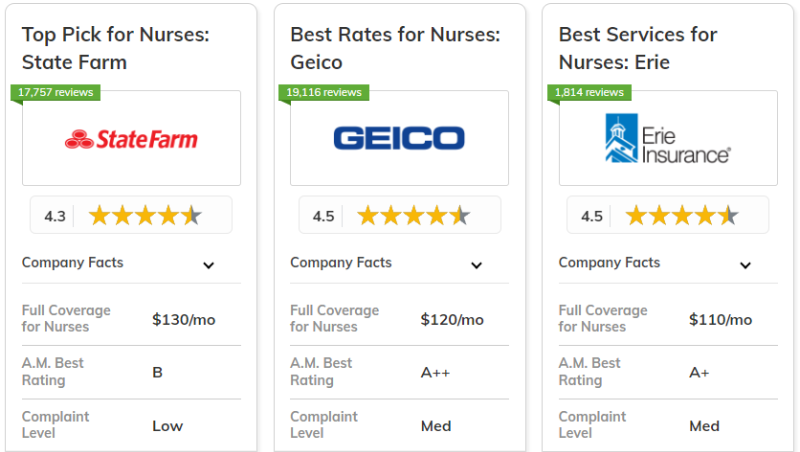

The best car insurance companies for nurses are State Farm, Geico, and Erie, with State Farm leading the way due to its exceptional coverage options and reliable customer service.

These providers stand out for offering affordable plans, starting at $45 per month, that cater to the specific needs of nurses. Whether it’s flexibility or comprehensive protection, these best car insurance companies excel in balancing cost and coverage.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Reliable Service | Geico">State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

|

#3 | 25% | A+ | Customer Service | Erie |

| #4 | 10% | A+ | Flexible Coverage | Progressive | |

|

#5 | 25% | A | Comprehensive Options | Liberty Mutual |

| #6 | 10% | A++ | Military Benefits | USAA | |

|

#7 | 20% | A+ | Personalized Service | Nationwide |

| #8 | 20% | A | Professional Discounts | Farmers | |

| #9 | 13% | A++ | Diverse Discounts | Travelers | |

| #10 | 15% | A | Tailored Policies | Safeco |

Their specialized policies ensure nurses receive optimal support in all areas of car insurance.

Enter your ZIP code above into our free comparison tool to see how much car insurance costs in your area.

What You Should Know

- State Farm provides top coverage, balancing affordability and comprehensive protection

- Nurses get tailored policies with flexible coverage options for their needs

- These companies offer convenience and support for nurses’ busy schedules

#1 – State Farm: Top Overall Pick

Pros

- Exceptional Support for Nurses: Known for consistently strong service scores, offering dependable customer assistance for nurses' demanding schedules.

- Robust Bundling Savings: Nurses can reduce costs by up to 17% when combining home and vehicle insurance plans through State Farm.

- Extensive Coverage: Offers a variety of coverage plans tailored to the specific needs of nurses and healthcare professionals. Learn more in our State Farm insurance review.

Cons

- Weaker A.M. Best Score: State Farm’s B rating is lower than some rivals, which might concern more cautious nurses.

- Pricey Premiums for Nurses: Even with savings, State Farm’s rates can surpass Geico’s for some healthcare workers.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Premiums for Nurses: Geico delivers some of the lowest prices for nurses, making it ideal for cost-conscious professionals.

- Top A.M. Best Rating: With an A++ rating, Geico offers strong financial reliability, appealing to nurses looking for security.

- High Bundling Savings: Nurses can bundle and save up to 25%, one of the most generous discounts available. Get more car insurance claims ratings.

Cons

- Inconsistent Customer Care: While affordable, some nurses report less personalized support compared to Erie or State Farm.

- Limited Coverage Enhancements: Geico may offer fewer add-ons for nurses who require more specialized protection.

#3 – Erie: Best for Superior Customer Service

Pros

- Excellent Service for Nurses: Erie excels in customer support, with healthcare professionals praising its attentive service.

- Competitive Premiums: Erie offers cost-effective insurance options, especially when nurses bundle and apply discounts.

- Customizable Coverage: Erie provides tailored insurance plans that meet the specific requirements of nurses. Find out more in our Erie car insurance review.

Cons

- Limited Availability: Erie’s services are only accessible in certain states, limiting options for nurses outside those areas.

- Bundling Complexity: Nurses may need to combine several policies to access maximum discounts, adding complexity.

#4 – Progressive: Best for Flexible Coverage

Pros

- Flexible Insurance Plans: Progressive provides highly customizable policies, ideal for nurses with varied needs.

- Usage-Based Discounts: Nurses who drive less can save with Progressive’s pay-as-you-go insurance, lowering premiums.

- Extensive Coverage Choices: Offers a broad range of policies that fit the personal and professional needs of nurses. Discover more in our Progressive car insurance review.

Cons

- Inconsistent Premiums: Progressive’s rates may fluctuate significantly by region, potentially costing more than Geico for some nurses.

- Lower Bundling Savings: Offers a smaller bundling discount (10%) for nurses compared to competitors like Erie and Geico.

#5 – Liberty Mutual: Best for Comprehensive Options

Pros

- Diverse Coverage Options: Liberty Mutual offers a wide variety of policies for nurses, including accident forgiveness and vehicle replacement.

- Reliable Financial Rating: An A rating from A.M. Best ensures solid financial backing for long-term protection tailored to nurses.

- Significant Bundling Savings: Nurses can save up to 25% by bundling multiple policies, maximizing discounts. Unlock details in our car insurance review of Liberty Mutual.

Cons

- Inconsistent Premiums: Liberty Mutual’s pricing may fluctuate depending on specific coverage needs, impacting nurses' costs.

- Higher Premiums for Low Mileage: Nurses who drive less may face higher premiums compared to usage-based plans offered by competitors.

#6 – USAA: Ideal for Military Benefits

Pros

- Exclusive Perks for Nurses in Military Families: USAA provides customized benefits for nurses with ties to the military.

- Exceptional Financial Security: Boasting an A++ rating, USAA ensures outstanding financial strength and protection for nurses.

- Affordable Plans for Nurses: USAA delivers competitive pricing, particularly for nurses connected to the military. Explore our USAA car insurance review for more details.

Cons

- Limited Availability: Only available to military families, limiting access for civilian nurses.

- Fewer Nurse-Focused Savings: USAA offers fewer discounts specifically for civilian nurses compared to other providers.

#7 – Nationwide: Best for Personalized Service

Pros

- Personalized Plans for Nurses: Nationwide provides highly tailored insurance policies to meet the distinct needs of nurses.

- Significant Multi-Policy Savings: Nurses can enjoy up to 20% off by bundling various insurance policies together. Discover our Nationwide car insurance review to learn more.

- Healthcare Worker Discounts: Nurses benefit from specific discounts aimed at healthcare professionals, further reducing premiums.

Cons

- Higher Costs for Stand-Alone Policies: Nurses who choose not to bundle may find premiums higher than other options like Geico.

- State-Specific Offerings: Some discounts and policies are restricted by location, which could limit availability for nurses.

#8 – Farmers: Great for Professional Discounts

Pros

- Healthcare Worker Savings: Farmers provides special discounts to nurses, helping them reduce their overall premium costs.

- Flexible Insurance Policies: Farmers offers customizable plans, allowing nurses to choose coverage tailored to their individual needs.

- Bundling Opportunities: Nurses can bundle home, auto, and other policies to save up to 20%, enhancing affordability. See our Farmers car insurance review.

Cons

- Variable Premiums for Nurses: Even with professional discounts, some nurses may find Farmers’ prices inconsistent or higher than competitors.

- Less Advanced Digital Interface: Farmers’ app may not be as user-friendly or feature-rich for nurses as platforms offered by competitors like Geico or USAA.

#9 – Travelers: Best for Diverse Discounts

Pros

- Wide Range of Discounts for Nurses: Travelers provides numerous discount opportunities, helping nurses reduce their insurance costs.

- Excellent Financial Security: Travelers’ A++ rating ensures strong financial backing and secure coverage for nurses' long-term needs.

- Multi-Policy Savings: Nurses can save up to 13% by bundling home and auto insurance policies, offering moderate savings. Find out more with our Travelers car insurance review.

Cons

- Price Fluctuations by Region: Premiums can vary widely by state, with some nurses facing significantly higher costs.

- Mixed Service Experiences: Some nurses report inconsistent customer service, with longer wait times or less personalized attention.

#10 – Safeco: Best for Tailored Policies

Pros

- Financially Stable with A-Rating: Safeco's strong financial health ensures reliable coverage for nurses’ long-term protection.

- Decent Bundling Savings: Nurses can combine auto and home policies for up to 15% savings, increasing affordability. Get more details about buying auto insurance online.

- Healthcare Worker Discounts: Safeco provides discounts specifically for nurses, making coverage more accessible and affordable.

Cons

- Less Advanced Digital Tools: Safeco’s app lacks some features that nurses may need, compared to more technology-forward companies like Progressive or Geico.

- Limited Agent Access: Nurses may struggle to find local Safeco agents, reducing the opportunity for personalized service.

Comparing Affordable Insurance Coverage Rates

When evaluating monthly coverage rates from top insurers, Erie stands out by offering the most affordable minimum coverage at $45 per month, while USAA delivers the lowest full coverage cost at $105 per month.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

|

$45 | $110 |

| $57 | $145 | |

| $50 | $120 | |

|

$65 | $150 |

|

$53 | $135 |

| $60 | $140 | |

| $62 | $142 | |

| $55 | $130 | |

| $52 | $138 | |

| $48 | $105 |

Geico and State Farm also present appealing choices, with minimum coverage priced at $50 and $55, respectively. For those seeking more comprehensive plans, Liberty Mutual and Farmers come in with higher full coverage options at $150 and $145.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Safe Driver, Good Student, Signal (Usage-Based), Homeowner, Bundling, Occupational, Anti-Theft Device | |

| Professional association, Multi-policy, Safe driver, Anti-Theft Device, Good Student, Military, Defensive Driving, Seat Belt Use | |

|

Multi-Policy, Professional Association, Safe Driver, New Vehicle, Hybrid Vehicle, Anti-Theft Device, Military, Good Student |

|

Multi-policy, Safe driver, Defensive Driving, Good Student, Anti-Theft Device, Paperless, Accident-Free, Pay-In-Full |

| Multi-Policy, Safe Driver, Continuous Insurance, Snapshot (Usage-Based), Homeowner, Multi-Car, Online Quote, Sign Online, Paperless | |

| Multi-Policy, Safe Driver, Good Student, New Vehicle, Anti-Theft Device, Accident-Free, Pay-In-Full, Diminishing Deductible | |

| Multi-Policy, Safe Driver, Good Student, Defensive Driving, Accident-Free, Anti-Theft Device, Vehicle Safety Features | |

| Multi-Policy, Safe Driver, Continuous Insurance, Good Student, Hybrid/Electric Vehicle, New Car, Homeowner, Multi-Car | |

| Multi-Policy, Safe Driver, Defensive Driving, Military, Good Student, New Vehicle, Stored Vehicle, Family Discount |

Ultimately, selecting between these providers depends on your financial plan, desired coverage level, and understanding what kind of car insurance you really need, but these rates make it clear which insurers provide the best value for both basic and full protection.

Understanding the Key Drivers of Insurance Costs for Nurses

Several factors uniquely affect insurance costs for nurses, many of which stem from the nature of their profession. Work-related driving is a significant factor, as nurses often commute frequently or travel for work, which can lead to higher premiums due to increased time on the road.

Nurses in urban or high-risk areas often face higher rates due to traffic and accident risks. Irregular shifts, like night driving, further raise premiums, making best car insurance for high-risk drivers essential for those in these situations.

Furthermore, if a nurse uses their vehicle for both personal and professional purposes, the dual usage can contribute to increased insurance costs. On the positive side, many insurance providers offer specific professional discounts tailored to healthcare workers, which can help offset these costs and provide nurses with significant savings.

Bundle is life! Can’t argue with that logic. 🏠 + 🚗https://t.co/uNYjYTKwoU pic.twitter.com/RRoMMaYbbc

— State Farm (@StateFarm) August 28, 2024

By understanding these factors, nurses can better navigate their insurance options and find ways to reduce their premiums.

Effective Ways for Nurses to Lower Car Insurance Costs

Nurses face unique insurance challenges, but there are several strategies to help lower car insurance premiums. By leveraging professional discounts available specifically for healthcare workers, nurses can reduce their costs significantly. Maintaining a clean driving record is another essential factor, as insurers reward safe drivers with lower rates.

Nurses can also benefit from bundling multiple policies, such as auto and home insurance, to receive discounts from providers. Additionally, choosing a higher deductible can lower monthly premiums, though it increases out-of-pocket costs in the event of a claim.

Finally, nurses should regularly compare quotes from different insurers to ensure they are getting the best deal possible based on their driving habits and location. By staying proactive with these strategies, nurses can maximize savings and keep insurance costs manageable.

Maximizing Savings with Insurance Tips

The above tips provide nurses with practical ways to minimize their car insurance expenses without compromising coverage. By exploring top ways customers save money on their car insurance, such as bundling policies and taking advantage of discounts, proactively reviewing and adjusting policies can result in significant savings over time.

Best Auto Insurance Providers for Nurses

Finding the right auto insurance provider is essential for nurses, whose demanding schedules and frequent commuting require reliable coverage. State Farm stands out, delivering a combination of trustworthy service, broad coverage, and special discounts aimed at healthcare professionals, making it an excellent choice for nurses seeking security on the road.

Geico follows closely with its cost-effective premiums and easy-to-use digital tools, allowing nurses to handle their policies, payments, and claims with ease, even with their hectic schedules. Erie is known for top-notch customer support, accident forgiveness, and competitive rates, giving nurses personalized care and protection.

These providers not only offer extensive coverage plans but also prioritize flexibility, affordability, and consistent service that seamlessly accommodates a nurse’s busy, fast-paced life, making them the car insurance companies that customers recommend.

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

Does Geico have a discount for nurses?

Yes, Geico offers discounts for nurses as part of its healthcare worker savings, helping to lower premiums.

What is the most trusted car insurance company for nurses?

State Farm is often regarded as the most trusted car insurance company for nurses due to its reliable coverage and tailored options.

What is the most common insurance for nurses?

The most common insurance for nurses includes liability car insurance and comprehensive policies from providers like Geico, State Farm, and Erie.

Who is the most expensive to insure for nurses car insurance?

Liberty Mutual tends to be one of the more expensive providers for nurses car insurance, especially for full coverage policies.

What is the best type of nurses car insurance to get?

Comprehensive coverage is the best type of nurses car insurance, offering protection for accidents, theft, and other potential risks.

Is Progressive cheaper than Geico for nurses car insurance?

In many cases, Progressive may have higher monthly premiums compared to Geico for nurses car insurance, but it depends on individual factors such as location and clean driving record.

Should nurses get their own insurance?

Yes, nurses should get their own car insurance to ensure they have coverage suited to their personal and professional needs.

How can I lower my nurses car insurance?

Nurses can lower their car insurance by maintaining a clean driving record, bundling policies, and taking advantage of professional discounts.

What are the key factors insurers consider when providing car insurance for nurses?

Insurers consider factors like driving history, location, vehicle use, low-mileage , and whether the nurse qualifies for healthcare worker discounts when providing car insurance.

What factors influence nurses car insurance rates?

Nurses car insurance rates are influenced by commuting distance, shift schedules, vehicle type, and the nurse's driving record.