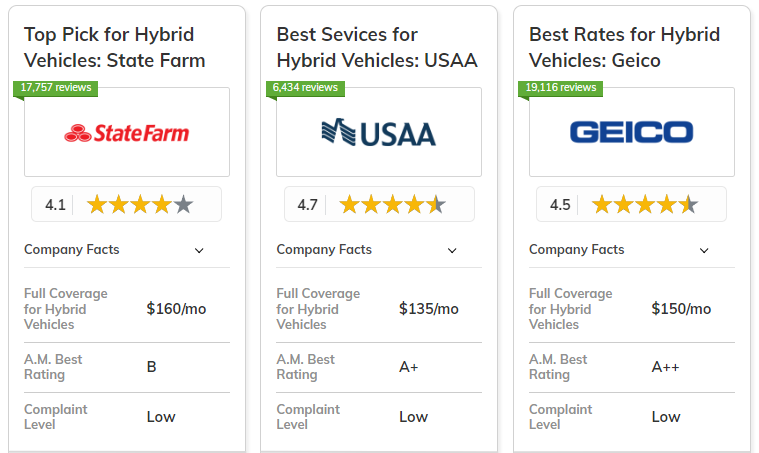

The top pick overall for the best car insurance for hybrid vehicles is State Farm, followed by USAA and Geico for the most affordable options.

With rates starting at $70 per month, State Farm offers comprehensive coverage, while USAA shines in customer service, and Geico delivers the cheapest rates for hybrid drivers.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Coverage | State Farm | |

| #2 | 10% | A++ | Customer Service | USAA | |

| #3 | 25% | A++ | Affordable Rates | Geico | |

|

#4 | 25% | A | Flexible Options | Liberty Mutual |

|

#5 | 20% | A+ | Comprehensive Plans | Nationwide |

| #6 | 10% | A+ | Tech Savvy | Progressive | |

| #7 | 13% | A++ | Environmental Focus | Travelers | |

| #8 | 25% | A+ | Strong Discounts | Allstate | |

| #9 | 25% | A | Family Oriented | American Family | |

| #10 | 20% | A | Custom Coverage | Farmers |

Each company offers unique strengths, from bundling discounts to reliable coverage options and they are also the top car insurance companies that customers recommend.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool above.

What You Should Know

- State Farm, USAA, and Geico are the top car insurance companies for hybrid vehicles

- Coverage for unique hybrid car components like batteries and charging stations

- Eco-friendly discounts and affordable rates are essential for hybrid vehicle owners

#1 – State Farm: Top Overall Pick

Pros

- Hybrid Vehicle Discount: Offers specific discounts for hybrid and electric vehicle owners, encouraging eco-friendly driving.

- Specialized Coverage: Provides tailored policies that address unique needs of hybrid vehicles, including battery protection.

- Drive Safe & Save Program: Rewards low-mileage hybrid drivers with potential savings up to 30%. Learn more about this program in our State Farm car insurance review.

Cons

- Limited EV Charging Network Coverage: May not offer comprehensive coverage for damages related to public charging stations.

- Higher Premiums for Luxury Hybrids: Premium hybrid models might face increased insurance costs due to higher repair expenses.

#2 – USAA: Best for Customer Service

Pros

- Military-Specific Hybrid Discounts: Offers exclusive savings for military members and their families who own hybrid vehicles.

- Alternative Fuel Vehicle Coverage: Provides specialized coverage options for various types of eco-friendly vehicles.

- 24/7 Claims Service: Provides 24/7 support for hybrid vehicle owners to address unique technical issues. Read more about their claims service in our USAA car insurance review.

Cons

- Limited Eligibility: Only available to military members, veterans, and their immediate families.

- Fewer Hybrid-Specific Add-ons: May offer fewer customization options tailored explicitly for hybrid vehicles compared to some competitors.

#3 – Geico: Best for Affordable Rates

Pros

- Hybrid Vehicle Discount: Offers a specific discount for insuring hybrid and electric vehicles, promoting green transportation.

- Usage-Based Insurance Option: DriveEasy program can benefit low-mileage hybrid drivers with potential premium reductions.

- Mechanical Breakdown Insurance: Covers repairs for hybrid vehicle components. Explore what kind of car insurance you really need for your hybrid to ensure comprehensive protection.

Cons

- Limited Specialized Hybrid Coverage: May not offer as many hybrid-specific coverage options as some competitors.

- Potential for Higher Rates in Some Areas: Rates for hybrid vehicles might be higher in certain locations due to repair costs.

#4 – Liberty Mutual: Best for Flexible Options

Pros

- Alternative Energy Discount: In our car insurance review of Liberty Mutual they provide a specific discount for hybrid and electric vehicle owners.

- RightTrack Program: Usage-based insurance option that can benefit efficient hybrid drivers with lower premiums.

- New Hybrid Replacement: Offers a new car replacement program specifically tailored for hybrid vehicles.

Cons

- Complex Policy Structure: Multiple coverage options and add-ons may be confusing for some hybrid vehicle owners.

- Potentially Higher Base Rates: Initial quotes for hybrid vehicles might be higher compared to traditional vehicles.

#5 – Nationwide: Best for Comprehensive Plans

Pros

- Green Vehicle Discount: Offers reduced rates for hybrid and electric vehicle owners. Check which discounts are available in our Nationwide car insurance review.

- SmartRide Program: Usage-based insurance that can particularly benefit fuel-efficient hybrid drivers.

- Hybrid Battery Coverage: Covers costly hybrid battery replacements, helping owners understand why car insurance is so expensive and value tailored coverages.

Cons

- Limited Availability of Some Features: Certain hybrid-specific coverages may not be available in all states.

- Potential for Rate Increases: Premiums might increase more significantly after claims due to higher repair costs of hybrids.

#6 – Progressive: Best for Tech Savvy

Pros

- Snapshot Program: Usage-based insurance particularly beneficial for efficient hybrid drivers.

- EV Charging Station Coverage: Offers protection for damage to at-home charging equipment.

- Name Your Price Tool: Allows hybrid owners to find coverage options within their budget constraints. You can learn more about this tool in our Progressive car insurance review.

Cons

- No Specific Hybrid Discount: Unlike some competitors, doesn't offer a dedicated discount just for owning a hybrid vehicle.

- Potentially Higher Rates for Some Hybrids: Luxury or high-performance hybrid models might face elevated premiums.

#7 – Travelers: Best for Environmental Focus

Pros

- Hybrid Vehicle Discount: Offers a specific discount for hybrid and electric vehicle owners.

- IntelliDrive Program: Usage-based insurance option that can benefit low-mileage hybrid drivers. Learn more about this program in our Travelers car insurance review.

- Gap Insurance for Hybrids: Provides coverage for the difference between the car's actual cash value and the amount owed on the lease or loan.

Cons

- Limited Availability: Hybrid-specific discounts and coverages may not be available in all states.

- Potentially Complex Claims Process: Handling claims for hybrid-specific issues might be more complicated than for traditional vehicles.

#8 – Allstate: Best for Strong Discounts

Pros

- Green Vehicle Discount: Offers reduced rates for hybrid and electric vehicle owners.

- Drivewise Program: Usage-based insurance that can particularly benefit fuel-efficient hybrid drivers.

- Replacement Coverage: Offers new car replacement for hybrid vehicles in case of total loss. Allstate car insurance review covers gap insurance as well as total loss coverage.

Cons

- Higher Than Average Base Rates: Initial quotes for hybrid vehicles might be higher compared to some competitors.

- Complex Discount Structure: Multiple savings options may be challenging for hybrid owners to fully optimize.

#9 – American Family: Best for Family Oriented

Pros

- Low Emission Vehicle Discount: As mentioned in our review of American Family car insurance they offer savings for hybrid and other eco-friendly vehicles.

- KnowYourDrive Program: Usage-based insurance option that can benefit efficient hybrid drivers.

- Diminishing Deductible: Reduces collision deductible over time, advantageous for long-term hybrid owners.

Cons

- Limited Availability: Not offered in all states, potentially excluding some hybrid vehicle owners.

- Fewer Hybrid-Specific Coverages: May offer fewer specialized options for hybrid vehicles compared to some competitors.

#10 – Farmers: Best for Custom Coverage

Pros

- Alternative Fuel Vehicle Discount: Provides savings for hybrid and electric vehicle owners.

- Signal App: Usage-based insurance program that can benefit fuel-efficient hybrid drivers. Learn more about their Signal app in our Farmers car insurance review.

- Eco-Rebuild Option: Offers the option to rebuild or repair the hybrid vehicle with more eco-friendly materials after a claim.

Cons

- Complex Policy Structure: Multiple coverage options may be confusing for some hybrid vehicle owners.

- Potentially Higher Premiums: Comprehensive coverage for hybrid vehicles might result in higher initial premiums for some drivers.

Hybrid Vehicle Car Insurance Costs Comparison

Hybrid vehicles are very popular on the roads today, and when looking for the best car insurance rates, it's important to know about both minimum and full coverage.

Compare costs from the table below as it shows monthly rates from the best car insurance companies for hybrid cars.

Hybrid Vehicles Car Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $170 | |

| $84 | $158 | |

| $92 | $175 | |

| $78 | $150 | |

|

$95 | $180 |

|

$88 | $165 |

| $82 | $155 | |

| $85 | $160 | |

| $87 | $162 | |

| $70 | $135 |

Based on this comparison, USAA has the most affordable rates for both minimum and full coverage, which makes it a worthy contender for hybrid vehicles owners.

However, Geico also offers a more affordable package with great discounts for green drivers as opposed to Liberty Mutual which has slightly higher premiums but has more options when it comes to coverage.

Hybrid Vehicle Coverage Options

Hybrid vehicles need the right car insurance policy and that is why you have to be careful when choosing an insurance policy. For more information, read our article titled "What Kind of Car Insurance You Really Need."

The following are the types of insurance that these cars require, battery insurance, mechanical breakdown insurance, charging stations insurance, gap insurance and comprehensive or collision insurance.

These options protect essential components, the sophisticated technology and the high costs of repair of hybrids.

Factors That Affect Hybrid Vehicle Insurance Rates

The price of insuring a hybrid car depends on many things. There’s the kind of car it is and what it’s worth in the market. Then there’s the cost of parts needed to fix it if something goes wrong.

The distance driven, where the car is located, and who is behind the wheel all matter too. Insurance companies consider the car’s price, the specialized parts for hybrids, and the incentives for being eco-friendly that can lower the premiums.

Read More: What a Driving Record Is and What It Tracks

Common Hybrid Vehicle Insurance Discounts

Hybrid cars are relatively new and can be expensive to insure but knowing available discounts can help in reducing the premium.

There are ways customers save money for hybrid cars, and there are also discounts for bundling insurance or for being safe drivers. See chart below:

| Insurance Company | Available Discount |

|---|---|

| Safe Driver, Bundling, New Car, Anti-Theft | |

| Safe Driver, Bundling, Teen Safe Driver, Good Student | |

|

Safe Driver, Bundling, Good Student, Accident Forgiveness |

| Safe Driver, Bundling, Good Student, Homeowner | |

|

Safe Driver, Bundling, New Car, Hybrid/Electric |

|

Safe Driver, Bundling, Vanishing Deductible, SmartRide |

| Safe Driver, Bundling, Snapshot, Homeowner | |

| Safe Driver, Bundling, Accident Forgiveness, New Car | |

| Safe Driver, Bundling, Good Student, Drive Safe & Save | |

| Safe Driver, Bundling, IntelliDrive, Homeowner |

Using these discounts cuts your insurance costs while ensuring comprehensive coverage for your hybrid vehicle. Use our free quote comparison tool below to find the cheapest coverage in your area.

Frequently Asked Questions

Which hybrid car is the cheapest to insure?

The Toyota Prius is often considered the cheapest hybrid to insure due to its affordability, reliability, and lower repair costs, which are attractive factors for insurance companies when calculating premiums.

Can I insure my hybrid battery?

Yes, many of the best car insurance providers for hybrid vehicles offer coverage options that include hybrid battery insurance, either through comprehensive or mechanical breakdown policies, ensuring protection for this essential component.

Read More: Top Ways Customers Save Money on Their Car Insurance

Which car is better hybrid or non-hybrid?

Hybrid cars are better for fuel efficiency and lower emissions, making them ideal for eco-conscious drivers. However, non-hybrid cars might have lower upfront costs and simpler maintenance, depending on your driving habits and budget.

Enter your ZIP code below to compare rates from the top providers near you.

Do electric cars need oil changes?

No, electric cars don’t require oil changes since they don’t have traditional internal combustion engines. This feature can help lower long-term maintenance costs compared to hybrid or non-hybrid vehicles.

Is there a downside to buying a hybrid?

The main downside to buying a hybrid vehicle is the higher upfront cost compared to non-hybrids, as well as potential higher insurance rates due to specialized parts, though many insurance companies now offer discounts to hybrid owners.

Read More: Ultimate Guide to Switching Car Insurance Companies to Save Money

What is the biggest problem with hybrids?

The most significant problem with hybrids is the potential high cost of replacing the battery, though many car insurance providers offer hybrid-specific coverage options to help offset repair and replacement costs.

Is it expensive to replace a hybrid battery?

Yes, replacing a hybrid battery can be expensive and one of the reasons why hybrid car insurance is so expensive, ranging from $2,000 to $8,000. However, some of the best car insurance for hybrid vehicles includes options for battery protection to help cover these costs.

How long can a hybrid car sit without being driven?

A hybrid car can typically sit for 30 days or more without being driven, but it’s best to start the car or drive it periodically to maintain the battery charge and ensure proper function.

Which type of hybrid is best?

Plug-in hybrids (PHEVs) are often considered the best type of hybrid because they offer the flexibility of using electric power for short trips and gasoline for longer journeys, providing a good balance between fuel efficiency and convenience.

How long do hybrid cars last?

Hybrid cars generally last between 150,000 and 200,000 miles, or around 10 to 15 years, with proper maintenance. Many insurance companies offer extended warranties or coverage options for long-term hybrid vehicle protection.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool below.