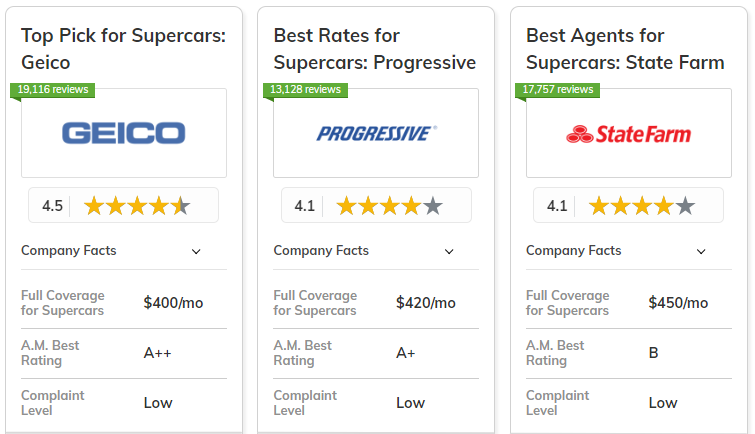

The best car insurance companies for supercars are Geico, Progressive, and State Farm, offering rates starting at $150 per month.

Geico stands out with its budget-friendly pricing, but drivers can save more money with Progressive Snapshot usage-based discounts.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Budget-Friendly | Geico | |

| #2 | 30% | A+ | Usage-Based Rates | Progressive | |

| #3 | 35% | B | Local Agents | State Farm | |

| #4 | 20% | A+ | Comprehensive Tools | Allstate | |

|

#5 | 25% | A+ | Vanishing Deductibles | Nationwide |

| #6 | 40% | A++ | Military Families | USAA | |

|

#7 | 15% | A | Customizable Policies | Liberty Mutual |

| #8 | 25% | A | Personalized Coverage | Farmers | |

| #9 | 29% | A | Customer Support | American Family | |

| #10 | 10% | A++ | Flexible Coverage | Travelers |

Compare the best and cheapest car insurance companies to protect your high-value vehicle while staying within budget.

Our free online comparison tool allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What You Should Know

- The best car insurance companies for supercars offer rates starting at $150 per month

- Geico is the top pick for budget-friendly, tailored supercar insurance coverage

- Progressive offers usage-based discounts, while State Farm provides local agent service

#1 – Geico: Top Overall Pick

Pros

- Affordable Monthly Premiums: Geico provides supercar coverage starting at an economical $150 per month for base-level protection.

- Bundling Incentives: See our Geico renters insurance review to learn how to save 25% by bundling supercar insurance policies with home or renters coverage.

- Robust Financial Standing: An A++ rating reflects Geico's strong financial health, ensuring trustworthiness for high-value supercar insurance.

Cons

- Limited Policy Customization: Geico offers fewer options for tailoring policies to the specific requirements of supercar owners.

- Basic Coverage Constraints: Geico’s standard coverage options may not include specialized features crucial for safeguarding supercars.

#2 – Progressive: Best for Usage-Based Rates

Pros

- Telematics-Based Discounts: Progressive uses its Snapshot program to provide owners of supercars with significant savings in exchange for their safe driving practices.

- Versatile Payment Plans: Offers flexible payment options to cater to the financial preferences of supercar enthusiasts. Our Progressive review goes into more detail.

- Competitive Base Rate: Progressive supercar minimum coverage is $160 per month, providing an affordable entry point for luxury vehicle insurance.

Cons

- Higher Premiums for Frequent Drivers: Supercar owners who log more miles may see elevated premiums due to usage-based pricing.

- Limited In-Person Support: Progressive offers fewer local agents, which may impact supercar owners who prefer face-to-face consultations.

#3 – State Farm: Best for Local Agents

Pros

- Tailored Advice: State Farm’s extensive network of local agents provides supercar owners with personalized guidance and custom policy options.

- Reasonable Rates: State Farm’s minimum liability coverage for supercars is offered at $170 per month, providing a balanced cost for tailored service.

- Substantial Bundling Savings: Bundle your supercar insurance with other State Farm coverage and receive a 35% discount. Discover more in our review of State Farm.

Cons

- Costly Full Coverage: Premiums for comprehensive coverage can be higher, potentially posing a challenge for supercar owners seeking complete protection.

- Limited Digital Offerings: State Farm’s online tools are less sophisticated, which may not suit digitally inclined supercar owners.

#4 – Allstate: Best for Comprehensive Tools

Pros

- Comprehensive Digital Resources: Allstate excels with extensive online tools that simplify managing supercar insurance policies. Read our Allstate review to learn more.

- Financial Strength: An A+ rating signals strong financial stability, providing peace of mind for supercar owners in claim situations.

- Accessible Pricing: Supercars can have entry-level coverage starting at $180 per month, which combines affordability with a full suite of digital capabilities. Cons

Cons

- Lower Bundling Incentive: Supercar owners wishing to combine multiple insurance may find less benefit from Allstate's 20% bundling discount.

- Higher Starting Premiums: In comparison to other insurers, base rates may be higher, particularly for some really expensive supercars.

#5 – Nationwide: Best for Vanishing Deductibles

Pros

- Decreasing Deductibles: Nationwide's vanishing deductible feature benefits supercar owners by lowering out-of-pocket expenses over time.

- Affordable Entry Point: Nationwide’s basic insurance rates commence at $175 per month, balancing cost with coverage for luxury vehicles.

- Dependable Financial Background: Nationwide reviews show an A+ rating, which ensures Nationwide’s reliability in handling claims for supercar insurance.

Cons

- Narrow Coverage Choices: Coverage options may not be as comprehensive or adaptable to unique supercar insurance needs.

- Limited Discount Variety: Aside from vanishing deductibles, fewer discounts are available for supercar owners.

#6 – USAA: Best for Military Families

Pros

- Exclusive Military Benefits: USAA offers tailored discounts and benefits for military families insuring supercars, which you can read more about in our USAA review.

- Exceptional Service Standards: USAA is well known for its exceptional customer service, which is a major benefit for owners of supercars who need consistent assistance.

- Most Competitive Rates: USAA is a great option for affordable supercar insurance, with coverage beginning at just $155 per month.

Cons

- Restricted Access: USAA car insurance for supercars is limited to military personnel and their families.

- Limited Flexibility in Policies: USAA provides fewer options for customizing supercar insurance policies.

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Personalized Coverage: Liberty Mutual allows supercar owners to customize their insurance to fit their specific needs.

- Affordable Rates: You can get essential coverage for your supercar starting at just $165 a month, balancing both affordability and flexibility. Check out our Liberty Mutual review for more details.

- Flexible Payment Plans: Supercar owners can select from a variety of payment options to suit their financial preferences.

Cons

- Limited Bundle Discount: The 15% discount for combining policies may not be very appealing to supercar owners.

- Average Customer Service Ratings: Liberty Mutual's customer service ratings are average, which may not fully meet the expectations of supercar owners.

#8 – Farmers: Best for Personalized Coverage

Pros

- Personalized Policy Options: Farmers provides customized insurance options designed to meet the specific needs of luxury car owners.

- Reasonable Rates: Farmers offers a starting monthly rate of $185 for basic coverage for high-end vehicles, striking a balance between affordability and personalized service.

- Savings Opportunities: Supercar owners can benefit from a 25% discount by bundling their policies. You can find more details in our Farmers review.

Cons

- Higher Full Coverage Rates: The cost of comprehensive insurance may be prohibitive for some supercar owners.

- Limited Online Features: Farmers' digital tools may not be as advanced as some competitors, which may not be ideal for all luxury car enthusiasts.

#9 – American Family: Best for Customer Support

Pros

- Exceptional Customer Support: Our American Family review reveals the company's reputation for providing responsive assistance, which is precious for high-performance car owners.

- Considerable Bundle Reduction: Bundling saves customers money on insurance for several assets, especially high-performance cars, as it entitles them to a 29% reduction.

- Affordable Pricing: American Family offers a base level of coverage for high-end cars that begins at $195 per month, providing dependable security and robust assistance at an affordable price.

Cons

- Geographic Limitations: Since American Family's services are not available in every state, some owners of luxury cars may find it difficult to use them.

- Limited Specialized Options: Fewer options are available that are expressly tailored to meet the insurance requirements of luxury vehicle owners.

#10 – Travelers: Best for Flexible Coverage

Pros

- Flexible Coverage Choices: Travelers provides varied policy options to ensure comprehensive protection for supercars.

- High Financial Security: An A++ rating indicates a strong financial foundation, ensuring the dependability of supercar claims. See our Travelers review for more details.

- Flexible Pricing: Supercar owners looking for adaptive coverage can use entry-level pricing starting at $200 per month.

Cons

- Minimal Bundling Savings: Supercar owners who wish to bundle many policies may need help finding a 10% savings to be appealing.

- Limited Specialty Options: Travelers may not offer as many specialized choices tailored for high-value supercars.

Comparing Car Insurance Rates for Supercars

Supercar insurance costs vary across providers for both minimum and full coverage. You'll likely want to carry full coverage, which is more expensive. Geico and USAA stand out with the most competitive rates for full coverage insurance on a supercar.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $180 | $460 | |

| $195 | $490 | |

| $185 | $470 | |

| $150 | $400 | |

|

$165 | $410 |

|

$175 | $430 |

| $160 | $420 | |

| $170 | $450 | |

| $200 | $500 | |

| $155 | $390 |

When insuring a supercar, it's essential to recognize the different types of coverage available and their importance. Minimum coverage typically includes liability liability car insurance, which covers damages or injuries you may cause to others in an accident.

While this may satisfy legal requirements, it provides little protection for your own vehicle, leaving supercar owners vulnerable to repair costs, theft, or vandalism.

Given the high value and specialized nature of supercars, full coverage is often the preferred choice, providing peace of mind and financial security against a wide range of risks.

By comparing supercar insurance rates by coverage and company, drivers can find the best option that balances cost, coverage, and additional benefits tailored to their specific needs.

Read More: Top Ways Customers Have Saved Money on Car Insurance Rates

Mastering Premium Savings for Supercar Insurance

To save on supercar insurance premiums, consider several strategic approaches that balance cost with adequate coverage.

Auto insurance discounts are easy ways to save money, and there are multiple ways to qualify for savings with the top ten car insurance companies for supercars.

| Insurance Company | Available Discount |

|---|---|

| Safe Driver Discount, Multi-Policy Discount, New Car Discount, Anti-Lock Brake Discount, Anti-Theft Discount | |

| Multi-Policy Discount, Low Mileage Discount, Defensive Driving Discount, Loyalty Discount, Early Bird Discount | |

| Multi-Policy Discount, Good Student Discount, Anti-Theft Discount, Distant Student Discount, Homeowner Discount | |

| Multi-Vehicle Discount, Good Driver Discount, Defensive Driving Discount, Military Discount, Air Bag Discount | |

|

Multi-Policy Discount, Hybrid/Electric Vehicle Discount, New Car Replacement Discount, Accident-Free Discount, Paperless Discount |

|

Multi-Policy Discount, SmartRide Discount, Anti-Theft Discount, Accident-Free Discount, Paperless Billing Discount |

| Multi-Policy Discount, Snapshot Discount, Continuous Insurance Discount, Good Student Discount, Pay-in-Full Discount | |

| Multi-Policy Discount, Safe Driver Discount, Vehicle Safety Discount, Good Student Discount, Accident-Free Discount | |

| Multi-Policy Discount, Safe Driver Discount, Homeownership Discount, Good Payer Discount, Early Quote Discount | |

| Multi-Policy Discount, Defensive Driving Discount, Military Discount, Vehicle Storage Discount, Family Discount |

Bundling policies, such as combining auto and home insurance with the same provider, will unlock substantial discounts. Taking advantage of usage-based insurance programs, like those offered by Progressive, can provide savings for drivers who maintain safe habits or drive less frequently.

Opting for a higher insurance deductible can significantly reduce monthly payments, as insurers often lower premiums when you agree to cover more out-of-pocket costs in the event of a claim.

Additionally, installing advanced security systems or keeping your supercar in a secured garage can further reduce premiums by mitigating the risk of theft or damage.

Regularly comparing quotes from multiple insurers ensures you are always getting the best deal tailored to your specific needs.

Choosing the Best Car Insurance Company for Your Supercar

Geico, Progressive, and State Farm are the best car insurance companies for supercars. Geico stands out for its budget-friendly rates starting at $150 per month, Progressive offers savings through usage-based programs, and State Farm excels with personalized service from local agents.

Supercar owners should explore various insurance providers to see how their car make and model impact car insurance rates and find the most competitive pricing.

Comparing multiple quotes online is the easiest way to ensure you’re getting the best deal tailored to your needs.

Ready to shop around for the best auto insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Frequently Asked Questions

What should I consider when choosing car insurance for a supercar?

When choosing car insurance for a supercar, consider factors such as coverage limits, deductibles, policy customization, insurer financial strength, and the availability of discounts like bundling or safe driving programs. Additionally, look for insurers with experience handling high-value vehicles.

What type of coverage is essential for supercars?

Essential insurance coverage for supercars includes comprehensive and collision insurance to protect against theft, damage, or accidents, as well as liability coverage to cover potential damages to others. Uninsured/underinsured motorist coverage is also recommended to protect against drivers who lack adequate insurance.

Why do supercars typically have higher insurance rates?

Supercars generally have higher insurance rates due to their high market value, expensive repair costs, powerful engines, and increased risk of theft or damage. Luxury and exotic car insurance companies consider these factors when calculating supercar premiums, often resulting in higher costs compared to standard vehicles.

How can I reduce my supercar insurance premiums?

To lower your supercar insurance premiums, consider options like raising your deductible, installing safety devices, driving less frequently, taking advantage of discounts (such as bundling or safe driver programs), and comparing car insurance quotes from multiple insurers to find the best rate.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

How does usage-based insurance work for supercars?

The best usage-based car insurance, like Progressive's Snapshot program, uses telematics to monitor driving behavior such as speed, mileage, and braking patterns. Supercar owners who drive safely or infrequently may benefit from lower premiums based on their actual driving habits.

Can I get an agreed-value insurance policy for my supercar?

Yes, many insurers offer agreed-value policies specifically for supercars. This type of policy guarantees a fixed payout amount in the event of a total loss, based on a pre-agreed value rather than the car's depreciated market value, ensuring adequate compensation for the car's true worth.

Are there special requirements for insuring a supercar?

Insuring a supercar may require additional requirements such as specialized appraisals, higher coverage limits, secure storage conditions, or proof of driving experience. Some insurers may also mandate mileage limits or driving restrictions to qualify for certain policy types or discounts.

What factors affect the cost of supercar insurance?

Factors affecting the cost of supercar insurance include the car's value, model, and engine size, as well as the owner's age, driving history, location, and how often the car is driven. Additional factors include the availability of safety features and the insurer's own risk assessment.

Learn More: Car Make and Model: How does it affect your car insurance rates?

Is it possible to insure a supercar for occasional use only?

Yes, some insurers offer policies specifically designed for supercars used occasionally, such as collector or hobbyist policies. These often come with lower premiums due to reduced risk exposure but may include mileage limits or restrictions on when and where the car can be driven.

How does storing my supercar in a garage affect my insurance?

Storing a supercar in a secure, enclosed garage can lower insurance premiums, as it reduces the risk of theft, vandalism, or weather-related damage. Many insurers offer discounts for cars stored in garages or secure facilities, especially when equipped with security systems.