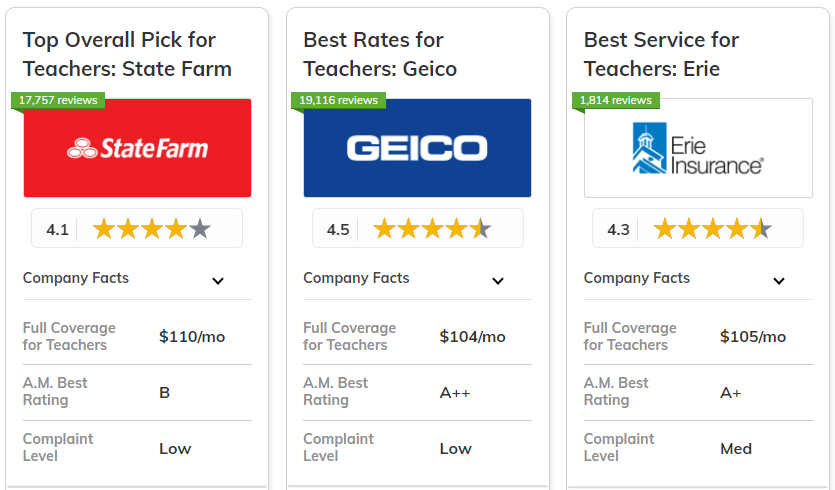

The top pick overall for the best car insurance companies for teachers is State Farm, followed by Geico and Erie for their competitive rates and tailored discounts. State Farm offers affordable premiums starting at $98/month with strong customer service and comprehensive insurance coverage options.

Geico and Erie also provide low rates with features designed specifically for educators. These companies stand out for combining cost-effectiveness with valuable protection, making them the best choices for teachers.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | B | Reliable Service | State Farm | |

| #2 | 12% | A++ | Affordable Rates | Geico | |

|

#3 | 12% | A+ | Customer Service | Erie |

| #4 | 15% | A | Teacher Benefits | Horace Mann | |

| #5 | 10% | A+ | Comprehensive Coverage | Allstate | |

| #6 | 14% | A+ | High-Risk Drivers | National General | |

| #7 | 13% | A | Custom Plans | Mercury | |

| #8 | 13% | A | Personalized Plans | Farmers | |

| #9 | 11% | A+ | Non-Standard Policies | Dairyland | |

| #10 | 13% | A | Family Discounts | American Family |

Enter your ZIP code above into our free comparison tool to see how much is car insurance for teachers in your area.

What You Should Know

- State Farm is the top pick, offering rates as low as $98 per month for teachers

- Geico and Erie offer low-cost plans with unique benefits for teachers

- The best car insurance companies for teachers offer classroom protection and discounts

#1 – State Farm: Top Overall Pick

Pros

- Reliable Service: State Farm is a trusted car insurance company for teachers, offering reliable and consistent service, as noted in many State Farm reviews.

- Affordable Minimum Rates: Minimum coverage starts at $35 per month, making it a competitive option for teachers seeking affordable protection.

- Bundling Discount: Teachers can benefit from a 15% discount by bundling multiple policies like home and auto insurance, maximizing savings.

Cons

- Limited Multi-Policy Discount: While helpful, the bundling discount may not be as high as some competitors, limiting savings for teachers looking to combine multiple policies.

- Premium Costs: Even with discounts, premium costs may be higher than expected for certain coverage levels, potentially affecting teachers with broader insurance needs.

#2 – Geico: Best for Affordable Rates

Pros

- Low Monthly Rates: Geico offers some of the most affordable rates among car insurance companies for teachers, with minimum coverage starting at $30 per month. For more information, refer to our guide titled "Top ways customers have saved money on car insurance rates."

- Financial Strength: Geico’s A++ rating from A.M. Best reflects its strong financial backing, providing teachers with dependable coverage.

- 12% Bundling Discount: Teachers can save by bundling policies such as auto and homeowners insurance, reducing their overall costs.

Cons

- Limited Coverage Options: While rates are low, Geico might not offer as many coverage customizations as other car insurance companies for teachers.

- Customer Service Delays: Some teachers may experience slower response times when dealing with Geico’s customer support team.

#3 – Erie: Best for Customer Service

Pros

- Exceptional Customer Support: Erie is widely recognized as a car insurance company for teachers that provides excellent customer service, ensuring teachers have a great experience, according to Erie reviews.

- Low Minimum Coverage Rates: Minimum coverage is priced at $31 per month, offering teachers an affordable option with top-tier service.

- 12% Bundling Discount: Erie offers a solid bundling discount, helping teachers reduce insurance costs by combining policies.

Cons

- Limited Availability: Erie is not available nationwide, restricting access to this car insurance company for teachers in certain regions.

- Less Flexible Discounts: Erie’s discount offerings are less varied compared to other car insurance companies for teachers, which might reduce savings potential.

#4 – Horace Mann: Best for Teacher Benefits

Pros

- Teacher-Specific Benefits: Horace Mann is a car insurance company for teachers that offers unique benefits tailored to educators, such as liability car insurance coverage for school-related driving.

- Lowest Minimum Coverage Rate: Teachers can take advantage of minimum coverage starting at just $29 per month, making it one of the most affordable options. Find more information about the provider's rates in our Horace Mann review.

- 15% Bundling Discount: Teachers can maximize savings by bundling multiple policies, with a substantial discount of 15%.

Cons

- Fewer Policy Options: Horace Mann offers fewer coverage options compared to some other car insurance companies for teachers, limiting flexibility for specific needs.

- Lower A.M. Best Rating: With an A rating, Horace Mann’s financial strength is not as high as other top-rated insurers.

#5 – Allstate: Best for Comprehensive Coverage Specialization

Pros

- Comprehensive Coverage Options: As a leading car insurance company for teachers, Allstate provides a variety of coverage options that offer extensive protection for educators, as mentioned in many Allstate reviews.

- Affordable Rates: Minimum coverage is available at $40 per month, providing teachers with a balance of coverage and affordability.

- Bundling Savings: Teachers can benefit from a 10% bundling discount when combining auto insurance with other policies like renters or homeowners insurance.

Cons

- Higher Full Coverage Costs: Full coverage rates start at $120 per month, which is higher than some competitors, potentially impacting teachers who need broader coverage.

- Discount Limitations: Allstate’s bundling discount may not be as substantial as what other car insurance companies for teachers offer, limiting potential savings.

#6 – National General: Best for High-Risk Drivers

Pros

- Specializes in High-Risk Drivers: National General is a top choice among car insurance companies for high-risk drivers among teachers, offering tailored coverage options. For more information, read our National General review.

- Affordable Minimum Coverage Rates: Teachers can secure minimum coverage for $32 per month, providing an affordable solution for those considered high-risk.

- 14% Bundling Discount: Teachers can save more by bundling their auto insurance with other policies, benefiting from a 14% discount.

Cons

- Higher Full Coverage Costs: Full coverage starts at $107 per month, which may be costly for some teachers seeking more extensive coverage.

- Customer Service Concerns: Some teachers may experience issues with National General’s customer service compared to other car insurance companies for teachers.

#7 – Mercury: Best for Custom Plans

Pros

- Customizable Insurance Plans: Mercury allows teachers to tailor their coverage based on specific needs, making it a great choice for those seeking flexibility in a car insurance company for teachers.

- Competitive Rates: Minimum coverage is priced at $33 per month, providing teachers with a customizable and affordable insurance option. Take a look at our Mercury insurance review to learn more.

- 13% Bundling Discount: Teachers can benefit from a 13% discount by bundling their auto insurance with other policies, maximizing savings.

Cons

- Limited Availability: Mercury is not available in all states, restricting access to this car insurance company for teachers in certain regions.

- Fewer Coverage Add-Ons: Compared to other insurers, Mercury may offer fewer additional coverage options for teachers seeking specific protections.

#8 – Farmers: Best for Personalized Plans

Pros

- Tailored Coverage Options: Farmers offers personalized coverage plans, making it an ideal car insurance company for teachers who want customizable policies. To see monthly premiums and honest rankings, read our Farmers review.

- Competitive Minimum Rates: Teachers can get minimum coverage for $38 per month, offering a balance of affordability and tailored coverage.

- 13% Bundling Discount: Teachers can reduce overall costs by bundling multiple insurance policies with Farmers, taking advantage of a 13% discount.

Cons

- Higher Full Coverage Rates: Full coverage starts at $115 per month, which is higher compared to some other car insurance companies for teachers.

- Limited Discount Flexibility: Farmers may not offer as many discount options as other companies, potentially reducing savings for teachers.

#9 – Dairyland: Best for Non-Standard Policies

Pros

- Specializes in Non-Standard Policies: Dairyland is a great car insurance company for teachers with unique insurance needs, offering non-standard policy options.

- Affordable Minimum Coverage Rates: Teachers can secure minimum coverage for $37 per month, providing an affordable option for specialized coverage needs, as confirmed by Dairyland reviews.

- 11% Bundling Discount: Teachers can save by bundling their auto insurance with other policies, receiving an 11% discount.

Cons

- Fewer Discount Options: Dairyland offers fewer discounts compared to other car insurance companies for teachers, limiting savings for some educators.

- Less Comprehensive Coverage: Some teachers may find that Dairyland’s coverage options are not as extensive as other insurers, which could limit protection.

#10 – American Family: Best for Family Discounts

Pros

- Family-Oriented Discounts: American Family is a car insurance company for teachers known for providing excellent family discounts, making it an attractive option for educators with dependents.

- Low Minimum Coverage Rates: Teachers can secure minimum coverage for $34 per month, offering both affordability and family-focused savings.

- 13% Bundling Discount: Teachers can save more by bundling auto and home insurance, benefiting from a 13% discount. Find more details about this provider in our guide: American Family review.

Cons

- Higher Full Coverage Rates: Full coverage starts at $109 per month, which is higher than some other car insurance companies for teachers.

- Limited Availability: American Family’s insurance options may not be available in all states, restricting access for some teachers.

Comparing Auto Insurance Rates Across Top Providers for Teachers

Understanding car insurance is vital. When comparing insurance rates across different companies, consider both minimum and full coverage for a well-informed decision. The table showcases the rates highlighting the variation in prices. For minimum coverage, Horace Mann offers the most affordable option at $29, while Allstate's $40 is on the higher end.

Geico and Erie also stand out for their low minimum coverage costs, making them competitive choices for those seeking basic protection. Full coverage, which provides more comprehensive protection, shows a similar trend. Horace Mann once again provides the lowest rate at $98, with Geico closely following at $104. Meanwhile, Allstate's full coverage is the priciest at $120.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $40 | $120 |

| American Family | $34 | $109 |

| Dairyland | $37 | $113 |

| Erie | $31 | $105 |

| Farmers | $38 | $115 |

| Geico | $30 | $104 |

| Horace Mann | $29 | $98 |

| Mercury | $33 | $108 |

| National General | $32 | $107 |

| State Farm | $35 | $110 |

Despite the higher cost, Allstate's extensive network and reputation may justify the premium for some policyholders. Other companies, like Farmers and State Farm, offer mid-range prices for full coverage, providing a balance between cost and coverage.

In conclusion, while Horace Mann and Geico appear to offer the most budget-friendly options, it's essential to weigh the coverage benefits and customer service reputation of each insurer. Consumers should evaluate their needs and risk tolerance before making a decision, as the cheapest option may not always provide the best value in the long run.

Unlock Maximum Savings With Teacher-Specific Discounts

Teachers can unlock significant savings on their car insurance by utilizing a variety of discounts offered by different providers. Good driver discounts are a popular option, rewarding those with clean driving records, as insurance companies view individuals without accidents or traffic violations as lower risk.

Another way to save is by taking advantage of multi-policy discounts, which allow teachers to bundle their auto insurance with other policies like home or life insurance, reducing costs across all areas. If you don’t drive often, you may qualify for a low mileage discount, as insurers typically offer lower rates for those who spend less time on the road.

Obtain more information on our guide: Best Low-Mileage Car Insurance Companies

Educator-specific discounts, such as those offered by Horace Mann, are also available and are tailored to the needs of teachers. Additionally, driving a vehicle equipped with safety features such as anti-lock brakes, airbags, or anti-theft devices can result in further savings, as these features help reduce risks.

Comparing quotes from multiple insurers is crucial for teachers who want to find the best deal. Each company assesses factors like driving history, coverage needs, and vehicle type differently, which can lead to variations in price.

By gathering quotes, teachers can ensure they are taking advantage of the most competitive rates while still receiving the coverage that meets their specific needs. This approach helps maximize savings and ensures that they are getting the best value for their money.

Case Studies: Teacher Auto Insurance Success Stories

Case Study #1 – Saving With State Farm: A Comprehensive Plan at a Low Rate Jennifer, a high school teacher from Texas, switched to State Farm after comparing quotes and reduced her monthly premium by $45. With the savings, she added comprehensive coverage for peace of mind while still staying under budget.

Case Study #2 – Geico: Affordable Coverage for New Teachers: Mark, a first-year teacher in Florida, was able to secure Geico’s affordable plan for just $110 a month. The low rates helped him manage his budget while still providing full coverage for his new vehicle.

Case Study #3 – Horace Mann: Tailored Benefits for Educators: Lisa, an elementary school teacher, chose Horace Mann due to their exclusive educator discounts. She saved 15% on her policy and received added benefits like roadside assistance for teachers. Learn more information on the best insurance companies for roadside assistance.

Case Study #4 – Erie: Reliable Customer Service and Extra Coverage: Robert, a middle school educator, chose Erie for its strong customer service and competitive rates. After filing a claim for a minor accident, he experienced fast and hassle-free service that reaffirmed his choice.

Case Study #5 – Allstate: High Premiums but Comprehensive Protection: Maria, a teacher in California, opted for Allstate despite the slightly higher cost because of their comprehensive coverage options. She valued the extra protection and the extensive network that helped her feel secure on the road.

Choosing the right car insurance is about more than just the lowest rate—it's about finding a provider that balances cost, coverage, and service. These real-world examples show that while some teachers save by switching to more affordable providers, others prioritize personalized service and unique benefits.

It’s crucial to evaluate individual needs, preferences, and risk factors when making a decision to ensure the best value over time.

Finding the Best Car Insurance for Teachers

Choosing the right car insurance as a teacher comes down to balancing affordability with tailored coverage and reliable customer service. State Farm, Geico, and Erie stand out for their competitive rates and educator-specific benefits.

However, other companies like Horace Mann and Allstate provide unique advantages, especially for those seeking specialized coverage. It's crucial to compare quotes from multiple providers to ensure you're getting the best value for your needs.

Delve more details on what to consider when getting car insurance quotes online.

Ultimately, the best choice will depend on your personal situation, risk tolerance, and desired level of coverage.

Frequently Asked Questions

What is the most trusted car insurance company for teachers?

State Farm, Geico, and Erie stand out for their tailored discounts, customer service, and specialized coverage, making them the best car insurance companies for teachers.

Which category of car insurance is best for teachers?

Comprehensive car insurance gives you the highest level of cover. It offers protection for you and your car if you're involved in an accident, no matter who is at fault.

What is the least amount of car insurance coverage for teachers?

The minimum car insurance you'll need is state-required liability coverage, which covers some or all of the damages you're responsible for in an accident. Most states require limits of $25,000/$50,000/$25,000, which answers the question of how much bodily injury liability is needed per person.

Which is better, third party or comprehensive car insurance for teachers?

Buying comprehensive car insurance is a smarter choice because it offers the dual benefit of third-party coverage as well as own damage cover. Plus, you can choose add-ons that will further enhance the scope of your insurance policy.

What type of insurance is most important for cars for teachers?

Auto liability coverage is the most important car insurance for teachers, covering costs for damage or injury caused to others in an accident. It’s required by law and protects against significant financial and legal risks.

Which type of vehicle insurance is best for teachers?

Here are the top five types of car insurance coverage: Third-party liability only cover, own damage cover, personal accident cover, uninsured motorist coverage protection, and comprehensive car insurance.

What is the best credit score for car insurance for teachers?

With above 800 being excellent and below 579 being poor. However, it's important to note that each insurer has its own criteria for evaluating credit scores and their impact on insurance rates.

What is the best level of car insurance for teachers?

You should carry the highest amount of liability coverage you can afford, with 100/300/100 being the best coverage level for most drivers. You may need to carry additional coverages to protect your vehicle, including comprehensive, collision and gap coverage.

Does credit score affect interest rates for teachers?

People with higher credit scores tend to qualify for lower interest rates because their credit score does affect insurance premiums and shows a reliable history of paying debts, which lenders prefer to minimize risk.

What is my credit rating?

Check your credit card, financial institution or loan statement. Many credit card companies, banks and loan companies have started providing credit scores for their customers. It may be on your statement, or you can access it online by logging into your account.