Find the best car insurance for homeless people from top companies like Progressive, USAA, and Allstate with premiums starting at $140/month.

Discover budget-friendly insurance choices as we offer valuable insights on how to get cheap car insurance from reputable providers. We will delve into the various types of essential coverage, available discounts, and financial assistance resources that can be tailored to your unique circumstances.

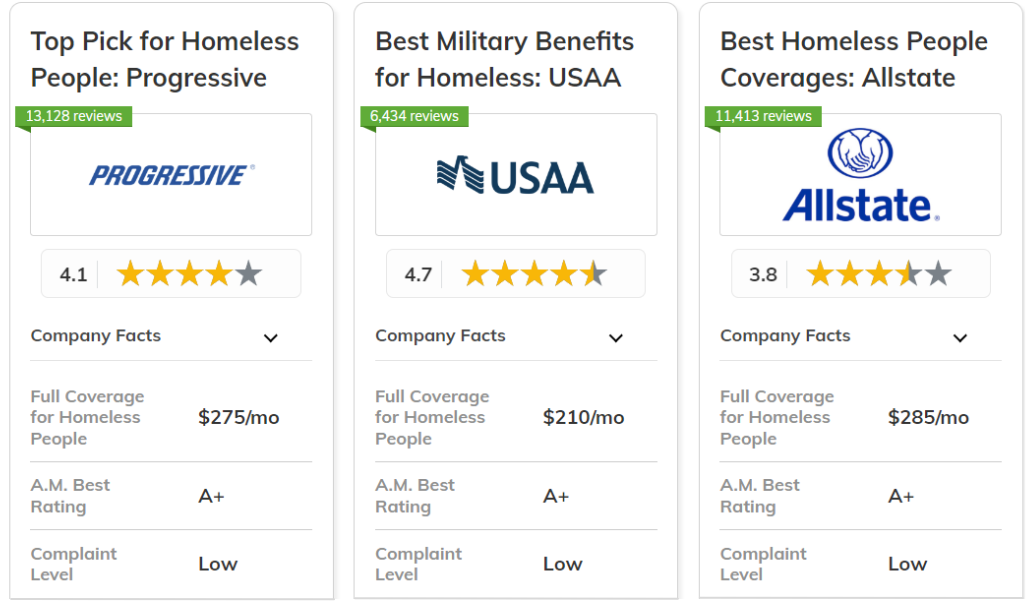

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Consistent Savings | Progressive | |

| #2 | 10% | A++ | Military Benefits | USAA | |

| #3 | 25% | A+ | Comprehensive Coverage | Allstate | |

|

#4 | 25% | A | Tailored Solutions | Liberty Mutual |

| #5 | 17% | B | Nationwide Network | State Farm | |

|

#6 | 20% | A+ | Strong Support | Nationwide |

| #7 | 13% | A++ | Reliable Service | Travelers | |

| #8 | 25% | A++ | Affordable Options | Geico | |

| #9 | 25% | A | Personalized Care | American Family | |

| #10 | 20% | A | Customer Loyalty | Farmers |

By utilizing this information, you can make informed decisions to find the insurance solutions that best align with your needs and financial situation. Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code above into our free comparison tool to see rates in your area.

What You Should Know

- For car insurance for homeless individuals, Progressive's the best option

- Understand the car insurance coverage option for homeless people

- Learn how to get financial assistance for car insurance costs

#1 – Progressive: Top Overall Pick

Pros

- Name Your Price Tool for Customized Coverage: This unique feature allows homeless individuals find affordable protection fit to their limited means.

- Multi-Policy Bundling Discount: The 10% bundling discount can be particularly helpful for homeless people who may have multiple insurance needs.

- Mobile App Accessibility: Progressive car insurance review highlights their user-friendly mobile app, which is especially convenient for homeless individuals.

Cons

- Higher Full Coverage Cost: At $275 for full coverage, Progressive could be challenging for homeless individuals on extremely tight budgets.

- Strict Requirements for Some Discounts: Certain discounts may be inaccessible to homeless individuals.

#2 – USAA: Best for Military Benefits

Pros

- Lowest Full Coverage Cost: At $210 for full coverage, USAA offers the most affordable option for homeless veterans or military family members.

- Vehicle Storage Discount: For homeless individuals who may need to store their vehicle temporarily, USAA offers discounts that can help reduce costs.

- Emergency Roadside Assistance: Our USAA car insurance review details their roadside assistance for homeless people living in their vehicles.

Cons

- Limited Non-Standard Coverage Options: Homeless people with unique vehicle situations may find USAA's non-standard coverage options more limited.

- Potential Coverage Gaps for Long-Term Vehicle Dwellers: USAA's policies may leave coverage gaps for homeless individuals.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options for Vehicle Dwellers: Allstate car insurance review showcases their policies that are beneficial for homeless people.

- Claim Satisfaction Guarantee: For homeless people who rely on their vehicles, Allstate provides added peace of mind during stressful claims process.

- Milewise Pay-Per-Mile Option: This program is particularly beneficial for homeless individuals who don't drive frequently.

Cons

- Limited Non-Owner Car Insurance Options: Allstate's non-owner car insurance options may be more limited for homeless people compared to some other providers.

- Potentially Higher Deductibles: Allstate's policies come with higher deductibles, which could be financially challenging for homeless people.

#4 – Liberty Mutual: Best for Tailored Solutions

Pros

- Tailored Solutions for Unique Situations: Liberty Mutual ranks highly for "Tailored Solutions," which can be particularly beneficial for homeless people.

- Lifetime Repair Guarantee: This feature can be particularly valuable for homeless individuals relying on their vehicles as shelter.

- 24/7 Roadside Assistance: As detailed in our car insurance review of Liberty Mutual, this service can be a lifeline for homeless individuals living in their vehicles.

Cons

- Highest Premium Costs: At $310 for full coverage, Liberty Mutual is costly for homeless individuals on extremely limited budgets.

- Complex Quote Process: Some homeless customers report difficulties in obtaining accurate quotes online.

#5 – State Farm: Best for Nationwide Network

Pros

- Rideshare Driver Coverage: State Farm offers coverage For homeless individuals using their vehicles for rideshare work.

- Flexible Payment Options: State Farm car insurance review shows their various payment plans that can accommodate homeless people.

- Car Rental and Travel Expenses Coverage: This can be particularly valuable for homeless individuals who rely on their vehicles as shelter.

Cons

- Stricter Underwriting for High-Risk Drivers: Homeless individuals with poor driving records may face more challenges getting coverage.

- Less Specialized Support for Homeless Situations: State Farm may lack specific programs or support for the unique challenges faced by homeless people.

#6 – Nationwide: Best for Strong Support

Pros

- Nationwide Network Access: As noted in our Nationwide car insurance review, their extensive network can be beneficial for homeless people.

- Gap Insurance: For homeless people who have financed their vehicles, this coverage can be crucial in protecting them from owing money on a totaled car.

- Pet Injury Coverage: For homeless individuals living in their cars with pets, Nationwide offers pet injury coverage as part of collision protection.

Cons

- Less Flexible Payment Options: Nationwide may offer less flexibility in payment plans, which can be challenging for homeless individuals with low income.

- Limited Coverage for Alternative Living Situations: Policies may not be optimally designed for homeless people living full-time in their vehicles.

#7 – Travelers: Best for Reliable Service

Pros

- Responsible Driver Discount: Homeless individuals with clean driving records can benefit from significant discounts.

- Accident Forgiveness: For homeless people, Travelers' accident forgiveness can prevent rate increases after a first at-fault accident.

- Gap Insurance: Our Travelers car insurance review explains how this coverage can be crucial for homeless people who have financed their vehicles.

Cons

- Potential for Higher Rates in Some Areas: Some homeless people in certain geographic areas may face higher premiums due to Travelers' pricing structure.

- Limited Discounts for Low-Income Individuals: Travelers may not offer as many discount options specifically beneficial to homeless people.

#8 – Geico: Best for Affordable Options

Pros

- Competitive Pricing for Homeless Individuals: At $265 for full coverage, Geico offers a more affordable option for homeless people.

- Multiple Vehicle Discount: For homeless individuals who may own more than one vehicle, Geico's multi-vehicle discount can provide significant savings.

- Non-Owner Car Insurance: Geico offers non-owner policies, providing liability car insurance at a lower cost for homeless people.

Cons

- Less Comprehensive Coverage Options: Geico may offer fewer add-ons or specialized coverages for homeless people with unique insurance needs.

- Potential for Rate Increases After Claims: Some homeless people report unexpected rate increases following claims.

#9 – American Family: Best for Personalized Care

Pros

- Diminishing Deductible: For homeless individuals who maintain safe driving records, this feature can reduce their deductible by $100 each year.

- Loyalty Discount: Long-term homeless customers can benefit from American Family's loyalty discount, potentially reducing premiums over time.

- Community Support: Our review of American Family car insurance mentions their community support may indirectly benefit homeless people in covered areas.

Cons

- Limited Options for Pay-Per-Mile Insurance: American Family may not offer robust pay-per-mile insurance options for homeless individuals.

- Potential for Strict Vehicle Inspection Requirements: Some homeless individuals report stringent vehicle inspection processes.

#10 – Farmers: Best for Customer Loyalty

Pros

- Extensive Customization Options: Farmers car insurance review details homeless individuals to tailor their policies to their unique living situations and needs.

- New Car Pledge: This feature can be particularly valuable for homeless individuals who have recently acquired a vehicle.

- Glass Repair Deductible Waiver: This covers windshield repairs without a deductible for homeless individuals living in their vehicles.

Cons

- Complex Policy Structure: Farmers' three-tiered coverage system (Standard, Enhanced, Premier) can be confusing for homeless individuals.

- Limited Support for Frequent Address Changes: Farmers' systems may not easily accommodate the frequent address changes that homeless individuals get.

Discounts and Car Insurance Prices for Homeless People

Figuring out how much car insurance costs per month can be tricky, especially for individuals experiencing unstable housing situations. This table shows you the differences between the basic and full insurance options from the best companies, so you can choose what’s best for your car.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $180 | $285 | |

| $175 | $290 | |

| $190 | $300 | |

| $165 | $265 | |

|

$200 | $310 |

|

$170 | $280 |

| $160 | $275 | |

| $150 | $245 | |

| $185 | $295 | |

| $140 | $210 |

It's really important for homeless individuals to choose the right insurance to stay financially safe without spending too much. Use this table to help you make a smart choice, and think about contacting insurance companies to find out if they offer any discounts or payment plans that could help you.

Here are the discounts provided by major insurance companies specifically designed to support individuals experiencing homelessness:

| Insurance Company | Available Discount |

|---|---|

| Safe Driver, Bundling, Anti-Theft | |

| Steer Into Savings, Bundling, Low Mileage | |

| Signal, Bundling, Good Driver | |

| Defensive Driver, Bundling, Military | |

|

Bundling, Paperless, Early Shopper |

|

SmartRide, Bundling, Anti-Theft |

| Snapshot, Bundling, Safe Driver | |

| Drive Safe & Save, Bundling, Good Student | |

| IntelliDrive, Bundling, New Car | |

| Military, Safe Driver, Multi-Vehicle |

A safe driver is often characterized by a clean driving record. Many companies recognize this and provide discounts to those who demonstrate responsible driving habits.

By taking advantage of the discounts listed above, you can find more affordable insurance options that offer necessary coverage without straining your budget.

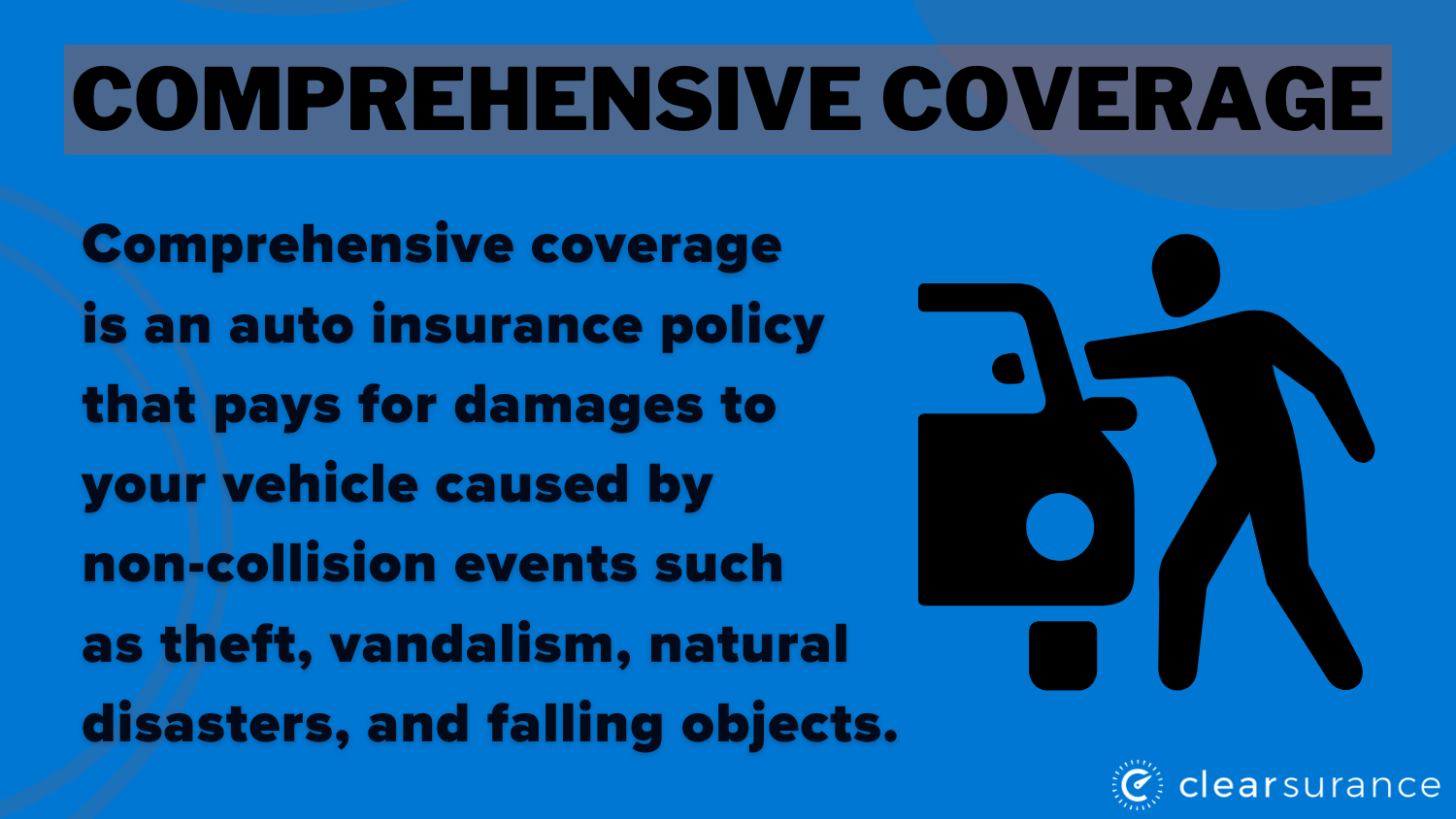

Understanding Car Insurance Coverage Options for Homeless People

Car insurance can be confusing, especially for those without a stable residence. It's crucial to understand the different types of coverage available:

- Liability Coverage: Protects you financially if you're at fault in an accident and covers the other party's injuries and damages.

- Comprehensive Coverage: Covers non-collision-related incidents such as theft, vandalism, and natural disasters.

- Collision Coverage: Pays for damage to your vehicle in case of a collision, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who lacks adequate insurance.

Understanding these different types of car insurance coverage can help you make informed decisions and ensure you're adequately protected, especially if you don't have a stable residence.

By knowing what each coverage entails, you can choose the right policy to fit your needs and safeguard yourself against unexpected financial burdens

Read More: Collision vs. Comprehensive Coverage

Insurance Costs Financial Assistance for Homeless Individuals

Certain nonprofits provide financial aid or resources to cover necessary expenses, including insurance. Many insurance companies like Progressive, USAA, and Allstate also offer flexible payment plans to spread out the cost of premiums.

There are resources available to help homeless individuals afford car insurance. Some states offer assistance programs to help low-income individuals pay for car insurance.

Read More: What happens if you don't pay your car insurance premium for your vehicle?

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Frequently Asked Questions

What is collision insurance?

Collision insurance covers damage to your vehicle after an accident, regardless of fault. It’s essential for protecting your car if it's involved in a collision, especially for those who rely on their vehicle for shelter.

Read More: Collision vs. Comprehensive Coverage

Which person would most benefit from having collision insurance?

Individuals who drive frequently or rely on their vehicle as their primary mode of transportation, including homeless people living in their cars, would benefit most from collision insurance.

What is the difference between full coverage and collision?

Full coverage includes both collision and comprehensive insurance. Collision covers accident-related damages, while comprehensive covers non-collision incidents like theft or weather damage.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

What does comprehensive coverage mean?

Comprehensive coverage protects against non-collision events such as theft, vandalism, or natural disasters. This is especially important for homeless individuals who may park in public areas frequently.

How can insurance protect you from financial loss?

Insurance helps protect against financial loss by covering repair or replacement costs after an accident, theft, or other covered incidents, minimizing the financial impact on drivers.

What is the most important insurance a driver can have?

Liability insurance is the most essential, as it covers damages you cause to others. However, homeless individuals should also consider comprehensive and collision coverage for their own protection.

Which insurance is the most important?

Liability insurance is required by law and protects against financial responsibility for injuries or damage to others. For homeless people, adding comprehensive and collision coverage is crucial.

What is the highest deductible for car insurance?

Deductibles typically range from $500 to $2,500. Higher deductibles can lower your premium but require more out-of-pocket expenses if you file a claim. Read our article titled "What is an insurance deductible?" for more information.

What is a premium in insurance?

A premium is the amount you pay for your insurance policy, usually on a monthly, quarterly, or annual basis. It varies depending on coverage type, location, and driving history.

Is insurance a monthly payment?

Insurance can be paid monthly, but many providers offer discounts for paying premiums in full annually or semi-annually. Monthly payments are common for those needing budget flexibility.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.