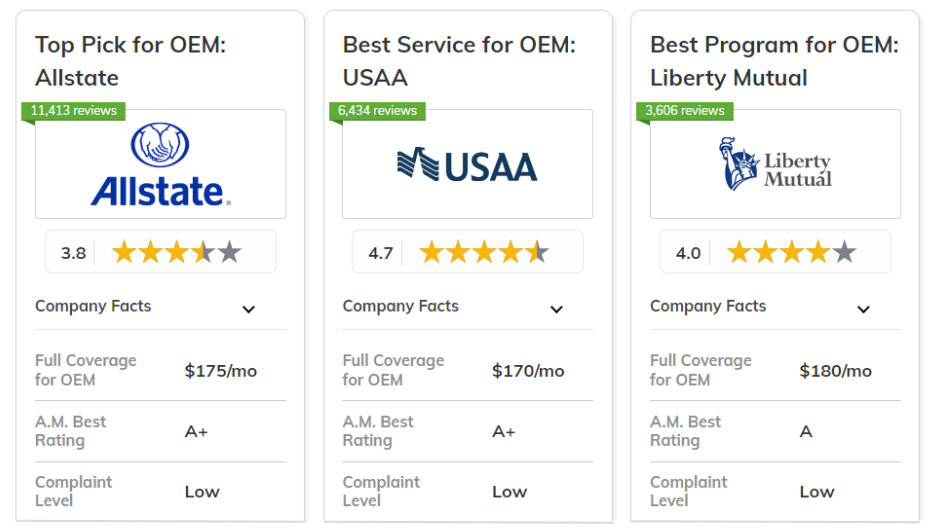

The best car insurance with original equipment manufacturer (OEM) coverage comes from Allstate, USAA, and Liberty Mutual.

OEM coverage pays for original parts during repairs, protecting your vehicle’s value. Many drivers with luxury or sports cars find this essential for vehicular maintenance and reliability.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Claims Satisfaction | Allstate | |

| #2 | 10% | A++ | Customer Service | USAA | |

|

#3 | 25% | A | RightTrack Program | Liberty Mutual |

| #4 | 25% | A++ | Various Discounts | Geico | |

|

#5 | 20% | A+ | Deductible Options | Nationwide |

| #6 | 17% | B | Cheap Rates | State Farm | |

| #7 | 13% | A++ | Unique Coverage | Travelers | |

| #8 | 10% | A+ | Roadside Assistance | Progressive | |

| #9 | 25% | A | Loyalty Rewards | American Family | |

| #10 | 20% | A | Great Add-ons | Farmers |

In this article, we'll explore the benefits of OEM coverage and highlight why these providers are some of the best car insurance companies that cover any car you drive.

Stop overpaying for OEM car insurance. Our comparison tool allows you to shop for free quotes from the top providers near you by entering your ZIP code.

What You Should Know

- OEM coverage ensures your vehicle is repaired with original manufacturer parts

- Allstate offers the best car insurance with OEM coverage starting at $82

- OEM coverage helps maintain your vehicle's value and performance over time

#1 – Allstate: Top Overall Pick

Pros

- Strong Claims Satisfaction: Allstate is one of the best insurance companies in this arena when it comes to claims management, particularly for those who purchase OEM coverage. See our Allstate review for details.

- Substantial Bundling Discounts: With a 25% discount for bundling policies, customers can save while securing original equipment manufacturer coverage.

- Diverse Coverage Options: The service provider incorporates various sorts involving policy the majority of that are panda automobile any difficulty automotive.

Cons

- Premium Costs: Allstate’s rates may be higher than some competitors, particularly affecting affordability for original equipment manufacturer coverage.

- Inconsistent Customer Service: Quality of service fluctuates, which may degrade claims on parts covered by the original equipment manufacturer.

#2 – USAA: Best for Customer Service

Pros

- Outstanding Customer Experience: USAA is known for its excellent customer service and claim satisfaction, and its OEM coverage is no different.

- Extensive Savings Opportunities: More than standard discounting options mean more ways to ensure military members can afford OEM coverage. See our USAA review for details.

- Sturdy Policy Coverage Includes: Comes with genuine OEM coverage as required to repair and replace.

Cons

- Eligibility Restrictions: Available only for military members and families; access to OEM coverage is restricted.

- Narrow Policy Selection: In some areas, the range of policies available may be limited, affecting choices for OEM coverage.

#3 – Liberty Mutual: Best for RightTrack Program

Pros

- Innovative RightTrack Program: Safe driving could generate possible savings on new vehicle-insured coverage as part of our pioneering RightTrack program.

- Extensive Savings Opportunities: A 25% bundle policy discount makes OEM coverage practical.

- Diverse Policy Options: Liberty Mutual provides a variety of plans that include effective OEM coverage for repairs. See our Liberty Mutual review for more.

Cons

- Claims Processing Delays: A few customers say claims are slow to process, which can be particularly frustrating when it’s OEM coverage.

- Higher Average Rates: OEM coverage rates may exceed those available from other insurance providers, diminishing its cost benefit.

#4 – Geico: Best for Various Discounts

Pros

- Competitive Discounts: Geico is well-known for offering car insurance discounts on OEM coverage to government employees, first responders, and students.

- Significant Bundling Discounts: Our Geico renters insurance review shows how to maximize savings on OEM coverage when you bundle home or renters insurance.

- Efficient Online Tools: Easy-to-use platform for policy management and access to original equipment manufacturer coverage.

Cons

- Limited Customization Options: A few customers might find that policies don’t offer the flexibility they desire for original equipment manufacturer coverage.

- Variable Claims Experiences: Feedback indicates inconsistencies in handling claims related to OEM coverage.

#5 – Nationwide: Best for Deductible Options

Pros

- Nationwide Private Client: This add ons includes OEM auto insurance deductibles up to $10,000.

- Customizable Coverage Solutions: Customers can tailor their policies, including specific features for original equipment manufacturer coverage.

- Substantial Bundling Savings: Offers a 20% discount for combining insurance policies, making OEM coverage more accessible. Learn more in our Nationwide review.

Cons

- Higher Premium Rates: Customers might find that premiums are significantly higher with some providers, with one of the main factors affecting the cost of OEM coverage being premium rates.

- Delayed Claims Processing: Many become frustrated with how long it takes to handle a claim when they specifically needed OEM coverage.

#6 – State Farm: Best for Cheap Rates

Pros

- Affordable Rate Options: State Farm has cheap full coverage insurance with OEM starting at $174/month.

- Extensive Agent Network: A wide array of local agents provides personalized assistance for original equipment manufacturer coverage needs.

- User-Friendly Digital Tools: Features an intuitive app that simplifies policy management, including OEM coverage details. Read our State Farm review for more.

Cons

- Uneven Financial Strength: State Farm financial rating with A.M. Best was lowered to a B last year, which could cause problems for some claimants seeking OEM insurance as well.

- Fewer Discounts: Not as many discounts are available for original equipment manufacturer protection, potentially reducing savings compared to competitors.

#7 – Travelers: Best for Unique Coverage

Pros

- Diverse Coverage Plans: Offers a wide selection of specialized policies that address various customer needs, including OEM coverage.

- Strong Financial Ratings: An A++ rating from A.M. Best indicates reliable claims handling and stability for OEM coverage. Find the full list in our Travelers review.

- Big Discounts for Safe Drivers: Travelers OEM parts coverage comes with 20% savings for safe and low-mileage drivers.

Cons

- Less Attractive Bundling Incentives: The bundling discount may not be as competitive as those offered by larger insurers for OEM coverage.

- Discrepant Claims Processing: The time to process claims differs based on customer reviews of original equipment manufacturer coverage.

#8 – Progressive: Best for Roadside Assistance

Pros

- Comprehensive Roadside Assistance: Provides a broad set of roadside coverage for those with OEM plans. Get a complete view in our Progressive review.

- Budget-Friendly Premiums: Known for competitive rates, making original equipment manufacturer coverage more attainable for a broader audience.

- Superior Online Services: An advanced online platform allows agents to manage policies, conduct virtual policy management, and access OEM information.

Cons

- Slower Processing of Variable Claims: Some clients report delays when processing claims related to original equipment manufacturer coverage.

- Customer Support Inconsistency: Policyholders may receive varied customer service experiences, especially regarding OEM coverage.

#9 – American Family: Best for Loyalty Rewards

Pros

- Genuine Parts Offers: A loyalty rewards program that provides benefits, such as original equipment manufacturer coverage for long-term customers.

- Major Bundling Discounts: This 25% bundling discount does a lot to help drive families toward OEM coverage.

- Comprehensive OEM Coverage Options: Policies often include extensive OEM coverage to ensure high-quality vehicle repairs. Explore our American Family review.

Cons

- Limited Customization Choices: Some plans may not offer as much flexibility as larger insurers regarding original equipment manufacturer coverage options.

- Inconsistent Claims Processing: AmFam has been sued by consumers and state regulators for using improper parts on vehicles with original equipment coverage.

#10 – Farmers: Best for Great Add-ons

Pros

- Variety of Add-on Options: Farmers includes many add-on options, such as OEM coverage for better vehicle protection. Find additional info in our review of Farmers.

- Large Agent Network: Rather than impersonal customer service, Farmers offers a network of local agents who assist end users with their original equipment manufacturer (OEM) protection.

- Farmers Discount: Farmers offers a 20% discount on bundled policies, which could make even OEM coverage an affordable option.

Cons

- Average Premium Rates: Farmers’ premiums are generally average, which may make basic insurance and OEM coverage more costly than some other options.

- Good Variable of Claims Processing Feedback: There are mixed customer reviews regarding claims processing, which could affect the overall OEM protection experience as well.

Shifting Gears to Affordable Car Insurance With Original Equipment Manufacturer (OEM) Coverage

What kind of car insurance do you really need? OEM coverage is only available with full coverage policies. This guide breaks down key competitors – minimums starting around $80 a month, and full coverage averaging about $175 per month.

Compare quotes from top insurers to get the best option for you that works with your budget and coverage.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $85 | $175 | |

| $83 | $173 | |

| $81 | $177 | |

| $82 | $172 | |

|

$88 | $180 |

|

$86 | $178 |

| $89 | $182 | |

| $84 | $174 | |

| $87 | $179 | |

| $80 | $170 |

It will increase what you pay each month, but full coverage auto insurance with OEM aids in preserving your automobile's value and ensures superior maintenance.

Do you know the costs of having the wrong car insurance coverage? It’s important to explore all available options when getting quotes to ensure you find the best rates and coverage that fit your needs.

Comparing Discounts for Original Equipment Manufacturer (OEM) Car Insurance

The following are some of the key discounts you should look at to save on your car insurance with OEM coverage:

- Safe Driver Discount: Rewarded for maintaining a clean driving record.

- Get a Bundle Discount: Save more by bundling your auto and home policies.

- Best Student: Another potential way you can save is by being a good student.

- Safety Tech Discount: Savings on cars with OEM safety tech.

- Discounts for Driving Less Than Average: Also known as low-mileage rate.

Most of the top companies selling original equipment insurance policies offer these and many more discounts to help reduce rates.

| Insurance Company | Available Discount |

|---|---|

| New Car Replacement, Safe Driving Bonus, Multi-Policy, Accident Forgiveness | |

| New Car Replacement, Multi-Policy, OEM Coverage, Safe Driver | |

| Signal® App, New Car Replacement, Multi-Policy, OEM Coverage | |

| OEM Coverage, Multi-Policy, Defensive Driving, Safe Driver | |

|

New Car Replacement, Multi-Policy, Accident Forgiveness, Safe Driver |

|

Vanishing Deductible®, OEM Coverage, Multi-Policy, Accident-Free |

| OEM Coverage, Snapshot®, Multi-Policy, Continuous Insurance | |

| Drive Safe & Save™, OEM Coverage, Multi-Policy, Accident-Free | |

| OEM Coverage, New Car Replacement, Multi-Policy, Safe Driver | |

| OEM Coverage, Multi-Policy, Loyalty, Safe Driver |

USAA has the best military car insurance discounts on OEM coverage, while Liberty Mutual, State Farm, and Farmers offer competitive usage-based discounts.

Your Guide to Finding the Best Original Equipment Manufacturer (OEM) Car Insurance

The best car insurance with OEM coverage comes from Allstate, USAA, and Liberty Mutual, which are known for their excellent customer service and comprehensive insurance coverage, including what is comprehensive insurance coverage tailored to your needs.

If you are into the market for the best car insurance having original equipment manufacturer coverage, actually this feature make sure that your vehicle original parts maintained while being repaired and hence preserve its value value of a car as well as performance.

If you are in the market for best car insurance with OEM coverage, be aware that this guarantees your vehicle will get repaired using original parts so it keeps its value and performance levels.

See our free online comparison tool below by simply typing in your ZIP code to get started.

Frequently Asked Questions

What is OEM car insurance?

OEM car insurance covers repairs guarantees that your vehicle is repaired with original parts, maintaining its value and performance.

Which is the best car insurance with OEM coverage?

The best auto insurance with original equipment manufacturer (OEM) coverage often includes options like Allstate, USAA, and Liberty Mutual.

Does car insurance have to use OEM?

No, but many policies will cover Original Equipment Manufacturer (OEM) parts if you ask. You will be responsible for any extra costs if you don't have an OEM rider on your policy.

Do I need OEM parts for my car?

OEM parts are recommended for quality, compatibility, and maintaining warranty coverage, though they may cost more than aftermarket options.

Who are the top 10 car insurance companies?

The top 10 insurance companies by market value are State Farm, Geico, Progressive, Allstate, USAA, Farmers, Nationwide, American Family, Liberty Mutual, and Travelers. Compare that to our list of the best car insurance companies.

What are the top three types of car insurance?

The three main types of car insurance are liability, collision, and comprehensive. Three of them would be part of a full coverage policy.

Which insurance cover is best for a car?

Full coverage car insurance is best for your vehicle, especially if you want original equipment coverage.

What car insurance company offers the cheapest full coverage with OEM coverage?

USAA has the cheapest car insurance with original equipment manufacturer (OEM) coverage starting at $170/month.

How do I know if a car part is OEM?

Check for a manufacturer-specific part number and branded packaging to verify if a car part is OEM. OEM parts often include documentation, like certificates or invoices, and should be purchased from authorized dealers or trusted retailers that clearly label them as OEM.

Is OEM car insurance worth it?

Insuring original market parts is often necessary if you drive a sports, luxury, or exotic car in order to protect the appreciation of these vehicles.