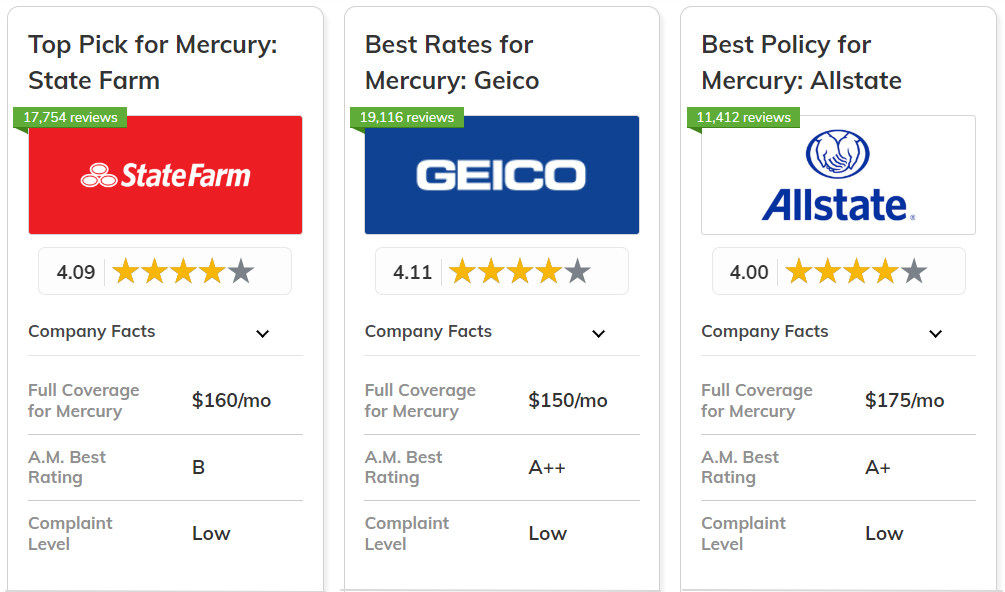

State Farm, Geico, and Allstate are the best car insurance companies for Mercurys, especially for drivers looking for full coverage policies.

State Farm takes our top spot for the best car insurance for Mercurys thanks to its low average rates, personalized service, and generous selection of discounts. As one of the most frequent car insurance companies that customers recommend, State Farm also has a reputation for quick claims and helpful representatives.

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | B | Agency Network | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | |

| #3 | 25% | A+ | Customized Policies | Allstate | |

| #4 | 12% | A+ | Roadside Assistance | Progressive | |

| #5 | 10% | A++ | Military Savings | USAA | |

|

#6 | 25% | A | Affinity Discounts | Liberty Mutual |

| #7 | 20% | A | Safety Discounts | Farmers | |

|

#8 | 20% | A+ | Multi-Policy Discounts | Nationwide |

| #9 | 8% | A++ | Low-Mileage Drivers | Travelers | |

| #10 | 10% | A++ | Reliability Focused | Auto-Owners |

Explore your options for used car insurance for your Mercury below. Then, enter your ZIP to find the cheapest Mercury auto insurance rates in your area.

What You Should Know

- As a discontinued make, Mercurys typically enjoy lower used car insurance rates

- Many drivers save by selecting minimum coverage for their Mercurys

- State Farm and Geico are the best Mercury car insurance companies

On this page:

- #1 – State Farm: Top Pick Overall

- #2 – Geico: Best for Affordable Mercury Car Insurance Rates

- #3 – Allstate: Best Add-Ons for Used Cars

- #4 – Progressive: Best for Digital Car Insurance Options

- #5 – USAA: Best for Military Families

- #6 – Liberty Mutual: Best for Diverse Coverage Options

- #7 – Farmers: Best for Mercury Car Insurance Discounts

- #8 – Nationwide: Best for Safe Driving Savings

- #9 – Travelers: Best for Excellent Customer Service

- #10 – Auto-Owners: Best for Quick Claims Service

- The Best Mercury Car Insurance Rates by Company

- How to Save on Mercury Car Insurance

- Best Mercury Car Insurance Discounts

- Find the Best Car Insurance Companies for Mercurys Today

- Frequently Asked Questions

#1 – State Farm: Top Pick Overall

Pros

- Coverage Option for Used Cars: State Farm offers a variety of car insurance add-ons that suit used Mercurys, like roadside assistance.

- Safe Driver Discounts: Savings like a multi-policy discount can significantly reduce Mercury car insurance quotes from State Farm.

- Repair Shop Network: State Farm’s extensive network of repair shops is familiar with Mercury vehicles, which makes it easy to resolve car insurance claims.

Cons

- Claim Process: Some Mercury drivers report slow car insurance claim processing times, particularly regarding how quickly State Farm representatives communicated.

- Coverage Restrictions: State Farm offers limited coverage options for heavily modified Mercurys. Get clarification in our State Farm review.

#2 – Geico: Best for Affordable Mercury Car Insurance Rates

Pros

- Competitive Pricing: Geico generally has cheap auto insurance for Mercurys. Compare Geico vs. Progressive to get low rates.

- Solid List of Discounts: With 16 discounts to take advantage of, finding cheap Mercury auto insurance rates is easy at Geico.

- 24/7 Customer Service: You’ll never have to worry about getting car insurance help from Geico with its round-the-clock customer support for Mercury drivers.

Cons

- Limited Local Agents: There are fewer local Geico car insurance agents, which might be a downside for Mercury drivers preferring in-person service.

- Claim Satisfaction: Some Mercury drivers report dissatisfaction with the Geico car insurance claims handling process.

#3 – Allstate: Best Add-Ons for Used Cars

Pros

- Coverage Options for Used Cars: Get the perfect policy for your Mercury with any of Allstate’s add-ons, like classic car insurance coverage and roadside assistance.

- Drivewise Program: Get cheap Mercury car insurance by enrolling in Allstate Drivewise usage-based insurance. Learn more in our Allstate car insurance review.

- Local Agents: Allstate maintains a strong network of local car insurance agents throughout the country to provide personalized service to Mercury owners.

Cons

- Expensive Coverage: While you can save on your car insurance with Drivewise, most Mercury drivers see higher premiums at Allstate compared to most competitors.

- Mixed Customer Reviews: Allstate typically receives mixed reviews regarding its customer service experiences for Mercury car insurance.

#4 – Progressive: Best for Digital Car Insurance Options

Pros

- Snapshot: Progressive offers a maximum car insurance discount of 30% to safe Mercury drivers who sign up for the Snapshot program.

- Affordable Rates: Progressive often offers cheap car insurance for Mercurys, especially for safe drivers. Compare free quotes in our Progressive Insurance review.

- Digital Tools: Digital options like the Name Your Price tool make Progressive an ideal choice for Mercury owners who want a modern insurance experience.

Cons

- Snapshot May Increase Rates: Mercury drivers who aren’t safe enough will see higher rates with Progressive Snapshot.

- Unexpected Price Increases: Some Mercury owners report significant price increases on their Progressive car insurance over time, even when nothing in their policy changes.

#5 – USAA: Best for Military Families

Pros

- Military Discounts: Military members can get the cheapest auto insurance for Mercurys with USAA’s substantial military discounts.

- Customer Satisfaction: USAA consistently receives high customer satisfaction ratings.

- Financial Stability: With strong financial stability ratings, you can rest assured that USAA will provide reliable payments for your Mercury car insurance claims.

Cons

- Eligibility Restrictions: USAA car insurance is only available to military members, veterans, and their families. See if you qualify for Mercury insurance in our USAA review.

- Less Robust Technology: USAA offers limited online car insurance tools compared to other competitors for Mercury coverage.

#6 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Unique Coverage Options: Liberty Mutual offers a variety of add-ons for Mercurys. Explore this add-on selection in our car insurance review of Liberty Mutual.

- Discounts: With 17 ways to save, Liberty Mutual is one of the cheapest Mercury car insurance companies because of its excellent discount selection.

- Local Support: Liberty Mutual offers a strong network of local car insurance agents in most states so Mercury drivers can get all the help they need.

Cons

- Higher Average Premiums: While it usually doesn’t have the most expensive Mercury auto insurance rates, Liberty Mutual is also rarely the cheapest.

- Claim Process Issues: Mercury owners leave mixed reviews on the Liberty Mutual car insurance claims handling process.

#7 – Farmers: Best for Mercury Car Insurance Discounts

Pros

- Discount Programs: Explore all 23 Mercury insurance discount options in our Farmers car insurance review.

- Excellent Coverage Options: Get the best auto insurance for Mercurys with Farmers’ comprehensive coverage options.

- 24/7 Claim Support: You can reach Liberty Mutual agents any time to file Mercury car insurance claims online or over the phone.

Cons

- Priceier Plans: Despite its 23 discounts, Farmers is often more expensive for Mercury car insurance than many other insurers.

- Lacking Online Tools: Farmers’ limited online tools for car insurance management make it a bad choice for Mercury drivers looking to handle their insurance online.

#8 – Nationwide: Best for Safe Driving Savings

Pros

- Vanishing Deductible: Sign up for this add-on to reduce your Mercury insurance deductible every year you spend claims-free. See how it works in our Nationwide review.

- Safe Driver Discounts: Nationwide offers a variety of discounts, including ways for safe Mercury drivers to lower their car insurance rates.

- Policy Customization Options: Nationwide is one of the best Mercury car insurance companies because it offers a wide array of coverage options.

Cons

- Premium Costs: While it often has affordable used vehicle car insurance rates, Nationwide can be on the expensive side for certain Mercury drivers.

- Slower Claims Process: Some Mercury owners report delays in the Nationwide claims process, as well as dissatisfaction with the resolution of their car insurance claims.

#9 – Travelers: Best for Excellent Customer Service

Pros

- IntelliDrive: Safe drivers can save money on Mercury car insurance by enrolling in IntelliDrive usage-based policies.

- Generous Discounts: Get the cheapest car insurance for Mercurys by taking advantage of Travelers’ multiple discount options. Compare discounts in our Travelers review.

- Excellent Financial Ratings: Travelers earns an A++ rating from A.M. Best, making it one of the most reliable Mercury insurance companies.

Cons

- Online Tools Lacking: Travelers may not be the best Mercury car insurance company if you want a streamlined digital experience.

- Fewer Local Agents: Mercury owners looking for in-person help will have a harder time finding a Travelers agent than they would at other car insurance companies.

#10 – Auto-Owners: Best for Quick Claims Service

Pros

- Solid Discounts: Save on Mercury car insurance by taking advantage of Auto-Owners’ generous discounts, including savings for bundling policies.

- Ample Coverage Options: Get the best Mercury auto insurance possible with Auto-Owners’ selection of coverage options.

- Claims Satisfaction: While Auto-Owners generally gets excellent customer service reviews, Mercury owners are particularly impressed with its quick claims resolutions.

Cons

- Costly Premiums: Auto-Owners doesn't typically have the cheapest car insurance for Mercurys. Explore rates in our Auto-Owners car insurance review.

- Coverage Restrictions: Some Auto-Owners car insurance options may not be available to older Mercury models.

The Best Mercury Car Insurance Rates by Company

Finding affordable used vehicle car insurance rates for Mercurys is usually easy. Mercurys are considered reliable used cars and typically don’t cost much to repair or replace.

Check below to see how much you might pay for your Mercury car insurance from our top companies:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $80 | $175 |

| Auto-Owners | $68 | $155 |

| Farmers | $85 | $180 |

| Geico | $70 | $150 |

| Liberty Mutual | $78 | $165 |

| Nationwide | $77 | $162 |

| Progressive | $65 | $145 |

| State Farm | $75 | $160 |

| Travelers | $82 | $170 |

| USAA | $60 | $140 |

As you can see, a minimum insurance policy is usually affordable for a Mercury. Most drivers opt for a liability car insurance plan since most Mercurys don't need more extensive coverage.

How to Save Money on Mercury Car Insurance

There are plenty of ways to see even lower car insurance rates on your Mercury, including the following:

- Look for car insurance discounts.

- Lower the coverage limits in your policy.

- Increase your deductible.

- Keep your driving record clean.

One of the most important steps to take while looking for cheap insurance is to compare quotes with as many companies as you can. Most companies make it easy to get free insurance quotes online — simply fill out the request form on the company’s website to get a price.

Even though comparing quotes is integral to finding an affordable policy, looking at different companies individually can be time-consuming. If you want to save time, an online quote-generating tool can give you multiple rates at once.

Top ways customers save money on their car insurance include enrolling in a usage-based insurance (UBI) program. However, UBI programs are not right for every driver, so it's important to understand how they work before you enroll.

Most of our top companies for Mercurys offer at least one type of UBI program. For example, Allstate and Nationwide both offer a discount of up to 40% to the safest Mercury drivers.

Best Mercury Car Insurance Discounts

While used car insurance rates are typically low, there’s always room to save more.

One of the most important things to look for when shopping for car insurance is discounts. Take a look below to see a selection of discounts from our top companies.

Some Mercury car insurance providers also offer exclusive savings for professional memberships and certain jobs, including car insurance discounts for teachers and educators. Always shop around to see if you can find an insurer that caters savings to you.

Find the Best Car Insurance Companies for Mercurys Today

Although there are things you should keep in mind before purchasing a used car like a Mercury, one benefit is that they usually come with lower car insurance rates.

Looking to buy a used car? Read this first: http://t.co/QcPgDhKDgv pic.twitter.com/tb1aaoIxrC

— Allstate (@Allstate) February 16, 2015

Understanding what kind of car insurance you really need for a Mercury can help you find the best rates possible. While some Mercurys benefit from a full coverage policy, most drivers will be fine with a minimum insurance policy.

While Mercury insurance is usually cheap, you should still compare quotes to find affordable rates. To see Mercury insurance rates in your area, enter your ZIP code into our free quote generator today.

FAQs

Is Mercury insurance expensive?

While some drivers will see higher rates, most drivers find very affordable Mercury car insurance prices. While there are many factors that affect car insurance rates, used cars are typically cheaper to insure than new vehicles.

Who has the best Mercury car insurance rates?

The best car insurance companies for you depend on your needs, but our research shows that State Farm, Geico, and Allstate have the best car insurance rates for Mercurys.

How much does Mercury car insurance cost?

The amount you pay for car insurance depends on your situation, but the average Mercury owner pays $75 per month for minimum insurance and $160 for full coverage. To find the lowest rates for your Mercury, enter your ZIP code into our free quote-generating tool.

Do all car insurance companies sell used car insurance?

You may run into a few issues buying car insurance for a used car, but most companies will gladly sell you a policy for your Mercury.

Do you need full coverage car insurance for a Mercury?

Full coverage policies are recommended for people with new or expensive vehicles that they can’t afford to replace outright. Since Mercurys are older, used cars, you’ll probably be fine getting less coverage. If you do want full coverage, picking the right company is crucial. For example, if you don't drive very often, shopping at the best low-mileage car insurance companies can help you save significantly.

Which Mercury is the cheapest to insure?

While rates can vary significantly, the Mariner is usually the cheapest Mercury model to insure.

What are easy ways to save on Mercury car insurance?

Since Mercury rates are typically low, finding affordable policies isn’t usually a hard task. If you want to save even more, consider trying a UBI program, finding car insurance discounts, and comparing quotes. You can also learn how to switch car insurance companies to ensure you always have the cheapest coverage possible.

What factors affect Mercury car insurance rates?

Factors that affect your Mercury car insurance rates include your ZIP code, gender, age, how old your Mercury is, your credit score, and your driving record.

Are Mercury cars reliable?

Mercurys are generally considered a reliable used car. Most experts agree that Mercurys are a safe choice for a first car for teens and new drivers.

Why did they stop selling Mercury cars?

Despite still commanding a loyal brand following, Ford decided to cancel Mercury in 2011 due to lagging sales.