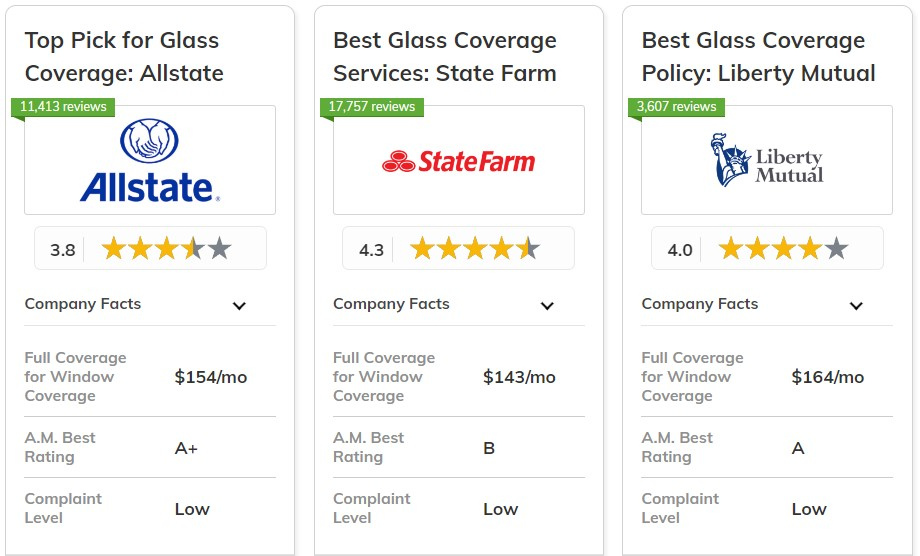

The best car insurance companies that cover car windows are Allstate, State Farm, and Liberty Mutual, offering rates as low as $50/month.

Allstate stands out for its comprehensive coverage, State Farm for reliable service, and Liberty Mutual for flexible policies. Whether you need basic protection or full coverage, these providers deliver excellent options for car windows.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #2 | 17% | B | Reliable Service | State Farm | |

|

#3 | 25% | A | Flexible Policies | Liberty Mutual |

| #4 | 10% | A++ | Military Support | USAA | |

|

#5 | 20% | A+ | Trusted Reputation | Nationwide |

| #6 | 25% | A++ | Affordable Rates | Geico | |

| #7 | 10% | A+ | Customizable Options | Progressive | |

| #8 | 20% | A | Personalized Service | Farmers | |

| #9 | 13% | A++ | Consistent Quality | Travelers | |

| #10 | A | 0.15 | Policy Bundles | Safeco |

Learn how to get cheap car insurance from companies that cover car windows and discover when to file a broken car window insurance claim. Plus, comparing quotes can help you secure the most affordable rate for your vehicle.

Take the first step toward cheaper car insurance rates. Enter your ZIP code above to see how much you could save.

What You Should Know

- Explore the best car insurance companies that cover car windows starting at $50/month

- Allstate is the top pick for comprehensive window coverage

- Comprehensive or collision coverage protects against window damage or replacement

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Window Coverage: Allstate offers dependable coverage for your car windows as part of their all-around insurance policies.

- Affordable Rates: You can get basic coverage for just $60 a month, including window protection.

- Savings for Bundling: If you bundle your policies with Allstate, you can save up to 25%. It’s a great way to help cut down on the cost of your car window coverage

Cons

- Limited Glass Add-ons: Specialized car window and windshield coverage options are limited.

- Higher Premiums for Extras: Adding windshield and car window replacement coverage raises premiums.

#2 – State Farm: Best for Reliable Service

Pros

- Trustworthy Window Security: State Farm insurance provides reliable coverage in the event that a car window is damaged.

- Reasonably Priced Coverage: Their auto window protection starts at just $54 a month, which is reasonable.

- Savings From Policy Bundling: If you bundle your policies, you can save even more on that coverage.

Cons

- Higher Glass Deductibles: The deductibles for car window repairs can be higher than other insurance companies.

- Limited Windshield Add-ons: Options for specialized windshield and car window coverage should be higher.

#3 – Liberty Mutual: Best for Flexible Policies

Pros

- Versatile Coverage: Liberty Mutual offers a range of car window protection options, so you can pick what works best for you.

- Economical Policy Rates: Their standard plan includes window protection and starts at just $65 a month.

- Package Savings: You can save even more with a great 25% discount on vehicle window coverage.

Cons

- Higher Premiums: Keep in mind that opting for more coverage might lead to higher premiums.

- Discounts Vary by State: The discounts on window coverage can differ depending on where you live, so it’s a good idea to check what’s available in your state.

#4 – USAA: Best for Military Support

Pros

- Uniformed-Focused Coverage: USAA car insurance is great for military families, offering tailored protection for car windows.

- Reasonably Priced Protection: You can get basic coverage, including for your car windows, starting at just $50 a month.

- Extra Glass Coverage: They partner with Safelite, so you have extra options for windshield repair and replacement.

Cons

- Military-Exclusive: Just a heads up—USAA is only available to military personnel and their families, so access is limited.

- Higher Deductibles in Some Areas: Keep in mind that deductibles for glass and window coverage can vary based on where you live.

#5 – Nationwide: Best for Trusted Reputation

Pros

- Solid Car Window Coverage: Nationwide Car Insurance Company really covers your car windows well. It’s part of their comprehensive plans, so you can drive knowing you’re protected.

- Affordable Starting Rates: You can get started for just $61 a month, which includes coverage for your car windows. Not too shabby.

- Nice Bundling Discounts: If you bundle your policies, you can save up to 20%. That definitely makes it easier on the wallet when it comes to car window coverage.

Cons

- Higher Deductibles for Glass Repairs: Just a little heads-up—if you need to repair your car windows, the deductibles might be a bit higher than you’d like.

- Claims Can Take Time: Some people have mentioned that the claims process for window and glass repairs can be slower than expected, so it’s something to keep in mind.

#6 – Geico: Best for Affordable Rates

Pros

- Cost-Effective Automobile Window Coverage: Geico offers reasonably priced automobile window protection solutions.

- Inexpensive Base Rates: Basic comprehensive coverage, which includes auto window protection, starts at $55 per month.

- Combining Discount: Geico lowers the cost of auto window coverage by offering up to 25% off for combining.

Cons

- Limited Glass Repair Access: Some regions may have limited access to Geico’s car window and glass repair partners.

- Premium Increases With Add-ons: Adding car window and windshield coverage can raise premiums.

#7 – Progressive: Best for Customizable Options

Pros

- Flexible Auto Coverage: You may customize your auto window protection to meet your unique requirements with Progressive insurance.

- Affordable Minimum Coverage: Starting at $62/month for minimum coverage, including protection for car windows.

- Savings by Bundling: You may receive a 10% discount when you combine your policies with Progressive, which will further reduce the cost of your auto window coverage.

Cons

- Higher Glass Deductibles: Deductibles for car window repairs may be higher than competitors.

- Lower Bundling Savings: Bundling discounts for car window coverage are smaller compared to other insurers.

#8 – Farmers: Best for Personalized Service

Pros

- Customized Auto Window Coverage: Farmers insurance is all about giving you personalized service. They offer flexible options so you can protect your car windows just the way you need.

- Reasonably priced Basic Coverage: You can kick things off with basic coverage for only $66 a month, and that includes your car window protection.

- Great Bundling Discount: If you bundle your policies with Farmers, you can score a 20% discount. That definitely helps keep costs down for your car window coverage.

Cons

- Increased rates for Add-Ons: If you’re looking for extra coverage for your car windows and glass, it can really raise your premiums.

- Less Variable Deductibles: You might find that the deductibles for car window coverage aren’t as flexible as what some other companies offer, so it’s something to think about.

#9 – Travelers: Best for Consistent Quality

Pros

- Dependable Car Window Coverage: Travelers car insurance company offers trustworthy protection for your car windows as part of their comprehensive policies.

- Low Starting Rates for Coverage: Minimum coverage, including car window protection, begins at just $63 a month and that’s quite affordable.

- Bundling Discounts Available: Travelers helps you save by providing up to 13% off when you combine your policies.

Cons

- Limited Glass Coverage in Some Regions: The availability of car window protection might differ depending on your location.

- Increased Premiums for Extra Coverage: If you opt for higher levels of car window protection, your premiums may also increase.

#10 – Safeco: Best for Policy Bundles

Pros

- Solid Car Window Coverage: Safeco insurance has you covered with great protection for your car windows, so you’re ready for anything that comes your way.

- Budget-Friendly Minimum Coverage: You can get basic coverage for just $64 a month, including protection for your car windows. Simple and budget-friendly.

- Nice Bundling Savings: If you bundle your policies, you can snag up to 15% off, which definitely helps keep your car window coverage affordable.

Cons

- Higher Deductibles for Glass: Windshield and car window replacement may come with higher deductibles.

- Limited Customization Options: Car window coverage options may not be as customizable as with other providers.

Affordable Rates From Car Insurance Companies That Cover Car Windows

You may be wondering, does car insurance cover broken windows? Fortunately, there are many affordable car insurance companies that cover car windows. But how well you're covered depends on what type of insurance you carry and how the window broke.

Below, compare the monthly full coverage and minimum coverage insurance rates from the top providers to help you determine the best car insurance company that covers car windows for you:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $154 | |

| $66 | $165 | |

| $55 | $145 | |

|

$65 | $164 |

|

$61 | $155 |

| $62 | $156 | |

| $64 | $158 | |

| $54 | $143 | |

| $63 | $157 | |

| $50 | $135 |

A basic policy usually does not replace broken windows. But full coverage insurance often does. Luckily, there aren’t really any affordable car insurance companies that don't cover car windows. But our top recommended providers for window coverage include USAA and Geico.

USAA is only available for military personnel and their families. But if you qualify, USAA offers some of the lowest rates throughout the country. The company also partners with Safelite and offers additional windshield repair and replacement glass coverage through the USAA Auto Glass Network.

Plus, if the windshield can be repaired rather than replaced, USAA waives your comprehensive insurance deductible.

You can also invest in Geico full glass coverage. Geico is available to any driver and often provides competitively priced quotes comparable to USAA.

Like USAA, Geico also waives your comprehensive insurance deductible if the windshield can be repaired rather than entirely replaced (Learn more: What is an insurance deductible? ).

Similarly, State Farm windshield coverage is another strong option. The provider partners with LYNX Services for the glass repair.

At the end of the day, not every insurance provider is active or available in every part of the country. Plus, many different variables impact your individual car insurance rates, including your age, ZIP code, coverage needs, and driving record.

When Car Insurance Covers Your Car Windows

Drivers often wonder, does car insurance cover a broken window? Technically, only certain types of insurance cover car windows.

For example, the liability insurance commonly required by state laws does not cover damage to your own vehicle.

It only pays for the damage to another driver if you cause an accident. If you just want basic liability coverage or your state’s minimum insurance requirements, then you’ll only get car insurance quotes from companies that don't cover car windows.

For coverages that pay for repairs to your vehicle, you’ll need to purchase comprehensive or collision insurance. But what does comprehensive and collision insurance cover? Comprehensive insurance is known as parked car insurance.

It covers damage to your vehicle while not in motion, including: weather damage, animal damage, fires, flooding, vandalism, and auto theft. Collision insurance covers damage to your vehicle while it’s in motion, including an accident with another driver or an object like a tree or telephone pole.

So if you use a car insurance company that doesn’t cover car windows, it may be because you do not have comprehensive or collision insurance. Both collision and comprehensive coverage have deductibles associated with the policies.

Through most providers, there’s a difference between repairing versus replacing your windshield. A total replacement may mean you use your insurance deductible. But some providers waive your deductible if the windshield can simply be repaired.

Similarly, many national insurance companies offer additional windshield replacement or glass repair coverage separate from other insurance types. How do I know if my insurance covers windshield replacement? You can ask your insurance representative, check the company website, or use your customer portal to see if your provider offers this service.

Buying Additional Car Insurance Coverage

To determine if you should buy additional insurance coverages, consider your budget, insurance limits, and the value of your car. People who rent or finance their vehicles may be required by their loan agreement to purchase full coverage car insurance.

Although state regulations do not require collision coverage, it might be required by your lender if you financed your car! ▶️ https://t.co/r5F6P6DgqT #CarInsurance #CarLoan #CarBuying 🚘 pic.twitter.com/g05yh4EqG6

— Clearsurance (@clearsurance) March 15, 2022

If your car is worth more than $3,000, experts typically recommend adding both comprehensive and collision insurance to your policy if it fits your budget.

Increasing your deductibles leads to lower monthly rates, but be careful not to set them too high, or it mitigates the usefulness of the policies.

According to the Insurance Information Institute (III), in 2020, the average collision claim cost $3,588; comprehensive claims were slightly lower at $1,995.

For older cars, comprehensive and collision coverage may not be necessary. Windshield coverage is worth considering if the annual cost is lower than a potential repair or replacement, which can range from $120 for repairs to $300–$900 for a replacement.

Without comprehensive insurance, if someone else damages your windshield, you might be able to claim under their liability or homeowners insurance, though proving fault is essential. Always shop around for better coverage if your insurer doesn’t meet your needs, ensuring no gap in coverage.

Filing a Claim for Car Window Damage

To file a car insurance claim for a broken window, follow the same process as any other insurance claim. Contact your provider by phone, online, or through their mobile app. If another driver is at fault, their liability insurance may cover your window repair; in this case, file a third-party claim with their insurer.

When considering filing a claim, remember that maintaining a claim-free record may qualify you for certain discounts, which could lower your premiums. Here are some discounts offered by various insurance companies that might help offset the cost of coverage:

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Claim-Free, Home Security System, Occupational | |

| Multi-Policy, Smoke Detector, Sprinkler System, Claim-Free | |

| Multi-Policy, Early Shopper, Claim-Free, Paperless Billing | |

|

Multi-Policy, Protective Device, Claims-Free, Paperless Billing |

|

Multi-Policy, Paperless Billing, Quote in Advance, New Policyholder |

| Multi-Policy, New Home, Protective Devices, Loyalty | |

| Multi-Policy, Home Security, Claim-Free, Automatic Sprinkler | |

| Multi-Policy, Protective Device, Green Home, Claim-Free | |

| Multi-Policy, Home Security, Loyalty, Automatic Payments | |

| Multi-Policy, Protective Device, Claims-Free |

If you’re considering a claim, think about how maintaining eligibility for discounts, like a claim-free or loyalty discount, could be beneficial in the long run.

Case Studies: Uncover the Experiences of Car Insurance Companies Covering Car Windows

Let's explore how the top car insurance companies offer solutions for broken car windows through comprehensive coverage, reliable service, and flexible policies.

Case Study #1 - Comprehensive Coverage at Affordable Rates: A Florida driver used Allstate’s comprehensive coverage after debris broke their windshield. With a $50/month rate and minimal deductible, they quickly replaced the windshield with no hassle.

Case Study #2 - Reliable Service and Quick Repairs: A Texas driver with State Farm had their side window shattered. State Farm processed the claim within hours and arranged immediate repairs, ensuring a smooth experience.

Case Study #3 - Flexible Policies Tailored to Unique Needs: A California driver used Liberty Mutual’s full glass coverage to repair their rear window without out-of-pocket costs after tree damage, thanks to Liberty’s customizable policy.

These case studies highlight how the best car insurance companies that cover car windows to meet the diverse needs of drivers. When it comes to window damage, choosing the right provider can make all the difference.

Now that you’ve learned about car insurance rates from companies that cover car windows, enter your ZIP code into our free tool below to compare quotes from the best providers in your region.

Frequently Asked Questions

What types of insurance cover car windows?

Comprehensive and sometimes collision insurance cover car windows damaged by incidents like theft, weather, or accidents. Explore our guide about the steps to take after your car is broken into, for full details.

How much does it cost to repair or replace a car window?

The average cost to repair a windshield is around $120, while full replacement can range from $300 to $900, depending on the make and model of your car.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Does liability insurance cover broken car windows?

No, liability insurance only covers damages you cause to other vehicles or property. It does not cover your own car’s windows.

Can I add specific glass coverage to my insurance policy?

Yes, some insurers offer additional glass coverage as a rider or add-on to your comprehensive insurance, specifically for window repairs or replacements.

What’s the difference between glass repair and replacement coverage?

Glass repair coverage typically waives your deductible if the damage can be fixed without replacing the entire window, while replacement coverage often requires a deductible.

Should I file a claim for a broken car window?

If the cost to repair or replace the window exceeds your deductible, it’s worth filing a claim. For minor damages, paying out of pocket may be more cost-effective. Delve into our extensive guide that answers the common question, how long after a car accident can you file a claim?.

Will filing a claim for a broken window increase my insurance premium?

It depends on your insurer and policy. Some claims may result in a rate increase, while others, such as minor glass repairs, may not affect your premium.

How long does it take to repair or replace a car window?

Repairing a small crack or chip usually takes 30 minutes to an hour, while replacing a full window may take a couple of hours.

What should I do if my car window is broken due to vandalism?

Report the vandalism to the police and file a claim with your insurer. Many companies require a police report for claims involving criminal activity.

Can I choose my own repair shop for window repairs?

Most insurers allow you to choose a repair shop, but some may recommend or require specific approved repair networks for faster service and direct billing.