Finding the best car insurance companies for women involves evaluating top providers like State Farm, Allstate, and Progressive, who offer competitive rates starting at $48/month.

How do you choose the best insurance company? Learn about minimum vs. full coverage costs, explore various discounts, and understand the types of coverage that meet your needs.

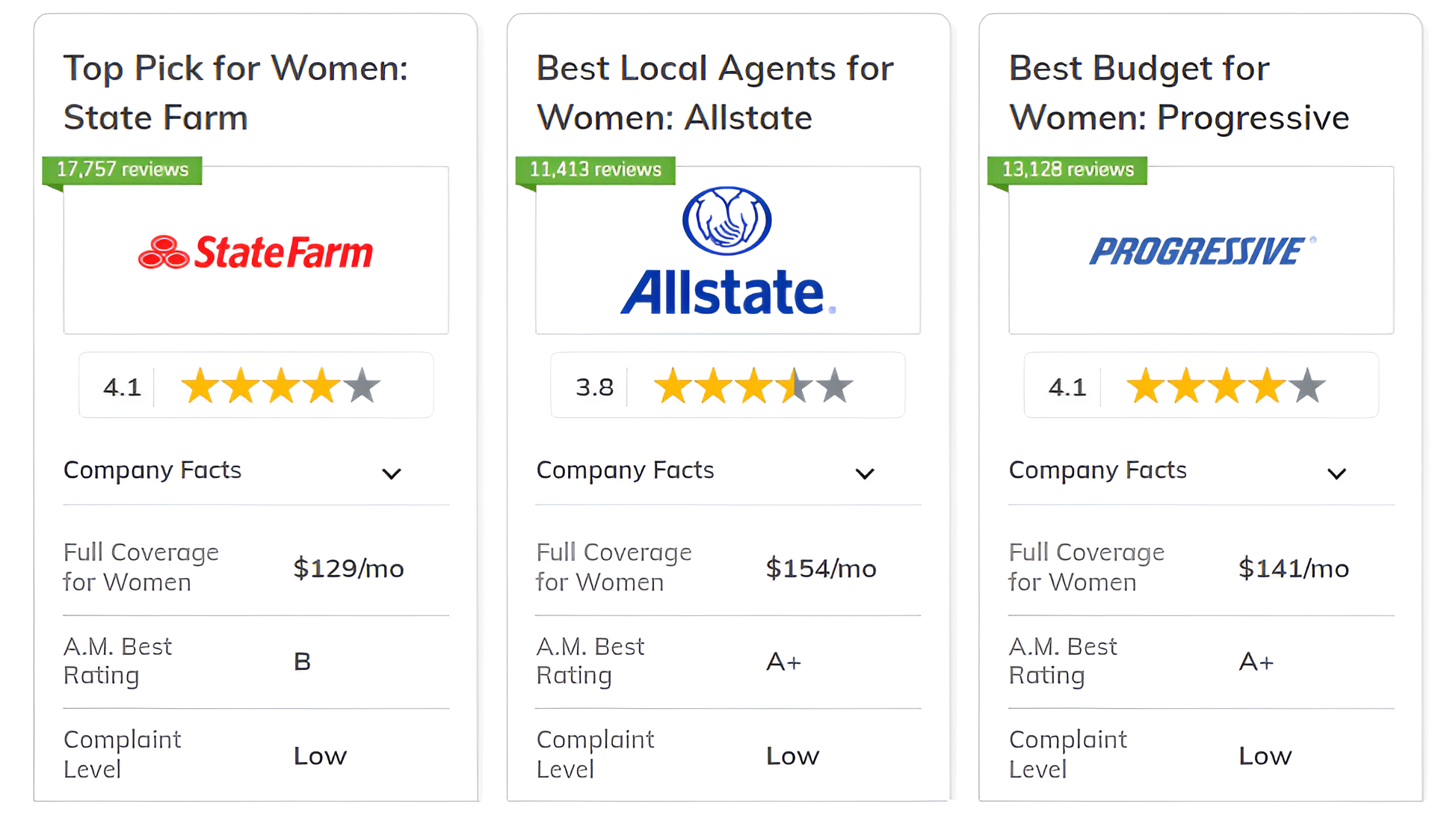

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Customer Service | State Farm | |

| #2 | 25% | A+ | Local Agents | Allstate | |

| #3 | 10% | A+ | Budgeting Tools | Progressive | |

|

#4 | 20% | A+ | Multi-Policy Savings | Nationwide |

|

#5 | 25% | A | 24/7 Support | Liberty Mutual |

| #6 | 20% | A | Discount Variety | Farmers | |

| #7 | 13% | A++ | Unique Coverage | Travelers | |

| #8 | 25% | A | Costco Members | American Family | |

|

#9 | 25% | A+ | Filing Claims | Erie |

| #10 | 15% | A | Diminishing Deductible | Safeco |

Whether you are a first-time insurance buyer or looking to reassess your current policy, exploring these aspects will empower you to navigate the insurance landscape with confidence. Ready to find cheaper car insurance coverage? Enter your ZIP above to begin.

What You Should Know

- State Farm offers the lowest minimum rates for women

- Find out which company provides the greatest discounts for women

- Explore the different types of coverage that women should consider

#1 – State Farm: Top Overall Pick

Pros

- Rideshare Coverage: Women driving for Uber or Lyft should check out our State Farm car insurance review to learn about their specialized coverage.

- Steer Clear Program: Young women under 25 can save money by completing this training, helping build a positive driving record.

- Bank/Insurance Combo: Manage finances and insurance in one place, potentially streamlining bills and unlocking unique discounts.

Cons

- Pricier Minimum Coverage: At $48, the basic option might deter women seeking only legally required insurance.

- No Gap Insurance: Women leasing or financing new vehicles may need to look elsewhere for this popular coverage option.

#2 – Allstate: Best for Local Agents

Pros

- Local Agent Network: Our Allstate car insurance review shows how women benefit from personalized advice through their extensive local agent network.

- Deductible Rewards: Earn $100 off your deductible yearly for safe driving, up to $500, rewarding clean records.

- Milewise Pay-Per-Mile: Great for women working from home or driving infrequently, potentially leading to significant savings.

Cons

- Complex Options: The wide array of coverages might overwhelm women new to auto insurance or seeking straightforward policies.

- Strict Discount Requirements: Some women may find it challenging to qualify for certain discounts due to stringent criteria.

#3 – Progressive: Best for Budgeting Tools

Pros

- Name Your Price Tool: Our Progressive car insurance review highlights this feature, helping budget-conscious women find policies fitting their financial situation.

- Pet Injury Coverage: Automatically included in collision policies, providing peace of mind for women traveling with pets.

- Deductible Savings Bank: Opt-in to reduce your deductible by $50 each claim-free period, rewarding safe driving over time.

Cons

- Higher Rates for Some: Certain groups of women, like those with accidents or in high-risk areas, may find less competitive rates.

- Snapshot Privacy Concerns: Some women might be uncomfortable with the data collection involved in determining discounts.

#4 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Savings: Our Nationwide car insurance review details how women can save up to 20% by bundling auto with other policies.

- Financial Stability: A+ rated by A.M. Best, ensuring reliable claim payouts even during economic uncertainties.

- Plenti Rewards: Earn points through this multi-company program, redeemable for savings on everyday purchases beyond insurance.

Cons

- Pricier Minimum Coverage: At $53, the basic option might discourage women only needing legally required insurance.

- Limited Young Driver Discounts: Fewer specific discounts for young women or student drivers compared to some competitors.

#5 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Our car insurance review of Liberty Mutual highlights round-the-clock assistance, ensuring help whenever women need it.

- Teacher's Auto Insurance: Female educators benefit from additional coverage, including vandalism protection on school property.

- Lifetime Repair Guarantee: Repairs through approved shops are guaranteed for as long as you own the vehicle.

Cons

- Highest Minimum Coverage Cost: At $67, the basic option is the priciest, potentially deterring women seeking only required insurance.

- Potential Rate Increases: Some women report significant premium hikes after claims or as they age.

#6 – Farmers: Best for Discount Variety

Pros

- Diverse Discounts: Our Farmers car insurance review showcases numerous savings, including for alternative fuel vehicles and defensive driving courses.

- New Car Pledge: Replace totaled new cars within the first two model years, not just pay depreciated value.

- Glass Deductible Buyback: Repair or replace windshields without paying a deductible, ideal for women in damage-prone areas.

Cons

- Inconsistent Claims Handling: Some women report mixed experiences with customer service during the claims process.

- Limited State Availability: Not available everywhere, potentially excluding some women based on location.

#7 – Travelers: Best for Unique Coverage

Pros

- Unique Add-Ons: Our Travelers car insurance review details distinctive options like gap insurance and new car replacement coverage.

- Accident Forgiveness: Add this feature to prevent rate increases after your first at-fault accident.

- Affinity Discounts: Women in certain groups or organizations may qualify for additional savings.

Cons

- Post-Claim Rate Hikes: Some women report significant premium increases after filing claims.

- Regional Rate Variations: Depending on location, rates may be less competitive compared to local insurers.

#8 – American Family: Best for Costco Members

Pros

- MyKey Program: Our review of American Family car insurance highlights discounts for young women maintaining good driving habits.

- Bundling Discount: Save up to 25% by combining auto with other policies, ideal for consolidating insurance needs.

- Gap Coverage: Protect against depreciation for leased or financed vehicles in case of total loss.

Cons

- Inconsistent Claims Handling: Some women report mixed experiences with customer service during the claims process.

- Limited Rideshare Options: Women driving for rideshare services may find less comprehensive coverage compared to competitors.

#9 – Erie: Best for Filing Claims

Pros

- Rate Lock Program: Our Erie car insurance review details how women can lock in rates to avoid unexpected increases.

- Auto Security Discount: Save more with anti-theft devices or other vehicle security features.

- ERIE Rate Protect: Helps shield women from rate hikes unrelated to driving behavior or policy changes.

Cons

- No Usage-Based Program: Lack of telematics options may disadvantage safe female drivers seeking such discounts.

- Limited Online Tools: Less developed digital presence may frustrate tech-savvy women preferring online policy management.

#10 – Safeco: Best for Diminishing Deductible

Pros

- Diminishing Deductible: Our guide on switching car insurance to save money explains how this program reduces collision deductibles.

- Single Loss Deductible: Pay only the highest deductible if a loss affects multiple Safeco policies.

- Multi-Policy Discount: Save up to 15% by bundling auto with other policies.

Cons

- Higher Full Coverage Premiums: At $149, rates may deter budget-conscious women seeking more affordable comprehensive coverage.

- Complex Policy Structure: Variety of options might overwhelm women new to auto insurance or seeking straightforward policies.

Top Tips for Women Seeking Car Insurance

Finding the right car insurance can be a challenge, but with a few tailored strategies, women can secure the best coverage at the most competitive rates. By assessing coverage needs, seeking gender-specific discounts, exploring bundling options, and reviewing customer service, you can make an informed choice that fits your lifestyle and budget.

- Assess Your Coverage Needs: Choose insurers that offer comprehensive coverage or pay-per-mile options based on your driving habits.

- Look for Gender-Specific Discounts: Benefit from discounts for a clean driving record and check for savings related to specific professions or educational backgrounds.

- Compare Bundling Options: Bundle auto insurance with home or renters insurance for extra savings and evaluate how bundling affects your overall premium.

- Review Customer Service and Claims Handling: Research customer reviews to ensure efficient claims handling and choose insurers with round-the-clock support for added peace of mind.

By following these tips, you’ll be better equipped to choose an insurance policy that meets your needs and maximizes savings.

Prioritize coverage that suits your driving habits, take advantage of available discounts, and ensure excellent customer service to enjoy peace of mind as you travel the road.

Women’s Car Insurance Costs: Minimum vs. Full Coverage

When comparing car insurance options, understanding the cost of both minimum and full coverage is essential. This table provides a snapshot of various insurance companies, highlighting their monthly rates for minimum and full coverage policies. Use this information to find a plan that balances cost and coverage effectively.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $62 | $154 | |

| $59 | $144 | |

|

$51 | $133 |

| $64 | $158 | |

|

$67 | $162 |

|

$53 | $146 |

| $58 | $141 | |

| $66 | $149 | |

| $48 | $129 | |

| $57 | $137 |

With these cost comparisons in mind, you can make a more informed decision about your car insurance. Consider both minimum and full coverage options to choose a policy that fits your budget and provides the protection you need.

We've compiled a list of top providers offering various discounts, from safe driver and multi-policy to unique options like teen safe driver and accident forgiveness. Compare and save with these top-rated insurance companies.

| Insurance Company | Available Discount |

|---|---|

| Safe Driver, Bundling, New Car, Anti-Theft | |

| Safe Driver, Bundling, Teen Safe Driver, Good Student | |

|

Safe Driver, Bundling, Good Student, Accident Forgiveness |

| Safe Driver, Bundling, Good Student, Homeowner | |

|

Safe Driver, Bundling, New Car, Hybrid/Electric |

|

Safe Driver, Bundling, Vanishing Deductible, SmartRide |

| Safe Driver, Bundling, Snapshot, Homeowner | |

| Safe Driver, Bundling, Accident Forgiveness, New Car | |

| Safe Driver, Bundling, Good Student, Drive Safe & Save | |

| Safe Driver, Bundling, IntelliDrive, Homeowner |

Maximize your savings with these excellent car insurance discounts from leading providers. Whether you're a safe driver, a homeowner, or have a new car, these discounts can help you get the best value. Choose the right provider and enjoy significant savings on your car insurance. If you're considering Progressive, check out our Progressive Snapshot Review.

Types of Coverage to Consider for Women

When selecting car insurance, women should consider coverage options that address their unique needs and lifestyle. Here’s a guide to essential types of coverage and what they mean for women:

Comprehensive Coverage

Protection Against Non-Collision Damage: Helps keep your car safe from things that can hurt it, even when you're not in a crash. This means it can protect your car if someone steals it, if someone damages it on purpose, if there's a big storm, or if you accidentally hit an animal. This is valuable for women who live in areas prone to these risks or who want additional peace of mind.

Collision Coverage

This type of coverage pays for repairs to your vehicle after a collision, regardless of who is at fault. It’s especially useful for women with newer or higher-value cars who want to ensure their vehicle is repaired or replaced after an accident.

Read More: Collision vs. Comprehensive Coverage

Gap Insurance

If you’re leasing or financing your car, gap insurance covers the difference between what you owe on your loan or lease and the current market value of your vehicle if it’s totaled. This is essential for women who have recently purchased or leased a new car.

Bundle is life! Can’t argue with that logic. 🏠 + 🚗https://t.co/uNYjYTKwoU pic.twitter.com/RRoMMaYbbc

— State Farm (@StateFarm) August 28, 2024

Rideshare Insurance

For women driving for rideshare services like Uber or Lyft, rideshare insurance provides coverage during the time you’re working, filling the gap that traditional auto insurance might not cover. Companies like State Farm offer specialized policies for rideshare drivers.

Roadside Assistance

Roadside assistance covers services such as towing, tire changes, and fuel delivery if you encounter issues while on the road. It’s a useful addition for women who frequently drive long distances or in areas where roadside help may be limited.

Rental Car Coverage

This option pays for a rental car if your vehicle is in the shop for repairs due to a covered claim. It’s helpful for women who rely on their car for daily commuting and want to ensure they have transportation while their car is being repaired.

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers, regardless of fault, in the event of an accident.

This is beneficial for women who want comprehensive coverage for medical costs and lost wages due to injuries.

This is beneficial for women who want comprehensive coverage for medical costs and lost wages due to injuries.

Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage helps pay for damages if you’re in an accident with a driver who doesn’t have adequate insurance. It’s important for women to consider this coverage to protect against the risk of being hit by a driver with insufficient insurance.

Each of these coverage types offers different benefits and protections, so it's important for women to assess their personal needs and choose the coverage that best suits their driving habits and lifestyle.

Finding the best car insurance for women involves comparing coverage options, discounts, customer service, and costs.

Best Car Insurance for Women: Top Service, Discounts, and Perks

Look for insurers with excellent customer service, flexible payment plans, specialized programs for young and rideshare drivers, and significant multi-policy discounts.

Additional perks like budgeting tools, pet injury coverage, and 24/7 support can enhance the insurance experience. By evaluating these factors, women can choose a provider that offers the best cost of car insurance tailored to their needs.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

What is the most trusted car insurance company?

The most trusted car insurance company can vary based on individual experiences and needs. It's best to research and compare multiple providers to find the one that suits you best.

Who is the top 5 insurance company?

The top 5 insurance companies can change over time, but typically include well-known names like State Farm, Geico, Progressive, Allstate, and Liberty Mutual. However, rankings can vary based on different factors and sources.

Which type of car insurance is best?

The best type of car insurance depends on your specific needs and circumstances. As you explore your options, our guide on what kind of car insurance you really need can help you understand the different types of coverage and determine which is best for your situation.

Who typically has the cheapest car insurance?

The cheapest car insurance provider can vary depending on factors like your location, driving history, and the type of coverage you need. It's important to compare quotes from multiple insurers to find the best rates for your specific situation.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Which insurance company has the highest customer satisfaction?

Customer satisfaction ratings can change annually. Companies like USAA, Amica Mutual, and NJM Insurance often rank highly, but it's best to check recent surveys and reviews for the most up-to-date information.

Which car insurance company has the best claim settlement ratio?

Claim settlement ratios can vary, but some companies consistently perform well in this area. To get a better understanding of how different insurers handle claims, you might find our article on consumer car insurance claims ratings helpful in your research.

Which company gives best insurance?

The best car insurance companies can vary depending on individual needs and preferences. It's important to compare different providers based on factors like coverage options, prices, customer service, and financial stability.

Which insurance cover is best for car?

The best car insurance coverage depends on your specific needs, budget, and the value of your car. Generally, a combination of liability, collision, and comprehensive coverage provides the most protection.

What are the 4 recommended type of insurance?

While recommendations can vary, four common types of car insurance are liability, collision, comprehensive, and personal injury protection.

At what age is car insurance cheapest?

Car insurance rates typically start to decrease around age 25 and continue to drop as you enter your 30s and 40s, assuming you maintain a good driving record. However, many factors beyond age affect insurance rates.

You can also enter your ZIP code below into our free comparison tool to start comparing car insurance rates now.