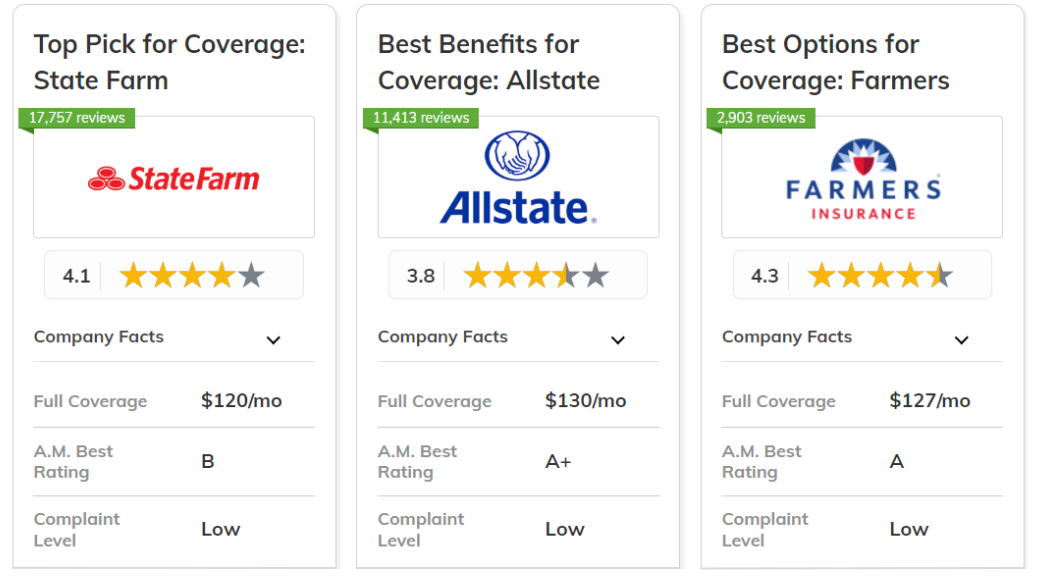

State Farm, Allstate, and Farmers offer the best comprehensive car insurance coverage, with a starting price of $35 per month. State Farm really shines with its wide range of insurance coverage.

Allstate offers some great roadside assistance perks specifically for AARP members, while Farmers has a variety of insurance options tailored to meet different needs. It’s worth taking a closer look at each of these companies to find the one that fits you best.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Coverage | State Farm | |

| #2 | 25% | A+ | AARP Benefits | Allstate | |

| #3 | 20% | A | Broad Options | Farmers | |

| #4 | 13% | A++ | Customizable Policies | Travelers | |

| #5 | 15% | A | Robust Protection | Safeco | |

| #6 | 25% | A | Loyalty Rewards | American Family | |

| #7 | 10% | A+ | Usage-Based Discounts | Progressive | |

|

#8 | 25% | A | Flexible Plans | Liberty Mutual |

|

#9 | 20% | A+ | Innovative Tools | Nationwide |

|

#10 | 5% | A+ | Personalized Service | The Hartford |

Keep reading to discover the top ways customers have saved money on car insurance rates with these cheap comprehensive car insurance companies.

Finding affordable car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

What You Should Know

- State Farm is the top pick at $35 per month

- Allstate AARP benefits apply to comprehensive coverage with roadside assistance

- Progressive has the best usage-based discounts on comprehensive coverage

#1 – State Farm: Top Overall Pick

Pros

- Wide-Reaching Coverage Options: State Farm offers reliable comprehensive car insurance coverage in 48 states.

- Affordable Rates: Comprehensive insurance rates start at $35 per month, offering cost-effective protection.

- Bundling Discounts: Offers a 17% discount on bundling comprehensive car insurance with other policies, which you can learn about in our State Farm review.

Cons

- Restricted Savings: Reductions on all-inclusive auto insurance packages could be less than those other competitors offer.

- Increased Premiums: For comprehensive auto insurance, premiums may increase if coverage levels are increased.

#2 – Allstate: Best for AARP Benefits

Pros

- AARP Benefits: Allstate offers comprehensive car insurance coverage with exclusive benefits for AARP members, but only when roadside assistance is included.

- High Discounts: Read our Allstate review, which emphasizes the 25% bundling discount, reducing comprehensive car insurance costs.

- Strong Ratings: Holds an A+ rating, ensuring financial stability and reliable comprehensive claim handling.

Cons

- Higher Rates: Comprehensive coverage starts at $40 per month, which is higher than some other providers.

- Limited Offers for Non-AARP Members: Fewer discounts for comprehensive car insurance are available to non-AARP members.

#3 – Farmers: Best for Broad Options

Pros

- Varied Choices Available: A range of comprehensive auto insurance policies designed to satisfy various needs are available from Farmers.

- Reasonable Pricing: Starting at $38 per month, the comprehensive coverage rates offer good value. Compare insurance costs in our Farmers review.

- Customizable Policies: Policyholders can personalize their comprehensive car insurance coverage to meet specific needs.

Cons

- Average Customer Reviews: Farmers insurance reviews for comprehensive insurance are average or below average in some states.

- Higher Rates for Younger Drivers: Younger drivers may face slightly higher comprehensive car insurance rates.

#4 – Travelers: Best for Customizable Policies

Pros

- Tailored Coverage: With highly adaptable comprehensive auto insurance options, travelers succeed.

- Affordable Rates: Travelers provides comprehensive coverage prices starting at $37 monthly. Check out our Travelers review for additional quotes.

- Robust Financial Strength: An A++ rating reflects strong financial reliability for comprehensive insurance claims.

Cons

- Low Discounts: Offers a 13% bundling discount for comprehensive car insurance, less than some competitors.

- Complex Options: Customizing comprehensive car insurance plans can be time-consuming.

#5 – Safeco: Best for Robust Protection

Pros

- Strong Coverage: Emphasizes comprehensive, high-quality auto insurance plans for the best possible protection. Check out our Safeco review to compare options.

- Affordable Rates: In order to balance cost and protection, comprehensive coverage starts at $36 per month.

- Financial Reliability: Maintains an A rating, guaranteeing reliable comprehensive claim assistance.

Cons

- Limited Tools: Fewer digital management options for comprehensive car insurance policies.

- Lower Discounts: Offers a 15% discount for bundling comprehensive car insurance, less than some others.

#6 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Provides comprehensive car insurance coverage with substantial loyalty rewards for families with multiple drivers.

- Generous Discounts: Offers a 25% discount for bundling comprehensive insurance with other AmFam policies.

- Low Base Rates: Comprehensive coverage is available at $35 per month. Check out our American Family review for more auto insurance quotes.

Cons

- Regional Limitations: AmFam comprehensive car insurance is only available in 26 states.

- Moderate Service Ratings: Customer service ratings for comprehensive coverage are average.

#7 – Progressive: Best for Usage-Based Discounts

Pros

- Usage-Based Discounts: Offers comprehensive car insurance coverage with discounts based on safe driving habits.

- Accessible Rates: Comprehensive coverage is available from $39 per month. Browse more in our Progressive review.

- High Financial Ratings: Holds an A+ rating, indicating strong financial backing if you need to file comprehensive auto insurance claims.

Cons

- Lower Bundling Discounts: Offers only a 10% discount for bundling comprehensive car insurance.

- Higher Rates for High-Risk Drivers: Premiums for comprehensive coverage can be higher for high-risk drivers.

#8 – Liberty Mutual: Best for Flexible Plans

Pros

- Multiple Choices: Offers individualized full auto insurance coverage.

- High Bundling Discounts: Provides complete insurance policy bundles with a 25% discount.

- Claims Processing Around-the-Clock: Drivers can submit comprehensive insurance claims at anytime. Read our Liberty Mutual review for more information.

Cons

- Costly Add-Ons: Additional coverages for comprehensive plans can increase costs.

- Mixed Feedback: Customer service experiences for comprehensive coverage are varied.

#9 – Nationwide: Best for Innovative Tools

Pros

- Digital Features: Offers advanced tools to manage comprehensive car insurance policies.

- Low Rates: Comprehensive coverage starts at $37 per month. Compare rates near you in our Nationwide review.

- Financial Strength: Holds an A+ rating, ensuring reliable, comprehensive insurance services.

Cons

- Limited New Customer Discounts: New customers are eligible for fewer extensive discounts.

- Moderate Customer Evaluations: In terms of customer service, comprehensive auto insurance evaluations are mediocre.

#10 – The Hartford: Best for Personalized Service

Pros

- Personalized Service: Provides tailored comprehensive car insurance coverage.

- Affordable Rates: Comprehensive coverage starts at $38 per month. Compare pricing in The Harford review.

- Senior Support: Focuses on additional services for older drivers seeking comprehensive insurance coverage.

Cons

- Minimal Discounts: Bundling discount for comprehensive insurance is limited to 5%.

- Restricted Availability: Comprehensive car insurance is not available to younger drivers who are not AARP members.

Comparing the Best Comprehensive Car Insurance Rates

Why is car insurance so expensive? Adding comprehensive insurance will raise your rates, but finding the best comprehensive coverage means understanding the differences in costs across the top ten companies:

| Insurance Company | Collision Coverage | Comprehensive Coverage | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| $65 | $40 | $58 | $130 | |

| $60 | $35 | $49 | $117 | |

| $70 | $38 | $57 | $127 | |

|

$68 | $42 | $56 | $128 |

|

$63 | $37 | $48 | $115 |

| $67 | $39 | $54 | $124 | |

| $64 | $36 | $53 | $122 | |

| $62 | $35 | $50 | $120 | |

|

$66 | $38 | $55 | $125 |

| $65 | $37 | $52 | $118 |

State Farm is one of the cheapest companies overall for comprehensive insurance and full coverage (which includes minimum liability, collision, and comprehensive insurance).

Allstate and Liberty Mutual are on the higher end, with monthly comprehensive rates of $40 and $42, respectively.

Exploring Your Comprehensive Car Insurance Coverage Options

Comprehensive car insurance coverage protects your vehicle from a wide range of non-collision-related damages, including theft, fire, vandalism, and natural disasters. This type of coverage can vary by company, and certain providers may list exclusions, such as flood damage.

Additional benefits, such as glass repair coverage, rental reimbursement, and roadside assistance, can further enhance the value of a comprehensive car insurance policy, making it a versatile choice for many drivers.

With many companies, roadside assistance is not available unless you add comprehensive or full coverage to your policy.

Have you heard of Drivewise? It's located in our Allstate app. We recently found out that customers who choose to use Drivewise are 25% less likely to have a severe collision than those who don't. https://t.co/HNMxg3hVAZ

— Allstate (@Allstate) May 13, 2024

Many insurers offer highly flexible comprehensive coverage plans that allow customers to select their deductibles, choose additional features, or sign up for usage-based or mileage-based coverage that better suits their lifestyles.

Learn More: Collision vs. Comprehensive Coverage

Savings on Comprehensive Car Insurance Coverage

The best comprehensive car insurance coverage often includes discounts for low-mileage drivers and vehicles with anti-theft devices. Here are the various discounts from the top ten comprehensive auto insurance companies:

| Insurance Company | Available Discount |

|---|---|

| Multi-policy, Safe driver, New car, Anti-theft, Early signing, Pay-in-full | |

| Multi-policy, Safe driver, Loyalty, Auto-pay, Good student | |

| Multi-policy, Good driver, Homeowner, Good student, Pay-in-full | |

|

Multi-policy, Safe driver, Military, New car, Early shopper |

|

Multi-policy, Safe driver, Anti-theft, Good student, Accident-free |

| Multi-policy, Safe driver, Continuous insurance, Snapshot (usage-based), Homeowner | |

| Multi-policy, Accident prevention, Homeowner, Anti-theft, New car | |

| Multi-policy, Safe driver, Good student, Anti-theft, Accident-free | |

|

Multi-policy, Safe driver, Defensive driving course, Anti-theft, AARP member |

| Multi-policy, Safe driver, Homeowner, Good student, New car |

Shopping around and comparing multiple providers online will ensure that you get the best discounts and the best coverage to match your driving needs.

Read More: 14 More Ways to Save Money on Car Insurance.

The Best Comprehensive Car Insurance Companies

State Farm, Allstate, and Farmers have the best comprehensive car insurance coverage. State Farm offers affordable rates starting at $35/month.

Allstate is one of the best car insurance companies for roadside assistance, with exclusive AARP benefits for older drivers looking to buy comprehensive car insurance.

To find the best comprehensive car insurance for your needs, comparing multiple quotes online is key. Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

What is the best comprehensive car insurance coverage?

The best and cheapest car insurance companies for comprehensive car insurance coverage include top providers like State Farm, Allstate, and Farmers.

What factors should I consider when choosing the best comprehensive car insurance coverage?

Compare policy options and limits, premium rates, number of discounts, and customer service reviews to find the best coverage for you.

How do I choose the right comprehensive car insurance provider?

Consider the insurer's reputation, customer service, and claims process to find the best company.

Why do I need comprehensive car insurance coverage?

Comprehensive coverage is essential if you want to protect your vehicle from unexpected events beyond accidents, such as severe weather, theft, or damage from falling objects.

What factors impact the cost of comprehensive car insurance?

Factors such as age, driving record, vehicle type, location, and coverage limits can all influence the cost of comprehensive car insurance. Enter your ZIP code below to compare comprehensive coverage near you.

Can I bundle my car insurance with other types of insurance for a discount?

Yes, many providers, such as State Farm, Allstate, and Farmers, offer bundling discounts when you combine comprehensive auto insurance with other policies, such as home or renters insurance.

How is comprehensive car insurance different from liability insurance?

Liability car insurance covers damages and injuries you cause to others in an accident, while comprehensive insurance covers damages to your vehicle from incidents other than collisions.

What is the difference between comprehensive and collision coverage?

Comprehensive coverage protects against non-collision incidents such as theft, fire, or natural disasters, while collision coverage covers damages resulting from an accident with another vehicle or object. Check out our guide on collision vs. comprehensive coverage.

Are there any discounts available for comprehensive car insurance?

Many insurers offer discounts for safe driving, bundling policies, vehicle safety features, or membership in specific organizations like AARP.

How do I file a claim with my comprehensive car insurance provider?

To file a claim, contact your insurance provider directly via their website, mobile app, or customer service hotline and provide all necessary details regarding the incident.