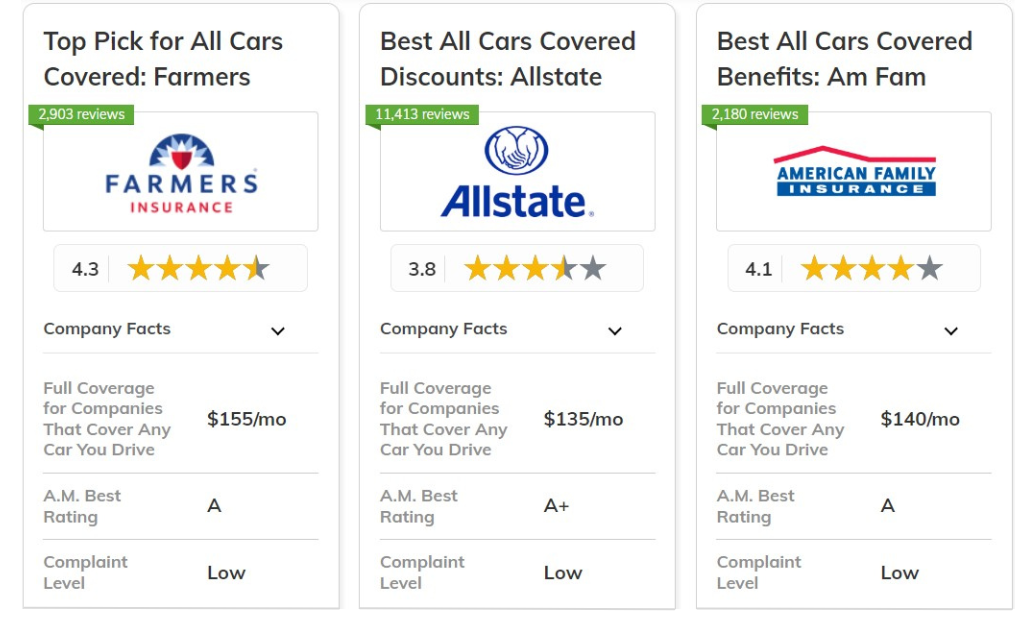

The best car insurance companies that cover any car you drive are Farmers, Allstate, and American Family, with rates starting as low as $41/month.

Farmers are the top pick, offering flexible coverage options, broad discounts, and loyalty benefits. These factors make them ideal for those needing coverage for multiple vehicles.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A | Flexible Coverage | Farmers | |

| #2 | 25% | A+ | Broad Discounts | Allstate | |

| #3 | 25% | A | Loyalty Benefits | American Family | |

|

#4 | 5% | A+ | AARP Partnership | The Hartford |

| #5 | 10% | A+ | Snapshot Program | Progressive | |

| #6 | 15% | A | Custom Policies | Safeco | |

| #7 | 25% | A++ | Military Discounts | Geico | |

|

#8 | 20% | A+ | SmartRide Program | Nationwide |

|

#9 | 25% | A | New Car Coverage | Liberty Mutual |

| #10 | 13% | A++ | Hybrid Discounts | Travelers |

This article highlights the top ways customers have saved money on car insurance rates by exploring the offerings of leading providers and how these options can reduce your insurance expenses.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

What You Should Know

- Farmers offers flexible coverage options, broad discounts, and loyalty benefits for drivers

- Insurers offer competitive non-owner insurance for those driving various vehicles

- Average rates start as low as $41/month with the best car insurance companies

#1 – Farmers: Top Overall Pick

Pros

- Flexible Coverage Options: Farmers Insurance lets you customize your coverage to fit your car and personal needs, making it simple to create a policy that works just for you.

- Comprehensive Support: here to help whenever you need it, no matter which car you're driving. You can find out more in our full review of Farmers.

- Reliable Financial Strength: Farmers Insurance is financially secure, meaning they're well-prepared to process claims, offering you peace of mind.

Cons

- Limited Availability: Farmers Insurance isn’t available everywhere, so depending on your location, coverage options may be limited.

- Complicated Policy Terms: Some customers have found it tough to work through the policy terms, which can make it harder to understand exactly what's covered.

#2 – Allstate: Best for Broad Discounts

Pros

- Lots of Ways to Save: Allstate offers plenty of ways to save, from safe driving perks to policy bundles—there’s something for everyone.

- Super Convenient App: Their app makes everything easy. Whether you’re checking coverage or filing a claim, you can do it all right from your phone.

- Accident Forgiveness: Allstate's accident forgiveness protects your rates and offers peace of mind after a mishap, which is covered in our Allstate review.

Cons

- Complex Discount System: While there are many discounts, figuring out which ones apply to you can be confusing.

- Delays With Claims: Few people have noticed that claims can take longer than expected, which can be a headache if you’re trying to get repairs done quickly.

#3 – American Family: Best for Loyalty Benefits

Pros

- Loyalty Perks: If you stick with American Family, you’ll enjoy rewards for staying loyal—it really pays off in the long run.

- Lots of Policy Options: No matter what you’re insuring, they offer plenty of choices, so finding the right fit for your vehicle is easy. See our American Family review for a full list.

- Helpful Resources: They offer tools to help you figure out what insurance works best, especially if you’re managing multiple vehicles.

Cons

- Average Claims Service: Their claims process is just okay—nothing special. If a smooth claims experience matters to you, this could be a downside.

- Limited Discounts: They don’t have as many discounts as some other insurers, which might make it harder to save on premiums.

#4 – The Hartford: Best for AARP Partnership

Pros

- AARP Discount: This insurer has teamed up with AARP to give exclusive discounts that are perfect for older people when it comes to insuring your car.

- Senior-Focused Plans: Specific to the needs of a senior driver, this plan can cover you for whatever car or other vehicle you own.

- Robust Customer Support: The Hartford is known for excellent customer service, offering support for coverage issues on any vehicle, read more about in our review of The Hartfod.

Cons

- Limited Availability: The Hartford is only available in certain states, which may limit choices for potential customers seeking companies that cover any car you drive.

- Limited Coverage for Older Cars: Comprehensive coverage for vintage or classic cars doesn't come easy particularly if your needs are more antique car insurance coverage.

#5 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive's Snapshot program offers savings based on driving habits. Find out more in our Progressive review.

- Easy Online Quoting: Their easy-to-use online quoting system enables quick comparisons, helping customers find the best rates for any vehicle.

- Price Competition: With rates consistently lower than many other insurance companies, Progressive appeals to customers who need high-vertical coverage without the top dollar.

Cons

- Complicated Policy Features: Few customer are unsure if their policy includes benefits or if certain coverage options are standard or extra.

- Claims Processing: There are also reports from policy holders of glitches or challenges with claims administration, difficulties in handling controls or delays in customer support.

#6 – Safeco: Best for Custom Policies

Pros

- Customized Policies: Safeco provides a variety of coverage options that can be customized depending on driving situation.

- Customized Customer Care: One of their auto coverage agents will personalize your policy so you only pay for what you need.

- Discounted Value for Insurance: Safeco also provides value through discounts offered to policyholders who insure both their cars and homes. See our Safeco review to more.

Cons

- Limited availability: Safeco is not available in every state, limiting the options for customers seeking providers who insure any car you drive.

- Mixed Customer Service Reviews: Some customers have had positive experiences, while others find the response times frustratingly slow for coverage on any vehicle.

#7 – Geico: Best for Military Discounts

Pros

- Best Military Discounts: Geico offers special military discounts that make it a top pick. Check our rankings: Military Car Insurance: Best Companies and Discounts

- Fast Quote Process: We loved how fast and seamless their online quoting tool is to help drivers compare rates and get coverage for any car you drive.

- Strong Financial Stability: With a rock solid financial backing, you can rest assured that any car you drive will be covered by the claims process with Geico.

Cons

- Complex Claims Processing: The claims process can be difficult for some customers which may impede vehicle coverage filings.

- Website Navigation Issues: Some users find Geico’s website navigation cumbersome, which can hinder the experience when seeking coverage for any car you drive.

#8 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide offers discounts for safe drivers through its SmartRide program, making it appealing to anyone looking to get coverage on any type of vehicle.

- User-Centric Mobile App: Nationwide Provides a Mobile App that Facilitates Policy Management and Encourages Safe Driving. Learn more in our Nationwide review.

- Discount Opportunities: SmartRide works with their other discount opportunities on top; like combining policies and customer loyalty to lower the rates for any vehicle coverage.

Cons

- Complex Policy Details: A few clients additionally consider the phrases of coverage hard to apprehend, leaving them clueless as to what safety they are getting for a vehicle.

- Higher Rates for Younger Drivers: If you're a younger or less experienced driver, it's likely that rates from only-to-drivers nationwide are more expensive.

#9 – Liberty Mutual: Best for New Car Coverage

Pros

- New Car Coverage Benefits: Provides personalized new car coverage options that can be used to get more flexible options. Find more in our Liberty Mutual review.

- Unique Customization Options: Their flexible policy designs allow customers to adjust coverage levels, ensuring that any car you drive is well protected.

- Strong Digital Presence: Allows you to adjust your policies, file claims, or find more information about coverage for whatever car you drive, similar to Metromile.

Cons

- Discount Eligibility Restrictions: Some discounts are very cut and dry in terms of who is eligible, which can lead to a lot of unhappy customers.

- Availability Issues: Liberty Mutual does not have a full suite of products available in every state, so availability could limit options for customers looking to insure any car.

#10 – Travelers: Best for Hybrid Discounts

Pros

- Hybrid Discounts: Travelers offers some of the most attractive hybrid discounts, making it a great choice for insuring eco-friendly cars. For a complete list, read our Travelers review.

- Robust Risk Assessment Tools: Their advanced tools can assess the best coverage options based on your specific driving needs for any car you own.

- Great Claims Support: Travelers offers more than just excellent car warranties, as this company also provides great claims support for any kind of vehicle type.

Cons

- Limited Discounts for Non-Hybrids: While hybrids get significant savings and more money back, non-hybrid owners have less left on the table.

- Complex Policy Structures: The specifics of their coverages can be complicated, which makes it difficult for customers to understand what coverage they have with each car.

Top Car Insurance Companies with Competitive Monthly Rates

There are so many choices for car insurance, it is overwhelming. To make the process easier for you here is a list of popular car insurance providers with monthly rates at just $41. Whether you require only minimum coverage or full protection, they service multiple needs and budgets.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $42 | $135 | |

| $45 | $140 | |

| $50 | $155 | |

| $41 | $130 | |

|

$46 | $142 |

|

$43 | $138 |

| $47 | $145 | |

| $49 | $150 | |

|

$44 | $137 |

| $48 | $148 |

Find low monthly prices for the best car insurance options, from $41 per month minimum coverage to as much as full coverage at a maximum of $155 across providers. No matter whether you are looking for comprehensive insurance coverage or individual insurance options, the companies provide solutions that generally match your budget.

Monthly rates, ranging from $41–$155, make it easier than ever to get covered without breaking the bank. Check these options out and compare so that you can find one that best suit your lifestyle and driving habits. Get the right car insurance to start saving today.

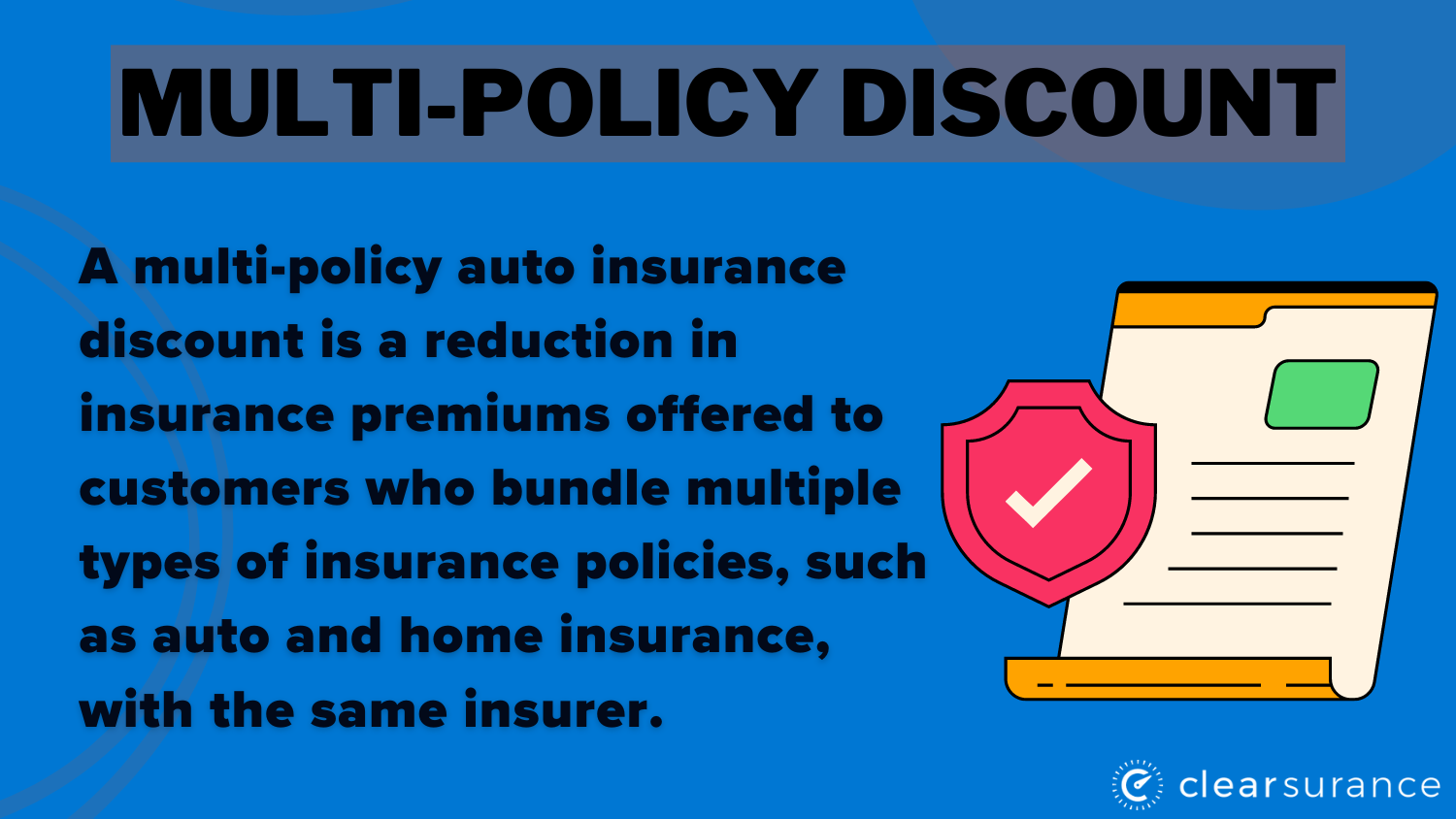

Maximize Your Savings: A Guide to Common Insurance Discounts

Several providers offer a variety of discounts to help customers save on their premiums. These discounts reward safe driving, bundling policies, and other qualifying behaviors.

| Insurance Company | Available Discount |

|---|---|

| Multi-policy, Loyalty, Defensive driving, Good student | |

| Multi-policy, Safe driver, Good student, Homeowner | |

| Multi-policy, Good driver, Military, Emergency deployment | |

| Multi-policy, New car, Safe driver, Paperless billing | |

|

Multi-policy, SmartRide program, Good student, Accident-free |

|

Multi-policy, Safe driver, Snapshot program, Homeowner |

| Multi-policy, Accident-free, Anti-theft, Low mileage | |

| Defensive driving, Bundling, Vehicle safety, New driver | |

|

Multi-policy, Safe driver, Hybrid vehicle, New car |

| Multi-policy, Accident-free, Anti-theft |

This table shows insurance discounts like multi-policy, safe driver, and good student. Other offers include savings for military, accident-free, low mileage, and hybrid vehicles, along with specialized programs like Snapshot and SmartRide for safe driving habits.

Utilizing the discounts available can greatly reduce your insurance expenses, so be sure to check which ones are relevant to your circumstances as part of the 32 genius ways to save money.

Understanding Whether Car Insurance Follows the Driver or the Vehicle

In general, car insurance follows the vehicle and not people. But this is most often with a car insurance company that only covers the cars listed in your policy — not any other type of vehicle you get behind the wheel of. The reason it would be a very high and unmanaged financial risk if your provider paid for damage to any car you drive is clear.

Any damage you do to other people, animals, or property while driving any vehicle comes under liability insurance that is generally covered by state law. Liability insurance: The least expensive, is an important part of any auto policy since it provides the only coverage guaranteed by law — but liability does not cover your own car.

Liability insurance always follows the person and covers anyone that you cause damage while driving any vehicle, common in state law. However, liability insurance pays for nothing regarding damage to the car itself. And then, it covers the person you hit if there is any damage done to them.

Medical Payments (MedPay) insurance, along with personal injury protection (PIP) are both individual-to-rider protections not specifically attached to a vehicle that apply when you're behind the wheel, on foot, bike, or as a passenger.

If the driver has insurance, their policy covers the other party's damages in at-fault states, but likely not their own car. If the other party is at fault, their liability insurance pays. In no-fault states, each person claims with their own insurance as there's no fault involved.

Do you need no car insurance? Car insurance when you need a car or not — It's called a non-owner policy, but it can be useful for many more scenarios than that. In that case, if you are unable to claim on your own vehicle and want the policy to cover any car you drive (which does not belong to a family or friend), then a non-owner policy may be suitable.

Explaining Non-Owner Car Insurance

Regardless if you own a car or not, almost every state legally requires that you carry auto insurance. The Insurance Information Institute (III) also reports that caught violators may incur a fine of up to $5,000 — and jail time.

Anyone who drives a car regularly but not daily — for example, commuting to work without your own vehicle — might consider non-owner auto insurance, which is available from most major national companies.

In most cases, it gives you the minimum amount of property damage coverage and bodily injury liability required by your state. Liability car insurance only covers damages inflicted on another party in the event of an accident you cause and does not provide coverage for injuries or damages to your own property.

Non-owner car insurance does not cover damages to your property or yourself. In some states, it may include MedPay, PIP, and uninsured motorist protection. Essentially, it functions as liability insurance, covering damages from accidents you cause.

The other driver files a third-party claim through your non-owner policy, but if you have MedPay or PIP, you can also file a claim for your medical bills. Non-owner car insurance typically costs between $200 and $600 annually and is generally cheaper since it doesn't include comprehensive or collision coverage.

Determining the Need for Non-Owner Car Insurance

Who exactly is non-owner car insurance for? Non-owner insurance may be a good idea for anyone with an active license who does not own or finance their car, but is renting, borrowing cars from friends/family frequently, and also using ride-sharing services.

In the same second, by buying a non-owner policy you keep insurance history current and avoid any coverage gap if there is time without vehicles. That way you will also be covered when under-taking test drives in replacement vehicles. Can you get an SR-22 with non-owner insurance? Check our list of top companies: Cheap Non-Owner Car Insurance

If your license is suspended due to a major traffic ticket, such as for example DUI; you might have to file SR22 insurance in order that the DMV will reinstate your driving permit. However, the form also requires you to include copy of your auto insurance. Fortunately, non-owner policies do satisfy these same state conductions.

Who shouldn’t buy non-owner car insurance? If you live with someone who owns a car, you likely won’t qualify for a non-owner policy. However, providers make exceptions for roommates who are not related to you. If you rarely drive, then paying for a non-owner policy is likely not worth it. Instead, invest in the renter’s insurance the few times you do rent a vehicle.

Purchasing Car Insurance Without a License

You feel much more confident in your quest to learn how to buy car insurance from companies that cover any car you drive, but what about if you are wondering can I get auto insurance without a license? Yes, you can buy a car without a license and some insurance companies will allow you to purchase coverage, but you will need to call them directly to request quotes.

If someone else regularly drives you, use that person as your primary driver on the policy. If nobody is driving your vehicle, inquire about parked car insurance and the proper way to store it as per your provider. That said, keep in mind that your rates might run above the norm. Customers without a license are considered high risk by insurance providers.

Best Car Insurance: Flexible Coverage for Every Driver

The best auto insurance comes from Farmers, Allstate, and American Family which cover any car you drive of for around $41/month. These companies provide flexible coverage options, multiple discounts, and loyalty benefits that are ideal for insuring more than one car, making them perfect for insuring multiple vehicles in a practical guide for understanding car insurance.

Finally, the article also delves into understanding types of insurance such as non-owner policies for those that don't own a car. To help drivers save as much money as possible and receive the coverage they need, compare quotes and take advantage of discounts that are available.

To find the best rates in your area, use our free tool by entering your ZIP code below.

Frequently Asked Questions

What factors affect my car insurance rates?

The factors are driving history, age, location, type of car, and credit score all influence your car insurance rates. Insurance companies assess these factors to gauge your risk as a driver.

Can I get coverage for any car I drive with my policy?

Some insurance policies, like liability insurance, cover you while driving any vehicle. However, comprehensive and collision coverage typically applies only to the vehicles listed on your policy. Check with your provider for specific details.

How can I compare car insurance quotes effectively?

To compare car insurance quotes effectively, gather quotes from multiple providers by entering your information into a comparison tool. Look for similar coverage options, insurance deductibles, and discounts to make an accurate comparison.

Is it possible to get car insurance without a license?

Yes, some insurance providers allow you to purchase car insurance without a license, but you will need to contact them directly. It’s important to name a licensed driver as the primary on the policy if applicable. Check if you’re getting the best discounts on your car insurance by entering your ZIP code below.

How do I know if I have enough coverage?

Assess your coverage needs by considering factors like the value of your vehicle, your financial situation, and your risk tolerance. Contact your insurance agent to check your current policy and make adjustments if necessary.

What discounts should I look for when comparing insurance quotes?

Look for discounts such as multi-policy (bundling home and auto insurance), safe driver, good student, military, low mileage, and loyalty discounts. Each insurance provider may offer unique discounts that can help lower your premium. Explore our list of the best insurance providers: Best Low-Mileage Car Insurance Companies

What should I do if I want to switch car insurance providers?

To switch car insurance providers, compare quotes from other companies, review your current policy for cancellation terms, and ensure there’s no gap in coverage. Once you’ve chosen a new provider, inform your current insurer of your cancellation.

How can I maximize my savings on car insurance?

For those looking to save a little extra, compare quotes from multiple companies, use all applicable deals, maintain a clean driving record, consider raising your deductible, and review your policy regularly to avoid over-insurance. Choose the right car insurance at the flexible price — enter your ZIP code below to shop for coverage from the best providers.

What is non-owner car insurance, and do I need it?

Non-owner car insurance is for individuals who frequently drive cars they do not own. Non-owner car insurance offers liability coverage but does not extend to damages to the vehicle itself; thus, if someone borrows your car, does car insurance cover you? This type of policy can be advantageous for those who frequently rent or borrow vehicles.

What is the difference between liability and full coverage insurance?

It includes liability insurance, which pays for damages to other people you cause an accident and full coverage (comprehensive/collision), takes care of your car from accidents like hail damage as well when a tree falls on it.