The best companies for commercial car insurance are Progressive, USAA, and Nationwide. Progressive and USAA are some of the cheapest providers, with rates starting at $58/month.

The top pick is Progressive for affordable rates and nationwide coverage. USAA is the best in customer service and Nationwide in multi-policy savings.

The top pick is Progressive for affordable rates and nationwide coverage. USAA is the best in customer service and Nationwide in multi-policy savings.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Cheap Rates | Geico | |

| #2 | 25% | A+ | Infrequent Drivers | Allstate | |

|

#3 | 25% | A+ | Tailored Policies | The Hartford |

| #4 | 20% | A++ | Agency Network | State Farm | |

| #5 | 20% | A | Policy Options | Farmers | |

|

#6 | 20% | A | Safe-Driving Discounts | Liberty Mutual |

|

#7 | 20% | A+ | Multi-Policy Savings | Nationwide |

| #8 | 12% | A+ | Qualifying Coverage | Progressive | |

| #9 | 10% | A++ | Customer Service | USAA | |

| #10 | 8% | A++ | Small Businesses | Travelers |

Keep reading to learn how customers save money on car insurance and where to find cheap commercial auto coverage near you. Get the right commercial car insurance at the best price by entering your ZIP code above.

What You Should Know

- Progressive offers full coverage commercial car insurance at $135/month

- USAA excels in customer service but is only available to military members

- Nationwide provides excellent multi-policy savings on comprehensive coverage

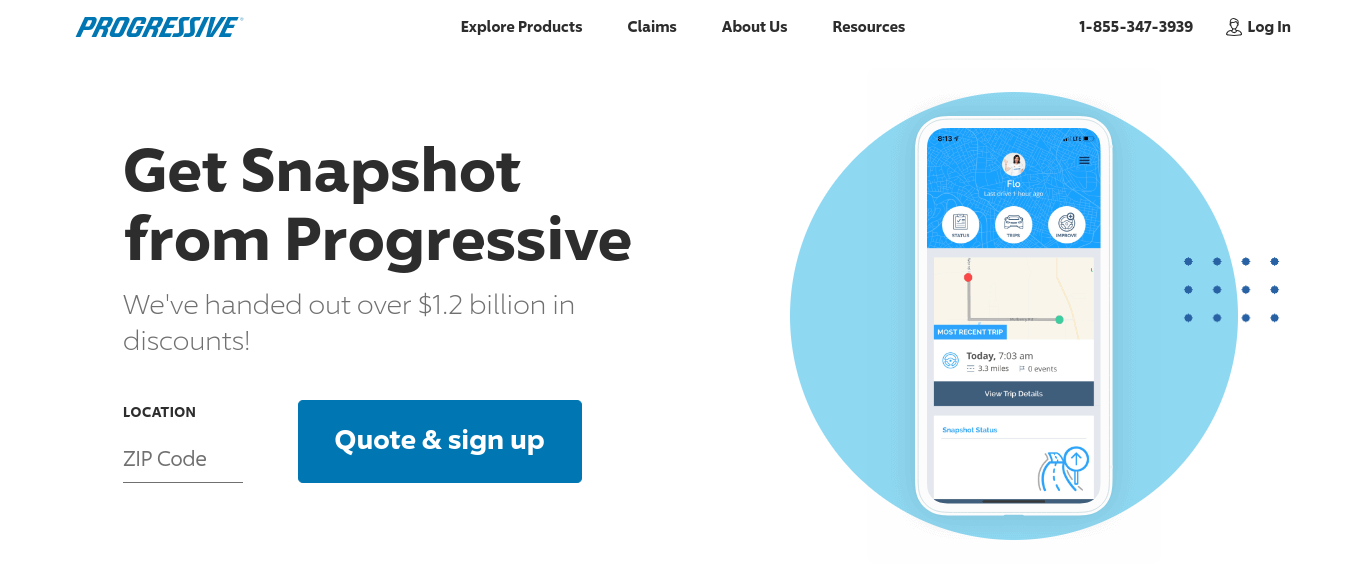

#1 – Progressive: Top Overall Pick

Pros

- Affordable Rates: Progressive offers reasonable prices for commercial car insurance; rates begin at $60 per month.

- Comprehensive Coverage: Progressive provides many coverage options, as mentioned in our Progressive review, to fit the different needs of business owners.

- User-Friendly Tools: Progressive has user-friendly online tools that help business owners efficiently manage their policies.

Cons

- Changing Prices꞉ Costs for commercial car insurance can differ significantly based on the business type and location.

- Slow Claims꞉ Processing commercial car insurance claims might take longer than other companies.

#2 – USAA: Best for Customer Service

Pros

- Top-Tier Service: USAA is renowned for providing excellent customer service and is among the best companies for commercial car insurance.

- Personalized Assistance: It offers tailored support for businesses with fleet or commercial car insurance.

- Efficient Claims Handling: Our USAA review highlights that it's one of the highest-ranked companies for commercial car insurance claims by customers.

Cons

- Eligibility Restrictions: USAA commercial car insurance is limited to military members and their families.

- Limited In-Person Service: USAA insurance and financial services operate primarily online, making buying commercial car insurance in person difficult.

#3 – Nationwide: Best for Multi-Policy Savings

Pros

- Great Savings: Nationwide provides significant savings on commercial car insurance through multi-policy bundling.

- Flexible Coverage: Read how the company offers adaptable coverage options that meet various commercial car insurance needs in our review of Nationwide.

- Fleet Management: Nationwide Vantage 360 Fleet provides usage-based and route-monitoring services for businesses with multiple commercial vehicles.

Cons

- Discount Limits: Multi-policy savings for commercial car insurance might not be as substantial for smaller businesses.

- Regional Limitations: Some commercial car insurance options may be limited based on location.

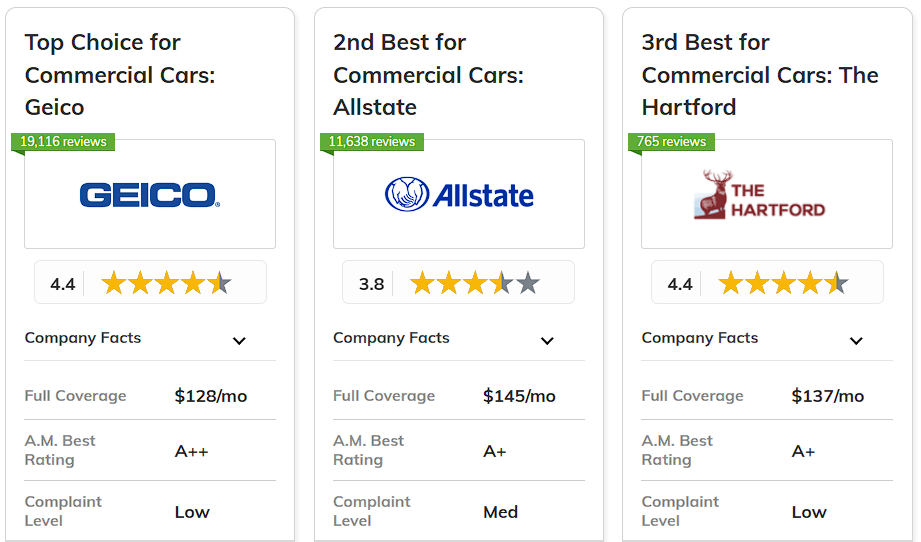

#4 – The Hartford: Best for Tailored Policies

Pros

- Expert Recommendations: The Hartford has an A+ financial rating and more than 200 years of experience in the commercial car insurance industry.

- Custom Policies: The Hartford specializes in tailored policies, making it one of the best companies for commercial car insurance.

- Flexible Options: As shown in our The Hartford review, it provides adaptable commercial car insurance solutions to meet specific business requirements.

Cons

- Complex Policies: Tailored policies can be more complex and challenging for business owners to understand.

- Potentially Higher Costs: Customized commercial car insurance coverage might have higher premiums than standard options.

#5 – Travelers: Best for Small Businesses

Pros

- Extensive Coverage: Our Travelers review highlights its comprehensive coverage options for various commercial auto insurance.

- Commercial Add-Ons: Small business owners can add Travelers Select Auto CoveragePlus to include gap insurance and rental car liability in their commercial car insurance.

- Bundling Discounts: Travelers offers easy management and notable discounts on commercial car insurance for small business owners who bundle policies.

Cons

- Limited Bundles: Bundling options might not cover all types of commercial car insurance for business owners.

- Potential Complexity: Managing multiple bundled policies with commercial car insurance can make business management more complex.

#6 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Comprehensive Coverage: Our Liberty Mutual review highlights the broad commercial car insurance coverage options.

- Safe-Driving Discounts: Liberty Mutual provides substantial discounts for safe driving to business owners.

- Risk-Management Solutions: Commercial auto insurance with Liberty Mutual includes free risk management for businesses.

Cons

- Discount Eligibility: Safe-driving discounts may not be available to all commercial car insurance policyholders.

- Higher Base Rates: Base rates for commercial car insurance might be higher before discounts are applied.

#7 – Farmers: Best for Policy Options

Pros

- Diverse Options: Our Farmers review lists the broad range of commercial car insurance policy options.

- Customizable Coverage: It provides flexible coverage solutions tailored to various commercial needs.

- Industry Experience: Farmers has an A rating from A.M. Best and nearly 100 years of experience in the commercial car insurance industry.

Cons

- Complex Choices: Many options can be overwhelming and difficult for business owners.

- Variable Costs: Costs for commercial car insurance can vary significantly based on selected policy options.

#8 – State Farm: Best Agency Network

Pros

- Extensive Network: Its large agency network provides local support and customized commercial car insurance solutions. Our State Farm review shows what local agents offer.

- Competitive Rates: Commercial auto insurance costs are cheap with State Farm, starting at $59/month for minimum coverage and $132/month for full.

- Reliable Coverage: It delivers dependable commercial car insurance coverage options supported by a strong local agency presence.

Cons

- Inconsistent Service: Service quality for business owners may vary between agents and locations.

- Potentially Higher Premiums: Premiums for commercial car insurance might be higher where you live due to the personalized service and extensive network.

#9 – Geico: Best for Cheap Rates

Pros

- Affordable Rates: Geico is known to offer cheap rates for commercial car insurance, starting at $57 monthly.

- Straightforward Coverage: As one of the top ten best car insurance companies, Geico provides simple and cost-effective commercial car insurance options.

- Efficient Online Tools: Geico’s online tools make managing commercial car insurance straightforward.

Cons

- Limited Coverage Options: Commercial car insurance options might be less comprehensive than those of other top companies.

- Customer Service: The quality of customer service for commercial car policyholders may not be as robust as some leading insurers.

#10 – Allstate: Best for Infrequent Drivers

Pros

- Specialized Coverage: Allstate tailors coverage for infrequent commercial car drivers.

- Cost-Effective: Our Allstate review reveals cost-effective insurance options for businesses with low mileage.

- Customizable Policies: Business owners who rarely drive can adjust their commercial car insurance coverage based on their driving frequency.

Cons

- Higher Rates: Commercial car insurance rates may be higher for businesses requiring more driving.

- Coverage Limitations: Commercial car insurance options for high-mileage companies may be less competitive.

Comparing Rates and Coverage from the Best Commercial Car Insurance Companies

Looking for cheap commercial car insurance? Compare minimum and full coverage options from top providers like Progressive, USAA, and Nationwide to find the best price.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $66 | $145 | |

| $61 | $136 | |

| $57 | $128 | |

|

$64 | $142 |

|

$65 | $140 |

| $60 | $135 | |

| $59 | $132 | |

|

$62 | $137 |

| $63 | $138 | |

| $58 | $130 |

USAA has the lowest commercial car insurance rates, but these prices are only available to business owners with military ties. Progressive, State Farm, and Geico offer affordable rates to most drivers.

Additionally, ensure that your commercial auto policy provides comprehensive insurance coverage to fully protect your business.

Commercial auto is not the same as personal car insurance, and adding commercial coverage will always raise your rates. Shop around with multiple companies to get the best coverage at an affordable price.

Discounts from the Best Companies for Commercial Car Insurance

Lots of providers offer multi-policy discounts, which can significantly lower commercial car insurance premiums. Safe driver discounts are another option, rewarding businesses who hire drivers with clean records.

| Insurance Company | Available Discount |

|---|---|

| Business Experience, Bundling, Safe Driver, Paid-in-Full | |

| Bundling, Business Owner, Safe Driver, Loyalty | |

| Bundling, Business Experience, Paid-in-Full, Anti-Theft | |

|

Bundling, Business Experience, Claims-Free, Fleet |

|

Bundling, Business Experience, Paid-in-Full, Commercial Fleet |

| Bundling, Safe Driver, Fleet, Accident-Free | |

| Bundling, Accident-Free, Paid-in-Full, Vehicle Safety | |

|

Business Owner, Bundling, Safe Driver, Fleet |

| Business Experience, Bundling, Fleet, Claims-Free | |

| Business Owner, Bundling, Safe Driver, Military |

Loyalty incentives also help reduce costs for long-term customers with commercial car insurance by offering additional savings and rewards.

Shopping for the right commercial car insurance involves comparing quotes, customizing coverage, and asking for discounts that reward your lifestyle:

- Compare Quotes: Get and compare quotes from multiple providers to find the best rates for commercial car insurance.

- Customize Coverage: Choose providers offering customizable policies to tailor your commercial car insurance plan to your business needs.

- Sign Up For UBI: The best commercial car insurance companies offer usage-based insurance (UBI) options for companies who hire safe drivers.

You can find more money-saving strategies in our practical guide for understanding car insurance.

Securing the Best Commercial Car Insurance

The best companies for commercial car insurance are Progressive, USAA, and Nationwide. These companies offer comprehensive coverage options to protect your business fleet that fits any budget.

Discounts for safe driving or multiple vehicles are the top ways customers have saved money on commercial car insurance. Regularly reviewing your policy ensures you get the best commercial auto insurance deal.

Stop overpaying for car insurance. Use our free quote comparison tool to find the best commercial car insurance by entering your ZIP code below.

Frequently Asked Questions

What are the best companies for commercial car insurance?

The top companies for commercial car insurance are Progressive, State Farm, and Nationwide, which are known for comprehensive coverage, strong customer support, and competitive rates.

Who are the top 10 commercial car insurance companies?

The top 10 companies for commercial vehicle insurance are Progressive, State Farm, Nationwide, Geico, Liberty Mutual, Travelers, Allstate, The Hartford, USAA, and Farmers. Enter your ZIP code to see which has the best commercial auto insurance rates in your state.

Which company has the highest customer satisfaction for commercial vehicle insurance?

State Farm and USAA consistently rank high for customer satisfaction due to personalized service and extensive coverage options. Compare State Farm vs. USAA car insurance here.

Which company offers the best commercial insurance packages?

Progressive and Nationwide are top choices for their tailored commercial insurance packages that include liability, physical damage, and cargo coverage.

Who are the largest providers of commercial car insurance?

Geico and State Farm are the largest commercial auto insurance companies in the U.S. by market share.

What is the best vehicle for commercial use?

Popular commercial vehicles include the Ford Transit, Mercedes-Benz Sprinter, and Ram ProMaster, which are known for reliability, cargo space, and efficiency.

What are the four recommended types of commercial car insurance?

Liability, collision, comprehensive, and uninsured/underinsured motorist coverage are essential for protecting commercial vehicles.

Which commercial car insurance company offers the best discounts?

Progressive is well-known for offering extensive discounts for commercial policies, including savings for multiple vehicles and safe driving records.

What is the most common commercial vehicle on the road?

The Ford Transit is one of the most commonly used commercial vehicles due to its versatility and affordability.

Which is the most expensive form of commercial car insurance?

Physical damage and liability car insurance for high-risk drivers or vehicles can be among the most expensive forms of commercial car insurance.