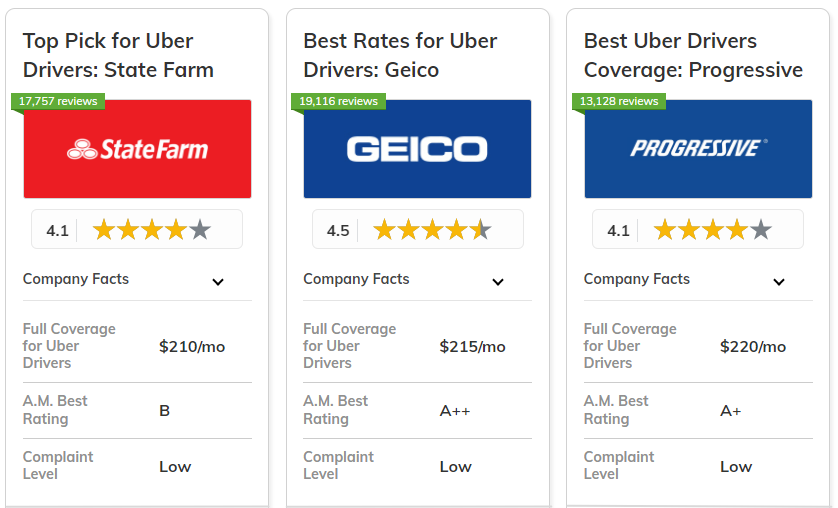

The best car insurance companies for Uber drivers are State Farm, Geico, and Progressive, offering comprehensive coverage tailored to rideshare needs.

State Farm stands out with its personalized options for drivers, while Geico and Progressive provide reliable hybrid policies that protect both personal and business use. These companies are the top picks for affordability, flexibility, and extensive protection on the road.

| Company | Rank | Safe Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | B | Reliable Service | State Farm | |

| #2 | 22% | A++ | Low Rates | Geico | |

| #3 | 20% | A+ | Broad Coverage | Progressive | |

| #4 | 25% | A+ | Comprehensive Care | Allstate | |

| #5 | 18% | A | Flexible Options | Farmers | |

| #6 | 10% | A++ | Military Families | USAA | |

|

#7 | 12% | A | Customizable Plans | Liberty Mutual |

|

#8 | 20% | A+ | Nationwide Service | Nationwide |

| #9 | 15% | A++ | Diverse Coverage | Travelers | |

|

#10 | 10% | A+ | Senior Drivers | The Hartford |

Each excels in delivering coverage that ensures Uber drivers stay covered at every stage of their job. Find insights in our guide titled, "Best Car Insurance Companies for Delivery Drivers."

Before you decide to buy car insurance that covers Uber from anyone, be sure to use our free tool above to compare rates and find exactly what you need.

What You Should Know

- State Farm is the top pick for Uber drivers, offering flexible and personalized coverage

- Uber drivers need hybrid policies that cover both personal and rideshare use

- Flexible coverage ensures Uber drivers stay protected at every stage of their job

#1 – State Farm: Top Overall Pick

Pros

- Dependable Coverage: State Farm provides consistent protection for Uber drivers. See the reviews and rankings in our full State Farm car insurance review.

- Safe Driving Savings: Uber drivers can reduce costs by up to 15% for safe driving habits.

- Efficient Claims Handling: Fast claims assistance keeps Uber drivers on the road.

Cons

- Higher Premiums: Uber drivers may notice slightly elevated costs compared to rivals.

- Fewer Hybrid Policy Choices: State Farm offers limited flexibility for Uber drivers needing blended coverage.

#2 – Geico: Best for Low Rates

Pros

- Safe Driving Discount: Uber operators can get as much as 22% off for maintaining clean driving records.

- Mixed Policies: Full coverage for Uber drivers whether on or off the job. Find more info in our car insurance claims ratings.

- Excellent Financial Rating: Geico holds an A++ rating, ensuring financial reliability for Uber drivers.

Cons

- Gaps in Rideshare Coverage: Geico's policies might not cover all situations Uber drivers could face.

- Average Customer Service: Uber drivers may experience slightly longer wait times for customer support.

#3 – Progressive: Best for Broad Coverage

Pros

- All-Around Protection: Progressive offers thorough rideshare insurance for Uber drivers. Read more about this provider in our Progressive car insurance review.

- Adjustable Policies: Uber drivers can modify coverage based on personal and rideshare use.

- 20% Safe Driver Discount: Uber drivers benefit from cost reductions by driving safely.

Cons

- Mobile App Limitations: Uber drivers report challenges navigating Progressive's mobile app.

- Discount Restrictions: Uber drivers may find fewer available discounts compared to other companies.

#4 – Allstate: Best for Comprehensive Care

Pros

- Generous Safe Driving Discounts: Uber drivers can save up to 25% by driving safely. Discover more: Allstate car insurance review.

- Broad Coverage Options: Allstate provides extensive protection for Uber drivers both on and off duty.

- High A+ Rating: Uber drivers can trust Allstate’s excellent financial stability.

Cons

- Slower Claims Response: Uber drivers have reported delays in the claims process.

- Limited Digital Support: Uber drivers might face fewer options for managing policies online or via mobile app.

#5 – Farmers: Best for Flexible Options

Pros

- Tailored Plans: Farmers offers customizable coverage for Uber operators needing rideshare and personal protection.

- 18% Discount for Safe Drivers: Uber drivers who maintain clean driving records can earn significant savings. Learn more by reading our Farmers car insurance review.

- Financial Stability: Farmers maintains a solid A rating, providing Uber drivers with financial reassurance.

Cons

- Lacking App Features: Uber drivers may find Farmers’ mobile app less functional than others.

- Fewer Savings Opportunities: Farmers offers fewer discount options, limiting savings potential for Uber operators.

#6 – USAA: Ideal for Military Families

Pros

- Superior Financial Stability: Uber drivers can rely on USAA’s top-notch A++ financial rating.

- Extensive Rideshare Add-ons: Flexible options ensure Uber drivers are covered at all stages of the job.

- Safe Driving Discounts: Uber drivers with clean records can lower their costs. For more information, read our USAA car insurance review.

Cons

- Eligibility Restrictions: USAA is only available to Uber drivers with military connections.

- Limited Hybrid Options: Uber drivers may not find as many combined policy choices.

#7 – Liberty Mutual: Best for Customizable Plans

Pros

- Adaptable Policy Choices: Uber drivers can tailor their plans to fit both personal and rideshare coverage.

- Safe Driver Benefits: Uber drivers may receive a 12% discount for maintaining a safe driving record.

- Competitive Rideshare Plans: Liberty Mutual offers strong protection for Uber drivers on duty. Find more details in our car insurance review of Liberty Mutual.

Cons

- Slower Claims Resolution: Some Uber operators report delays in Liberty Mutual’s claims handling process.

- Limited Discount Programs: Liberty Mutual offers fewer discount opportunities, restricting savings for Uber operators.

#8 – Nationwide: Best for Nationwide Service

Pros

- Wide-Ranging Coverage: Uber drivers can depend on Nationwide’s extensive rideshare policy options.

- Safe Driver Rewards: Uber drivers can save up to 20% with a strong driving record. Find out more in our guide: Nationwide car insurance review.

- Strong Financial Ratings: Nationwide provides Uber drivers with peace of mind through its A+ financial standing.

Cons

- Fewer Digital Resources: Uber drivers might find Nationwide’s mobile tools less advanced than competitors'.

- Fewer Rideshare-Specific Add-Ons: Nationwide’s rideshare policies lack certain specialized features for Uber drivers.

#9 – Travelers: Ideal for Diverse Coverage

Pros

- Flexible Insurance: Travelers provides Uber drivers with adaptable plans for varied coverage needs.

- Safe Driver Discounts: Uber drivers can earn up to 15% in savings for safe driving practices.

- Fast Claims Assistance: Uber drivers benefit from quick and efficient claims processes. See details in our Travelers car insurance review.

Cons

- Higher Premiums: Uber drivers might find Travelers' rates above those of budget-friendly providers.

- Limited Discount Options: Travelers offers fewer discounts, reducing savings potential for Uber drivers.

#10 – The Hartford: Best for Senior Drivers

Pros

- Senior-Focused Plans: The Hartford designs coverage specifically for senior Uber drivers. Explore more discount options in our The Harford review.

- Safe Driving Incentives: Uber drivers can qualify for a 10% discount with a clean driving record.

- Excellent Financial Health: Uber drivers trust The Hartford's A+ rating for financial stability.

Cons

- Focus on Senior Drivers: The Hartford’s primary focus on senior Uber drivers limits its broader appeal.

- Limited Digital Features: Uber drivers may find The Hartford's mobile tools less robust than other competitors.

Coverage Rates for Uber Drivers

The table below provides a detailed comparison of the monthly rates for minimum and full coverage offered by top insurance providers. State Farm and USAA stand out with the lowest monthly rates, with USAA offering the most affordable option for Uber drivers at $90 per month for minimum coverage and $205 per month for full coverage.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $105 | $225 | |

| $110 | $235 | |

| $97 | $215 | |

|

$115 | $240 |

|

$102 | $230 |

| $100 | $220 | |

| $95 | $210 | |

|

$120 | $245 |

| $108 | $225 | |

| $90 | $205 |

State Farm follows closely with $95 for minimum and $210 for full coverage. Geico and Progressive also offer competitive pricing, with Geico providing minimum coverage at $97 and full coverage at $215, and Progressive offering $100 and $220, respectively.

Bundle is life! Can’t argue with that logic. 🏠 + 🚗https://t.co/uNYjYTKwoU pic.twitter.com/RRoMMaYbbc

— State Farm (@StateFarm) August 28, 2024

On the higher end, Liberty Mutual and The Hartford offer more comprehensive protection, with Liberty Mutual starting at $115 for minimum and $240 for full coverage, and The Hartford at $120 for minimum and $245 for full coverage.

| Insurance Company | Available Discount |

|---|---|

| Anti-Lock Brakes, Anti-Theft, New Car | |

| Accident-Free, Safe Driver, Good Student | |

| Anti-Theft, Defensive Driving, Good Student | |

|

Anti-Theft, Bundling, Hybrid Vehicle |

|

Accident-Free, Paperless, SmartRide |

| Continuous Insurance, Homeowner, Bundling | |

| Accident-Free, Safe Driving, Multi-Vehicle | |

|

Bundling, Hybrid/Electric, Vehicle Safety Features |

| Continuous Insurance, Good Payer, Multi-Car | |

| Loyalty, Multiple Vehicle, Safe Driver |

Each provider balances affordability and comprehensive coverage, allowing Uber drivers to choose the plan that best fits their needs.

Leading Insurers Offering Rideshare Coverage

A lot of of car insurance companies now offer rideshare coverage to policyholders. Typically, larger insurance companies are better-known for covering individuals who drive for companies like Lyft and Uber. Find out more in our guide titled, "Do I need different car insurance as an Uber driver?"

Along with other insurance companies, some of the most popular options for car insurance coverage as an Uber driver include:

- State Farm Rideshare Insurance

- Geico Rideshare Insurance

- Farmers Rideshare Insurance

- USAA Rideshare Insurance

- Mercury Rideshare Insurance

As an Uber driver, you may find that one of these companies works better than any of the others when it comes to car insurance for your job. But your best bet is to compare many car insurance companies that cover Uber at once to see for sure.

It's also important to remember that, while many car insurance companies offer coverage for rideshare services, there are still car insurance companies that don't cover Uber. So don't get discouraged if a few of the companies you're considering don't offer you coverage.

Key Features of Rideshare Car Insurance Explained

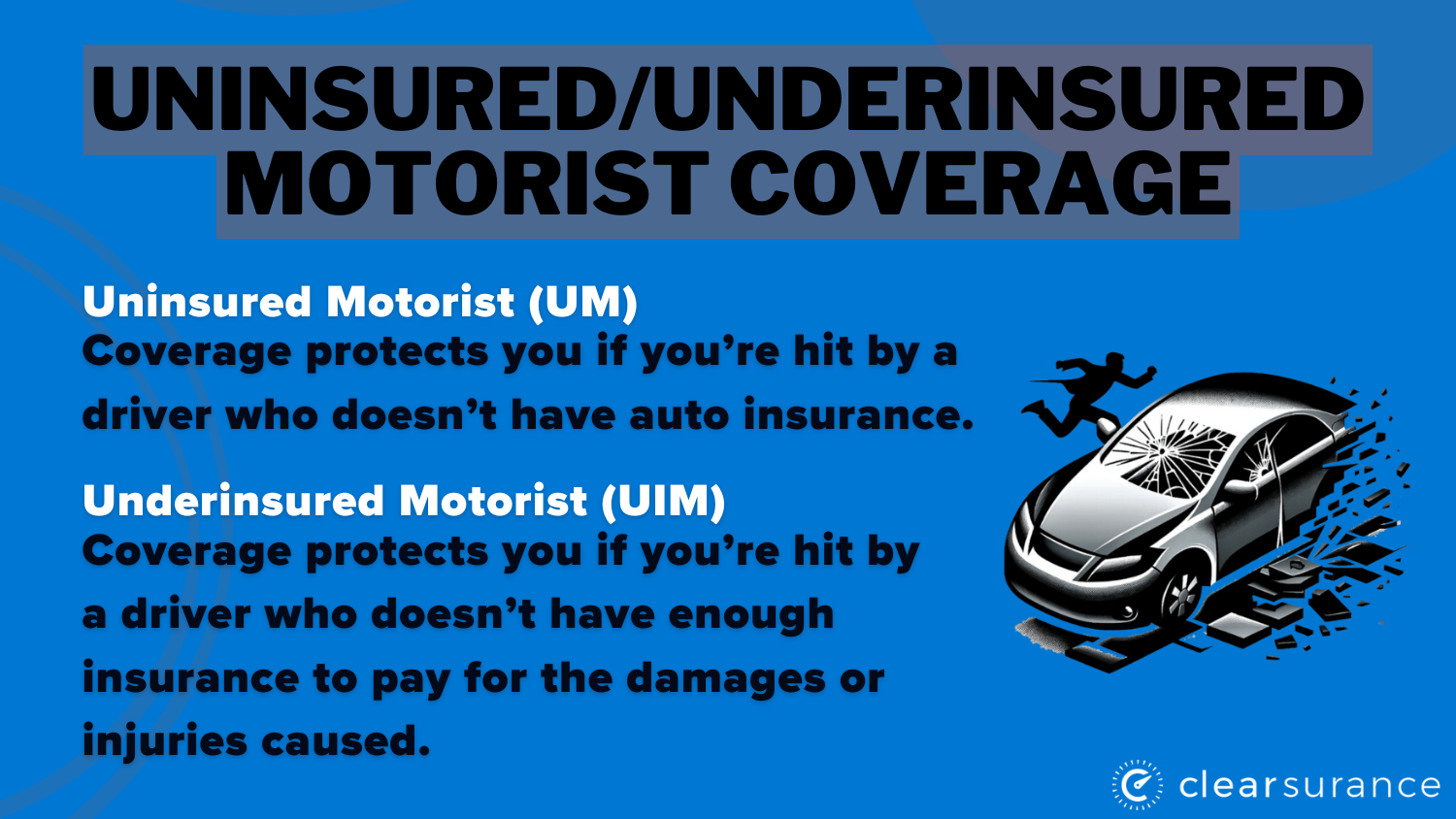

Some rideshare services offer their drivers a measure of commercial protection when they are on the job.

For example, Uber and Lyft both provide their drivers with liability, uninsured motorist coverage/underinsured motorist, and comprehensive and collision coverage when they are on their way to pick up a passenger or when they're driving that passenger to the destination.

This type of coverage is extremely helpful and helps Uber drivers know they have support if they ever wind up in an accident.

But Uber, Lyft, and other rideshare companies have their limits when it comes to car insurance coverage.

While Uber offers a great deal of protection when drivers are headed to a passenger or on their way to the designated location, Uber only offers liability coverage for drivers who are on the clock but do not yet have any passengers.

Because of this low level of coverage, many car insurance companies offer Uber and Lyft drivers unique policies that will help them remain fully covered regardless of what stage of the process they are in.

Exploring Various Rideshare Insurance Options

If you drive for Uber, you have a few options with most car insurance companies when it comes to adequate coverage on the job.

Your first option is additional protection. An additional protection plan—typically considered a type of gap insurance—will account for much of what is not covered by your rideshare company while you are working. Get further details in our comprehensive guide titled, "What is gap insurance, and do I need it?"

Next, you can choose a personal insurance extension plan. You would purchase a plan like this with your existing car insurance provider and simply extend some of the coverages you already have to keep you safe and fully covered on the road during personal or business use of your vehicle.

Lastly, there are hybrid policies that take the place of your personal car insurance plan. Hybrid policies offer coverage that is rideshare-friendly but is also useful when you're not on the job.

State-Specific Rideshare Insurance Guidelines

Depending on where you live, there may be different requirements when it comes to rideshare services.

For most states, you can legally drive for a rideshare company as long as you meet your state's requirements for car insurance coverage to drive in general.

Rideshare insurance in California, for example, simply requires that you carry personal car insurance that includes:

- $15,000 bodily injury coverage per person injured in an accident

- $30,000 of bodily injury coverage per accident

- $5,000 of property damage coverage per accident

Meeting these requirements may not help you find the best car insurance in California, and they will not help you if you're in an accident and need to pay for damage to your car or if your car is parked and someone runs into it.

Because state requirements are typically quite low, most people choose to purchase additional car insurance coverage to make sure they're taken care of.

Rideshare Insurance: A Must-Have for Uber Drivers

Depending on how much you drive for Uber, you may not need to buy additional car insurance, but it's never a bad idea to shop around and compare rates to see how much it would cost.

As you shop around online for the best car insurance companies, be sure to compare multiple providers and pay attention to the different coverage options and how much you would end up paying.

You can use our free tool below to compare car insurance rates that cover Uber and see how much you could save.

Frequently Asked Questions

What is the best auto insurance for Uber drivers?

State Farm, Geico, and Progressive offer the best auto insurance for Uber drivers, providing flexible coverage tailored to rideshare needs.

Find out more by reading our guide titled, "State Farm Drive Safe and Save Review.

What is the cheapest auto insurance for Uber drivers?

USAA and State Farm offer the cheapest auto insurance for Uber drivers, with minimum coverage starting as low as $90 and $95 per month, respectively.

Will Geico pay for my Uber?

Yes, Geico provides coverage for Uber drivers through rideshare-specific policies, ensuring you're protected while driving for Uber.

Does USAA cover Uber drivers?

Yes, USAA covers Uber drivers through rideshare insurance policies, offering affordable and reliable protection for military members and their families.

Explore more details in our complete resource titled, "Best Military Car Insurance: Companies and Discounts."

Does Liberty Mutual cover Uber drivers?

Yes, Liberty Mutual offers rideshare coverage for Uber drivers, though it’s often priced higher compared to other companies.

Do Uber drivers use their own insurance?

Yes, Uber drivers typically use their own insurance, but they may need additional rideshare coverage to ensure full protection while driving for Uber.

Does Uber count as rideshare for insurance?

Yes, Uber is considered a rideshare service, and you will need rideshare insurance or a rideshare add-on to your personal policy for full coverage.

Discover more by checking out our guide titled, "Liability vs. Full Coverage: Car Insurance Explained.

Does Allstate cover Uber drivers?

Yes, Allstate provides rideshare coverage for Uber drivers, offering comprehensive options for on and off-duty protection.

Does Progressive insurance cover Uber drivers?

Yes, Progressive offers rideshare insurance specifically for Uber drivers, with policies that cover both personal and work-related driving.

Does Farmers cover Uber drivers?

Yes, Farmers offers rideshare insurance for Uber drivers, providing flexible options for coverage while driving for Uber.