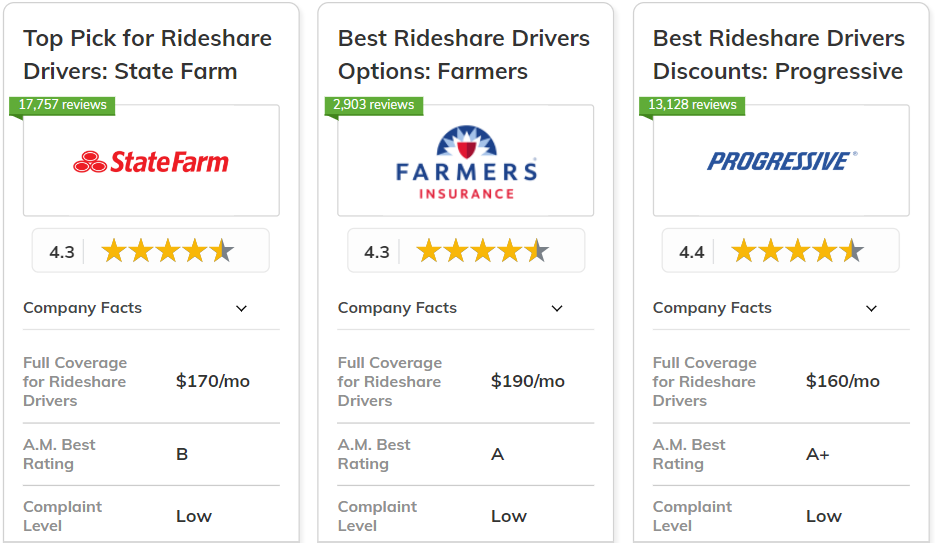

The best car insurance companies for rideshare drivers include State Farm, Farmers, and Progressive, with rates starting as low as $65/month.

State Farm is the top pick for its competitive pricing and comprehensive coverage. These leading providers offer significant discounts and flexible plans for rideshare drivers.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Comprehensive Coverage | State Farm | |

| #2 | 20% | A | Flexible Options | Farmers | |

| #3 | 10% | A+ | Combining Discounts | Progressive | |

| #4 | 10% | A++ | Military Benefits | USAA | |

|

#5 | 25% | A | Diverse Discounts | Liberty Mutual |

| #6 | 25% | A+ | Innovative Technology | Allstate | |

| #7 | 25% | A++ | Competitive Rates | Geico | |

|

#8 | 20% | A+ | Usage-Based Discounts | Nationwide |

| #9 | 13% | A++ | Flexible Policies | Travelers | |

| #10 | 25% | A | Customizable Policies | American Family |

To find the most cost-effective and reliable insurance, consider comparing quotes from these top-rated companies.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code above into our free comparison tool to see rates in your area.

What You Should Know

- State Farm provides the best rates and coverage for rideshare drivers

- Top providers like Farmers and Progressive offer flexible plans and discounts

- Rates start as low as $65/month with leading companies in rideshare insurance

#1 – State Farm: Top Overall Pick

Pros

- Comprehensive Protection: Offers extensive coverage that fully protects rideshare drivers in all scenarios. Find additional details in our State Farm review.

- Strong Reputation: Known for quick and reliable claims handling specifically for rideshare drivers.

- Tailored Policies: State Farm offers customizable plans that meet the unique needs of rideshare drivers.

Cons

- Premiums Can Be Higher: While comprehensive, rideshare drivers may find the full coverage premiums slightly more expensive.

- Limited Discounts: State Farm offers fewer discounts specifically geared toward rideshare drivers.

#2 – Farmers: Best for Flexible Options

Pros

- Highly Customizable: Offers flexible coverage options that can be adjusted to meet the specific needs of rideshare drivers.

- Easily Add Rideshare Coverage: Farmers makes it easy to add rideshare insurance to an existing policy. Gain insights from our Farmers review.

- Flexible Payment Plans: Provides several payment options tailored to fit a rideshare driver's fluctuating income.

Cons

- Fewer Discounts: Compared to other providers, there are fewer discount opportunities specifically for rideshare drivers.

- Complex Policy Options: The number of flexible options may overwhelm some rideshare drivers, leading to confusion about the best plan.

#3 – Progressive: Best for Combining Discounts

Pros

- Significant Discounts: Progressive offers various discounts specifically aimed at rideshare drivers, including safe driving and bundling discounts.

- Combining Multiple Discounts: The ability to stack discounts makes Progressive appealing to rideshare drivers looking to save. Discover more in our Progressive review.

- User-Friendly Digital Platform: Progressive’s online tools make it easy for rideshare drivers to manage their policies and claims.

Cons

- Not the Cheapest for High-Mileage: Progressive may not be the most affordable for rideshare drivers who log high miles.

- Limited Rideshare Discounts: Discount availability for rideshare drivers varies by location.

#4 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: USAA offers significant discounts for rideshare drivers who are active or retired military.

- Exceptional Customer Service: Known for outstanding support for military rideshare drivers. Check out our USAA review for more information.

- Lower Rates for Military Family: Rideshare drivers with military family ties can benefit from lower rates.

Cons

- Fewer Physical Locations: Limited in-person support for rideshare drivers who prefer dealing with agents face-to-face.

- Limited to Military and Family Members: Only available to military rideshare drivers and their families, excluding the general public.

#5 – Liberty Mutual: Best for Diverse Discounts

Pros

- Wide Range of Discounts: Liberty Mutual offers various discount programs that rideshare drivers can take advantage of. See our Liberty Mutual review for further exploration.

- Diverse Rideshare Insurance Options: Provides different levels of coverage for rideshare drivers, from basic to premium packages.

- Rideshare Discounts for Safe Drivers: Rideshare drivers with clean driving records can benefit from lower premiums.

Cons

- Discounts May Be Hard to Qualify For: Some rideshare drivers may find it difficult to qualify for all available discounts.

- Complex Discount Structure: The wide range of discount options may be confusing to some rideshare drivers.

#6 – Allstate: Best for Innovative Technology

Pros

- Advanced Rideshare Tracking: Allstate’s advanced technology helps rideshare drivers track driving habits and insurance needs effectively. Explore our Allstate review for further details.

- Efficient Claims Process: The innovative tech streamlines the claims process, making it quicker and easier for rideshare drivers to get the support they need after an incident.

- Accurate Premium Adjustment: Allstate’s technology allows for precise adjustments to premiums based on actual rideshare driving patterns, ensuring fair pricing.

Cons

- Tech Dependency: Rideshare drivers who are not tech-savvy might find the reliance on apps and technology challenging to manage.

- Potential Data Privacy Concerns: Using apps to track driving behavior could raise privacy issues for rideshare drivers concerned about data security.

#7 – Geico: Best for Competitive Rates

Pros

- Affordable Rideshare Insurance: Geico provides some of the most competitive rates for rideshare drivers, helping them save on insurance costs while working.

- Discount Opportunities: Rideshare drivers can benefit from additional discounts based on their driving records and policy bundling with Geico.

- Low Minimum Coverage Rates: Geico offers affordable minimum coverage, ideal for rideshare drivers seeking savings. For more details, check out our comprehensive guide, "Car Make and Model: Impact On Car Insurance Rates."

Cons

- Discount Complexity: Navigating discount options and eligibility for rideshare drivers might be confusing or require extra effort.

- Customer Service Variability: Rideshare drivers might encounter inconsistent customer service experiences, especially if issues arise with rideshare-specific coverage.

#8 – Nationwide: Best for Usage-Based Discounts

Pros

- Pay-Per-Mile Options: Their usage-based insurance allows rideshare drivers to pay based on mileage, making it a cost-effective choice for those who drive frequently.

- Detailed Driving Reports: Rideshare drivers get detailed driving reports to help monitor and improve their habits. Get details in our Nationwide review.

- Flexibility in Coverage: Nationwide provides flexible coverage options that can be adjusted based on the rideshare driver’s needs and driving patterns.

Cons

- Mileage Tracking Requirement: Rideshare drivers must accurately track their mileage to benefit from usage-based discounts, which may be cumbersome for some.

- Potential Rate Fluctuations: Rates may fluctuate based on driving habits, which could lead to unexpected changes in premiums for rideshare drivers.

#9 – Travelers: Best for Flexible Policies

Pros

- Adjustable Premiums: Rideshare drivers can adjust their premiums based on their coverage needs and driving patterns, ensuring they only pay for what they use.

- Multiple Policy Options: They provide a variety of policy options, allowing rideshare drivers to choose the best fit for their driving activities and financial situation.

- Flexible Payment Plans: Travelers offers flexible payment plans that can accommodate the fluctuating income of rideshare drivers. Discover more in our Travelers review.

Cons

- Extended Application Process: The process of customizing and adjusting policies can be time-consuming for rideshare drivers seeking quick coverage solutions.

- Inconsistent Discounts: Flexible policies might not offer consistent discounts for rideshare drivers, leading to potential variability in costs.

#10 – American Family: Best for Customizable Policies

Pros

- Highly Customizable Policies: American Family offers policies that can be tailored specifically to the needs of rideshare drivers, ensuring comprehensive coverage.

- Variety of Add-Ons: They offer a wide range of add-ons and optional coverages that can be customized to fit the unique requirements of rideshare drivers.

- Personalized Customer Support: American Family offers personalized support to help rideshare drivers manage their coverage. Review American Family for a complete overview.

Cons

- Potential for Over-Insurance: The process of customizing policies can be intricate and time-consuming for rideshare drivers who need quick and straightforward solutions.

- Inconsistent Policy Information: Customizable policies might lead to inconsistencies in coverage details, making it harder for rideshare drivers to understand their protection fully.

Cost and Discounts: Car Insurance Rates for Rideshare Drivers

The following table outlines the monthly rates for minimum and full coverage across various insurance companies. The monthly rates for minimum coverage range from $65 to $90, while full coverage ranges from $150 to $200 across various insurance companies.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $200 | |

| $82 | $185 | |

| $85 | $190 | |

| $72 | $165 | |

|

$80 | $180 |

|

$78 | $175 |

| $70 | $160 | |

| $75 | $170 | |

| $77 | $173 | |

| $65 | $150 |

USAA offers the lowest rates at $65 for minimum and $150 for full coverage. Progressive and Geico follow with minimums of $70 and $72, respectively. At the higher end, Allstate’s minimum is $90 and full coverage is $200. American Family, Farmers, Liberty Mutual, Nationwide, State Farm, and Travelers offer varying rates in between these ranges.

| Insurance Company | Available Discount |

|---|---|

| Drivewise (usage-based), Safe driver, Multi-policy, Multi-car, New car, Anti-theft, Early signing, Responsible payer, Rideshare endorsement discount | |

| KnowYourDrive (usage-based), Multi-policy, Multi-car, Good student, Defensive driving, Early signing, Rideshare endorsement discount | |

| Safe driver, Multi-policy, Multi-car, Good student, Defensive driving, Rideshare endorsement discount | |

| Defensive driving, Multi-policy, Multi-car, Good student, Safe driver, Anti-theft, Seat belt use, Rideshare-specific discount | |

|

Multi-policy, Multi-car, Homeowner, Safe driver, Anti-theft, Defensive driving, Hybrid/electric vehicle, Rideshare-specific discount |

|

SmartRide (usage-based), Multi-policy, Multi-car, Good student, Safe driver, Defensive driving, Accident-free, Rideshare-specific discount |

| Snapshot (usage-based), Multi-policy, Multi-car, Continuous insurance, Homeowner, Rideshare-specific discount | |

| Safe driver, Multi-policy, Multi-car, Anti-theft, Good student, Defensive driving, Rideshare-specific discount | |

| IntelliDrive (usage-based), Multi-policy, Multi-car, Good student, Safe driver, Hybrid/electric vehicle, New car, Homeowner, Rideshare-specific discount | |

| Safe driver, Multi-policy, Multi-car, Good student, Defensive driving, Military affiliation discount |

Top insurers offer rideshare driver discounts, including Allstate, American Family, Farmers, and Geico. Others like Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, and USAA also provide savings for rideshare drivers through various programs and discounts. Check out our ranking of the top providers: Car Insurance Companies for High-Risk Drivers

USAA offers the lowest rates for both minimum and full coverage, while other providers like Progressive and Geico offer competitive prices. Additionally, many insurers provide valuable discounts for rideshare drivers, helping you save on your premium. Consider these options to find the best combination of coverage and cost for your needs.

Understanding When Your Employer's Car Insurance Covers You

Car insurance coverage as it relates to ridesharing can be complicated, but it’s helpful to understand how it applies to the different scenarios you may be driving in.

There are essentially four different periods to consider — three that your rideshare drive is broken up into.

- Period 0: Your rideshare app is off while you’re in your car. Your personal insurance policy covers you. This is essentially any personal driving that you do.

- Period 1: When your rideshare app is on but you haven't accepted a ride, rideshare insurance provides coverage, as the company doesn’t offer collision coverage. In case of a collision, you'll pay both your personal auto and rideshare insurance deductibles.

- Period 2: You accepted a ride request and you’re en route to pick up a passenger. The company you drive for covers you during this period.

- Period 3: You have passengers in your car and you’re driving to their destination. Your employer’s insurance policy is implemented and you will only have to pay the deductible in the event of a collision.

If you don't have rideshare coverage, you could have a coverage gap during Period 1, when you're driving without a passenger. You personal auto coverage may not be enough to cover an accident during this period.

Do you drive for Uber or Lyft? We've got everything you need to know about Uber insurance and Lyft insurance.

Handling the Absence of Rideshare Insurance from Your Car Insurance Provider

Rideshare insurance isn’t offered from every insurance carrier or in every state. If your current auto insurance company doesn’t offer a rideshare policy, they may offer you a commercial insurance policy. Commercial insurance covers vehicles that are used for business purposes where you’re being paid to drive, this ranges from ice cream trucks to delivery vehicles.

However, keep in mind that commercial insurance coverage is much more expensive when compared to rideshare insurance. You may want to look into switching auto insurance companies to a company that offers rideshare insurance to protect you at an affordable cost.

Your personal insurance company may also offer a commercial rider that you can add to your personal policy. This is cheaper than buying a separate commercial auto policy, so it's a good option if rideshare coverage isn't available. For more details, see our comprehensive resource, "A Practical Guide For Understanding Car Insurance."

Essential Coverage Types for a Commercial Policy

Commercial policies can be customized with many of the same coverage options as personal car insurance policies. These include:

- Liability Insurance: This insurance covers costs associated with injuries and damages you cause to others in an accident. Bodily injury liability pays for medical expenses and lost wages of the other party, while property damage liability covers repair or replacement costs for their damaged property.

- Collision Insurance: This insurance covers vehicle repairs or replacement after a collision, regardless of fault, including accidents with other vehicles or objects like fences and trees. Learn more by exploring our comprehensive insurance guide, "Collision vs. Comprehensive Coverage: Differences in Car Insurance Policies."

- Comprehensive Insurance: Comprehensive insurance covers damage to your vehicle that isn't caused by a collision. This includes incidents such as theft, vandalism, natural disasters, and animal strikes.

- Uninsured/Underinsured Motorist Coverage: This protection kicks in if you're involved in an accident where the other driver is either uninsured or lacks sufficient insurance to cover the costs of the damages or injuries. It helps cover your medical expenses and vehicle repair costs.

- Personal Injury Protection (PIP): PIP insurance, also known as no-fault insurance, covers medical expenses for you and your passengers regardless of who is at fault in an accident. It may also cover lost wages and other related expenses.

Commercial auto insurance coverage is available from most major auto insurance providers, but a separate commercial policy will cost you more than rideshare coverage.

If the insurance rates on a commercial policy are too high, shop around for quotes from other companies.

Ensuring Comprehensive Coverage for Rideshare Drivers: Why Rideshare Insurance Matters

Rideshare insurance provides full protection for driving with Uber, Lyft, or other services. If your current insurer doesn’t offer it, consider switching or adding commercial insurance to your standard policy.

Don’t risk your coverage — make sure you inform your personal auto insurer that you’re a rideshare driver. You wouldn’t want to have to pay the cost of an accident if Uber or Lyft doesn’t cover you in that period. For full details, see our analysis titled "Five Steps to Take After a Car Accident."

Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

Frequently Asked Questions

What is rideshare insurance, and why do I need it?

Rideshare insurance is a type of coverage specifically designed for drivers who use their personal vehicles for rideshare services like Uber or Lyft. It provides additional protection that personal auto insurance may not cover during rideshare activities.

What are the benefits of choosing State Farm for rideshare insurance?

State Farm is known for its competitive pricing and comprehensive coverage options for rideshare drivers. They offer flexible plans and significant discounts, making them a top choice for many drivers.

How does rideshare insurance differ from standard auto insurance?

Rideshare insurance differs from standard auto insurance because it covers the unique risks associated with transporting passengers for a fee. Standard auto insurance typically does not provide coverage when you’re driving for a rideshare service.

To expand your knowledge, refer to our comprehensive handbook titled "Liability vs. Full Coverage: Car Insurance Explained."

Are there specific insurance companies that offer the best rates for rideshare drivers?

Yes, companies like USAA, Progressive, and Geico are known for offering competitive rates for rideshare drivers. Rates can start as low as $65 per month for minimum coverage.

What should I do if my current insurance provider doesn’t offer rideshare coverage?

If your current insurance provider doesn’t offer rideshare coverage, you might need to switch to a provider that does. Alternatively, you can look into commercial insurance or a commercial rider on your personal policy as a cheaper option.

What are the main coverage types included in a commercial policy?

Commercial policies typically include coverage options like liability, collision, and comprehensive coverage, similar to personal auto insurance but tailored for business use.

For a comprehensive overview, explore our detailed resource titled "What does liability car insurance cover?"

How can I ensure I have the right coverage during different rideshare periods?

To ensure you have the right coverage, understand the four periods of ridesharing: when you're online but not yet matched with a passenger, when you're en route to pick up a passenger, while transporting a passenger, and after the ride is completed. Each period may require different levels of coverage.

Why is it important to inform your personal auto insurer that you drive for a rideshare service?

Informing your personal auto insurer about your rideshare activities is crucial to ensure you’re not left with a coverage gap. If an accident occurs during rideshare periods and your insurer is unaware, you may face out-of-pocket expenses.

Can I combine discounts with my rideshare insurance?

Yes, many insurance providers, including Progressive and Farmers, offer opportunities to combine discounts for rideshare drivers. This can help reduce your overall insurance costs.

For detailed information, refer to our comprehensive report titled "Why is car insurance so expensive?"

How can I compare insurance quotes to find the best coverage and rates?

To find the best coverage and rates, use an online comparison tool where you can enter your ZIP code and view quotes from various insurance providers. This will help you identify the most cost-effective and suitable insurance options for your needs.