When looking for the best car insurance companies that don't monitor your driving, State Farm, USAA, and Nationwide are our go-to insurers. USAA offers the best overall rates, starting at just $35/month.

When looking for the best car insurance companies that don't monitor your driving, State Farm, USAA, and Nationwide are our go-to insurers. USAA offers the best overall rates, starting at just $35/month.

We are here to help you find the best companies that provide solid coverage and a range of discounts without watching your every move.

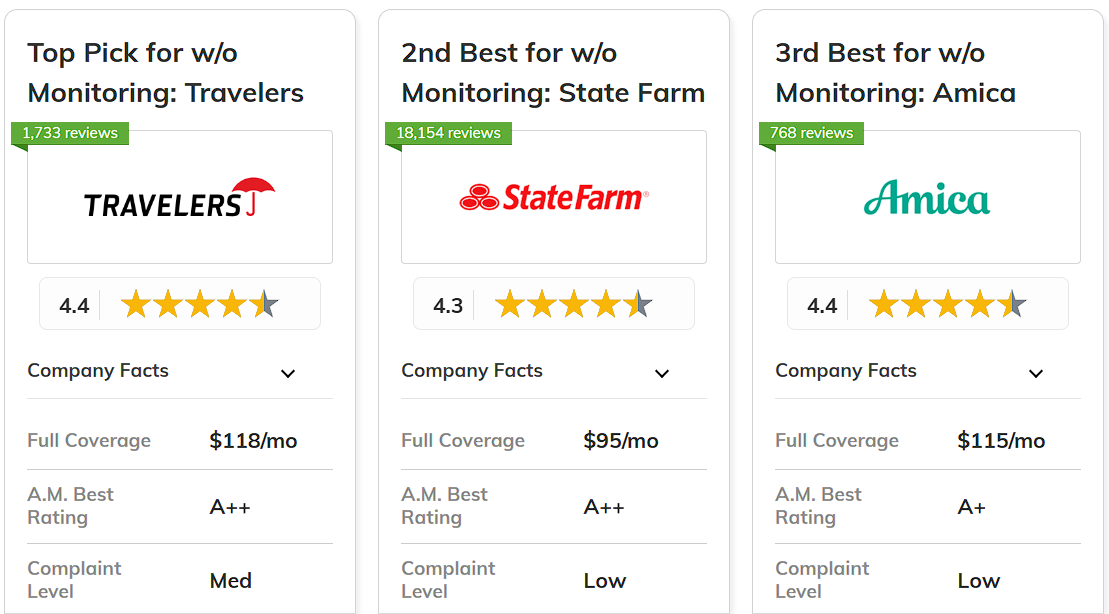

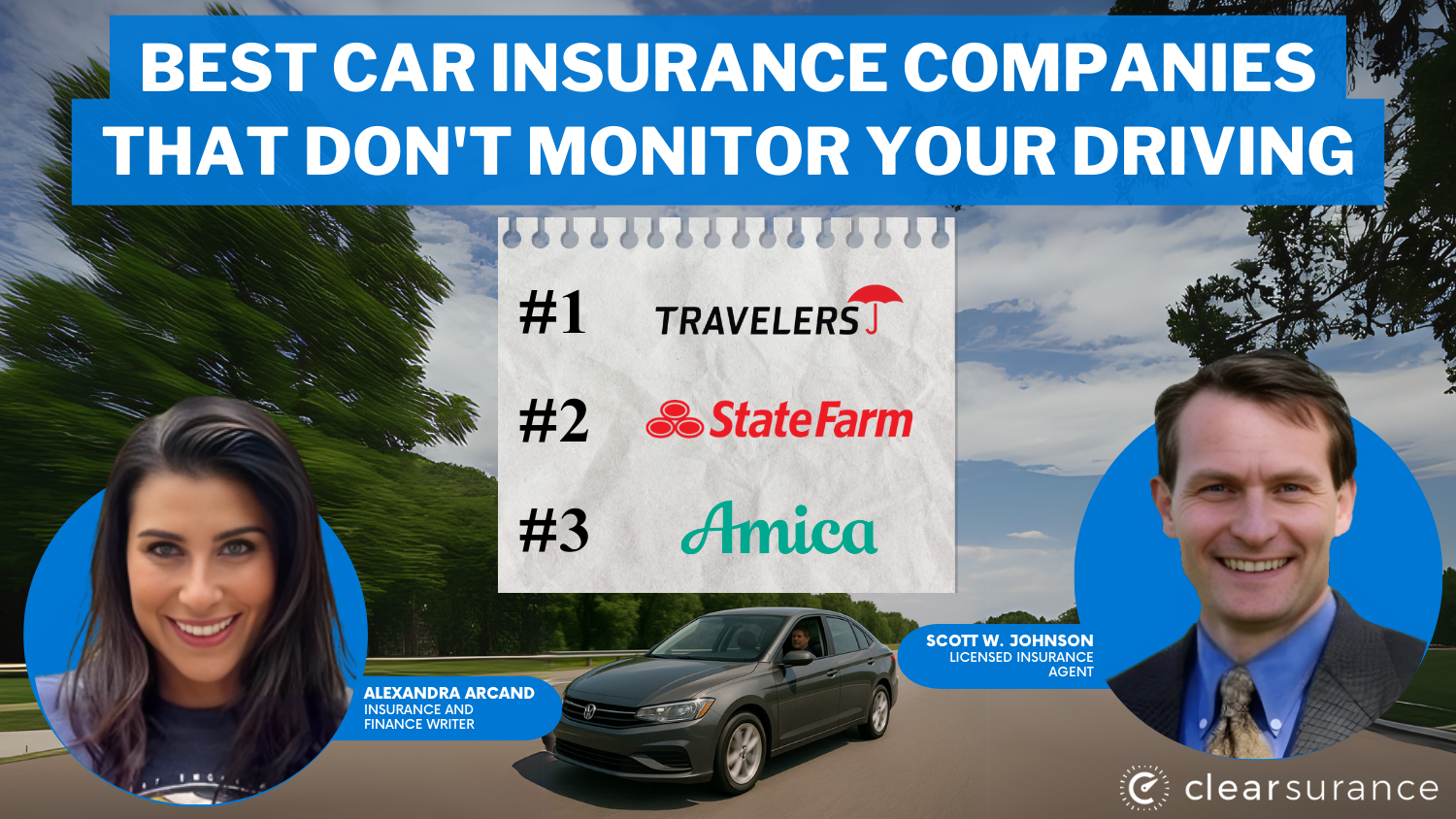

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Business-Use Coverage | Travelers | |

| #2 | 15% | A++ | Many Discounts | State Farm | |

| #3 | 12% | A+ | Customer Service | Amica | |

|

#4 | 10% | A+ | Low-Mileage Drivers | Nationwide |

|

#5 | 10% | A+ | Senior Drivers | The Hartford |

| #6 | 5% | A++ | Military Members | USAA | |

| #7 | 5% | A++ | Add-Ons | Auto-Owners | |

|

#8 | 5% | A+ | Financial Stability | Erie |

| #9 | 5% | A | Diminishing Deductible | Safeco | |

| #10 | 5% | A | Costco Members | American Family |

Use our car insurance calculator to find the best policy for your needs, ensuring a stress-free experience with fixed premiums. See how much you’ll pay for car insurance by entering your ZIP code above into our free comparison tool.

What You Should Know

- Non-monitored policies protect privacy and offer consistent premiums

- Top insurers like State Farm, USAA, and Amica provide coverage without tracking

- Enjoy multi-policy, safe driver, and vehicle safety discounts

#1 - State Farm: Top Overall Pick

Pros

- Discount Options: Read our State Farm review and learn that a 17% bundling discount lowers premiums without the need for invasive monitoring.

- Vehicle Safety Discounts: Safety features applied to cars can be offered at a discount to encourage safety without having to collect ongoing driving data.

- Local Agent Network: If you’re searching for non-monitored insurance options that custom fit your needs, local agents offer personalized customer service.

Cons

- No Pay-Per-Mile Option: State Farm doesn’t offer low mileage drivers looking for unmonitored insurance with mileage-based pricing.

- Potential for Mispricing Risk: State Farm might only accurately price individual risk for non-monitored policies with constant driving data.

#2 – USAA: Best for Military Members

Pros

- Unbeatable Full Coverage Rate: At $85/month, USAA is the cheapest full coverage option for eligible military members who prefer not to have a monitored service.

- Military-Centric Benefits: USAA offers tailored benefits and discounts for service members so they don't have to be constantly monitored while driving.

- Solid Financial Strength: It holds an A++ rating from A.M. Best. It meets claims without needing to monitor the numbers.

Cons

- Strict Eligibility Requirements: USAA's car insurance review states that non-monitored insurance options are limited to military members and their families.

- Less Customization for Short-Term Changes: Without ongoing driving data, there's less flexibility in adjusting premiums based on temporary changes in driving patterns.

#3 – Nationwide: Best Pay-Per-Mile Coverage

Pros

- Pay-Per-Mile Insurance Experts: Our Nationwide insurance review explains how Nationwide SmartMiles tracks monthly mileage to set rates.

- Defensive Driving Incentives: Nationwide offers savings for completing defensive driving courses and promotes safety without requiring ongoing driving data collection.

- Annual Policy Review: Nationwide's "On Your Side Review" ensures non-monitored customers get appropriate coverage and discounts without constant data tracking.

Cons

- Risk Assessment Challenges: Without constant driving data, Nationwide may struggle to assess the true risk of those policies that go unmonitored.

- Reduced Premium Adjustment Options: Non-monitored policies do not allow for easy changes to premiums when driving habits shift in the short term.

#4 – Amica: Best for Customer Service

Pros

- Award-Winning Customer Service: Amica is known for its excellent support for policyholders who prefer non-monitored insurance.

- Dividend Policies: Dividends refund non-monitored customers in order to offset discounts. Learn about ways customers have saved money on car insurance rates.

- Comprehensive Platinum Choice Auto: This package also provides accident forgiveness and a diminishing deductible for nonmonitored policies.

Cons

- Absence of Mileage-Based Options: Unfortunately, Amica doesn’t offer a robust pay-per-mile insurance program for customers looking to get mileage-based coverage.

- Potential Risk Assessment Inaccuracies: The absence of constant monitoring means Amica might not precisely assess individual risk for non-monitored policyholders.

#5 – The Hartford: Best for Senior Drivers

Pros

- AARP Benefits: The Hartford partners with AARP to provide non-monitored auto insurance for those over 65. Explore the best car insurance companies for senior drivers.

- Unique RecoverCare Coverage: Post-accident assistance coverage enhances non-monitored policies without requiring ongoing driving data collection.

- 12-Month Rate Protection: Non-monitored policies offer a year-long fixed rate, so you don't have to worry about regular monitoring and price changes.

Cons

- Limited Access to Younger Drivers: Only retired drivers with AARP memberships can buy The Hartford car insurance that doesn't monitor driving.

- Potential Savings Gap: Without constant driving data, some exceptionally safe drivers might miss out on additional discounts offered by fully monitored policies.

#6 – Travelers: Best for Business-Use Coverage

Pros

- Accident Forgiveness Option: Available in some states, this feature protects rates after a first accident on non-monitored policies without needing constant tracking.

- Business-Use for Rideshare Drivers: Travelers ride-sharing coverage doesn't track driving behavior while drivers are at work.

- Gap Insurance Availability: Offering gap insurance on non-monitored policies provides additional protection for financed vehicles without requiring driving data.

Cons

- Expensive Base Rates: At $49/month, Travelers is one of the most expensive companies that don't monitor driving behavior. Compare more quotes in our Travelers review.

- Fewer Short-Term Customization Options: Non-monitored policies offer less flexibility in adjusting premiums based on temporary driving behavior changes.

#7 – Auto-Owners: Best for Add-Ons

Pros

- Comprehensive Personal Auto Plus: This package adds 10 additional coverages to non-monitored policies without the need for driving data collection.

- Broad Form Collision Option: This flexible collision coverage is offered on non-monitored policies, so you can have additional protection without participating in telematics.

- Unique Common Loss Deductible: This feature adds value to non-monitored policies by reducing out-of-pocket expenses on multiple claims.

Cons

- Geographic Availability: Non-monitored policies with Auto-Owners are available in 26 states. Perhaps insurance companies that customers recommend.

- Lack of Nationwide Coverage: Customers who frequently move and prefer constant, interruption-free coverage may be limited to the company’s regional focus.

#8 – American Family: Best for Costco Members

Pros

- Teen Safe Driver Program: As highlighted in our American Family's car insurance review, this program helps young drivers by offering them valuable lessons and knowledge.

- MyAmFam App Convenience: Offers policy management and claim filing for non-monitored policies without the need for driving data collection.

- Loyalty Discount Opportunities: Loyalty is rewarded with discounts on non-monitored policies without the company forcing long-term customers to undergo invasive tracking.

Cons

- Risk Assessment Challenges: Without driving data on a continuous basis, they may not be able to estimate an individual's risk for policies without monitoring.

- Fewer Customization Options: Policies that are not monitored have less flexibility to adjust premiums for short-term changes in driving behavior.

#9 – Erie: Best for Financial Stability

Pros

- Rate Lock Program: Erie's car insurance review reveals its Rate Lock feature, which allows clients to keep their same premium, even without being tracked.

- Pet Injury Coverage: Non-monitored comprehensive coverage includes unique pet injury protection, adding value at no cost without requiring telematics.

- New Car Protection: New vehicles receive better coverage under non-monitored policies. This adds value without requiring the collection of driving data.

Cons

- Lack of National Presence: Customers who frequently relocate find the company's regional focus limiting due to the lack of reliable, unmonitored coverage options.

- Potential Missed Savings: Without constant driving data, some really safe drivers might miss out on extra discounts that come with fully monitored policies.

#10 – Safeco: Best for Diminishing Deductible

Pros

- Diminishing Deductible: Reduces your deductible each year of safe driving, rewarding responsible behavior. Learn more about what a driving record is and what it tracks.

- Emergency Roadside Assistance: Offering comprehensive roadside help for non-monitored policies adds value without needing ongoing driving data.

- Reimbursement for First Aid: Unique coverage that reimburses policyholders for first aid supplied at an accident scene, available without monitoring requirements.

Cons

- Limited Direct-to-Consumer Options: Safeco sells mostly through agents. This makes it hard for people to buy directly online.

- RideshareFewer Customization Options: Non-monitored policies offer less flexibility in adjusting premiums based on short-term changes in driving behavior.

Car Insurance Costs for Non-Monitored Policies

Before deciding on an auto insurance company that does not track your driving behavior, it is best to compare the costs for the minimum and full coverage. Here are the non-monitored policies’ monthly premiums offered by the leading insurance companies:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $44 | $111 | |

| $48 | $115 | |

| $45 | $105 | |

|

$43 | $101 |

|

$50 | $120 |

| $46 | $112 | |

| $42 | $95 | |

|

$47 | $110 |

| $49 | $118 | |

| $35 | $85 |

USAA offers the cheapest car insurance that doesn't monitor your driving but is only available to the military and their families. State Farm and Erie have decent full coverage packages for those who don't want to be monitored.

Keep reading to learn more about what kind of car insurance you really need and make an informed decision.

Discounts Offered by Non-Monitored Car Insurance Companies

Most major insurance companies offer discounts to lower rates without tracking driving habits, like multi-car discounts and discounts for certain vehicle safety features.

| Insurance Company | Available Discount |

|---|---|

| Good Student, Multi-Vehicle, Defensive Driving | |

| Loyalty, Multi-Line, Claim-Free | |

| Multi-Policy, Safety Features, Paid-in-Full | |

|

Safe Driver, Multi-Car, Anti-Theft |

|

Accident-Free, Multi-Policy, Good Student |

| RightTrack®, Homeowner, Anti-Theft | |

| Drive Safe & Save™, Good Student, Accident-Free | |

| AARP Member, Bundling, Vehicle Safety | |

| Multi-Policy, Safe Driver, New Car | |

| Safe Driver, Good Student, Multi-Policy |

If you are a good student, have multiple policies, or drive a safe vehicle, you can lower your premiums. There is no need for telematics or tracking apps, as these discounts will help you save money. Learn more about defensive driving course benefits.

Choosing the Best Non-Monitored Car Insurance Company

Finding the best car insurance companies that don't track your driving habits involves more than just comparing prices.

Make sure the insurer offers various coverage options, including full coverage car insurance and added benefits like accident forgiveness, without using telematics or tracking apps.

Keep this in mind, and you can find the right non-monitored car insurance company with the policy you need.

Where to Find Car Insurance Companies That Don't Track Driving Habits

USAA, State Farm, and Nationwide are the best car insurance companies that don't monitor your driving. Drivers get the cheapest rates with USAA and State Farm, starting at $35/month. USAA may be inexpensive but is limited to military members and their families, it's also one of the best military car insurance.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Frequently Asked Questions

Who typically has the cheapest car insurance without monitoring my driving?

USAA, Erie, and State Farm often offer the most competitive rates without tracking driving habits.

Which car insurer is best?

State Farm is often considered one of the best overall insurers. Find out why in our State Farm car insurance review.

What car insurance is best with a bad driving record?

Companies like Progressive and State Farm often provide competitive rates for drivers with less-than-perfect records without requiring constant monitoring.

What insurance is best for high-risk drivers?

Insurers like The General and Dairyland specialize in high-risk drivers without mandatory monitoring. Enter your ZIP code below to find affordable high-risk car insurance.

Who is the most trusted insurance company that doesn't monitor driving?

USAA consistently ranks high in customer trust, especially for military members and their families. Get full ratings in our USAA insurance review.

How does an insurance app know if you're driving?

Insurance companies can monitor your driving through the GPS in your phone or by the tracking device you install in your vehicle when you sign up for usage-based insurance.

What is the cheapest insurance with a bad driving record?

Companies like USAA, Geico, and State Farm often provide affordable options for drivers with poor records without requiring constant monitoring.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What is the best protection against uninsured drivers?

Uninsured/underinsured motorist coverage from reputable companies like State Farm or Allstate provides robust protection without monitoring.

What does comprehensive coverage mean in car insurance?

Comprehensive coverage protects against non-collision-related damage like theft, vandalism, or natural disasters.

What is the best driving record you can have?

The best driving record is one free of accidents, violations, and claims. Understanding what a driving record tracks can help you maintain a clean record without needing constant monitoring from your insurer.

What's the best car insurance coverage to have?

Full coverage, including liability, collision, and comprehensive, offers the most protection.