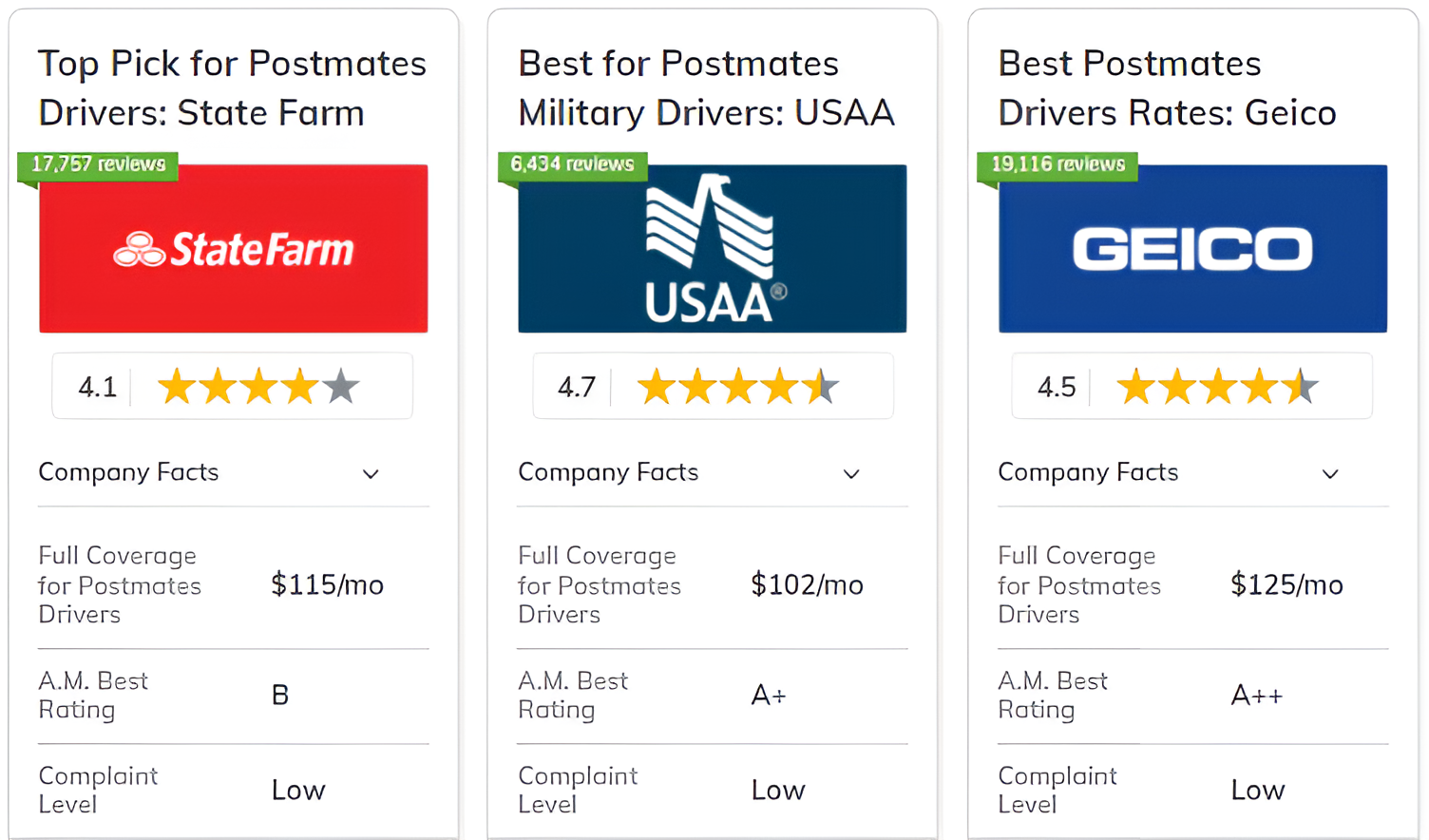

State Farm, USAA, and Geico are the best car insurance companies for Postmates drivers, offering rates as low as $40 per month.

State Farm is known for its low-cost options, USAA offers special features for those in the military, and Geico is known for its low rates and significant multi-policy discounts.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Affordable Add-Ons | State Farm | |

| #2 | 10% | A++ | Military Drivers | USAA | |

| #3 | 25% | A++ | Competitive Rates | Geico | |

| #4 | 25% | A+ | Added Protection | Allstate | |

| #5 | 12% | A+ | Flexible Coverage | Progressive | |

|

#6 | 10% | A | Comprehensive Protection | Liberty Mutual |

| #7 | 20% | A | Gap Coverage | Farmers | |

|

#8 | 20% | A+ | Affordable Rates | Nationwide |

| #9 | 15% | A | Many Discounts | Mercury | |

| #10 | 13% | A++ | Customizable Options | Travelers |

This article looks at the best car insurance companies differentiate themselves through delivery policies, and ways to lower your auto insurance rates.

Ready to shop around for the best car insurance company? Enter your ZIP code above and see which one offers the coverage you need.

What You Should Know

- Car insurance rates starts as low as $40 per month for minimum coverage

- Secure coverage for policies and discounts suited for Postmates drivers

- How to reduce insurance expenses without compromising necessary coverage

#1 – State Farm: Top Overall Pick

Pros

- Full-Spectrum Delivery Protection: Explore our State Farm car insurance review to learn how their policies can benefit Postmates drivers.

- Mileage-Based Savings Program: Drive Safe & Save feature rewards Postmates drivers with discounts up to 30% for prudent driving habits.

- Continuous Claims Assistance: Round-the-clock support caters to Postmates drivers working unconventional hours.

Cons

- Geographical Coverage Gaps: State Farm's specialized Postmates coverage isn't universally available across all regions.

- Cost Barriers for Newcomers: Postmates drivers new to the platform may face higher initial premiums for delivery coverage.

#2 – USAA: Best for Military Drivers

Pros

- Interim Period Protection: In our USAA car insurance review they cover Postmates drivers during the crucial window between activating the app and accepting an order.

- Armed Forces Discounts: Provides exclusive savings for active duty and veteran Postmates drivers.

- Adaptable Payment Structure: Offers multiple payment plans to accommodate the fluctuating income of Postmates drivers.

Cons

- Restricted Customer Base: Exclusively serves military members and their families, excluding many civilian Postmates drivers.

- Partial Delivery Phase Coverage: May not provide comprehensive protection for all stages of the Postmates delivery process.

#3 – Geico: Best for Competitive Rates

Pros

- Unified Coverage Solution: Provides a single policy encompassing both personal use and Postmates deliveries, streamlining insurance for drivers.

- Budget-Friendly Premiums: Known for helping Postmates drivers maximize their earnings. As listed in our guide to car insurance companies that customers recommend.

- Intuitive Mobile Platform: Offers a user-friendly app for easy policy management and claim submissions, ideal for on-the-go Postmates drivers.

Cons

- Regional Policy Variations: Postmates drivers may encounter differing coverage terms based on their operating location.

- Limited Customization Options: Fewer policy add-ons available for Postmates drivers with unique coverage requirements.

#4 – Allstate: Best for Added Protection

Pros

- Ride for Hire Coverage: Our Allstate car insurance review mentioned Ride for Hire coverage for Postmates drivers.

- Deductible Difference Coverage: Bridges the gap between Postmates' insurance deductible and the driver's personal policy.

- Safe Driving Rewards: Drivewise program incentivizes cautious driving, benefiting Postmates drivers who spend extensive time on the road.

Cons

- Elevated Premium Rates: Postmates drivers may incur higher costs for the extensive rideshare coverage offered.

- Intricate Policy Framework: The nuanced coverage structure may prove challenging for novice Postmates drivers to navigate.

#5 – Progressive: Best for Flexible Coverage

Pros

- Personalized Policy Options: Learn how progressive customized your Postmates policy in our Progressive car insurance review.

- Behavior-Based Discount Program: Snapshot feature offers potential savings for Postmates drivers exhibiting safe driving practices.

- Specialized Delivery Endorsement: Provides a specific add-on to protect Postmates drivers, filling gaps in standard auto policies.

Cons

- Dynamic Pricing Model: Postmates drivers' premiums may fluctuate based on Snapshot data or increased delivery frequency.

- Inconsistent Protection Levels: Comprehensive coverage for all aspects of Postmates delivery may vary by state.

#6 – Liberty Mutual: Best for Comprehensive Protection

Pros

- Enhanced Vehicle Replacement: In our car insurance review of Liberty Mutual they offer a year-newer car if a Postmates driver's vehicle is deemed a total loss.

- Safe Driving Incentives: RightTrack program rewards cautious Postmates drivers with potential premium reductions.

- Food Delivery Insurance Option: Provides a specific endorsement covering Postmates activities in select locations.

Cons

- Geographic Restrictions: Food delivery coverage for Postmates drivers isn't universally available across all states.

- Premium Cost Concerns: Extensive protection may result in higher costs, potentially affecting Postmates drivers' profit margins.

#7 – Farmers: Best for Gap Coverage

Pros

- Expanded Personal Policy: Extends standard coverage to include Postmates deliveries, as mentioned in our Farmers car insurance review.

- Behavior-Based Discounts: Signal app monitors driving patterns, offering savings opportunities for prudent Postmates drivers.

- Customizable Deductibles: Allows Postmates drivers to adjust their financial responsibility based on individual circumstances.

Cons

- Intricate Rate Structure: Postmates drivers might find it challenging to estimate costs due to multiple pricing variables.

- Coverage Availability Issues: Specialized food delivery insurance may not be accessible to Postmates drivers in every state.

#8 – Nationwide: Best for Affordable Rates

Pros

- Regular Coverage Evaluation: Learn how assessment ensures Postmates drivers' policies remain relevant as their work evolves in our Nationwide car insurance review.

- Usage-Based Savings: SmartRide program offers potential discounts for Postmates drivers demonstrating safe delivery practices.

- Comprehensive Delivery Protection: Rideshare endorsement covers various stages of the Postmates delivery process where available.

Cons

- Inconsistent Offerings: Specific food delivery coverage may not be available for Postmates drivers in all operating areas.

- Delivery Frequency Impact: Increased vehicle use for Postmates activities could lead to higher insurance costs over time.

#9 – Mercury: Best for Many Discounts

Pros

- Tailored Delivery Coverage: Offers a specialized endorsement designed for drivers engaged in services like Postmates.

- Diverse Savings Opportunities: Provides numerous discount options for Postmates drivers. This tip is mentioned in our top ways customers save money.

- Round-the-Clock Support: 24/7 claim reporting accommodates the irregular schedules of many Postmates drivers.

Cons

- Limited Market Presence: Mercury's specialized coverage for Postmates drivers may not be offered in all operational regions.

- Initial Cost Hurdles: Base rates might be higher, requiring Postmates drivers to qualify for multiple discounts to achieve competitive pricing.

#10 – Travelers: Best for Customizable Options

Pros

- Flexible Policy Extension: Explore our Travelers car insurance review to learn more about their customizable options for Postmates drivers.

- Telematics-Based Pricing: IntelliDrive program provides opportunities for careful Postmates drivers to reduce their premiums.

- Loyalty Rewards: Offers a decreasing deductible benefit, advantageous for long-term Postmates drivers with safe records.

Cons

- Uneven Availability: Postmates drivers in certain states may not have access to specialized food delivery insurance options.

- Policy Complexity: The array of customizable choices may be daunting for Postmates drivers new to commercial auto insurance.

Comparing Costs: Minimum vs. Full Coverage for Postmates Drivers

Deciding on the right coverage level is important for Postmates drivers to avoid being exposed to risk so make sure to explore and compare which is best.

Although minimum coverage is cheaper, full coverage is better for those who drive frequently. Let's examine the monthly cost differences among top insurers:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $50 | $140 | |

| $52 | $145 | |

| $45 | $125 | |

|

$55 | $150 |

| $44 | $120 | |

|

$49 | $130 |

| $47 | $135 | |

| $40 | $115 | |

| $48 | $138 | |

| $38 | $102 |

State Farm offers competitive rates for both minimum and full coverage making it a top overall pick for Postmates drivers.

Keep in mind that coverage needs may vary based on your specific situation as a Postmates driver and choose wisely as you will get penalty for driving without car insurance.

Maximizing Discounts for Postmates Drivers

There are various ways through which Postmates drivers can get discounts that can greatly lower their premiums. Every provider has its own special deals. Here's a breakdown of available discounts from top insurers:

| Insurance Company | Available Discount |

|---|---|

| Safe Driver, Bundling, New Car, Early Signing | |

| Bundling, Signal App, Good Student, Safe Driver | |

| Bundling, Good Driver, Military, Good Student | |

|

Bundling, New Vehicle, Online Purchase, Accident-Free |

| Bundling, Good Driver, Anti-Theft, Pay-in-Full | |

|

Bundling, SmartRide, Accident-Free, Paperless Billing |

| Bundling, Snapshot, Good Student, Pay-in-Full | |

| Bundling, Drive Safe & Save, Accident-Free, Good Student | |

| Bundling, Safe Driver, Homeownership, Continuous Insurance | |

| Bundling, Safe Driver, Military, Defensive Driving |

While all companies offer multi-policy and safe driver discounts, some provide unique options like Farmers' Signal App Discount or Allstate Drivewise. Postmates drivers should explore these opportunities to maximize their savings.

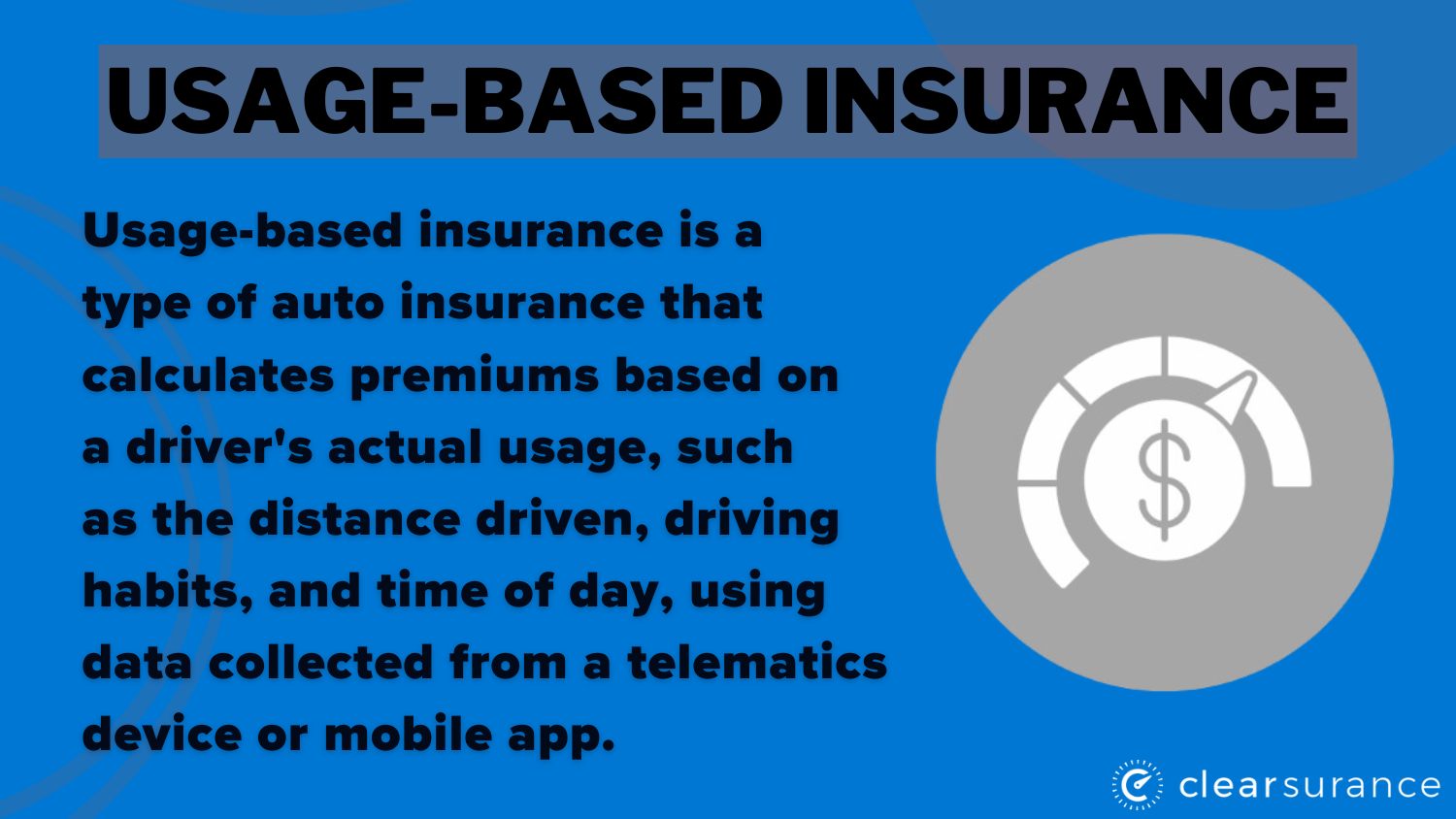

How Telematics Can Benefit Postmates Drivers

Telematics programs can offer significant savings for safe, efficient Postmates drivers. These usage-based insurance options monitor driving behavior and reward good habits.

However, high-mileage drivers should carefully consider how their delivery work might impact potential discounts. Read our Progressive Snapshot review for Progressive's telematics program that tracks driving habits before awarding a discount.

Add-ons and Endorsements for Postmates Drivers

Standard auto policies may not fully protect Postmates drivers. Specialized add-ons like rideshare endorsements can fill coverage gaps.

While these extras increase premiums, they provide crucial protection for delivery drivers. Get the best rideshare car insurance companies by comparing options that offer specialized coverage for delivery drivers.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

Which company gives best insurance for delivery drivers?

State Farm stands out as the top overall pick for Postmates drivers, offering full-spectrum delivery protection and a mileage-based savings program. However, the best company can vary depending on individual circumstances. Explore our State Farm car insurance review for their offerings on Postmates drivers.

What type of car insurance is the cheapest for food delivery drivers?

Minimum liability coverage is typically the cheapest option, but it may not provide adequate protection for delivery drivers. Geico is known for offering competitive rates while still providing necessary coverage for Postmates drivers.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What is the most basic car insurance coverage required for Postmates drivers?

While state minimum liability coverage is the most basic, Postmates drivers should consider additional coverage such as comprehensive, collision, and specific rideshare or delivery endorsements to ensure proper protection.

Which category of car insurance is best for food delivery work?

A commercial auto policy or personal policy with a rideshare/delivery endorsement is best for food delivery work. Consider what kind of car insurance you really need to ensure you're adequately covered for all aspects of your work.

What type of driver is most at risk in the food delivery industry?

New or young drivers working for Postmates may be considered higher risk due to less driving experience. Additionally, drivers with previous accidents or violations on their record may face higher insurance costs and be deemed higher risk.

What is the lowest form of car insurance acceptable for Postmates drivers?

While state minimum liability is the lowest form of car insurance legally, it's generally not sufficient for Postmates drivers. At minimum, drivers should have a personal policy with a rideshare/delivery endorsement or a commercial policy.

Which insurance companies offer the best coverage for part-time Postmates drivers?

USAA (for military families), Progressive, and Nationwide offer flexible options that can be suitable for part-time Postmates drivers, with features like usage-based insurance and customizable policies.

What is the cheapest insurance option for high-risk delivery drivers?

Companies like Progressive and The General often provide more affordable options for high-risk drivers. If you're concerned about being a high-risk driver, learn more about the best car insurance for high-risk drivers to find suitable coverage options.

What additional coverage should Postmates drivers consider beyond basic insurance?

Postmates drivers should consider adding comprehensive and collision coverage, uninsured/underinsured motorist coverage, and a specific rideshare or delivery endorsement to their policy for full protection.

How can Postmates drivers find the most affordable comprehensive coverage?

Drivers can find affordable comprehensive coverage by comparing quotes from multiple insurers, taking advantage of discounts, and considering usage-based insurance programs offered by companies like Progressive and Nationwide.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.