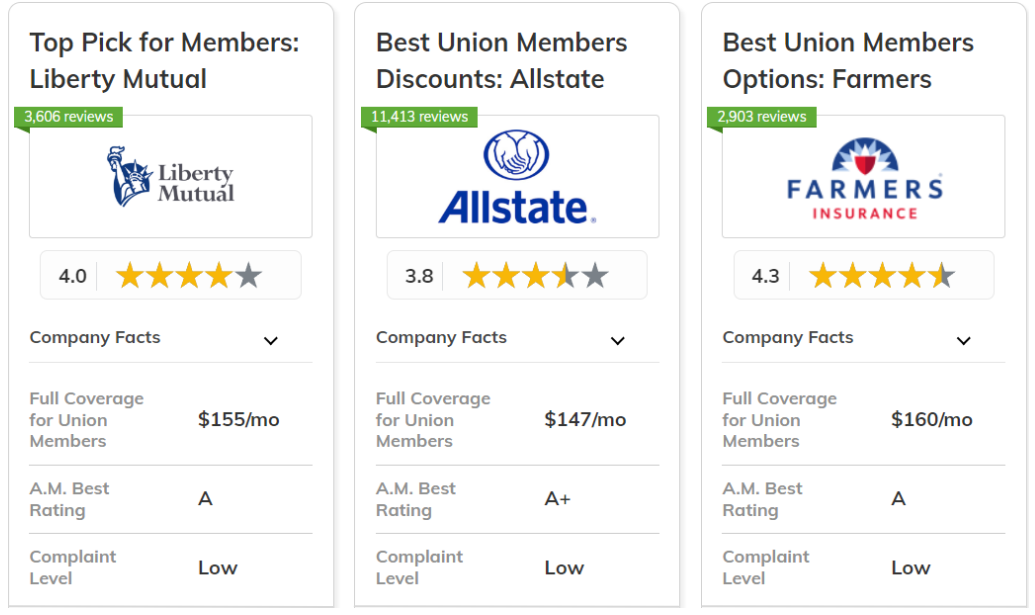

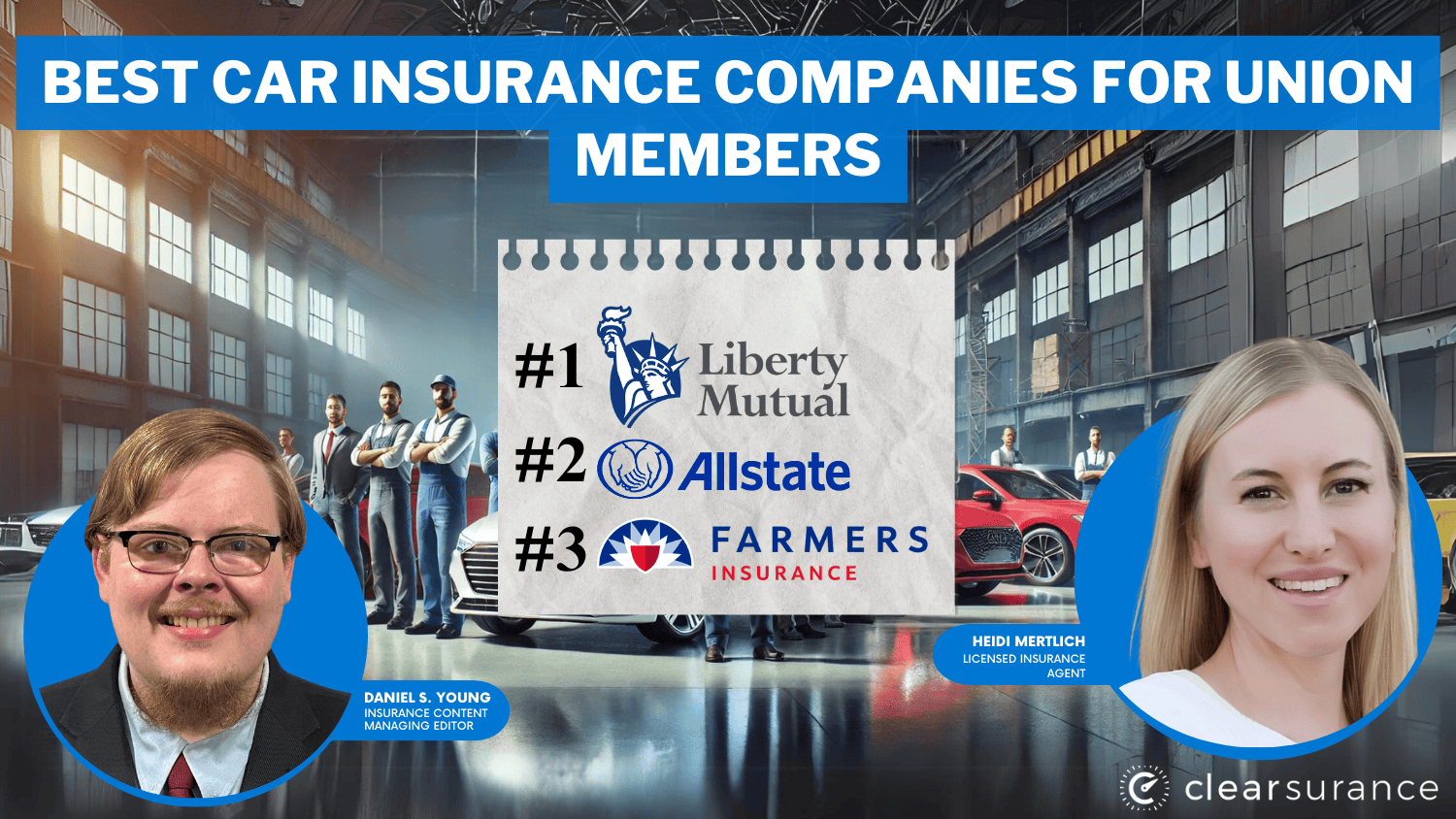

Liberty Mutual, Allstate, and Farmers are the best car insurance companies for union members, offering union-specific features and rates that start at $40/month.

Liberty Mutual offers round-the-clock roadside assistance to union members with irregular working schedules, while Allstate offers 25% bundling discounts for additional savings.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

|

#1 | 25% | A | Comprehensive Coverage | Liberty Mutual |

| #2 | 25% | A+ | Strong Discounts | Allstate | |

| #3 | 20% | A | Flexible Options | Farmers | |

| #4 | 10% | A++ | Military Benefits | USAA | |

|

#5 | 5% | A+ | Retired Members | The Hartford |

|

#6 | 20% | A+ | Broad Coverage | Nationwide |

| #7 | 25% | A++ | Competitive Rates | Geico | |

| #8 | 17% | B | Extensive Network | State Farm | |

| #9 | 10% | A+ | Customizable Policies | Progressive | |

| #10 | 15% | A | Online Tools | Safeco |

To secure the best insurance rates, union members should compare quotes from car insurance companies that customers recommend. Farmers offer a diminishing deductible for safe-driving union members, which means that the out-of-pocket expense decreases over time.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

What You Should Know

- Liberty Mutual is the best car insurance company for union members

- Union members can save up to 25% with Allstate if they bundle home and auto

- The Hartford has the best auto insurance for retired union members

#1 – Liberty Mutual: Top Overall Pick

Pros

- Union-Tailored Policies: Customize coverage for job-specific needs. Learn more in our Liberty Mutual insurance review.

- Comprehensive Options: Wide range of coverages suitable for various union professions.

- 24/7 Roadside Assistance: Round-the-clock help for union members with irregular hours.

Cons

- Limited Accident Forgiveness: Less generous program may impact high-risk occupation union members.

- Complex Claims Process: Some union members report challenges that are potentially problematic for those with limited time.

#2 – Allstate: Best for Strong Discounts

Pros

- Bundling Discount: Significant 25% savings for union members combining policies. See our Allstate insurance review for more.

- DriveWise Discount Program: Benefits safe-driving union members with cheaper rates.

- Milewise Discount Rates: With Allstate pay-per-mile car insurance, union members who don't drive often can save money.

Cons

- Potential Rate Increases: Claims lead to large rate hikes, union members say.

- Strict Accident Forgiveness: It may affect union members in higher-risk occupations.

#3 – Farmers: Best for Flexible Options

Pros

- Customizable Union Policies: These policies cover the risks related to the job. Explore options in our Farmers insurance review.

- New Car Pledge: Provides more protection for union members with new vehicles.

- Diminishing Deductible: Rewards safe driving and potentially cuts costs over time.

Cons

- Limited Usage-Based Options: Savings for safe union member drivers may be limited in less developed programs.

- Fewer Digital Tools: It may annoy tech-savvy union members who prefer online management.

#4 – USAA: Best for Military Benefits

Pros

- Military and Veteran Benefits: Tailored discounts for union members with military backgrounds or families. Check our USAA insurance review for details.

- Accident Forgiveness: Protects rates after first-time accidents in high-risk union jobs.

- Deployment-Friendly: Special coverage options for active military or reservist union members.

Cons

- Limited Local Agents: Fewer face-to-face options compared to some competitors.

- Fewer Local Partnerships: May limit union-specific discount opportunities.

#5 – The Hartford: Best for Retired Union Members

Pros

- Strong Financial Stability: A+ A.M. Best rating assures reliable union member insurance claims handling.

- 12-Month Rate Protection: Helps union members budget for car insurance.

- Disappearing Deductible: Reduces insurance deductibles over time for union members who are safe drivers.

Cons

- Limited Appeal for Younger Members: AARP focus will not benefit younger union workers.

- Smaller Market Share: Fewer local agents or service centers in some areas.

#6 – Nationwide: Best for Broad Coverage

Pros

- On Your Side Review: Annual policy review allows coverage to match changing union job needs. See our Nationwide insurance review for more.

- SmartMiles Program: The pay-per-mile option is a good option for union members who drive infrequently.

- Bundling Discount: 20% savings on car insurance if combined with other policies.

Cons

- Potential Rate Increases: Fixed salary union members report unexpected hikes at renewal.

- Complex Policies: This can be overwhelming for union members seeking a more straightforward kind of coverage.

#7 – Geico: Most Affordable Full Coverage

Pros

- Low Full Coverage Rates: Geico charges Union members $125 monthly for full coverage. Find out how to switch car insurance companies and save money.

- User-Friendly Digital Tools: It caters to tech-savvy union members with its advanced apps and online services.

- 24/7 Customer Service: Support union members with irregular work schedules around the clock.

Cons

- Mixed Claims Process Reviews: Some union members report difficulty, which could be a problem and time-consuming.

- Lower Bundling Discount: Some are more competitive for bundling discounts.

#8 – State Farm: Best for Extensive Network

Pros

- Large Local Agent Network: Extensive face-to-face service options. Learn more in our State Farm insurance review.

- Rideshare Coverage: Specialized protection for union members supplementing income with rideshare driving.

- Multiple Line Discount: Big savings for union members who bundle auto with home or renters insurance.

Cons

- Higher Full Coverage Cost: State Farm full coverage is more expensive than other cheap car insurance companies for union members.

- Lower Financial Ratings: State Farm's A.M. Best rating is lower than the competition.

#9 – Progressive: Best for Customizable Policies

Pros

- Name Your Price Tool: Helps union members find coverage fitting their budget. See our Progressive insurance review for details.

- Small Accident Forgiveness: Protects rates after minor incidents, valuable for high-risk union jobs.

- Pet Injury Coverage: Included with collision coverage, which benefits union members traveling with pets.

Cons

- Higher Rate Increases: Union members report unexpected and expensive insurance rate hikes at renewal.

- Limited Large Accident Forgiveness: Stricter eligibility may impact union members in high-risk professions.

#10 – Safeco: Best Online Claims

Pros

- 24-Hour Online Claims Assistance: It provides round-the-clock service during irregular union work hours. Find out when to file car insurance claims.

- First Aid Reimbursement: This covers first aid supplies used at accident scenes and is beneficial for emergency response unions.

- New Vehicle Replacement: It replaces totaled new cars in the first year or first 15,000 miles.

Cons

- Potential Rate Increases: For fixed salary union members, it is also a challenge as they report unexpected hikes after claims.

- Complex Policy Structure: Those who are looking for simple coverage may be overwhelmed by a variety of options.

Comparing Car Insurance Rates for Union Members

Below is a table detailing the minimum and full coverage monthly costs for union members of several top insurance companies.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $147 | |

| $58 | $160 | |

| $45 | $125 | |

|

$60 | $155 |

|

$50 | $135 |

| $54 | $145 | |

| $48 | $132 | |

| $52 | $138 | |

|

$53 | $150 |

| $55 | $140 |

Geico and State Farm are the cheapest car insurance companies for union members. However, Liberty Mutual offers competitive rates for those who need to customize more comprehensive coverage.

Comparing insurance rates is crucial for finding the best coverage at the right price. Whether you need minimum or full coverage, this information helps you make an informed decision.

Union Member Insurance Discounts and Benefits

Union members often enjoy special discounts and benefits from insurance companies. Insurers like Liberty Mutual and Farmers offer exclusive rates and perks for union members.

| Insurance Company | Available Discount |

|---|---|

| Union Member, Bundling, Safe Driving, New Car | |

| Union Member, Bundling, Safe Driver, Good Student | |

| Union Member, Bundling, Safe Driver, Military | |

|

Union Member, Bundling, Safe Driver, Good Student |

|

Union Member, Bundling, Safe Driver, Good Student |

| Union Member, Bundling, Safe Driving | |

| Union Member, Bundling, Safe Driver, Good Student | |

| Union Member, Bundling, Safe Driver, Good Student | |

|

Union Member, Bundling, Safe Driving, Anti-Theft Device |

| Union Member, Military, Bundling, Safe Driver |

These discounts can lower premiums, and the multi-policy discount, in particular, can help you save more by bundling different types of insurance policies together.

Remember to ask about discounts for union members to make sure you're getting every bit of savings you can.

Read More: Best Car Insurance Companies for Accident Forgiveness

Choosing the Best Insurance Company for Union Members

Liberty Mutual, Allstate, and Farmers are the best car insurance companies for Union Members.

Union members can enjoy competitive rates and reliable service from Liberty Mutual. Fair treatment and customer satisfaction are what Allstate is known for. Farmers provide tailored insurance solutions with a strong reputation.

If you ask us, there’s no such thing as too many Dougs. pic.twitter.com/s5o0940Bwz

— Liberty Mutual (@LibertyMutual) November 6, 2023

Union members should consider the reputation and reliability of the insurer when choosing a car insurance company. You can check this in our consumer car insurance claims ratings.

It’s important to select a company known for consistent service and fair treatment. Find your cheapest coverage option by using our free quote comparison tool below today.

Frequently Asked Questions

What are the insurance benefits of a union membership?

Being a member of a worker's union can qualify you for affiliation discounts and additional savings with some providers.

What are the top 10 insurance companies for union members?

The best car insurance companies for union members include State Farm, Geico, Liberty Mutual, Farmers, and Allstate.

Which company gives the best car insurance for union members?

Liberty Mutual has the best car insurance coverage for union members for its policy variety and customization options.

Who typically has the cheapest car insurance for union members?

Geico and State Farm have cheap auto insurance for union members in most states. Compare rates from the 10 cheapest car insurance companies to get the lowest price near you.

Is USAA car insurance only for the military?

Yes, USAA primarily serves military members, veterans, and their families. It is available to active duty, retired, and honorably discharged personnel, as well as cadets and midshipmen at service academies.

Read More: Best Military Car Insurance

What is the most common insurance in the U.S.?

Auto insurance is the most common insurance in the U.S. due to legal requirements in most states. Enter your ZIP code to find affordable car insurance near you.

Do union members get car insurance discounts?

Yes, many major insurers, including Liberty Mutual and Geico, offer discounts to certain member affiliation groups.

Do unions offer life insurance?

Some unions may offer group life insurance to their members. It's important to talk to your union leaders about the insurance benefits available to you.

What does UBI mean in car insurance?

UBI refers to usage-based car insurance that uses tracking devices to monitor driver behavior and mileage to set rates and discounts. Learn more about car insurance companies that use tracking devices.

Which insurance company is owned and controlled by its members?

Mutual insurance companies like Amica are owned by policyholders rather than shareholders.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.