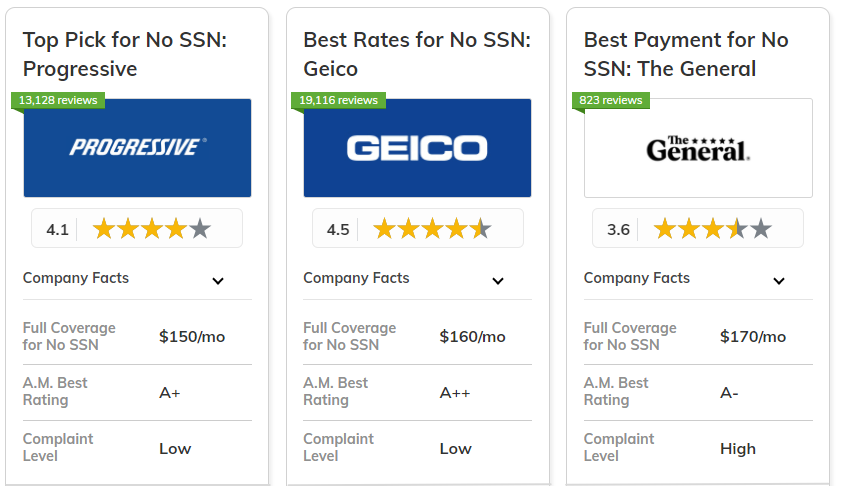

The best car insurance companies that don't require a Social Security number are Progressive, Geico, and The General.

These providers offer rates starting at $68 per month, making them top choices for affordable, flexible coverage. For detailed information, refer to our comprehensive report titled "A Practical Guide For Understanding Car Insurance."

| Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Easy Access | Progressive | |

| #2 | 20% | A++ | Affordable Rates | Geico | |

| #3 | 10% | A | Flexible Payments | The General | |

|

#4 | 10% | A | Budget Friendly | SafeAuto |

| #5 | 12% | A+ | Nonstandard Risks | National General | |

| #6 | 11% | A+ | High-Risk Drivers | Dairyland | |

|

#7 | 10% | A | Comprehensive Coverage | Liberty Mutual |

|

#8 | 10% | A+ | Quick Approval | Direct Auto |

| #9 | 10% | NR | Low Requirements | AssuranceAmerica | |

| #10 | 13% | A- | Simple Process | Infinity |

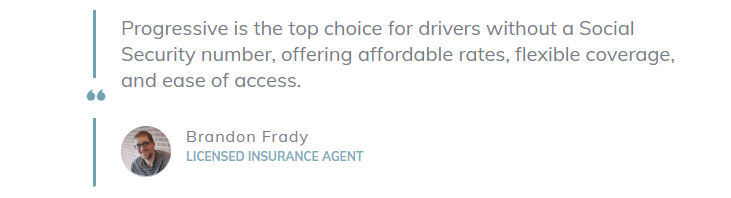

Progressive stands out overall for its balance of price, coverage options, and ease of access. If you're seeking reliable insurance without needing an SSN, these companies offer the best solutions.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

What You Should Know

- Progressive is the top pick for affordable rates and easy coverage

- These companies offer SSN-free coverage from $68/month with flexible options

- Companies without SSNs provide reliable and flexible coverage options

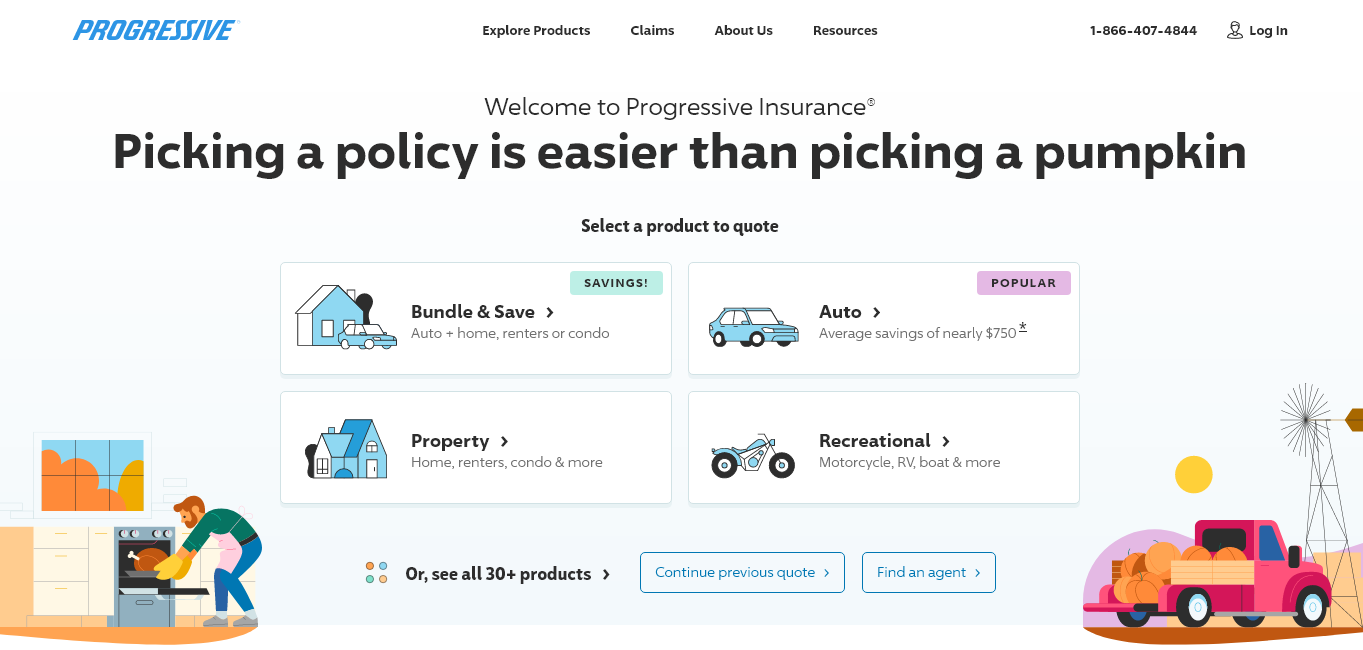

#1 – Progressive: Top Overall Pick

Pros

- Inclusive Eligibility: Progressive broadens eligibility by not requiring a Social Security number, making it accessible to a diverse range of applicants.

- User-Friendly Interface: The online application is straightforward and optimized for those without a Social Security number.

- Comprehensive Support: Provides extensive customer support tailored for individuals without a Social Security number. Find out more in our Progressive review.

Cons

- Potential Rate Hikes: Premiums might be higher due to the additional risk assessment for applicants without a Social Security number.

- Discount Restrictions: Certain discounts might be inaccessible to those without a Social Security number.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico offers competitive rates for car insurance policies even if you don’t have a Social Security number.

- Alternative Identification: Geico accepts other forms of identification, such as an ITIN, which helps those without an SSN.

- User-Friendly Online Platform: The online platform offers easy access and quote generation without requiring an SSN. Expand your knowledge with our comprehensive guide, "What To Know About Buying Auto Insurance Online."

Cons

- Complicated Claims Process: The claims process might be more complicated for those without an SSN.

- Less Personalization: Geico may offer less personalized service for clients without a Social Security number.

#3 – The General: Best for Flexible Payments

Pros

- Flexible Payments: The General offers flexible payment options for drivers who don't require a Social Security number, making it easier to manage your budget.

- No SSN Required: The General provides coverage without requiring a Social Security number, making it accessible to those without one, which you can learn about in our The General review.

- Customizable Plans: Their flexible payment plans can be tailored for individuals without a Social Security number, providing more options.

Cons

- Less Online Support: Online resources and support may be less comprehensive for individuals who don't require a Social Security number.

- Eligibility Constraints: There might be additional eligibility requirements for those without a Social Security number.

#4 – SafeAuto: Best for Budget Friendly

Pros

- Accessible to All: Provides insurance coverage to individuals without a Social Security number, making it easier for those with alternative identification to get insured.

- Flexible Payment Plans: Offers various payment options that accommodate individuals who don't have a Social Security number. For a complete list, read our SafeAuto review.

- Ease of Application: The application process is straightforward for those without a Social Security number, simplifying coverage access.

Cons

- Limited Full Coverage Options: May not offer extensive full coverage options for those without a Social Security number compared to other providers.

- Basic Coverage Limits: Coverage might be more basic compared to competitors, particularly for those who don’t have a Social Security number.

#5 – National General: Best for Nonstandard Risks

Pros

- Flexible Policies: National General offers coverage options for drivers who don't require a Social Security number, catering to nonstandard risks.

- Tailored Coverage: Offers specialized insurance for individuals without an SSN, including high-risk drivers. For a comprehensive analysis, refer to our detailed guide titled "Top 10 Car Insurance Companies for High-Risk Drivers."

- Accessible Solutions: Easily accessible to individuals without a Social Security number, making insurance more inclusive.

Cons

- Higher Risk Profile: Coverage for high-risk drivers without an SSN may be more expensive and less comprehensive.

- Limited Discounts: May offer fewer discounts for those who don’t require a Social Security number compared to standard insurance plans.

#6 – Dairyland: Best for High-Risk Drivers

Pros

- High-Risk Friendly: Specializes in accommodating high-risk drivers, which is beneficial for those without an SSN who may have a challenging driving history.

- Accessible for Undocumented Drivers: Allows undocumented drivers to secure insurance without needing a Social Security number. Read more in our review of Dairyland.

- Flexible Payment Plans: Offers flexible payment options for drivers without a Social Security number, helping manage budgets better.

Cons

- State Restrictions: Availability and terms may vary by state, potentially limiting options for drivers without a Social Security number.

- Complex Application Process: The application process for those without an SSN can be more complicated and time-consuming.

#7 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Wide Coverage Options: Liberty Mutual offers extensive coverage options without requiring a Social Security number, ensuring broad protection.

- Strong Financial Stability: Liberty Mutual’s financial stability means reliable coverage without needing an SSN for underwriting, which is covered in our Liberty Mutual review.

- High Coverage Limits: Provides robust coverage limits, beneficial for those who do not have a Social Security number.

Cons

- Potential Coverage Gaps: Some coverage options might be less accessible without a Social Security number.

- Increased Documentation: More documentation might be needed to prove identity without an SSN.

#8 – Direct Auto: Best for Quick Approval

Pros

- Fast Processing: Direct Auto offers quick approval for policies without requiring a Social Security number, expediting the insurance application process.

- Streamlined Application: Their simple approach makes getting coverage easy, even without an SSN, which you can check out in our Direct Auto review.

- Flexible Documentation: Accepts alternative forms of identification, simplifying the application process for those without an SSN.

Cons

- Discounts May Vary: The availability of discounts might be inconsistent for those without a Social Security number.

- Complex Policies: Some policy details may be more complex to understand without traditional identification like an SSN.

#9 – AssuranceAmerica: Best for Low Requirements

Pros

- Minimal Documentation: AssuranceAmerica has low requirements, making it easier to get insurance without a Social Security number.

- Simple Application Process: The application process is straightforward, even for applicants who don’t have a Social Security number.

- No SSN Barrier: Specifically caters to those who do not have a Social Security number, ensuring inclusivity. Read our AssuranceAmerica review to learn what else is offered.

Cons

- Limited Add-Ons: Optional coverage add-ons may be restricted for those applying without a Social Security number.

- Less Customization: The ability to tailor insurance policies may be less flexible for applicants without an SSN.

#10 – Infinity: Best for Simple Process

Pros

- Efficient Application: Infinity provides a simple process for obtaining insurance without needing a Social Security number, making it user-friendly.

- Alternative Identification: Accepts various forms of identification, which helps those without a Social Security number get covered.

- Accessible Coverage: Ensures that insurance is available to individuals who may not have a Social Security number, broadening access. Discover our Infinity review for a full list.

Cons

- Limited State Availability: Infinity Insurance may not be available in all states where drivers without a Social Security number are permitted, potentially limiting options.

- Variable Discounts: Infinity Insurance’s discount offerings may not be as robust for clients who don’t have a Social Security number, possibly affecting overall savings.

Compare Coverage Options: Affordable Car Insurance Rates and Discounts Without SSN

The following table provides a comparison of monthly rates for both minimum and full coverage car insurance. SafeAuto offers the lowest minimum coverage at $68, while Liberty Mutual has the highest full coverage rate at $180. For deeper insights, check out our resource on insurance titled "Top Ways Customers Have Saved Money on Car Insurance Rates."

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $75 | $150 | |

| $70 | $140 | |

| Direct Auto | $72 | $145 |

| $80 | $160 | |

| $90 | $175 | |

|

$90 | $180 |

| $78 | $155 | |

| $75 | $150 | |

|

$68 | $140 |

| $85 | $170 |

Rates range from $68 to $180, with SafeAuto having the lowest minimum and Liberty Mutual the highest full coverage. Explore discounts from Progressive, Geico, and Liberty Mutual.

Discover car insurance discounts from top providers that don't require an SSN. Explore savings opportunities for safe driving, multi-car policies, and more. Compare discounts from companies like Progressive, Geico, and Liberty Mutual to find the best deal for you.

Unlock valuable discounts from leading car insurance companies that don't require an SSN. Take advantage of savings for safe driving, multi-car policies, and more. Compare providers like Progressive, Geico, and Liberty Mutual to find the best rates and discounts tailored to your needs.

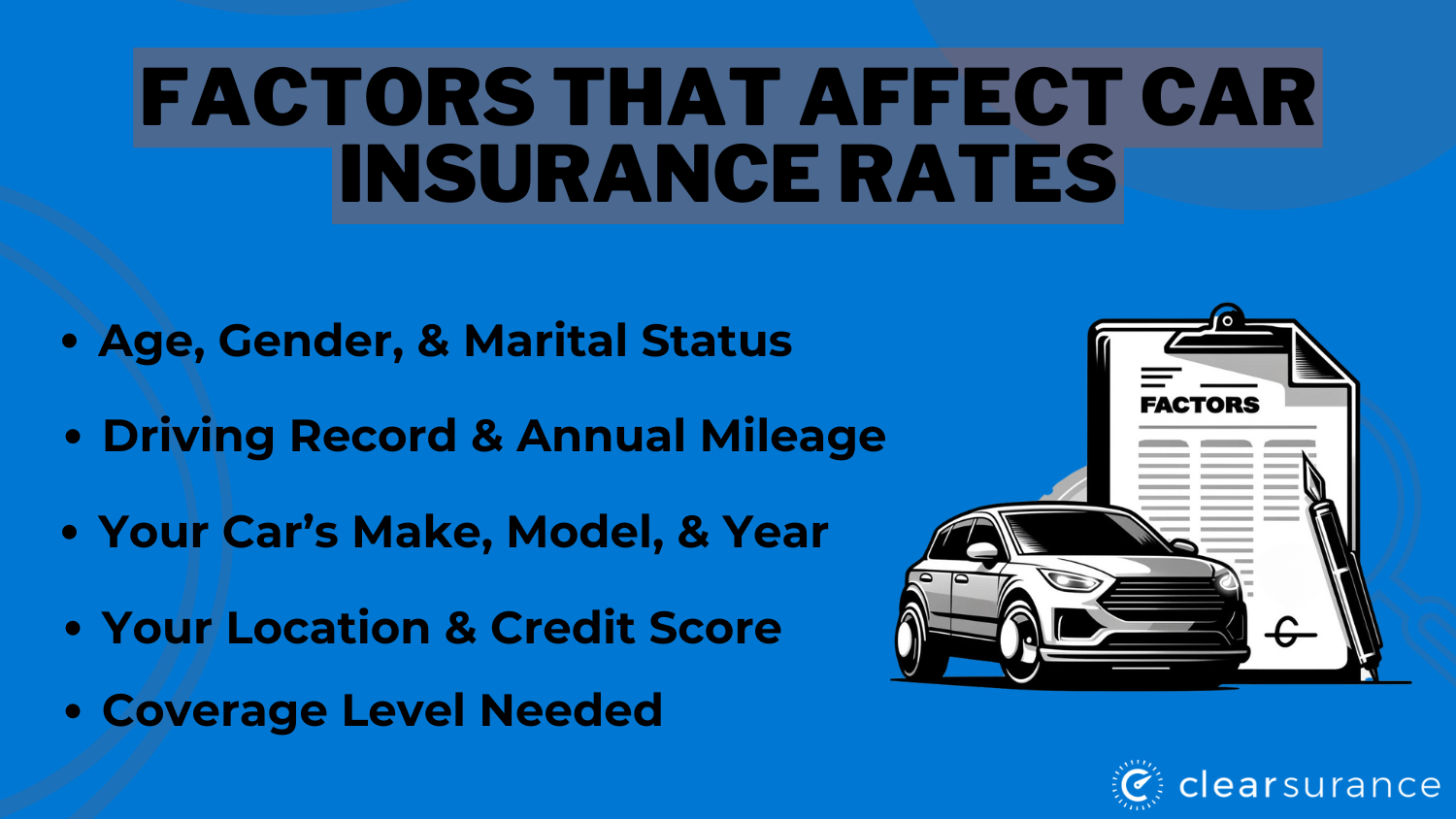

Understanding Why Insurance Companies Request Your Social Security Number

An insurance company will usually want to check a driver’s credit history and even check if they have a criminal record. The Social Security number helps track applicants. For a comprehensive overview, explore our detailed resource titled "How does my credit score affect my insurance premium?"

Even if you find an insurance company that does not ask for an SSN, another obstacle to undocumented immigrants is that all insurance companies ask for a driver’s license.

Luckily, it’s possible in 15 states and Washington, D.C., for undocumented drivers to get a license. The states where you can be licensed are California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, New Mexico, Nevada, New York, New Jersey, Oregon, Utah, Vermont, Virginia, and Washington.

Driving Without Car Insurance: What Undocumented Individuals Need to Know

No matter what state you live in, the penalty for driving without insurance is serious. You would also be left unprotected and in financial difficulties if you cause injury to a person or someone’s property. In the worst-case scenario, if you are undocumented and are caught driving with no insurance, you could be deported.

Driving without car insurance can be tricky if you’re undocumented. This guide highlights the legal risks, potential consequences, and alternative options to help you make informed decisions and stay compliant with the law.

Top Car Insurance Options for Drivers Without a Social Security Number

Getting affordable car insurance without a Social Security number can be tough, but providers like Progressive, Geico, and The General offer rates from $68 per month. Compare rates and check for discounts like safe driving or multi-car policies to get the best deal. To gain profound insights, consult our extensive guide titled "The Cost Benefits to Taking a Defensive Driving Course."

It's important to be aware of the legal risks of driving without insurance, especially for undocumented individuals. Fortunately, 15 states and Washington, D.C. allow undocumented drivers to obtain a license, helping them comply with insurance requirements. For more insights and comparisons, use our free tool to find the best rates near you.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Frequently Asked Questions

Can I get car insurance without a Social Security number?

Yes, some car insurance companies, like Progressive, Geico, and The General, offer policies without requiring a Social Security number. These companies may use other forms of identification to process your application.

What forms of identification can I use instead of a Social Security number?

If you don't have a Social Security number, you may use an Individual Taxpayer Identification Number (ITIN), a driver’s license, or other valid forms of identification, depending on the insurance provider's requirements.

Are there any special discounts available for drivers without a Social Security number?

Yes, some insurance providers offer discounts for safe driving, multi-car policies, and other factors, regardless of whether you have a Social Security number. It’s a good idea to inquire about available discounts when you apply.

To learn more, explore our comprehensive resource on insurance titled "14 Ways To Get Cheap Car Insurance."

How do car insurance rates compare for drivers without a Social Security number?

Rates for car insurance can be similar to those for drivers with a Social Security number. Companies like Progressive, Geico, and The General offer competitive rates starting around $68 per month, even without an SSN.

What states allow undocumented drivers to obtain a driver's license?

As of now, 15 states and Washington, D.C. allow undocumented drivers to obtain a license: California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, New Mexico, Nevada, New York, New Jersey, Oregon, Utah, Vermont, Virginia, and Washington.

What are the legal consequences of driving without car insurance?

Driving without car insurance can result in severe penalties, including fines, license suspension, and, in some cases, deportation if you're undocumented. Insurance provides financial protection in case of accidents and helps you comply with legal requirements.

For a thorough understanding, refer to our detailed analysis titled "What is the penalty for driving without insurance?"

What should I do if my car insurance application is rejected due to not having an SSN?

If your application is rejected, try contacting the insurance company to explain your situation. You can also explore other companies or options, like using an ITIN, or seeking insurance from providers known for working with non-traditional identification methods.

Can I use an ITIN to get car insurance?

Yes, some insurance companies accept an Individual Taxpayer Identification Number (ITIN) instead of a Social Security number. Be sure to check with the insurance provider about their specific requirements.

What should I know about coverage options if I’m getting car insurance without an SSN?

When getting car insurance without a Social Security number, compare both minimum and full coverage options. Providers like SafeAuto offer low minimum coverage rates, while others like Liberty Mutual may have higher full coverage rates. Ensure you understand what each type of coverage includes to choose the best option for your needs.

To expand your knowledge, refer to our comprehensive handbook titled "Liability vs. Full Coverage: Car Insurance Explained."

How can I find the best car insurance rates if I don’t have a Social Security number?

To find the best rates, compare quotes from different providers using our free comparison tool. Enter your ZIP code to see available rates and options tailored to your needs.