 |

Learn more ways to save money on car insurance for teens and young drivers, who historically pay the highest premiums. If you're ready to find cheaper insurance enter your ZIP code to begin.

What You Should Know

- State Farm, Allstate, and Geico offer up to 35% off for students with a 2.7+ GPA

- Proof of grades, like report cards and transcripts, are required

- Some insurance companies require updated proof of grades at policy renewal

How to Get a Good Student Car Insurance Discount

Students can save up to 35% on their premiums with this discount, but they must meet certain requirements, which we explain below. To save even more on your premiums you should pay your annual insurance upfront and qualify for pay-in-full insurance discounts.

Maintain Good Grades

According to most insurance companies, students must keep a minimum B average of 3.0 GPA or higher to meet the good student discount GPA requirement. However, Allstate's insurance company requires a 2.7 GPA. The student must also remain among the highest 20% in their academic class to qualify.

Students who take the SAT, ACT, or PSAT also qualify for insurance discounts under specific conditions. See what other discounts are available at the cheapest car insurance companies for 18-year-olds.

Be a Full-Time Student

To receive a good student discount, drivers must enrolled in high school, college, or university. Good grades show responsibility, which is why students who do well in school qualify for lower-risk driver discounts.

Students taking part-time courses or online programs are not eligible for good student insurance discounts. Students uncertain whether their school qualifies should check with their providers.

Read More: Cheap Car Insurance For Teens After an Accident

Meet the Age Requirement

Young drivers can get cheaper rates from insurance companies with good student discounts as long as they maintain good grades and are between 16 and 25. The good student discount ends automatically at age 26, regardless of academic performance.

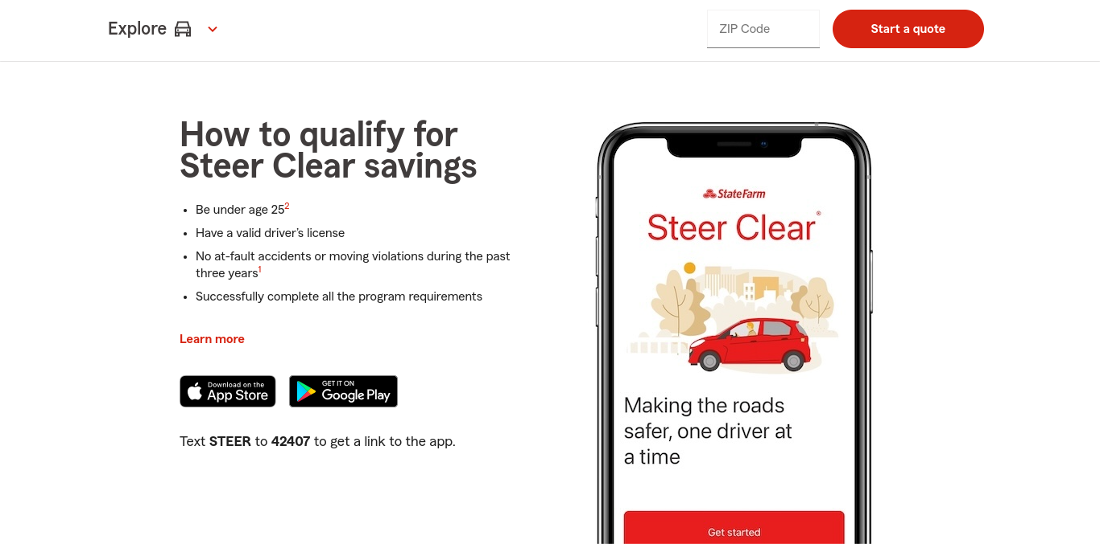

State Farm offers an exclusive discount to students under 25 who complete its Steer Clear program, regardless of their GPA. The program encourages safe driving through training modules and driving tests.

Also, Progressive discounts good students under 24, while it’s 25 with most providers. For Geico, there is a Geico good student discount verification where you can check if you qualify.

Learn More: Best Car Insurance For New Drivers.

Provide Proof of Academic Performance

Insurance companies require students to submit proof of their academic achievements to get discounts. Some insurers accept standardized test score reports. USAA good student discount requirements include showing these records. If you meet the criteria, you may get a USAA good student discount.

You don't need to worry if your grades are not the best. Companies like Geico offer cheap car insurance for college students, so you can still save on your premiums.

Maintain Eligibility Every Policy Period

Eligible drivers must keep up their good grades to maintain good student auto insurance discounts. Your insurer may request to see your grades every six or 12 months when your policy renews.

The table below shows minimum and full monthly coverage offered by various insurance companies. The second column shows the minimum coverage, while the third column shows the full coverage offered by these companies.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $47 | $124 | |

| $49 | $128 | |

| $76 | $198 | |

| $43 | $114 | |

|

$96 | $248 |

|

$63 | $164 |

| $47 | $123 | |

| $32 | $84 |

Students risk losing their discount until grades reach the required standard again. Find out what happens if you don't pay your car insurance.

Good Student Car Insurance Rates & Savings

Insurance companies consider all drivers under 26 high-risk, making them expensive to insure. Car insurance for 16-year-olds costs more than twice as much as it does for 25-year-olds, as you can see below. The table shows full coverage monthly rates for young drivers.

Fortunately, Country Financial, State Farm, and Allstate have the biggest good student insurance discounts. Drivers who qualify save about $20 per month on minimum car insurance.

The table below shows the monthly liability insurance rates from different companies before and after applying a good student discount. This discount helps students save money on their car insurance. The "Before Discount" column lists the regular rates, while the "After Discount" column shows the reduced prices for those who qualify.

| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $90 | $72 | |

| $68 | $54 | |

| $85 | $68 | |

| $75 | $60 | |

|

$95 | $76 |

|

$70 | $56 |

| $80 | $64 | |

| $60 | $48 | |

| $78 | $62 | |

| $55 | $44 |

BUt what is the difference between liability insurance and full coverage insurance? Learn more in our Liability vs. Full Coverage car insurance article.

State Farm is one of the cheapest companies after USAA for both minimum and full coverage car insurance. Compare State Farm vs. USAA car insurance rates for a complete breakdown.

Students who are Geico policyholders can take advantage of the company's affordable full coverage insurance rates and multiple discounts, which offer an average of 20% in savings if you have good grades.

The table below shows the monthly cost of full coverage car insurance before and after a good student discount. The first column lists the insurance companies, the second shows the regular rates, and the third shows the reduced rates after the discount is applied.

| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $160 | $128 | |

| $130 | $104 | |

| $155 | $124 | |

| $135 | $108 | |

|

$170 | $136 |

|

$140 | $112 |

| $145 | $116 | |

| $120 | $96 | |

| $150 | $120 | |

| $110 | $88 |

Allstate is more expensive, but it has the second-highest discount for students at 22%, helping young drivers save around $500 per year (Read More: Allstate Car Insurance Review).

Best Companies for Good Student Car Insurance

The best good student car insurance discounts are a great way for young drivers to save money on car insurance. State Farm, Allstate, and Geico offer up to 25% savings for students who maintain good grades, meet age requirements, and provide proof of academic performance.

Students can take advantage of these discounts and lower their insurance costs by staying focused on their studies and meeting the criteria. Remember to ask about good student insurance discounts at cheap car insurance companies for teen drivers to get even lower rates.

Take the first step toward cheaper car insurance rates. Enter your ZIP codeto see how much you could save.

Frequently Asked Questions

How much is a good student discount on car insurance?

Country Financial has the biggest good student discount at 35% if you meet specific academic criteria. Keeping up your grades can lower your monthly payments. It’s a good idea to ask your insurance company for details to see how much you can save.

Why is student car insurance so expensive?

Due to their lack of driving experience, insurers consider young drivers to be high-risk. Shop for affordable auto insurance today by comparing quotes with our free tool.

What GPA is needed to get a good student discount on car insurance premiums?

Students must have a 3.0 GPA to qualify for good student discounts, but Allstate gives a 22% discount to students with an average GPA of 2.7 or higher.

Which category of car insurance is best for student drivers?

The most complete car insurance option is full coverage car insurance, which protects against most types of collision and damage, including theft and vandalism.

Does being a student decrease car insurance rates?

A student who passed their driving test and maintains good grades could expect to save up to 35% through the good student discount

What type of insurance do college students need?

Car insurance is required if the student plans to drive while they are on campus. Renters insurance will protect personal belongings in dorms, apartments. and vehicles.

What is required for a good student car insurance discount?

You need to display your student ID and your grades, typically by sending a copy of your report card or transcript to your insurance company.

Does education affect car insurance rates?

Insurance rates are affected by education levels. The data demonstrates that increased educational attainment leads drivers with college or advanced degrees experience fewer accidents and make fewer insurance claims. There are other cost benefits to taking a defensive driving course that can help you save more.

Do student loans cover car insurance?

Students can use loan money to cover auto insurance and vehicle expenses while enrolled in school unless there are specific exclusions listed in the loan agreement.

How do I get a student discount on everything?

The most common hacks to save money on car insurance rates are through student discount websites offering popular brand deals, which provide codes for student savings on in-store and online purchases.