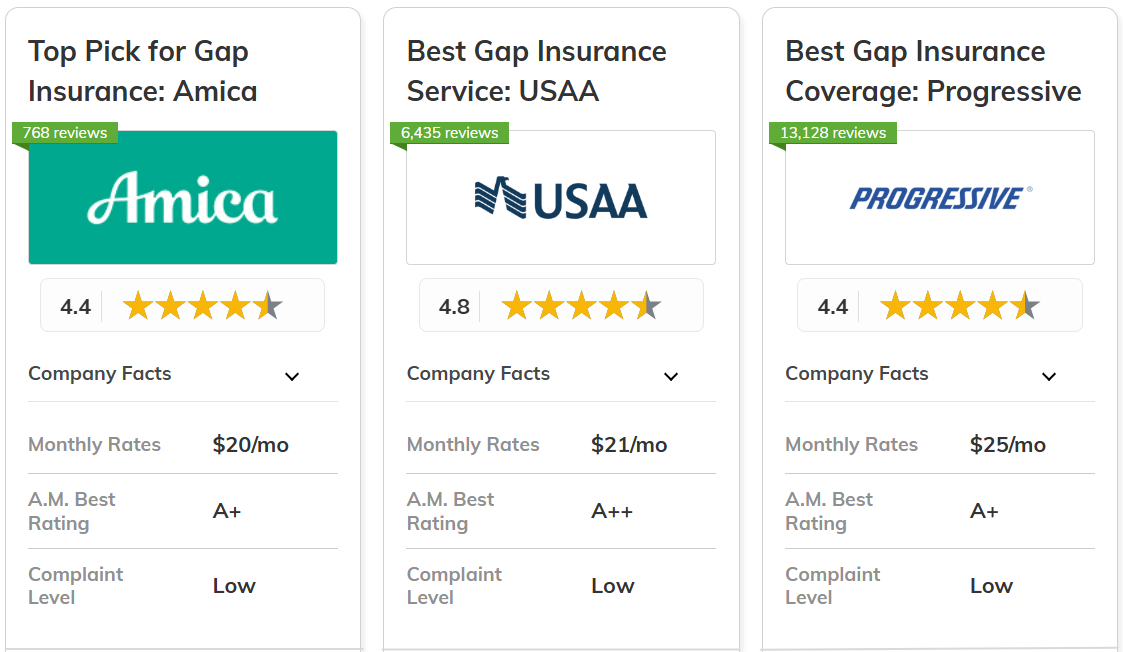

The best gap insurance companies are Amica, USAA, and Progressive, with competitive rates and robust coverage options for complete loan protection after a total loss.

Amica offers affordable rates and excellent customer service, while USAA provides the best military car insurance. Progressive is also a strong option for customizable gap insurance plans on new cars.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Cheap Rates | Amica | |

| #2 | 10% | A++ | Customer Service | USAA | |

| #3 | 10% | A+ | Qualifying Coverage | Progressive | |

| #4 | 17% | B | Personalized Service | State Farm | |

|

#5 | 20% | A+ | Vanishing Deductible | Nationwide |

|

#6 | 25% | A | Customizable Policies | Liberty Mutual |

| #7 | 25% | A+ | Financial Stability | Allstate | |

| #8 | 13% | A++ | Competitive Rates | Travelers | |

| #9 | 20% | A | Comprehensive Coverage | Farmers | |

|

#10 | 5% | A+ | Tailored Policies | The Hartford |

Consider these leading companies to secure the best gap insurance tailored to new or leased vehicles. Enter your ZIP code above to shop for coverage from the top insurers.

What You Should Know

- Gap insurance covers the difference between your loan balance and car value

- Amica is the top pick for the best comprehensive gap insurance

- Travelers in the cheapest gap insurance company starting at $19/month

#1 – Amica: Top Pick Overall

Pros

- Affordable Rates: Amica offers competitive gap insurance rates at $20/month.

- Top-Notch Customer Service: Amica is one of the top companies for gap insurance claims and customer satisfaction.

- Customizable Policy Options: Amica provides flexible insurance policies with gap coverage for those wondering what kind of car insurance you need.

Cons

- Limited Availability: Amica gap insurance coverage isn't available in all states.

- Fewer Discounts: Discounts and savings may be less extensive compared to other gap insurance companies.

#2 – USAA: Best for Customer Service

Pros

- Tailored Gap Coverage for Military: USAA is widely regarded as one of the best gap insurance companies for military members.

- Exceptional Customer Service: USAA is one of the best gap insurance companies known for its high customer support ratings. Learn more in our USAA review.

- Full Financial Suite: Military members have access to banking and investment options through USAA, along with cheap gap insurance.

Cons

- Limited Eligibility: Unlike other best gap insurance companies, USAA restricts its services to military members and their families.

- Fewer Discount Options: USAA has fewer gap insurance discount options than other providers.

#3 – Progressive: Best for Qualifying Coverage

Pros

- Wide Range of Gap Coverage Options: Progressive is one of the best gap insurance companies for its comprehensive, flexible gap coverage.

- Innovative Tools for Savings: Read in our Progressive review about its usage-based Snapshot program for gap insurance discounts.

- Customizable Payment Plans: Progressive offers flexible payment plans on gap insurance that can fit various budgets and needs.

Cons

- Customer Service Variability: While Progressive is among the best gap insurance companies, some customers report inconsistent experiences with support.

- Higher Premiums for High-Risk Drivers: Progressive may charge higher gap insurance premiums for high-risk drivers.

#4 – State Farm: Best for Personalized Service

Pros

- Personalized Customer Support: State Farm ranks among the best gap insurance companies for customer satisfaction. Explore more ratings in our State Farm review.

- Variety of Policy Add-Ons: State Farm has a diverse range of insurance products to enhance car insurance, including cheap gap coverage.

- Local Agent Support: State Farm’s agent network offers in-person service, which is ideal for those seeking the best gap insurance companies.

Cons

- Lower Financial Rating: State Farm’s B rating is lower than that of other gap insurance companies.

- Higher Premiums: Despite being one of the best gap car insurance companies, State Farm's premiums can be higher compared to other providers.

#5 – Nationwide: Best for Vanishing Deductibles

Pros

- Vanishing Deductible Reward: Nationwide offers a vanishing deductible benefit on its gap insurance to reward safe driving.

- Personalization of Policies: Nationwide does allow clients to personalize their gap insurance and other coverage.

- Digital Tools for Easy Management: Nationwide is considered the best for its smooth digital interface in managing gap insurance. See more details in our Nationwide review.

Cons

- Higher Premiums for Full Coverage: Nationwide may charge slightly higher premiums for combined full coverage policies with a gap than other providers.

- Fewer Discounts Compared to Competitors: Nationwide offers fewer gap insurance discounts, meaning only limited savings can be attained.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Gap Insurance Policies: Our Liberty Mutual review breaks down its customizable gap insurance options for drivers.

- Excellent Customer Service: Liberty Mutual ranks among the best gap insurance companies due to its 24/7 claims filing service.

- Broad Coverage Options: Liberty Mutual offers extensive coverage options on policies with gap protection.

Cons

- Higher Premiums for Riskier Drivers: Liberty Mutual may charge higher premiums for gap insurance in your state than other companies.

- Limited Agent Availability in Some Areas: Liberty Mutual reviews reveal that in-person support for gap insurance needs to be improved in certain regions.

#7 – Allstate: Best for Financial Stability

Pros

- Financially Stable Gap Coverage: Allstate is regarded as one of the best gap insurance companies due to its financial stability, with an A+ rating from A.M. Best.

- Comprehensive Policy Offerings: Allstate provides a broad range of gap insurance options, including loan/lease gap coverage and new car replacement, allowing flexible coverage.

- Local Agents Provide Personalized Service: Allstate offers personalized agent support. Get more details in our Allstate review.

Cons

- Higher Premiums for Comprehensive Coverage: Allstate tends to have higher premiums for full coverage with gap insurance.

- Inconsistent Customer Support: Some gap insurance customers report varied experiences with Allstate customer service.

#8 – Travelers: Best for Competitive Rates

Pros

- Competitive Gap Insurance Rates: Travelers is a cheap gap insurance company with rates starting at $19 monthly.

- Comprehensive Coverage Options: Travelers is one of the best gap insurance companies for a wide range of coverage options. Compare coverage in our Travelers review.

- Strong Financial Rating: With an A++ rating, Travelers is one of the most trusted companies for gap insurance claims.

Cons

- Few Discounts on Gap Insurance: Travelers offer fewer discounts on gap insurance than the competition.

- Customer Service Feedback: Travelers received mixed customer service feedback for its customer service regarding the gap insurance cover.

#9 – Farmers: Best for Comprehensive Coverage

Pros

- Comprehensive Gap Insurance: Based on our Farmers review they offer tailored gap insurance options, which are among the best for those who want personalized coverage.

- Strong Regional Presence: Farmers have a high regional network, which is especially fit for customers who value local and person-to-person support policy.

- User-Friendly Mobile Application: Easy-to-use, top-rated app where managing gap insurance is now easier than ever, so you are updating your policy and filing a claim.

Cons

- Higher Premiums in Certain Areas: Farmers' gap insurance rates can be higher than rivals' in certain areas.

- Average Claims Service: Farmers receive mixed reviews for claims handling with lower satisfaction ratings than other gap insurance providers.

#10 – The Hartford: Best for Tailored Policies

Pros

- Tailored Gap Insurance for AARP Members: The Hartford offers tailored gap coverage for AARP members.

- Exceptional Claims Service: Based on our The Hartford review, it's known as one of the best gap insurance companies due to its highly rated claims service.

- Broad Coverage Choices: The Hartford offers a variety of coverage options for gap insurance.

Cons

- Limited Discount Opportunities: The Hartford has fewer gap discount opportunities than some competitors.

- No Coverage for Younger Drivers: Only AARP members can buy The Hartford car insurance.

Best Gap Insurance Rates and Discounts for Maximum Savings

To find the best gap insurance companies, compare the cost of coverage with the company's available discounts. This table shows how much gap insurance costs at each top company:

| Insurance Company | Monthly Rates |

|---|---|

| $26 | |

| $20 | |

| $24 | |

|

$27 |

|

$28 |

| $25 | |

| $23 | |

|

$22 |

| $19 | |

| $21 |

Travelers has the lowest monthly gap insurance rates at $19/month, but Amica and USAA are also very affordable at $20/month and $21/month respectively.

Discounts can help reduce gap insurance costs. Insurance add-ons, like new car replacements from Allstate, Liberty Mutual, and Nationwide, can boost gap protection and help drivers get back on the road quickly after a claim.

| Insurance Company | Discount Availability |

|---|---|

| Bundling, Safe Driver, Good Student, New Car, Early Signing, Anti-Theft, Responsible Payer, Autopay & Paperless | |

| Bundling, Claim-Free, Good Student, Safe Driver, Defensive Driver, Autopay & Paperless, Anti-Theft, Low Mileage | |

| Bundling, Signal Program, Good Student, Safe Driver, Homeowner, Autopay & Paperless, New Car Replacement | |

|

Bundling, Early Shopper, Good Student, Safe Driver, Accident-Free, Anti-Theft, Autopay & Paperless, New Vehicle |

|

Bundling, SmartRide Program, Good Student, Defensive Driver, Accident-Free, Autopay & Paperless, Anti-Theft, New Vehicle |

| Bundling, Snapshot Program, Good Student, Safe Driver, Autopay & Paperless, Multi-Vehicle, Homeowner, Continuous Insurance | |

| Bundling, Good Student, Safe Driver, Accident-Free, Steer Clear, Defensive Driver, Anti-Theft | |

|

Bundling, Defensive Driver, Accident-Free, Safe Driver, Good Student, New Vehicle, Vehicle Recovery Systems |

| Bundling, IntelliDrive Program, Good Student, Safe Driver, Homeowner, Autopay & Paperless, Continuous Insurance, New Car | |

| Military, Good Student, Bundling, Safe Driver, Defensive Driver, New Vehicle, Vehicle Storage, Low Mileage |

Many providers, including Amica, Farmers, and Progressive, offer multi-policy and bundling discounts to help further reduce gap insurance rates.

Additionally, usage-based programs provide extra opportunities for drivers to save. Read our Progressive Snapshot review to learn why it's the top three best gap insurance companies.

Understanding Gap Insurance

Gap insurance, short for guaranteed asset protection, covers the financial difference between a car's actual market value and the remaining balance on your loan or lease if your car is totaled. For instance, if your vehicle is valued at $15,000 but still owes $20,000, gap insurance would cover the $5,000 shortfall.

This protection can reduce financial strain and provide peace of mind, especially with more significant loan balances or newer vehicles. When selecting a policy, it’s helpful to explore the best gap insurance providers to find the most trusted option with the highest level of coverage.

Remember, the best type of gap insurance will offer comprehensive protection, covering the difference between your insurer's pay and your loan balance.

If you're wondering what is better than gap insurance, consider whether loan/lease payoff insurance or vehicle replacement coverage suits your needs better. These options can offer enhanced coverage beyond the standard gap insurance policy. Get more tips to negotiate the best settlement for a totaled car.

Gap Insurance Eligibility

Gap insurance can be a valuable addition to your auto insurance policy, but it's unnecessary for everyone. Understanding who benefits most from gap insurance can help determine if it's right for you.

- New Car Buyers: If you have purchased a new car and put down a small down payment, in case your car is totaled, the insurance payout may not be enough to pay off the remaining loan balance. That's what Gap does: it ensures you are not left paying off a loan on a car that you no longer have.

- Leased Vehicles: Most lease agreements require a gap because, in a totaled vehicle, you will be required to pay its full value. Gap insurance covers the difference between the car's market value and the remaining lease payments, protecting you from financial loss.

- High Loan-to-Value Ratio: The higher the amount you borrowed relative to the worth of your car, the higher the risk if your car gets totaled. If you financed a high percentage of your car's value, consider gap insurance.

- High Depreciation Vehicles: If your car has a history of high depreciation rates, consider gap insurance to protect yourself against total loss. Check with your dealer or insurance provider about the estimated rate of your vehicle's depreciation.

- Individuals With Limited Savings: If one encounters an accident and their car becomes a total loss, even when the balance is outstanding against the vehicle, he will fall into the high-risk category. Gap insurance saves you from spending all your savings or taking an additional loan.

Evaluating your need for gap insurance involves your current financial situation, vehicle depreciation, and loan or lease terms. It is valuable protection, but whether such benefits apply to your particular circumstance is the question.

How to Secure the Best Gap Insurance Coverage

The best gap insurance companies are Amica, USAA, and Progressive, offering reliable coverage for new and leased vehicles. Gap insurance meaning is simple: it covers the difference between your car’s depreciated value and your loan balance.

Amica provides competitive pricing, while USAA offers plans for military families. Progressive is known for its trusted gap insurance for new car owners. Gap insurance quotes typically start around $20/month. Many ask, what is the most gap insurance will pay? It covers the full difference between your car’s value and your loan balance.

For the best gap cover, Amica, USAA and Progressive are top choices, and gap insurance generally covers the whole difference.

Comparing insurance quotes online can give drivers the chance to get rates from multiple providers. Search for companies by ZIP code below.

Frequently Asked Questions

What is gap insurance, and why might I need it?

Gap insurance covers the difference between the amount you owe on your car loan and the car's current market value if it's totaled or stolen. It's especially useful if you owe more than your car is worth, which often happens with new vehicles.

How do I determine the best gap insurance companies?

To determine the best gap insurance companies, it’s essential to assess customer reviews, coverage options, pricing, and the claim process, especially when to file a car insurance claim. Seek out companies with high financial ratings and strong reputations for outstanding customer service.

Which gap cover is best?

The best gap insurance providers are Amica, USAA, and Progressive. Amica offers excellent customer service and affordable coverage, USAA is ideal for military families, and Progressive provides customizable options for new cars with its Snapshot program.

What should I look for when comparing gap insurance providers?

When comparing gap insurance providers, focus on coverage options, exclusions, pricing, and additional benefits. Customer reviews and ratings, especially from customers’ choice top-ranked insurance companies, can offer valuable insights into the claims process and service quality.

How does gap insurance differ from standard auto insurance?

The difference between auto insurance and gap is that gap insurance only covers the remaining balance on your loan or lease. It doesn't pay for repairs or replacement parts the way standard auto insurance does.

Does gap insurance cover the whole difference?

Yes, gap insurance generally covers the entire difference between your car’s actual value and the remaining balance on your loan or lease, provided it’s totaled due to an accident or theft.

What is the most gap insurance will pay?

Gap insurance covers the difference between your loan balance and your car’s actual value if it’s totaled due to a collision or comprehensive coverage claim. The payout is based on the amount left on the loan or lease.

What is the most gap insurance will pay?

Gap insurance covers the difference between your loan balance and your car’s actual value if it’s totaled due to a collision or comprehensive coverage claim. The payout is based on the amount left on the loan or lease.

Can I purchase gap insurance through my car dealership?

Yes, many car dealerships offer gap insurance at the time of purchase. However, it’s often recommended to compare dealership offers with those from independent gap insurance companies to ensure you're getting the best value. Enter your ZIP code below to see how much car insurance costs in your area.

What are the typical costs associated with gap insurance?

The cost of gap insurance varies based on factors like the vehicle's make and model, your loan amount, and the insurance provider. On average, it ranges from $20 to $50 per year, but checking with multiple providers can help you find the best rate.