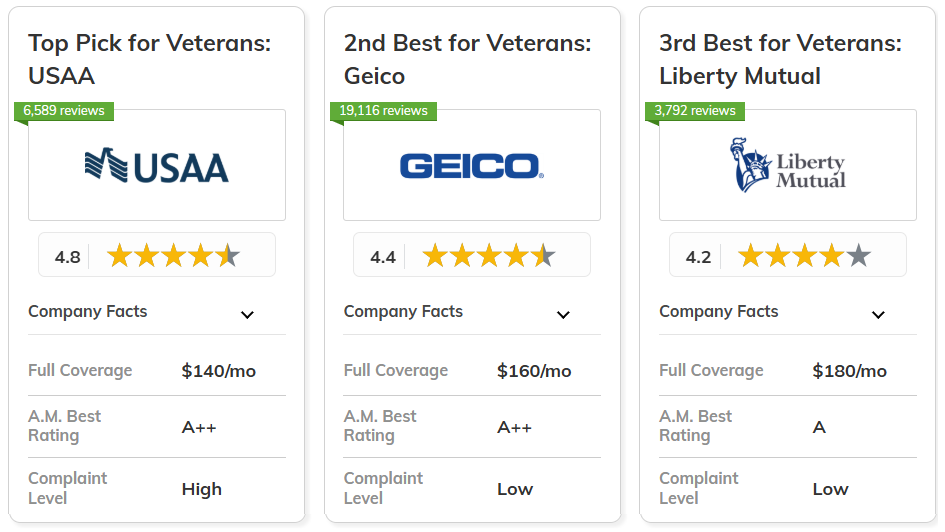

USAA, Geico, and Liberty Mutual are the best car insurance companies for veterans. USAA offers the lowest monthly rates, starting at $80 for minimum coverage.

Veterans seeking insurance need providers who understand military-specific needs, such as deployment coverage, storage unit insurance, and flexible payment arrangements during service transitions.

| Company | Rank | A.M. Best | Bundling Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | 10% | Military Benefits | USAA | |

| #2 | A++ | 25% | Military Discount | Geico | |

|

#3 | A | 25% | Storage Discount | Liberty Mutual |

| #4 | A | 20% | Innovative Tool | Farmers | |

| #5 | B | 17% | Comprehensive Coverage | State Farm | |

|

#6 | A+ | 17% | Deployment Discount | Nationwide |

| #7 | A+ | 20% | Competitive Rates | Progressive | |

| #8 | A+ | 25% | Custom Policies | Allstate | |

|

#9 | A+ | 25% | Customer Service | Erie |

| #10 | A++ | 13% | Accident Forgiveness | Travelers |

All ten top providers offer accident forgiveness and roadside assistance, but only USAA, Liberty Mutual, Nationwide, and Progressive include comprehensive coverage across all six major benefit categories discussed in this guide.

What You Should Know

- USAA leads the best car insurance companies for veterans

- Liberty Mutual provides veterans with the highest military discount available at 35%

- Veterans with Geico receive a 25% bundling discount

Keep reading to find the best car insurance companies for veterans in your state. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

#1 – USAA: Top Overall Pick

Pros

- Military-Focused Experts: USAA provides personalized insurance support because its experts possess military-focused knowledge.

- Lowest Rates: Offers the cheapest average premiums for veterans in need of coverage, with basic policies beginning at $80 per month.

- Exclusive Military Perks: Offers specialized benefits unavailable through other providers, including deployment storage options. Learn more in our USAA car insurance review.

Cons

- Few Physical Offices: Fewer in-town agents than competitors, and for veterans, talking face to face is a challenge.

- Membership Requirements: Only open to military, veterans, and their families.

#2 – Geico: Best for Military Discount

Pros

- Big Military Discount: Offers a 25% military discount, which is a big savings for veterans looking for cheap insurance.

- Great Package Deals: Good bundling options to combine car insurance with other coverages for maximum savings.

- User-Friendly Technology: Geico has a user-friendly mobile app that lets veterans easily manage their insurance policies from pretty much anywhere.

Cons

- No Gap Coverage Protection: Lacks vehicle depreciation protection that many competing veteran insurance companies provide (Read More: What is gap insurance?).

- Primarily Digital Experience: Functions mostly on an electronic basis, potentially challenging for veterans accustomed to traditional insurance transactions.

#3 – Liberty Mutual: Best for Storage Discount

Pros

- Deployment Vehicle Protection: Provides up to 60% discounted vehicle storage coverage for deployed veterans, including vehicle theft protection while serving abroad.

- Premium Military Discount: In our car insurance review of Liberty Mutual, it delivers a 35% military discount for all veterans regardless of deployment status.

- Progressive Deductible Program: Features vanishing deductible options that reduce your collision deductible by $100 annually when veterans maintain clean driving records.

Cons

- More Expensive Basic Coverage: Provides higher premiums to veterans under basic policies than any other company.

- Finite Digital Tools: It has few online resources for managing policies. Some insurers have long served veterans and offer more.

#4 – Farmers: Best for Innovative Tools

Pros

- Overseas Coverage: As discussed in our Farmers insurance review, it includes deployment coverage for veterans stationed outside the country.

- Local Presence: A lot of its local agents understand the local conditions that affect veterans' insurance premiums in different areas.

- Usage-Based Rates: The Farmers Signal app, their usage-based insurance program, can save veterans up to 30% based on actual driving habits.

Cons

- No Loyalty Rewards: It doesn’t offer a vanishing deductible for long-term veteran policyholders.

- Higher Base Rates: Charges higher minimum coverage rates than some other companies, which might put a strain on veterans' budgets during their transitions.

#5 – State Farm: Best for Comprehensive Coverage

Pros

- Great Protection Options: All-inclusive protection like roadside help when you need it and money for a car rental.

- Widespread Agent Network: Maintains over 19,000 local agents nationwide who understand veterans' needs. Learn more in our State Farm car insurance review.

- Safety Incentives: Competitive discounts for vehicles with safety features so veterans can save on protected transportation.

Cons

- Financing Protection Gap: Lacks gap insurance coverage many veterans require when financing new vehicles after military service.

- Restricted Multi-Policy Savings: Has a limited bundling discount of 17%, lower than what most competing veteran insurance organizations offer.

#6 – Nationwide: Best for Deployment Discount

Pros

- Reserve Service Benefits: Featured in our Nationwide car insurance review, it offers deployment discounts for car storage and suspended coverage during active deployment.

- Decreasing Deductible Advantage: Excellent vanishing deductible program for veterans building long-term civilian driving records.

- Safe Driver Rewards: Offers a 40% good driver discount for veterans who are safe drivers, the highest in the market.

Cons

- Minimal Military Discount: Provides a surprisingly low 5% military discount, significantly less generous than other leading veteran insurance providers.

- Fewer Features for Veterans: It has less of what veterans need when they leave the service and step into civilian life.

#7 – Progressive: Best for Competitive Rates

Pros

- Affordable Transition Coverage: Offers consistently budget-friendly premium options for veterans entering civilian life. Learn more in our Progressive car insurance review.

- Exact Savings: Offers driving-habit insurance with dollar savings and not a percentage-based discounts for veterans.

- Veteran-Friendly Forgiveness: There are not that many military-trained representatives among the top veteran insurance companies.

Cons

- Reduced Package Incentives: Only 10% bundling discount, so less savings for veterans buying multiple policies.

- Fewer Military-Trained Reps: Has fewer military-trained customer service representatives than the highest-ranked veteran insurance providers.

#8 – Allstate: Best for Custom Policies

Pros

- More Safety Incentives: As highlighted in our Allstate car insurance review, it has discounts for anti-lock brakes, anti-theft devices, and car safety features for veterans.

- Coverage Options: Vets can preview neat options such as the Drivewise telematics program and the optional roadside advantage.

- Specialized Agents: There are agents in every town who know the insurance needs of veterans and have specific training.

Cons

- Premium Price Point: Charges elevated minimum coverage rates compared to most competitors, creating challenges for veterans with fixed incomes.

- Missing Loyalty Benefits: Lacks decreasing deductible options that many veterans prefer when seeking long-term insurance rewards.

#9 – Erie: Best for Customer Service

Pros

- Adaptable Protection Plans: Offers adjustable coverage options for veterans, including Rate Lock and diminishing deductibles. Learn more in our Erie car insurance review.

- Competitive Full Coverage: Offers good rates for solid coverage, allowing veterans to protect their newer vehicles without paying too much.

- Loyalty Deductible Program: Great diminishing deductible benefits for veterans to build a consistent civilian driving record.

Cons

- Regional Availability Restrictions: Available only in a few states, this denies numerous veterans from receiving reasonable rates and coverage they are entitled to.

- No Military-Specific Discounts: It doesn't have the special discounts for service members that most other top insurance companies offer to veterans.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Financing Protection: Gap insurance covers up to 25% above actual cash value for new cars, so veterans don't lose car equity.

- Multi-Vehicle Specialization: Customized plans for veterans with multiple vehicles, each requiring a different level of coverage.

- Accident Forgiveness Coverage: It forgives accidents for minor violations to help vets get accustomed to driving as a civilian.

Cons

- Limited Vehicle Safety Incentives: Provides reduced discounts for safety features compared to competitors (Read More: Travelers Car Insurance Review).

- Moderate Service Discounts: Gives comparatively modest military rate reductions at 15%, offering veterans fewer savings than most competitors.

Car Insurance Costs for Veterans

Veterans deserve affordable coverage that honors their service and provides full coverage. The best car insurance for veterans typically offers military discounts that save you up to 10% or more on your monthly premiums.

| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $120 | $200 | |

|

$85 | $145 |

| $100 | $175 | |

| $95 | $160 | |

|

$105 | $180 |

|

$98 | $165 |

| $110 | $190 | |

| $90 | $155 | |

| $100 | $170 | |

| $80 | $140 |

According to our table of monthly rates above, costs vary significantly among the best military car insurance companies, with insurers like USAA being the most competitive.

While costs matter, veterans should also consider military discounts, deployment coverage options, and features specific to military life.

How Veterans Can Save Money on Car Insurance

Veterans are owed some special consideration by insurance companies, and there are a number of ways other than regular military discounts that can actually lower your premiums substantially. The following are the best ways to save you the most:

- Request for Military Installation Discounts: The majority of insurers give an extra 15-20% discount when your vehicle is garaged on a military base.

- Take Defensive Driving Course: Enroll in a military-approved defensive driving course for an additional 10-15% discount on premiums.

- Look at Pay-Per-Mile Insurance: For less than 10,000 miles annually, veterans can save up to 40% on usage-based insurance.

- Request Deployment-Specific Discounts: Store your vehicle during deployment for premium reductions of up to 60% while maintaining comprehensive coverage.

The top car insurance companies that customers recommend offer several insurance discounts for veterans to help military families lower their expenses. Below is a breakdown of discount percentages available from top providers.

| Company | Military Discount | Bundling | Good Driver | Safe Vehicle | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

|

15% | 20% | 30% | 25% | 30% |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

|

35% | 25% | 20% | 15% | 30% |

|

5% | 20% | 40% | 15% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 13% | 10% | 8% | 30% | |

| 15% | 10% | 30% | 10% | 30% |

Liberty Mutual has the greatest military discount at 35%, while Nationwide rewards good drivers with the largest discount at 40%. Military veterans seeking to bundle policies will want to consider Allstate, Geico, and Liberty Mutual, each of which provides 25% discounts.

Many insurers also have usage-based insurance (UBI) policies that reward good driving, and Nationwide has a 40% savings potential.

Comprehensive Comparison of Coverage for Veterans

When selecting an automobile insurance, veterans have to consider both military and general options. The most basic common plans are:

- Liability Insurance: Required in most states, covers damages to others in accidents you cause.

- Collision Coverage: Pays for damage to your vehicle after an accident.

- Comprehensive Coverage: Covers non-collision damage (theft, vandalism, natural disasters).

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: This protects you if a driver with insufficient insurance hits you.

Beyond this basic coverage, veterans can benefit from other additional protection options. Take a look at the table below to see what coverage you can get from the top providers:

| Company | Accident Forgiveness | Vanishing Deductible | Roadside Assistance | Rental Car Reimbursement | Gap Insurance |

|---|---|---|---|---|---|

| ✅ | ❌ | ✅ | ✅ | ✅ | |

|

✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ❌ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | ❌ | |

|

✅ | ✅ | ✅ | ✅ | ✅ |

|

✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ❌ | ✅ | ✅ | ❌ | |

| ✅ | ❌ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

Most of the best car insurance companies for veterans offer accident forgiveness and essential coverages. While roadside assistance and rental car coverage are widely available, gap insurance and vanishing deductibles are less common.

What's in our baby bag? LOTS and LOTS of diapers. For more advice: https://t.co/mzwxpGlbBv pic.twitter.com/WesdkPiy7C

— USAA (@USAA) March 3, 2025

However, only USAA, Liberty Mutual, Nationwide, and Progressive provide all six featured benefits, including vanishing deductibles and gap insurance options that can be particularly valuable for veterans financing new vehicles.

Securing the Best Veteran Car Insurance

USAA, Geico, and Liberty Mutual are the best car insurance companies for veterans. USAA offers exclusive military-focused benefits, Geico provides substantial 25% military discounts, and Liberty Mutual features specialized vehicle storage protection during deployment.

Veterans can find optimal coverage by comparing multiple auto insurance quotes online, allowing them to discover which military discounts and deployment protections best fit their specific situation. On threads about the best car insurance for veterans, Reddit users frequently recommend checking USAA first:

Comment

byu/Tasty-Window from discussion

inVeteransBenefits

Need the cheapest car insurance possible? Enter your ZIP code into our free comparison tool to find the most affordable rates for your vehicle.

FAQ

What’s the best auto insurance for veterans?

USAA, Geico, and Liberty Mutual typically offer the best veteran options, combining competitive rates with military-specific discounts and coverage benefits.

Does Allstate offer veteran discounts?

Allstate offers veterans a 10% military discount, plus additional savings through their bundling options and safe driving programs.

Read More: What Is Considered a Clean Driving Record?

How do military car insurance needs change during deployment?

During deployment, veterans need storage coverage options, suspended liability coverage, and flexible payment plans that accommodate military service requirements.

What insurance do most veterans have?

USAA is the most popular insurance choice among veterans due to its military-exclusive benefits, competitive rates, and specialized customer service.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Is USAA only for the military?

USAA membership is exclusively available to active military veterans and their eligible family members, including spouses and children.

Read More: How to Find Out if You're Eligible for USAA Insurance

How does car insurance for military families differ from standard policies?

Unlike standard policies, military insurance offers flexible coverage that can be paused during deployments, waives cancellation fees during relocations, and accommodates international service requirements—all designed specifically for the unique demands of military life.

How do car insurance rates for veterans compare between minimum and full coverage?

Veterans typically save 15-25% compared to civilians on both coverage types, with USAA offering the most competitive rates for full coverage car insurance.

Which states require insurance companies to provide military discounts to veterans?

Only California, Connecticut, Delaware, Illinois, Indiana, and Pennsylvania have laws requiring insurers to offer military discounts to veterans.

Ready to shop around for the best car insurance company? Enter your ZIP code and see which one offers the coverage you need.

Can veterans get auto insurance for $29 a month?

While some companies advertise the cheapest car insurance for veterans, starting at $29 monthly, most veterans will pay more. Minimum coverage might approach this price point for veterans with perfect driving records in low-cost states.

Do 100% disabled veterans get cheaper car insurance?

Yes, disabled veteran car insurance often includes additional discounts beyond standard military savings. USAA and other insurers offer specific programs for 100% disabled veterans that can reduce premiums by an additional 10-15% compared to regular car insurance discounts for veterans.

Read More: 10 Best Car Insurance Companies for Disabled Veterans

Do veterans really get cheaper car insurance?

Yes, veterans typically save 15-35% on car insurance compared to civilians. Military discounts are legitimate savings offered by most major insurers, with Liberty Mutual providing the highest discount at 35% and USAA car insurance for veterans offering the lowest overall rates.

Is USAA the cheapest car insurance?

USAA car insurance consistently offers the lowest average rates for military members and veterans, with minimum coverage starting around $80 monthly.

Is USAA cheaper than State Farm?

For military members and veterans, USAA insurance typically costs 10-15% less than State Farm. USAA's minimum coverage averages $80 monthly compared to State Farm's $90, while full coverage averages $140 at USAA versus $155 at State Farm.

Read More: State Farm vs. USAA

Does Geico do veteran discounts?

Yes, Geico offers significant car insurance discounts for veterans at 25% off, one of the highest military discounts in the industry. This discount applies to veterans from all service branches.