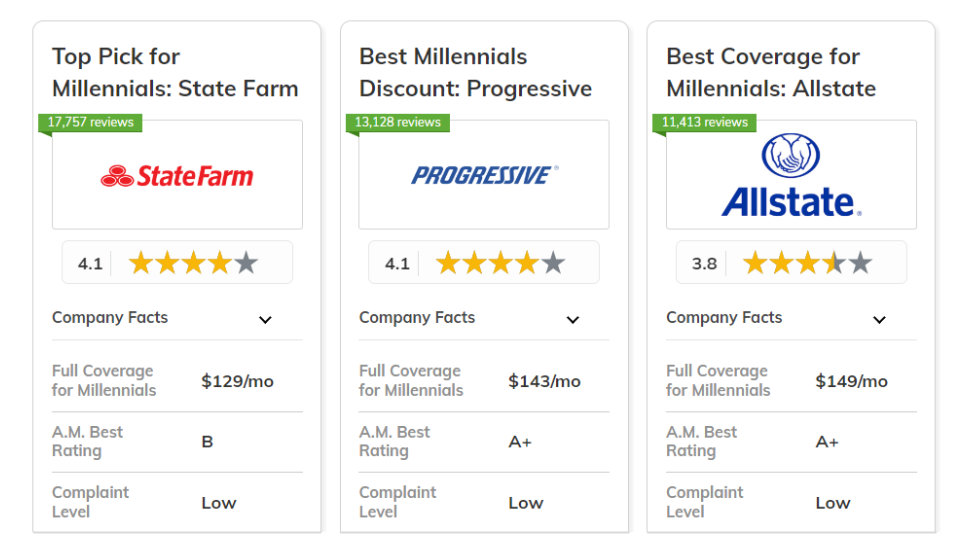

The top car insurance companies for millennials are State Farm, Progressive, and Allstate. State Farm offers competitive rates starting at $52/month

Our review of millennials and insurance factors in customer service, discounts for a clean driving record, and convenient online tools for policy management.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Customer Service | State Farm | |

| #2 | 10% | A+ | Online Tools | Progressive | |

| #3 | 25% | A+ | Add-on Coverages | Allstate | |

|

#4 | 20% | A+ | Usage-Based Savings | Nationwide |

|

#5 | 25% | A | 24/7 Support | Liberty Mutual |

| #6 | 13% | A++ | Industry Experience | Travelers | |

| #7 | 20% | A | Safe Drivers | Farmers | |

| #8 | 25% | A | Costco Members | American Family | |

| #9 | 15% | A | Diminishing Deductible | Safeco | |

|

#10 | 25% | A+ | Filing Claims | Erie |

Millennials looking for affordable, reliable coverage will find these options stand out for both price and benefits. Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What You Should Know

- The best car insurance companies for millennials offer rates from $49/month

- State Farm is the top pick for affordable rates and great customer service

- Millennial drivers benefit from safe-driving discounts and usage-based coverage

#1 – State Farm: Top Overall Pick

Pros

- Tailored Customer Service: Millennials are used to prefer custom customer service experiences that can be quickly and easily accessed across the internet or through mobile apps.

- High Customer Satisfaction: State Farm’s strong reputation for customer service ensures millennials feel supported during claims or policy inquiries.

- Local Agents Available: Millennials who prefer in-person service can rely on State Farm’s large network of local agents. Learn more in our State Farm review.

Cons

- Traditional Approach: Millennials seeking digital-first experiences may find State Farm’s approach less tech-savvy than competitors.

- Limited Mobile Support: Customer service features may be more cumbersome for millennials relying heavily on mobile communication.

#2 – Progressive: Best Online Policy Management

Pros

- Name-Your-Price Online Tool: Millennials can find cheap car insurance with Progressive by choosing coverage that fits a fixed budget.

- Convenient Mobile App: Millennials can manage policies, file claims, or add coverage instantly with the Progressive app. Read more about it in our Progressive review.

- Immediate Savings: Small accident forgiveness starts immediately, which appeals to millennials looking for instant savings.

Cons

- Monitoring Concerns: Some millennials might feel uncomfortable with the level of tracking required for some safe-driving discounts.

- Poor Customer Service Reviews: Millennials rank Progressive customer service below State Farm, Allstate, and other top companies.

#3 – Allstate: Best Add-on Coverages

Pros

- Customizable Plans: Millennials can personalize their insurance plans by adding options like roadside assistance and rental reimbursement for more tailored protection.

- Flexibility: Allstate’s variety of add-on options offers millennials the flexibility to adjust coverage as their lifestyle changes, which is covered in our Allstate review.

- Enhanced Protection: Millennials will sleep better knowing they have extra protection as well, like accident forgiveness or identity theft coverage.

Cons

- Higher Premiums: Millennials seeking basic coverage might find the cost of add-ons inflates their premiums.

- Overcomplication: Too many add-on options can confuse millennials who prefer straightforward insurance plans.

#4 – Nationwide: Best for Usage-Based Savings

Pros

- Usage-Based Discounts: Track driving habits to save up to 40% on millennial auto insurance with Nationwide SmartRide. Find out more in our Nationwide review.

- Low-Mileage Programs: Millennials who work from home or have short commutes can sign up for Nationwide SmartMiles and get cheaper rates.

- Wide Coverage Options: Millennials with diverse insurance needs benefit from Nationwide’s broad selection of policy options.

Cons

- Not Always the Cheapest: Millennials may find that Nationwide doesn't always offer the lowest rates compared to other providers.

- Expensive for High-Risk Drivers: Millennials with a history of claims or accidents may not be eligible for usage-based discounts.

#5 – Liberty Mutual: Best for 24/7 Support

Pros

- Round-the-Clock Availability: Millennials with busy or unpredictable schedules benefit from Liberty Mutual’s 24/7 support.

- Responsive Service: Millennials can access immediate assistance, especially in emergencies, via phone or online.

- Mobile App Integration: Millennials can use Liberty Mutual’s mobile app to get 24/7 support on the go, which you can learn about in our Liberty Mutual review.

Cons

- Impersonal Service: Some millennials may feel that 24/7 support lacks the personal touch of a dedicated agent.

- Potential Delays: Millennials could have to wait longer during off-peak hours, while the support is 24/7 in appearance.

#6 – Travelers: Best for Industry Experience

Pros

- Strong Financial Ratings: Travelers has an A++ rating from AM Best, which means they pay out claims to their millennial drivers promptly and effectively.

- Customizable Coverage: Since millennials are all about self-expression it helps that Travelers offers completely customizable bundling plans.

- Responsible Driver Plan: Millennial drivers can sign up for these plans to earn accident forgiveness and diminishing deductibles.

Cons

- Complex Pricing: Travelers car insurance for millennials can be more expensive than other providers. Get a free rate comparison in our Travelers review.

- Poor Claims Service: Numerous customer complaints and successive claims experience, despite Travelers's best financial condition.

#7 – Farmers: Best for Safe Drivers

Pros

- Safe Driver Discounts: Millennials can save big with Farmers' safe driver discounts. Check out how in our Farmers review.

- Usage-based Rewards: Farmers offers millennials incentives such as lower premiums through programs like Signal, which tracks safe driving habits.

- Ideal for Low-Risk Millennials: Millennials who practice caution on the road can see substantial savings with Farmers’ safe driver programs.

Cons

- Savings Vary by State: Farmers’ safe driver discounts are inconsistent across all states, making it harder for some millennials to access the full benefits.

- Tracking Privacy Concerns: Millennials who are worried about data privacy could be put off by Farmers using such information in usage-based programs.

#8 – American Family: Best for Costco Members

Pros

- Exclusive Discounts for Costco Members: Costco millennial members get exclusive auto insurance discounts from American Family.

- Member-Only Perks: Millennials with Costco memberships can get extra perks with AmFam Insurance.

- Affordable Rates for Members: American Family offers affordable auto insurance for millennials starting at $54/month. Compare rates in our AmFam review.

Cons

- Additional Membership Costs: For millennials the expense for buying a membership could render it pointless to look for what may amount to paltry insurance savings.

- Limited Availability: AmFam only sells car insurance in 26 states, which may leave some millennial drivers out in the cold.

#9 – Safeco: Best Diminishing Deductible

Pros

- Biggest Diminishing Deductible: Millennials who maintain clean driving records can reduce their deductibles by $50 every six months, up to $500.

- Claims-Free Cash Back: Safeco pays millennial drivers 2.5% of their policies if they remain claim-free every six months. Learn more in our review of Safeco.

- Convenient Online Tools: For tech-savvy millennials, the user-friendly online tools provided by Safeco for policy management, claims and document access makes it easy.

Cons

- Limited Human Interaction: Millennials who prioritize human interaction over technology may be put off by how Safeco relies heavily on online tools.

- Tech-Dependent: The high-tech tools may not be a good fit for those millennials with an unreliable internet connection or that still like the personal touch of traditional service.

#10 – Erie: Best for Filing Claims

Pros

- Efficient Claims Process: If any issue arises, like an accident or damage, Erie is one of the best providers for younger drivers looking to get a repair.

- 24/7 Claims Reporting: Erie offers millennials around-the-clock claims reporting, allowing for immediate filing, which fits their need for fast, responsive services.

- Cheap Millennial Insurance Rates: Erie car insurance for young drivers is cheap, starting at $49/month. Compare more quotes in our review of Erie.

Cons

- Limited App Features: While Erie offers online claims filing, its app lacks some of the advanced features millennials expect from digital platforms.

- Regional Focus: Erie car insurance for millennials is only available in 12 states.

Monthly Car Insurance Rates for Millennials

This table compares monthly millennial insurance rates for both minimum and full coverage from our top ten companies.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $66 | $149 | |

| $54 | $133 | |

|

$49 | $124 |

| $69 | $154 | |

|

$72 | $162 |

|

$61 | $137 |

| $58 | $143 | |

| $63 | $147 | |

| $52 | $129 | |

| $57 | $138 |

Rates vary by insurer and coverage. Erie and State Farm are cheap car insurance companies for millennials for both minimum liability and full coverage policies.

State Farm car insurance is available at low rates in more states than its competitors, which is why it's our top pick for millennial auto insurance.

Smart Strategies for Millennials to Cut Car Insurance Costs

Every insurer provides its own kind of discount, such as price breaks for driving a hybrid vehicle, buying a new car, or using usage-based tracking apps. This table makes it easy for those in their 20s to compete by comparing and seeing where they can save most.

| Insurance Company | Available Discount |

|---|---|

| Safe Driver, Multi-Policy, Good Student, AutoPay | |

| Good Driver, Loyalty, Young Driver, Defensive Driving | |

|

Safe Driver, Multi-Vehicle, Paid-in-Full, Young Driver |

| Good Student, Multi-Policy, Safe Driver, Affinity | |

|

Good Student, Early Shopper, Multi-Policy, Online Quote |

|

SmartRide, Multi-Policy, Good Student, Paperless |

| Snapshot, Multi-Policy, Good Student, Continuous Insurance | |

| Teen Safety, Multi-Policy, Good Student, Low Mileage | |

| Steer Clear, Good Student, Drive Safe & Save, Multi-Policy | |

| Good Payer, Multi-Policy, New Car, Continuous Insurance |

There are discounts like safe driver, good student, multi-policy or usage-based programs shown from providers such as Allstate, Progressive and State Farm among many others.

Millennials can also save on car insurance by bundling policies, like auto and renters, for discounts from companies like Nationwide and Travelers.

If you're a student, maintaining good grades can qualify you for discounts with State Farm or American Family. Increasing your deductible is another way to reduce monthly costs, though it means paying more if you file a claim.

Read More: How does my credit score affect my insurance premium?.

Top Car Insurance Companies for Millennials

State Farm, Progressive, and Allstate lead as the best car insurance companies for millennials, offering strong customer service, flexible coverages, and easy-to-use online tools.

Check our insurance checklist for millennials to find the best car insurance rates and maximize savings through strategic discounts based on driving habits and lifestyle.

Affordable car insurance rates are just a click away. Enter your ZIP code below to find the best policy for you.

Frequently Asked Questions

What is the best way for millennials to save money on car insurance?

Millennials can save money by comparing quotes from multiple insurance providers, bundling policies like auto and renters insurance, and taking advantage of usage-based car insurance programs.

How do safe-driving apps help reduce millennial car insurance premiums?

Safe-driving apps track driving habits, such as speed, braking, and distance driven. Companies like Progressive and Allstate offer these programs, which reward safe drivers with lower premiums based on their performance.

Read More: What is a driving record and what does it track?

What are the best car insurance companies for millennials?

State Farm, Progressive, and Allstate are the best auto insurance companies for millennials due to their affordable rates, starting as low as $49/month, and a variety of discounts tailored to young drivers. Instantly compare quotes by entering your ZIP code below.

Are there specific car insurance discounts for millennials?

Yes, millennials should look for discounts such as good student, multi-policy, safe driver, hybrid vehicle, and usage-based discounts. These can significantly reduce their premiums when compared across providers.

What is bundling car insurance for millennials?

Bundling means purchasing multiple policies (such as auto, renters, or home insurance) from the same provider. Companies like Nationwide and Travelers offer discounts when policies are bundled, which helps millennials save on both insurance types.

Can millennials reduce car insurance costs by increasing their deductible?

Yes, increasing your insurance deductible can lower monthly premiums. Still, be sure you have enough saved to weather a bigger deductible in case your home has serious damage.

Is it cheaper to pay millennial car insurance monthly or annually?

While most millennials prefer the flexibility of monthly payments, paying annually often comes with a discount, making it the more cost-effective option in the long run. Always check with your insurer to see if this option is available.

What is full coverage, and do millennials need it?

Full coverage includes liability, collision, and comprehensive protection. It’s ideal for newer cars or those with a loan or lease. Millennials with older, paid-off vehicles may opt for minimum coverage to save money. Enter your ZIP code below to compare rates from the top providers near you.

How often should millennials compare car insurance quotes?

Millennials should compare car insurance quotes on online marketplaces for insurance at least once a year or whenever they experience a major life change (e.g., moving, buying a new car, or getting married) to ensure they’re getting the best deal and taking advantage of new discounts.

How does being a good student help millennials lower car insurance rates?

State Farm, American Family, and others sometimes have a good student discount for students who maintain a 3.0 or higher GPA. This is a good thing for college millennials and their car insurance.