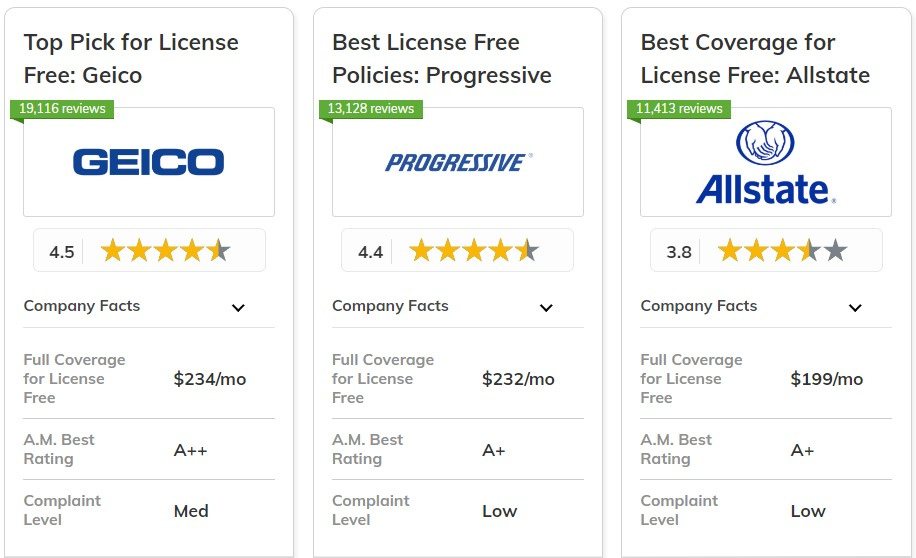

Geico, Progressive, and Allstate offer the best car insurance companies that don’t ask for a license due to their flexibility and competitive rates, with some starting as low as $75/month.

Geico is very good at giving cheap policies for cars that are not being used. Progressive helps drivers who have high risk. Allstate is good if you need SR-22 insurance and want some flexibility.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 10% | A+ | Flexible Policies | Progressive | |

| #3 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #4 | 17% | B | Excellent Service | State Farm | |

|

#5 | 25% | A | Customizable Plans | Liberty Mutual |

| #6 | 10% | A++ | Military Focus | USAA | |

|

#7 | 20% | A+ | Reliable Discounts | Nationwide |

| #8 | 20% | A | High Satisfaction | Farmers | |

| #9 | 13% | A++ | Trusted Reputation | Travelers | |

| #10 | 15% | A | Innovative Benefits | Safeco |

The article tells how people without a driver’s license can still get insurance. It explains important steps, like naming someone else as the main driver or getting parked car insurance. Below, learn how to get cheap car insurance without a license near you.

Then, compare multiple quotes by entering your ZIP code above for auto insurance for unlicensed drivers to find the best rates for you.

What You Should Know

- The best car insurance companies that don’t ask for a license is Geico

- Some companies that ask for a license still insure unlicensed customers

- You may face higher rates for no-license car insurance based on why you lack a license

#1 – Geico: Top Overall Pick

Pros

- Bundle Savings: A 25% discount is offered for bundling auto and home insurance to people who do not have a driving license. Learn more by reading our car insurance claims ratings.

- Affordable Stored Vehicle Coverage: Geico offers budget-friendly insurance for drivers who do not have a license but keep their vehicles stored.

- Low-Cost Coverage for Parked Cars: Low-cost policies for unauthorized drivers with parked cars are Geico's specialty.

Cons

- Limited Online Estimates: Geico’s online tools, when using, need valid license therefore drivers without license must contact Geico for personalized pricing.

- Higher Costs for Suspended Licenses: The rates given to drivers with suspended licenses are still high despite discounts.

#2 – Progressive: Best for Flexible Policies

Pros

- SR-22 Assistance: Progressive is excellent for unlicensed drivers, particularly those who require SR-22 documentation.

- Custom Coverage: They provide unlicensed drivers with customizable policies that are ideal for people who need non-owner coverage or are storing cars.

- Bundle Savings: Progressive helps families with unlicensed drivers save by combining multiple vehicles under one plan.

Cons

- Extra Fees for Suspended Licenses: Unlicensed drivers might face extra fees. Check out our full review of Progressive insurance.

- Location-Based Rates: Insurance costs for unlicensed drivers depend on where you live.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Stored Vehicle Plans: People who maintain their car for an extended period of time can get comprehensive no-license coverage from Allstate.

- Bundling Savings: For unlicensed individuals, they`ll be able to get up to 25% off bundled policies including home and auto insurance.

- Discounts for Added Drivers: Unlicensed drivers can still enjoy savings by adding someone else as the main driver.

Cons

- Reduced Discounts for Younger Drivers: There are discounts for savings that younger unlicensed drivers may not qualify for.

- Higher Rates for Non-Owner Coverage: Unlicensed drivers may find non-owners more expensive. Get more info in our Allstate car insurance review.

#4 – State Farm: Best for Excellent Service

Pros

- Great Customer Support: State Farm is known for providing exceptional customer service, drivers without a license can rely on it.

- Bundling Discounts: Unlicensed drivers can enjoy a 17% savings on bundled insurance. Read more in our full review on State Farm car insurance review.

- Tailored SR-22 Assistance: Unlicensed drivers in need of SR-22 forms can find assistance through State Farm.

Cons

- Fewer Discounts if You Don’t Bundle: Unlicensed drivers might miss out on big savings if they don’t combine their home and auto insurance.

- Not the Best for High-Risk Drivers: Unlicensed drivers labeled as high-risk may face higher premium rates.

#5 – Liberty Mutual: Best for Customizable Plans

Pros

- 25% Bundling Discount: Bundling discounts for unlicensed drivers are offered by Liberty Mutual. Check out our car insurance review of Liberty Mutual.

- Custom Non-Owner Coverage: Drivers without a license can create tailored policies, like non-owner coverage, to suit what they need.

- Student Discounts: Liberty Mutual's savings plan for families helps students who do not yet have licenses.

Cons

- Higher Rates for Solo Drivers: Costs may go up for people who aren't licensed and don't have a main driver.

- Requires State ID for Some Policies: Certain plans necessitate the use of a state-issued ID as a substitute for a license.

#6 – USAA: Best for Military Focus

Pros

- Exclusive Military Discounts: Members of the service who don't have a license can save a lot of money with USAA.

- Low-Cost Parked Car Coverage: Lower premiums are offered to service members who are not licensed and whose cars are parked.

- Bundling Savings: When you combine auto and other types of insurance, USAA will give you a 10% discount. For more information, read our USAA car insurance review.

Cons

- Military-Only Access: USAA’s no-license plans are available exclusively to military personnel and their families.

- Higher Premiums for Non-Military: Drivers without a military affiliation may encounter elevated rates if they are unlicensed and non-military.

#7 – Nationwide: Best for Reliable Discounts

Pros

- 20% Bundling Savings: Drivers without a license may obtain a 20% discount by combining their policies with home or life insurance.

- Reliable Discounts for Multiple Drivers: Unlicensed drivers have the option to include family members as primary drivers in order to get lower rates.

- Stored Vehicle Coverage: Provides attractive pricing options for unlicensed individuals who need to store their cars.

Cons

- Less Savings Without Bundling: Unlicensed drivers can score big discounts if they bundle their policies.

- State ID Needed for Some Plans: Certain programs ask for a state-issued ID instead of a license. Check out our full Nationwide car insurance review for more info.

#8 – Farmers: Best for High Satisfaction

Pros

- 20% Bundling Discount: Individuals without a license can take advantage of Farmers' substantial savings on vehicle and life insurance policies when bundled together.

- Stored Vehicle Coverage: Cheap rates for unlicensed individuals who need a place to keep their cars for a long amount of time.

- Top Customer Service: Recognized for its high level of customer satisfaction, which includes assistance for individuals without a license.

Cons

- Higher Rates for Young Drivers: Unlicensed drivers aged 25 may face higher premiums. See details in our Farmers car insurance review.

- Fewer Discounts for Solo Plans: Drivers who do not have a valid license and who do not have bundled coverage may miss out on significant discounts.

#9 – Travelers: Best for Trusted Reputation

Pros

- Affordably Priced Rates for Parked Cars: Travelers offers reasonable rates for people who park their cars.

- A.M. Best Rating: Travelers provides excellent financial protection for drivers who do not have licenses. Take a look at our Travelers car insurance review.

- Dependable Option: Travelers is known for providing reliable service and having a good image with unlicensed drivers.

Cons

- Higher Non-Owner Costs: Non-owner policies can be a bit pricier for unlicensed drivers.

- Fewer Discounts Without Bundles: Unlicensed drivers might miss out on big savings if they don’t bundle.

#10 – Safeco: Best for Innovative Benefits

Pros

- A.M. Best Rating: Safeco has an A rating, offering security for those without licenses. Read more about buying auto insurance online.

- Innovative Coverage for Parked Cars: Provides flexible plans for unlicensed individuals storing their vehicles.

- Discounts for Multiple Drivers: Helps those without a license save even more money by letting them designate another person as their main driver.

Cons

- Higher Rates Without Bundling: Potentially greater rates may be incurred by unlicensed drivers who do not have bundled plans.

- Fewer SR-22 Discounts: For unlicensed drivers, SR-22 filings don't save as much money.

Understanding Monthly Auto Insurance Premiums

The monthly premiums offered by different providers are crucial when choosing auto insurance or when you need to file a car insurance claim. You can see which insurance companies offer the best solutions for your budget and coverage needs in the table below, which displays both the minimum and full monthly coverage costs.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $86 | $199 | |

| $112 | $249 | |

| $82 | $234 | |

|

$101 | $238 |

|

$90 | $210 |

| $97 | $232 | |

| $99 | $243 | |

| $80 | $216 | |

| $88 | $220 | |

| $75 | $218 |

As shown in the table, USAA offers the most affordable minimum coverage at $75 per month, while Farmers stands at the higher end with $112.

| Insurance Company | Available Discount |

|---|---|

| Multi-policy, Safe Driver, Signal App, Homeowner, Good Student, Business/Professional Group | |

| Multi-policy, Multi-vehicle, Good Driver, Military, Federal Employee, Anti-theft Device, Defensive Driving, Good Student | |

| Multi-policy, Vehicle Safety Features, Hybrid Vehicle, New Move, Military, Paperless, Early Shopper | |

|

Multi-policy, Safe Driver, Accident-Free, Paperless, Family Plan, Good Student |

|

Multi-policy, Snapshot Usage-Based, Good Student, Paperless Billing, Safe Driver, Homeowner |

| Multi-policy, Accident Forgiveness, Diminishing Deductible, Low Mileage, Safety Equipment | |

| Multi-policy, Good Driver, Steer Clear for Young Drivers, Good Student, Safe Vehicle, Accident-Free | |

| Multi-policy, Safe Driver, New Car, Homeownership, Hybrid Vehicle, Good Student, Early Shopper | |

| Multi-policy, Safe Driver, Loyalty, Good Student, Military, Defensive Driving | |

| Multi-policy, Multi-vehicle, Good Driver, Military, Federal Employee, Anti-theft Device, Defensive Driving |

For full coverage, Allstate remains one of the most budget-friendly, with a rate of $199 monthly, whereas Farmers charges the most at $249. This is a helpful way to assist in identifying which insurance provider best fits your budget and protection needs.

Best Insurance Providers for Drivers Without a License

If you own a car but do not have a license, you may still need a car insurance policy. Perhaps you only have a learner’s permit, or someone else drives you around.

What insurance companies will insure you without a license? Most affordable car insurance companies that don't ask for a license are smaller, local agencies that specifically work with unlicensed clients.

However, some of the national providers also sell policies to unlicensed customers. But because you’re unlicensed, you usually need to call the companies directly to request quotes.

You are also considered a higher risk, so expect higher-than-average rates. But why do insurance companies prefer drivers with licenses?

Experienced drivers have robust driving histories that allow underwriters to evaluate their risk levels accurately. Unlicensed drivers do not.

Major car insurance companies that might sell policies to unlicensed clients include:

- AAA Car Insurance Company

- Freeway Car Insurance Company

- Geico Car Insurance Company

- The Hartford Car Insurance Company

- State Farm Car Insurance Company

Geico is available to all drivers in every state and typically underwrites cheaper base quotes. Even though Geico is technically a car insurance company that does ask for a license, Geico also sells policies to unlicensed drivers, typically if the car is in storage.

Ultimately, many different variables impact your car insurance rates, including your age and ZIP code. Plus, not every provider is active or available in all parts of the country.

So you may be able to purchase AAA insurance with no license or Freeway insurance with no license, but you need to call the companies directly.

Comparing quotes is the best way to buy car insurance from companies that don't ask for a license. Try creating a list of multiple providers you’re interested in contacting to get the best rates.

Securing Auto Insurance for Unlicensed Drivers

Can you can get car insurance without a license? Yes, sometimes you can even buy car insurance from companies that do ask for a license number.

First, however, you need to call and speak to an agent directly to explain your situation.

Why do you need to call? Most online quote comparison tools require a valid license number, even if the provider offers insurance to unlicensed customers.

But why insure a vehicle that you don’t plan to drive? If you get a license in the future, an insurance coverage lapse will increase your rates.

Plus, car insurance is legally required in almost every state. Without it, if a driver is involved in an accident while using your vehicle, you risk legal consequences and are responsible for the financial losses out of pocket.

According to the Insurance Information Institute (III), in 2020, the average bodily injury liability claim cost was $20,235.

So follow these easy steps on how to get car insurance with no license.

First, some companies accept state-issued ID cards. Get a state-issued ID card if you’re interested in using companies like Commonwealth or Direct Auto. Next, determine the kind of policy you need. For example, if no one drives your vehicle, comprehensive coverage or parked car insurance may suffice.

To qualify, you must store your car in an approved location. But this is your cheapest option.

You might also consider changing your car’s registration to get insurance. Vehicle ownership is sometimes a requirement for purchasing a policy. Or, try purchasing a policy but naming someone else as the primary driver.

Who’s allowed to be a primary driver on a car insurance policy? Typically, it’s whoever drives the car the most. However, know that their driving record will impact the policy rates.

How do you add a named or primary driver on your policy? Some customer portals and mobile applications offer this feature. You may also need to call your provider directly. Finally, reconsider buying a policy and listing yourself as an excluded driver. You may not be adequately covered this way.

Don’t drive your car for any reason. The penalty for driving without car insurance can be severe depending on the state you live in.

Purchasing a Vehicle Without a License

You’ve learned how to get car insurance quotes from companies that do ask for a license number but also sell policies to unlicensed drivers. But what about buying a car?

Fortunately, you can legally purchase a car without a license. However, you cannot take the vehicle for a test drive.

Registering a vehicle, even without possessing a driver's license, is also accessible in most states.

But if you’re wondering how to get car insurance with a suspended license, you might be required to purchase high-risk or SR-22 insurance.

Find the Best Car Insurance Companies That Don’t Ask For A License Today

Unlicensed customers can still purchase car insurance from the best car insurance companies. However, the process is untraditional, and typically rates are a bit higher.

If you keep coming across car insurance rates from companies that do ask for a license number, consider calling the provider directly to explain your situation.

To secure the cheapest car insurance with no license, call around to compare quotes and determine if naming someone else as the policy owner or purchasing parked car insurance works best for you.

Now that you’ve compared car insurance rates from companies that don't ask for a license, compare quotes from the best providers near you for free by entering your ZIP code into our rate tool below.

Frequently Asked Questions

Can I insure a vehicle without a driver's license?

Yes, you can insure a vehicle without a license. Many companies offer policies for unlicensed individuals, often with higher monthly rates.

Can you get car insurance in Florida without a license?

Yes, it’s possible to get the best car insurance in Florida without a license by naming someone else as the primary driver or purchasing parked car insurance.

Can I get insurance without a license in Texas?

Yes, in Texas, you can get car insurance without a license by naming a primary driver or using state-issued ID for identification.

Can you insure a car without a license in MA?

Yes, in Massachusetts, you can insure a car without a license, but you’ll need to designate someone else as the primary driver.

Can you register a car with a suspended license in NC?

Yes, in North Carolina, you can register a car with a suspended license, but you'll likely need to file the best North Carolina SR-22 insurance to prove financial responsibility.

Can someone drive my car if they are not on my insurance in Florida?

Yes, but your insurance will still apply if the driver has permission to drive your vehicle and is not excluded from the policy.

Can I get car insurance without a license in NC?

Yes, you can get car insurance in North Carolina without a license by naming a primary driver on the policy.

Do you need to be on the insurance and have a license to take a driving test in California?

In California, you don’t need to be on an insurance policy, but you must have a valid learner's permit or driver’s license to take a driving test with the best car insurance in California.

Who has the cheapest car insurance for drivers without a license in Texas?

The cheapest car insurance for unlicensed drivers in Texas is typically offered by Geico, with monthly rates starting around $82, depending on your situation.

Who is cheaper for drivers without a license, Geico or Progressive?

Geico is usually cheaper than Progressive for drivers without a license, offering more affordable monthly premiums, especially for parked or stored vehicles.

Enter your ZIP code to find cheap full coverage insurance near you.