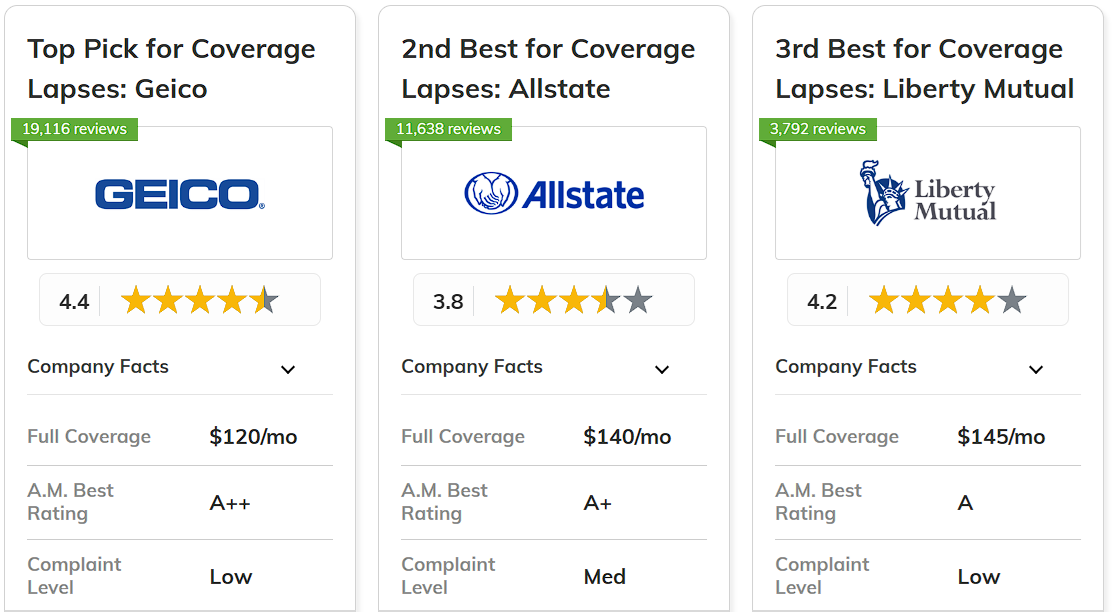

Progressive, Geico, and Allstate are the best car insurance companies that don't penalize for a coverage lapse, starting at $75/month.

Geico has the cheapest rates after a gap in coverage, but Progressive encourages continuous coverage with loyalty discounts and rewards, including accident forgiveness.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #3 | 25% | A++ | Senior Drivers | Geico | |

| #2 | 25% | A+ | Mileage-Based | Allstate | |

|

#9 | 25% | A | Green Discount | Liberty Mutual |

|

#5 | 20% | A+ | Deductibles | Nationwide |

| #7 | 20% | A | OEM Coverage | Farmers | |

| #6 | 17% | A++ | Students | State Farm | |

| #8 | 13% | A++ | Financial Stability | Travelers | |

| #1 | 10% | A+ | Loyalty Rewards | Progressive | |

| #4 | 10% | A++ | Military Savings | USAA | |

|

#10 | 5% | A+ | Retired Drivers | The Hartford |

If you're worried about a lapse in your car insurance, our guide to the best car insurance for lapse coverage has you covered.

We rank the top providers, highlighting key benefits like mileage-based savings, military deployment coverage, and new car replacements. Discover the top ways customers have saved money on car insurance, strategies to restore your insurance history, state-specific laws, and usage-based policies.

Ready to find cheaper car insurance coverage? Enter your ZIP code above to begin.

What You Should Know

- Insurance providers consider a gap in car insurance high-risk

- Geico has the best rates after a gap in auto insurance for $75/month

- Drivers with gaps in coverage should consider usage-based insurance plans

#1 – Progressive: Top Overall Pick

Pros

- Loyalty Rewards: Long-term customers are offered increasing benefits that encourage continuous coverage.

- Bundling Options: Offers big discounts when you combine auto with home or renters insurance.

- Pet Injury Coverage: Includes protection for pets injured in car accidents at no extra cost. Learn more in our Progressive car insurance review.

Cons

- Rate Fluctuations: Drivers with insurance gaps complain about rate increases after renewal in some states despite loyalty and continuous coverage discounts.

- Coverage Gaps: Not all states offer some of these optional coverages.

#2 – Allstate: Best for Pay-Per-Mile Insurance

Pros

- Milewise Program: Drivers can save money using the pay-per-mile insurance option when restarting their insurance after a coverage lapse.

- New Car Replacement: Offers full replacement for new cars totaled within the first two years.

- Claim Satisfaction Guarantee: Provides a credit if you're unsatisfied with your claims. Explore more details in our Allstate car insurance review.

Cons

- Add-On Costs: Some additional coverage may be needed in order to purchase some desirable features.

- Local Agent Variability: Quality of service can depend on your assigned local agent.

#3 – Geico: Best for Senior Drivers

Pros

- Prime Time Contract: Offers guaranteed renewal for customers over 50 with clean driving records.

- Emergency Roadside Assistance: Provides affordable add-on for 24/7 help, useful when restarting coverage.

- Mechanical Breakdown Coverage: Offers protection similar to an extended warranty for new cars. Geico is one of the best car insurance companies for federal employees.

Cons

- Limited Bundling Options: Fewer choices for combining different types of insurance policies.

- No Gap Insurance: Doesn't offer loan/lease gap coverage, which some restarting coverage might need.

#4 – USAA: Best for Military Deployment Coverage

Pros

- Vehicle Storage Discount: They offer reduced rates when you use your vehicle while deployed to help avoid coverage lapse.

- No-Fee Payment Plans: Allows flexibility in paying while not charging extra for drivers to keep their policies.

- Moving Coverage: It automatically adjusts policies for driver relocations so drivers don’t have an unexpected gap in coverage. Discover more in our USAA insurance review.

Cons

- Strict Membership Criteria: Only available to military members, veterans, and their families.

- Limited Physical Locations: Primarily operates online and by phone, with few in-person offices.

#5 – Nationwide: Best for Total Loss Deductible Waiver

Pros

- Total Loss Deductible Waiver: You don’t have to pay your deductible if your car is totaled, which is good for restoring coverage.

- Accident Forgiveness: Available as an add-on to prevent rate increases after your first at-fault accident.

- Gap Coverage: Offers protection for the difference between car value and loan balance. Learn more in our Nationwide car insurance review.

Cons

- Telematics Program Participation: Some discounts require you to enroll in usage based insurance programs.

- Policy Customization: Coverage options may not be fully understood and optimized without professional help.

#6 – State Farm: Best for Student Discounts

Pros

- Steer Clear Program: Offers discounts for young drivers completing safe driving courses.

- Rideshare Coverage: Offers add-on protection for drivers working with rideshare companies. Explore more in our State Farm car insurance review.

- Excellent Claims Service: State Farm is among the top five companies for car insurance claims satisfaction.

Cons

- Inconsistent Pricing: The amount you pay for coverage can be very different before and after a lapse.

- Lower Financial Ratings: State Farm has a lower A.M. Best rating than other insurance companies that don't penalize for a lapse in coverage.

#7 – Farmers: Best for Original Equipment Manufacturer (OEM) Coverage

Pros

- Guaranteed Value Coverage: Offers agreed-upon value for collector or custom cars.

- OEM Coverage: Ensures that repairs use original manufacturer parts for newer vehicles, and classic or luxury autos.

- Glass Deductible Buyback: Option to have a $100 deductible on glass claims. Read more in our Farmers car insurance review.

Cons

- Complex Discount System: After a lapse in coverage, it may be difficult to understand all of the available savings opportunities.

- Mixed Customer Service Reviews: Different policyholders have inconsistent experiences with claims handling.

#8 – Travelers: Best for Financial Stability

Pros

- Excellent Financial Ratings: It's one of the most trusted companies that don't penalize for a gap in coverage, with an A++ A.M. Best rating and over 100 years in the industry.

- Decreasing Deductible: Reduces your deductible by $50 for every claim-free year, up to $500. Read how it works in our Travelers car insurance review.

- Affinity Program: Also offers discounts through employers or member groups, good for those just starting back on coverage.

Cons

- Eligibility for Discounts: Other savings opportunities may come with strict qualification requirements.

- Limited Rideshare Coverage: In states that don’t offer Travelers rideshare insurance, gig workers with a hole in their car insurance may be out of luck.

#9 – Liberty Mutual: Best for Alternative Energy Discounts

Pros

- Hybrid/Electric Vehicle Discount: Offers savings for environmentally friendly vehicles. Learn more in our car insurance review of Liberty Mutual.

- Liberty Mutual Deductible Fund: You can reduce your deductible by $100 if you renew your car insurance annually.

- Teachers' Auto Insurance: Special coverage for educators with a lapse in coverage and personal property used in teaching.

Cons

- Varied State Availability: Some coverages and discounts after a lapse in coverage may not be available in all states.

- Potential for Rate Increases: Some customers will see big bumps in their premiums after the first policy period.

#10 – The Hartford: Best for Retired Drivers

Pros

- Retiree Occupational Discount: The Hartford is one of the best car insurance companies for senior drivers. It offers savings for AARP members who are active volunteers.

- Disappearing Deductible: Reduces collision deductible by $150 for each year of safe driving, up to $500.

- 12-Month Rate Protection: Guarantees your rate won't change for a full year, providing stability after a gap in insurance.

Cons

- Age Restrictions: The Hartford is for drivers over 65 and limits options for younger individuals with a gap in insurance.

- Quote Process: May require more detailed information compared to some competitors when shopping for car insurance after a lapse in coverage.

Best Car Insurance Rates After a Lapse in Coverage

The best auto insurance companies that do not penalize you for having a gap in your coverage will have competitive rates for both minimum and full coverage insurance. Compare monthly rates below:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $140 | |

| $89 | $138 | |

| $75 | $120 | |

|

$93 | $145 |

|

$88 | $135 |

| $85 | $130 | |

| $82 | $128 | |

|

$91 | $140 |

| $87 | $132 | |

| $80 | $125 |

After a lapse, Geico has some of the best prices for both coverage types. Minimum coverage starts at $75 monthly, while full coverage costs $120 monthly.

Progressive and State Farm also have fairly decent options for those with any gaps in their coverage. Compare more providers in our guide to saving money by switching car insurance companies.

How to Save on Car Insurance for Lapsed Coverage

It’s important to know what happens if you don't pay your car insurance premium?. A gap in car insurance occurs when your current policy ends without a new one in place.

Providers view insurance lapses as high-risk behavior and will charge higher rates when you buy new coverage. Rates are climbing everywhere, yet some companies offer discounts to attract new customers.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Multi-Vehicle, Safe Driver, Anti-Theft Device, New Car, Early Signing, Autopay, Good Student | |

| Multi-Policy, Multi-Vehicle, Safe Driver, Signal (telematics), Good Student, Homeowner, Professional, Mature Driver | |

| Multi-Policy, Multi-Vehicle, Safe Driver, Anti-Theft Device, Military, Federal Employee, Emergency Deployment, Good Student, Seat Belt Use | |

|

Multi-Policy, Multi-Vehicle, Safe Driver, Online Purchase, Paperless, Pay-In-Full, New Graduate, Military, Early Shopper |

|

Multi-Policy, Multi-Vehicle, Smart Ride (telematics), Smart Miles (pay-Per-Mile), Safe Driver, Paperless, Anti-Theft Device, Autopay |

| Multi-Policy, Multi-Vehicle, Safe Driver, Continuous Insurance, Homeowner, Online Quote, Paperless Billing, Pay-In-Full | |

| Multi-Policy, Multi-Vehicle, Safe Driver, Steer Clear (for Young Drivers), Good Student, Defensive Driving, Anti-Theft Device | |

|

Multi-Policy, Multi-Vehicle, Safe Driver, Anti-Theft Device, Driver Training, Aarp Member, Defensive Driver, Vehicle Fuel Type |

| Multi-Policy, Multi-Vehicle, Safe Driver, Homeowner, New Car, Pay-In-Full, Good Payer, Continuous Insurance | |

| Multi-Policy, Safe Driver, New Vehicle, Annual Mileage, Military Installation, Good Student, Family Discount |

Usage-based and pay-per-mile policies are great options for drivers with lapsed car insurance coverage. Allstate Milewise and Nationwide SmartMiles set rates based on the miles you drive every month, while Progressive Snapshot tracks and rewards safe driving habits.

Check out insurers that offer mileage-based or usage-based car insurance. These can be less expensive if you’ve had a lapse in coverage.

Comparing the Best Companies After a Gap in Car Insurance

Progressive, Allstate, and Geico are the best car insurance companies that don't penalize for a coverage lapse. If you renew your policy with Progressive, you can receive a 15% discount.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

What happens if you let a car insurance policy lapse?

If you let an insurance policy lapse, you'll lose coverage and potentially face legal penalties, higher future premiums, and financial responsibility for any accidents or damages.

What will happen if I didn't renew my car insurance?

If you don't renew your car insurance, you'll be driving uninsured, risking legal consequences, fines, license suspension, and personal liability for any accidents. Our free online comparison tool below allows you to compare cheap car insurance quotes instantly so you can find coverage quickly. Enter your ZIP code to get started.

What is the lapse risk of insurance?

Lapse risk refers to the possibility of a policy terminating due to non-payment of premiums, potentially leaving the policyholder without coverage and facing various consequences.

How long can you go without car insurance before being penalized?

In most states, driving without insurance can result in immediate penalties. Learn more about the penalty for driving without car insurance in various states.

How do you avoid a lapse in car insurance coverage?

Paying your car insurance premiums on time and signing up for automatic renewal can help you avoid coverage gaps.

Will my car insurance automatically renew?

Most car insurance policies auto-renew, but it's not guaranteed. Always confirm with your insurer and ensure your payment information is up-to-date.

What does non-renewal mean in car insurance?

Non-renewal occurs when an insurer decides not to continue coverage at the end of a policy term, often due to increased risk or changes in underwriting guidelines.

Is there a cancellation fee for Progressive car insurance?

Progressive typically doesn't charge a cancellation fee, but policies vary. For details on Progressive's cancellation policies, see our Progressive car insurance review.

Can I get my money back if my car insurance lapsed?

Insurance companies typically don't reimburse for periods of non-coverage.

Can I revive a lapsed car insurance policy?

Some insurers offer policy reinstatement within a certain timeframe after a policy lapses. Contact your insurer immediately to explore options for reviving a lapsed policy.