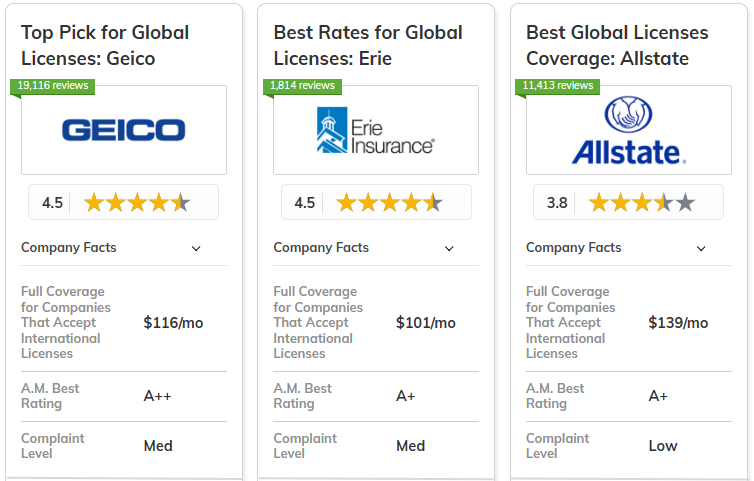

Geico, Erie, and Allstate are the best car insurance companies that accept international licenses, with rates starting at $44.

Geico stands out as the top choice for budget-conscious drivers, while Erie offers competitive rates and Allstate provides dependable coverage.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Budget Friendly | Geico | |

|

#2 | 25% | A+ | Competitive Rates | Erie |

| #3 | 25% | A+ | Reliable Coverage | Allstate | |

| #4 | 20% | A | Comprehensive Offers | Farmers | |

|

#5 | 25% | A | Multiple Discounts | Liberty Mutual |

| #6 | 17% | B | Nationwide Availability | State Farm | |

|

#7 | 20% | A+ | Customizable Policies | Nationwide |

| #8 | 15% | A | Tailored Options | Safeco | |

| #9 | 10% | A+ | Flexible Payment | Progressive | |

| #10 | 13% | A++ | Hybrid Discounts | Travelers |

Considering factors like your location and driving experience is crucial in finding the right policy. This article explores the best car insurance companies cater to all types of drivers, not all companies will offer coverage to international drivers.

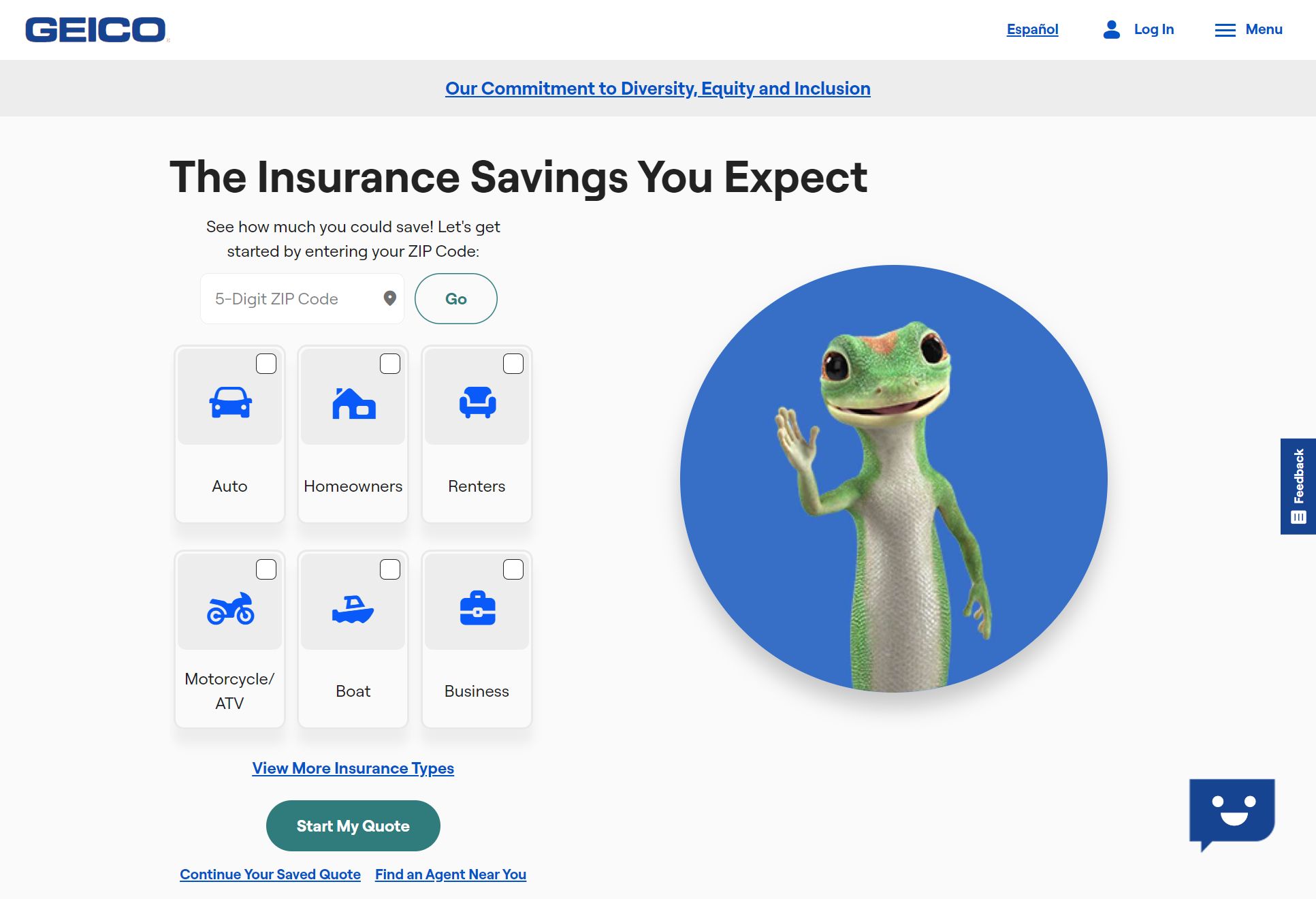

Get the right car insurance at the best price enter your ZIP code above to shop for coverage from the top insurers.

What You Should Know

- Geico is a top car insurance choice for international licenses, with rates starting at $44

- Geico is the best choice for budget-friendly coverage for international drivers

- Location and driving experience impact auto insurance rates

#1 – Geico: Top Overall Pick

Pros

- Extensive Support: Geico provides an impressive range of discounts for foreign-licensed drivers.

- User-Friendly Platform: All of your information is saved online, especially if you are international licensee.

- Flexible Coverage: eico makes plans that are specific to international license drivers easily accessible- such as new driver car insurance, including new driver car insurance.

Cons

- Limited Options: Some coverage options for international licenses can come off as somewhat restrictive.

- Variable Response Times: At times, their customer support may take a little time to get back at you especially if you have some inquiries about your international license.

#2 – Erie: Best for Competitive Rates

Pros

- Tailored Guidance: Erie offers individualized attention for people with international permits so you can understand American road rules.

- Attractive Rates: As often international or global licenses emerge attractively priced, it will allow you to save from your travel insurance plan. Find out our Erie review for more details.

- Knowledgeable Agents: Erie insurance agents are familiar with the specific circumstances of foreign license drivers.

Cons

- Regional Limitations: While international licenses are accepted, some areas may restrict coverage.

- Policy Navigation Challenges: Regarding international Life licenses – clients reporting that the policy details are a bit convoluted to understand.

#3 – Allstate: Best for Reliable Coverage

Pros

- Robust Protection: Allstate has great deals on insurance for international drivers. Discover details in our Allstate review.

- Personalized Assistance: Their specially trained agents provide targeted help for holders of foreign licenses.

- Resource Availability: Allstate can provide you with resources and information to make sure you are getting properly covered, even if an international driving license is needed.

Cons

- Claims Documentation: Filing a claim might involve extra paperwork for those with international licenses

- Higher Premiums: Some folks find Allstate's rates to be on the higher side for drivers with international licenses.

#4 – Farmers: Best for Comprehensive Offers

Pros

- Specialized Coverage: Farmers specializes in unique policy needs for international license holders. Find more in our Farmers review.

- Comprehensive Resources: Their plans generally have strong support for U.S. driving laws. This is a great help to people who own international licenses

- Helpful Navigation Support: Farmers provides support for consumers across the US, bypassing state license issues by using assure alliance, licensed in all 50 states, to integrate insurtech seamlessly.

Cons

- Availability Limitations: Some coverage options are limited by your state of residence. Drivers with international licenses may have to do a little more digging.

- Understanding Policy Details: Some customers find the insurance lingo hard to grasp, especially regarding international licenses.

#5 – Liberty Mutual: Best for Multiple Discounts

Pros

- Discount Opportunities: Liberty Mutual offers savings specifically for international license holders, It makes getting covered a little easier on the wallet.

- Insightful Online Tools: Their online resources help you understand your coverage options better. This is a big help for international license holders.

- Focused Resources: They have dedicated materials that cater to international license holders, so you’ll stay informed throughout your journey. See our Liberty Mutual review for more.

Cons

- Inconsistent Service Quality: Customer service can vary, especially for international license inquiries. It can be tough when you need assistance.

- Limited Policy Flexibility: There is very limited policy flexibility when it comes to certain policies. This would mean searching for coverage could be quite difficult for those who have an international license.

#6 – State Farm: Best for Nationwide Availability

Pros

- Experienced Agents: State Farm’s agents are well-versed in the needs of international licenses.

- Comprehensive Options: They offer a variety of coverage tailored to drivers with international licenses. Read our State Farm review for more.

- Customer-Centric Approach: State Farm focuses on keeping customers happy, which includes providing plenty of resources for international license holders.

Cons

- Cumbersome Claims Process: Filing a claim can be especially challenging if you have an international license.

- Variable Premium Rates: Premium costs can change a lot. This could impact international license holders differently than local drivers.

#7 – Nationwide: Best for Customizable Policies

Pros

- Customizable Coverage: Nationwide provides several options for holders of a foreign license so that they can build their policy to suit them best.

- Strong Customer Satisfaction Focus: They really aim to ensure customers are happy, including those with international licenses. Learn more in our Nationwide review.

- Seasoned Agents: Nationwide has agents who have dealt with international driver's licenses before.

Cons

- Limited Coverage Availability: International licenses may not be covered by some carriers in your area.

- Complex Policies: There are some policies that can be somewhat complex, particularly for those who have an international driver's license.

#8 – Safeco: Best for Tailored Options

Pros

- Tailored Insurance Products: Safeco tailors its products to drivers holding international licenses. You will receive personalized coverage.

- Competitive Pricing Structure: They have reasonable pricing, so it's friendly to international copyright holders. Check out our Safeco review.

- Helpful Resources: Resources available to drivers with international licenses from insurance companies like Safeco.

Cons

- Variable Service Quality: Licensees may receive different levels of service depending on the region where they operate.

- Policy Clarity Issues: There are a few of customers who need time to understand what the policy content.

#9 – Progressive: Best for Flexible Payment

Pros

- Flexible Payment Plans: For people with foreign licenses who are on a budget, Progressive has the best flexible payment plans.

- Online Tools: Their robust online platform makes managing policies easier, even for those with international licenses. Get a complete view in our Progressive review.

- Comprehensive Coverage Options: Progressive offers hundreds of plans to choose from for international license drivers who can get behind the wheel safely and covered.

Cons

- Customer Service Wait Times: Some international license holders report long wait times when contacting customer support, which can be frustrating.

- Complex Discounts: With discounts that can be hard to qualify for, especially if you have an international license, it's not easy to save with Progressive.

#10 – Travelers: Best for Hybrid Discounts

Pros

- Hybrid Discounts: Travelers offers hybrid discounts, which you can use to lower your premiums even if you have an international license.

- Specialized Support: The agents provide specialized attention to international license holders which in turn helps make the insurance process easier and more user-friendly.

- Customizable Policies: Travelers permits drivers on international licences to tailor their policy. Explore our Travelers review for more information.

Cons

- Limited Availability: May not be available for all international licenses or states. That is something you need to make sure of before join.

- Complicated Policy Details: Some find Travelers' policy language a bit complex, especially for international license holders unfamiliar with U.S. insurance terms.

Finding Car Insurance Companies That Accept International Licenses

It can save you even more if you shop rates from provider to provider, ensuring you get the right coverage or deal at an affordable price. Minimum and total coverage rates are $45—Geico,$52 Erie, and relatively Allstate at $51—rate type per month. Knowing the monthly rate helps you understand what your costs will look like.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $51 | $139 | |

|

$52 | $101 |

| $62 | $140 | |

| $45 | $116 | |

|

$84 | $173 |

|

$49 | $109 |

| $56 | $130 | |

| $64 | $148 | |

| $44 | $122 | |

| $45 | $89 |

When selecting the best car insurance company that accepts international licenses, consider these key factors:

- Driving Experience: International drivers with extensive experience may get better rates.

- Coverage Options: It is in your best interest to confirm that the company has enough coverage options ideally for liability and full protection.

- Company Policies: Some insurance companies may not accept an international driver's license, so check before you compare the prices.

These options make it easier to buy insurance directly and find a plan that both fits your needs as well as wallet. You can then survey the rates, select whatever works for your individual needs and get covered at a rate that is in control.

With the right policy, you can drive worry-free no matter where you are or how experienced a motorist. One question that may pop in your head if you get an offer from someone else is, Can I switch car insurance companies mid-policy?

The answer is yes. Most insurers allow you to switch without penalties, giving you the freedom to find the best coverage whenever you need it.

Key Discounts for Car Insurance Companies Accepting International Licenses

Top companies that accept international licenses and offer valuable discounts include Geico, Progressive, and State Farm.

| Insurance Company | Available Discount |

|---|---|

| Safe Driving, Bundling, Multi-Vehicle, Early Signing, Good Student, Anti-Theft, New Car, Automatic Payments | |

|

Safe Driver, Bundling, Payment History, Vehicle Safety Equipment, Young Driver, Accident Prevention, Diminishing Deductible |

| Bundling, Multi-Vehicle, Good Driver, Good Student, Alternative Fuel, Accident-Free, Mature Driver, Professional, Affinity Discounts | |

| Bundling, Multi-Vehicle, Good Driver, Good Student, Anti-Theft, Defensive Driving, Military, Federal Employee, Emergency Deployment | |

|

Bundling, Multi-Vehicle, New Car, Vehicle Safety, Homeowner, Good Student, Accident-Free, Military, Early Shopper |

|

Bundling, Multi-Vehicle, Accident-Free, Good Student, Defensive Driving, Easy Pay, Smart Ride, Anti-Theft, Paperless Billing |

| Bundling, Multi-Car, Safe Driver, Continuous Insurance, Pay-in-Full, Good Student, Homeowner, Online Quote, Snapshot | |

| Bundling, Multi-Vehicle, Good Student, Safe Driver, Anti-Theft, Accident Prevention, Telematics-Based, New Car | |

| Bundling, Multi-Vehicle, Good Student, Safe Driver, Accident-Free, Defensive Driving, Good Driving, Vehicle Safety Features | |

| Bundling, Multi-Vehicle, Safe Driver, Hybrid/Electric Vehicle, Home Ownership, New Car, Good Student, Pay-in-Full, Defensive Driving |

Safe driving discounts and bundling your insurance will help you save more for having clean records. So, what is considered clean driving record? Plus, young drivers can benefit from good student discounts if they’re doing well in school.

Candidates can look into these options to find more cost-effective ways in which drivers may insure a vehicle. Telematics programs offer usage-based rates, which can lead to personalized quotes based on specific driving habits and more savings with multi-car or new vehicle discounts as well as those for homeowners and members.

Guide to Finding Car Insurance Companies for International Drivers

Car insurance for international drivers may seem a bit overwhelming, but it can done. Not a bad price, with offerings from around $89 per year available from companies like Geico, Erie and Allstate. We will dissect all of these to point you in the right way to obtain the coverage that best fits your lifestyle. These are a few tips you should take care of:

Here are a few things to keep in mind:

- Affordable Options: There are individual firms that regard and cater to the plight of international drivers, so they offer relatively less costly.

- Tailored Coverage: Look for policies that fit your specific driving experience and situation. You want something that feels right for you.

- Discounts are Your Friend: Keep an eye out for discounts, like safe driving or bundling multiple policies.

Go and look for quotes from several insurance companies Sure sounds a little cumbersome but somehow buffalo nickel will make you rich.

When you're looking for car insurance, it’s not just about the best price; it’s about the right coverage for you. So, what is comprehensive insurance coverage? It protects you from unexpected events like theft, vandalism, and natural disasters, giving you peace of mind when life gets unpredictable.

Just make sure, the correct policy can give you that psychological peace of running with security which is important to be carefree and then feel secure in your drive rather than feeling guilty about it.

Closing Insights on Car Insurance for International Drivers

As a non-resident driver, it may feel overwhelming trying to find the right insurance. Good auto insurers to try first are Geico, Erie and Allstate. Our cash-saver selection, thanks to the rock-bottom starting rate from $44 per month by Geico.

Meanwhile, if you need something a bit more flexible in terms of coverage and pricing both Erie is another good option with very competitive prices; dependable Allstate will probably be your best bet. Plus, their claims processes are straightforward, ensuring you can navigate an insurance claims easily when needed.

Enter your ZIP code to compare quotes from auto insurance companies that accept international licenses in the area you will be visiting for free.

Frequently Asked Questions

Can you get car insurance in the US with an international license?

If you have an international license, you can still find car insurance in the US. Just keep in mind that different insurance companies have their own requirements, so it’s a good idea to shop around and ask about policies that accept International Licenses.

What insurance company is most reliable for international students?

When it comes to reliability for international students, Geico and Progressive often come out on top. They’re known for providing solid coverage and support, which is super helpful when you’re navigating a new country and trying to get settled.

Can I buy a car with an international driver license in the USA?

You can buy a car with your international driver's license. Remember, you might need to show some extra paperwork, like proof of residency and a valid insurance policy, to finalize the purchase. Can I switch car insurance companies mid-policy? Yes, it’s possible, but check for any fees or terms involved.

Which international driving license is valid in the USA?

The International Driving Permit (IDP) is the way to go. It’s widely recognized in the USA, allowing you to drive alongside your home country’s license. Just make sure you have both when you're on the road.

Can I get car insurance without a US driver's license?

Many insurance companies offer coverage even if you don’t have a US driver's license. If you have an international license, you should be able to find a policy that fits your needs, so don’t hesitate to reach out to various insurers.

Can I drive in the USA as an international student?

You can drive in the USA if you're an international student with a valid international driving license. Make sure you meet the local insurance requirements or check out some of the best car insurance companies that don't ask for a license, and you’ll be ready to hit the road.

Which insurance company has the highest customer satisfaction for international students?

A lot of international students who used USAA have nothing but good things to say when it comes to customer satisfaction. They are also well known for their competitive rates and extensive coverage benefits that fit the needs of students abroad.

Can you register a car in the United States using an international driver's license, and what requirements or conditions should be considered?

Registering a car with an international license is totally doable. Just be aware that the process might vary depending on which state you’re in, and you’ll typically need to provide proof of insurance.

What happens if you drive a car without insurance in the USA?

In the USA one can be fined, have their license suspended and forced to pay for property damages out of pocket if involved in an accident without insurance. You might also be left to ponder, How long after a car accident can you file a claim?—not a situation you want to be in. It’s better to avoid the hassle altogether.

How can a foreigner insure a car in the US?

If you are a great son of the soil wishing to secure insurance for a car in America, get first and foremost an international permit and prepare a set of necessary documents. After that, look for an insurance provider who is able to work with international students or non-residents. We will help you through the process and get you gap protection.