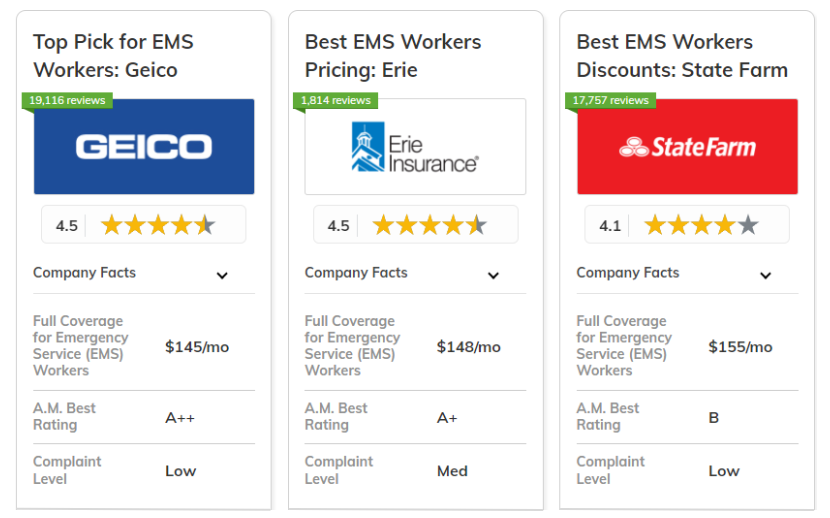

Geico, Erie, and State Farm offer the best car insurance for emergency service workers for $55/month.

With special savings for first responders, Geico is the best option. State Farm distinguishes itself with its many policy selections, whereas Erie excels in customer service and has outstanding scores for consumer car insurance claims ratings.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

|

#2 | 25% | A+ | Claims Service | Erie |

| #3 | 17% | B | Comprehensive Coverage | State Farm | |

| #4 | 10% | A+ | Online Tools | Progressive | |

|

#5 | 20% | A+ | Reliable Coverage | Nationwide |

|

#6 | 25% | A | Customization Options | Liberty Mutual |

| #7 | 20% | A | Safe Drivers | Farmers | |

| #8 | 10% | A++ | Military Benefits | USAA | |

|

#9 | 5% | A+ | Retired Drivers | The Hartford |

| #10 | 15% | A | Bundling Discounts | Safeco |

These providers provide complete protection and affordability while precisely meeting the special needs of emergency personnel.

If you need cheap car insurance for emergency service workers, enter your ZIP code above to compare free quotes today.

What You Should Know

- Geico offers specialized car insurance coverage for EMS workers

- Unique insurance discounts cater to the high-risk needs of EMS professionals

- USAA is the cheapest car insurance company for EMS workers at $48/month

#1 – Geico: Top Overall Pick

Pros

- Savings for EMS Workers Only: Geico provides special savings for EMS personnel. Learn more about the top ways customers have saved money on car insurance rates.

- Customizable Coverage: EMS workers may readily modify their coverage to address certain on-the-job dangers with Geico's customizable coverage.

- Customer Support: Emergency medical care workers need prompt and reliable claims help, and Geico provides it.

Cons

- Local Agent Restrictions: When compared to other insurers, emergency medical personnel in remote locations could think that Geico's agent availability is inadequate.

- Basic Policy Restrictions: Geico's lower-tier insurance might not cover some high-risk EMS-related circumstances.

#2 – Erie: Best Insurance Claims Service

Pros

- Outstanding Claims Service: Erie is known for offering very high-quality customer support that attends to the pressing requirements of emergency medical services personnel.

- Flexible Options for Coverage: Erie gives EMS personnel the ability to customize coverage for emergency service cars as well as personal automobiles.

- Superior A.M. Best Rating: Because of its strong financial standing, Erie can assure that emergency medical services workers are adequately covered in any situation. For further details, see our Erie review.

Cons

- Limitations on Availability: Erie's customized services might not be available to EMS personnel traveling outside of its service areas.

- Higher Premiums: The premiums for Erie's EMS-specific plans may be somewhat higher than those of budget insurers.

#3 – State Farm: Best for Comprehensive EMS Policy Options

Pros

- Many Coverage Choices: State Farm has many policy options, perfect for EMS workers who want full protection.

- Discounts for EMS Workers: People working as EMS get special discounts on policies, making premiums lower. Check out our review of State Farm to find more savings.

- Nationwide Coverage: EMS professionals can rely on State Farm’s widespread availability across all states.

Cons

- Premium Variability: Also with EMS discounts, State Farm’s premiums can still change depending on where you live and what coverage you need.

- Basic Coverage Limits: Certain EMS-specific incidents might not be fully covered under basic plans.

#4 – Progressive: Best for Online Policy Management

Pros

- Easy Online Access: Progressive’s user-friendly online platform allows EMS workers to manage their policies conveniently.

- Snapshot Program: EMS professionals can save more through Progressive’s Snapshot program by tracking safe driving habits.

- Wide Range of Discounts: EMS workers enjoy multiple discounts, lowering the overall cost of premiums. Get a discount list in our Progressive review.

Cons

- Higher Rates for Riskier Areas: Progressive’s premiums for EMS workers may increase significantly in high-risk zones.

- Customer Service Limitations: Progressive’s customer service may not provide the level of immediate support needed for EMS workers in critical situations.

#5 – Nationwide: Best Reliable Coverage

Pros

- On-Your-Side Service: Support when it's most needed is guaranteed by Nationwide's EMS-friendly claims procedure. Read more in our Nationwide Review.

- Specialized EMS Policies: Nationwide offers specialized insurance plans that are tailored to the particular requirements of emergency medical services workers.

- Discounts for Multiple Policies: When EMS workers combine their auto insurance with life or home insurance, they may save money and make it more reasonable.

Cons

- Limited Customization: Nationwide might not have enough alternatives that are tailored to the unique hazards of EMS jobs, even though bundling is beneficial.

- Additional Costs for Specialty Plans: Specialized plans for emergency medical care may be more expensive than more basic coverage.

#6 – Liberty Mutual: Best for EMS Coverage Customization

Pros

- Customizable EMS Policies: Liberty Mutual allows EMS professionals to adjust their policies for unique work-related risks.

- 24/7 Claims Support: EMS workers can access Liberty Mutual’s round-the-clock claims service, vital for emergency professionals.

- Affordable EMS Discounts: Our Liberty Mutual review offers more information on discounts specifically for EMS personnel.

Cons

- Higher Premiums for Comprehensive Plans: EMS workers seeking full coverage might find Liberty Mutual’s prices on the higher side.

- Limited Local Agent Support: EMS professionals in rural areas may find it harder to access in-person support from agents.

#7 – Farmers: Best for EMS Safe Driver Discounts

Pros

- Discounts for Safety Drivers: Personnel of EMS having flawless records in driving can save a substantial amount of money at Farmers. See more details in our Farmers reviews.

- Many Policy Options: People who work for EMS can change their insurance to protect against dangers in both personal and professional life.

- Assistance on the Road: With their insurance coverage, Farmers also give medical care providers emergency help if they are stuck on the road. There are more benefits too.

Cons

- Premium Hike Over Time: After the initial year, EMS workers resorting to Farmers' services may notice their premiums going up.

- Limited Coverage for EMS: Despite that Farmers provides many types of policies, their insurance choices specifically designed for EMS may not be as wide-ranging compared to other insurers.

#8 – USAA: Best for Military Families

Pros

- Special Reductions for EMS and Military Personnel: USAA presents significant markdowns for professionals in Emergency Medical Services, particularly those having a military history.

- Great Appreciated Customer Help: USAA is recognized for wonderful customer help, very important for EMS workers who need fast aid.

- Full Coverage Choices: USAA gives variable plans that are suitable for EMS specialists and their relatives. Uncover insights in our USAA reviews.

Cons

- Eligibility Restrictions: USAA is only available to EMS professionals with military ties, limiting access.

- Non-Military EMS Support Limited: USAA gives attention mainly to military EMS personnel. This leaves less choices for civilian EMS professionals.

#9 – The Hartford: Best for Retired EMS Workers

Pros

- AARP Discounts: Retired EMS workers who are AARP members can access additional discounts. Read more in The Hartford customer reviews.

- Accident Forgiveness Program: EMS workers benefit from Hartford’s accident forgiveness, which prevents rate increases after a first-time incident.

- Tailored EMS Coverage: The Hartford offers EMS-specific coverage that addresses both personal and professional risks.

Cons

- AARP Membership Required: Certain discounts and benefits are limited to EMS workers who are also AARP members.

- Limited Online Management: EMS workers may find Hartford’s online management tools less intuitive than other providers.

#10 – Safeco: Best for Bundled Discounts

Pros

- Opportunities for Bundling: EMS workers can get savings through bundling their auto insurance with other policies, like home or renters insurance.

- Emergency Support Add-Ons: Safeco has special add-ons like EMS roadside assistance. Get the details in our Safeco review.

- EMS Premium Discounts: EMS workers get special discounts, which help reduce the total premium expenses.

Cons

- Higher Deductibles: Safeco insurance deductibles for certain EMS-specific policies may be higher than competitors.

- Difficult Claims Process: EMS workers might think Safeco’s claims process is harder than they imagined, especially when quick help is needed.

Car Insurance Coverage Comparisons for Emergency Service Workers

Carefully weighing the expenses of monthly minimum and full coverage is necessary to choose the most affordable insurance plan for EMS workers. Finding the greatest deal on the appropriate degree of protection requires comparing the leading providers.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

|

$55 | $148 |

| $73 | $183 | |

| $55 | $145 | |

|

$70 | $175 |

|

$65 | $160 |

| $65 | $165 | |

| $65 | $165 | |

| $60 | $155 | |

|

$70 | $175 |

| $48 | $130 |

USAA stands out by offering the lowest monthly car insurance rates for EMS workers at $48, but these rates are only available to first responders from military families.

In terms of full coverage, Geico remains competitive with a monthly rate of $145, while insurers such as Liberty Mutual and The Hartford trend toward the higher end at $175.

Read More: What is comprehensive insurance coverage?

Specialized Car Insurance Discounts for Emergency Service Workers

Emergency service workers qualify for exclusive discounts on car insurance. These discounts recognize the unique risks EMS personnel face and reward safe driving habits and loyalty.

| Insurance Company | Available Discount |

|---|---|

|

First Responder, Bundling, Safe Driver, Multiple Vehicle, Young Driver, Anti-Theft |

| Occupation-Based (Including EMS Workers), Safe Driver, Bundling, Multiple Vehicle, Good Student, Defensive Driving Course | |

| Emergency Deployment, Military, Federal Employee, Multiple Vehicle, Defensive Driving Course | |

|

First Responder, Safe Driver, Bundling, Good Student, Paperless Billing, Pay-In-Full |

|

Professional Organization, Safe Driver, Bundling, Automatic Payment, Defensive Driving Course, Anti-Theft |

| Emergency Services, Safe Driver, Bundling, Multiple Vehicle, Paperless Billing, Pay-In-Full | |

| Emergency Responder, Bundling, Safe Driver, Multiple Vehicle, Good Student, Pay-In-Full | |

| Emergency Service Personnel, Bundling, Multiple Vehicle, Safe Driver, Defensive Driving, Good Student | |

|

AARP Membership, First Responder, Defensive Driving Course, Bundling, Anti-Theft, Vehicle Safety Features |

| Military And EMS, Safe Driver, Bundling, Loyalty, Family, Defensive Driving Course |

For instance, Erie provides a first responder discount and recognizes the importance of safe driving by including both safe driver and anti-theft discounts.

Discounts are one of the easiest ways to get cheap car insurance for EMS workers and first responders.

Finding the Right Car Insurance Coverage for Emergency Service Professionals

Geico, Erie, and State Farm have the best car insurance for emergency service workers due to their targeted benefits exclusive to first responders.

Geico excels with emergency-specific discounts and fast response services, while Erie and State Farm provide unmatched customer service and rewards for long-term EMS personnel.

When you bundle, you don't have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

Emergency Service workers face unique challenges on the road, making it essential to compare multiple quotes to find the best insurance. Online tools make this easier by providing quick comparisons.

Check out our helpful guide on what to know about buying auto insurance online to help EMS professionals secure the right coverage. You can also use our free quote tool to get free insurance quotes from local companies.

Frequently Asked Questions

How much does car insurance cost for emergency service workers?

Full coverage car insurance for emergency service workers generally starts at around $145 per month, depending on the coverage level and insurer. Explore more details in our car insurance shopping guide.

What is the most affordable car insurance for emergency service workers?

USAA is the least expensive option for emergency service workers. Prices start around $48/month for basic coverage with USAA or $55/month with Geico or Erie.

Are first responders and EMS workers eligible for USAA car insurance?

EMS workers can buy USAA insurance if they, their parents, or their spouses are active or retired military members. Find out how to qualify in our USAA review.

Is AARP car insurance for EMS workers cheaper than Allstate?

Retired emergency service workers and first responders often get cheaper car insurance through The Hartford and AARP than Allstate.

What are the benefits of car insurance for emergency service workers?

Car insurance for EMS workers provides critical protection during high-risk situations and emergency responses, with many policies offering unique discounts tailored to their needs.

Is comprehensive insurance required for emergency service workers?

Comprehensive insurance coverage is not required for emergency service workers unless they have an auto loan or lease. It offers valuable coverage for incidents like theft, fire, or weather-related damage.

How much is a car insurance deductible for emergency service workers?

For EMS workers, car insurance deductibles typically range from $250 to $1,000 per month, depending on the policy and provider.

Which type of car insurance is the most suitable for emergency service workers?

Full coverage, which includes liability, collision, and comprehensive insurance, is often the best choice for EMS workers due to their elevated risk on the road. Enter your ZIP code to find cheap full coverage insurance near you.

What does roadside assistance cover for emergency service workers?

Roadside assistance for EMS workers includes services like towing, jump-starting the battery, and fuel delivery if their vehicle breaks down. Compare the best car insurance companies for roadside assistance to learn more.

How can EMS workers file a car insurance claim?

To file a car insurance claim, contact your insurer, provide necessary documentation, and follow the provider’s process, which may involve submitting repair estimates or arranging vehicle inspections. Learn more about when to file a car insurance claim.