The best car insurance companies for married couples are State Farm, Progressive, and Allstate. These providers offer the most competitive rates for comprehensive coverage.

State Farm excels with its personalized service and discounts, Progressive stands out for its flexibility and innovative online tools, and Allstate offers rewarding features for multiple drivers.

State Farm excels with its personalized service and discounts, Progressive stands out for its flexibility and innovative online tools, and Allstate offers rewarding features for multiple drivers.

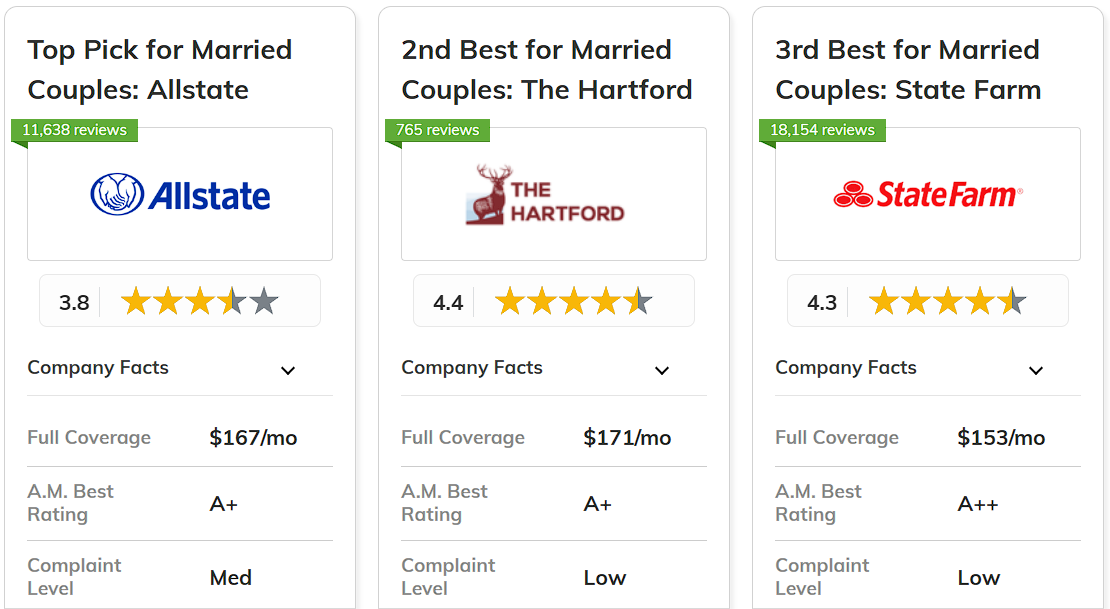

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Infrequent Drivers | Allstate | |

|

#2 | 25% | A+ | Exclusive Benefits | The Hartford |

| #3 | 20% | A++ | Customer Service | State Farm | |

|

#4 | 20% | A+ | Multi-Policy Savings | Nationwide |

| #5 | 20% | A | Discount Variety | Farmers | |

|

#6 | 20% | A | 24/7 Support | Liberty Mutual |

| #7 | 20% | A | Costco Members | American Family | |

| #8 | 12% | A+ | Budgeting Tools | Progressive | |

| #9 | 10% | A++ | Reliability Focused | Auto-Owners | |

| #10 | 8% | A++ | Unique Coverage | Travelers |

This guide evaluates factors like customer service, insurance coverage options, and savings opportunities to help married couples find the best auto insurance company.

Use our free online comparison tool above to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What You Should Know

- State Farm is the top choice for married couples seeking comprehensive coverage

- Progressive has cheapest insurance for married couples with rates as low as $62/month

- Look for policies that provide flexible coverage options and multi-car discounts

#1 – State Farm: Top Overall Pick

Pros

- Top-Ranked Customer Service: State Farm is considered one of the best car insurance companies for married couples due to its excellent customer service.

- Bundling Benefits: With a 17% bundling discount, State Farm offers significant savings for married couples who bundle home and auto insurance.

- Competitive Full Coverage Rates: State Farm has cheap full coverage car insurance for married couples starting at $153/month. Compare rates in our review of State Farm.

Cons

- Limited Advanced Tools: Compared to other car insurance companies for couples, State Farm may lack some advanced budgeting tools.

- Less Competitive Discounts: Some State Farm car insurance discounts are lower for married couples compared to other companies.

#2 – Progressive: Best for Budgeting Tools

Pros

- Robust Budgeting Tools: Progressive is top-rated for married couples, thanks to its extensive budgeting tools. Learn more in our Progressive review.

- High Industry Standing: Progressive’s strong performance and stability make it a preferred choice among the best car insurance companies for couples.

- Bundling Savings: Progressive provides notable savings for married couples who bundle policies or insure multiple vehicles.

Cons

- Higher Rates for Some Profiles: Couples with Progressive car insurance report high rate increases at policy renewal, even with discounts.

- Less Competitive Discounts: Progressive car insurance discounts are lower for married couples compared to other insurers, especially its bundling discount.

#3 – Allstate: Best for Infrequent Drivers

Pros

- Tailored for Infrequent Drivers: Allstate usage_based insurance policies offer 30%-40% discounts for married couples who drive less.

- Generous Savings: With a 25% bundling discount, Allstate provides substantial savings on auto insurance for couples.

- Exceptional Service: According to our Allstate review, the company ranks among the best auto insurance companies for married couples in terms of customer satisfaction.

Cons

- Higher Premiums for Some Drivers: Allstate's higher costs make it one of the most expensive insurance companies for married couples.

- Complex Claims Process: Allstate’s claims process can be more complicated compared to other auto insurance companies for married couples.

#4 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Savings: Nationwide offers a 20% multi-policy discount on car insurance for married couples.

- Wide Coverage Options: Known for its variety of coverage options, Nationwide is a leading choice for married couples. Explore more in our Nationwide review.

- Established Reputation: Nationwide’s reliable track record makes it one of the best insurance providers for married couples.

Cons

- Limited Local Offices: Fewer local insurance offices might mean less personal service for married couples.

- Inconsistent Service: Customer service experiences can vary for couples looking for affordable auto insurance.

#5 – Farmers: Best for Discount Variety

Pros

- Variety of Benefits: Farmers’ 20% bundling discount makes it a competitive choice for married couple car insurance. Get more details on our Farmers review.

- Adaptable Coverage Options: With flexible coverage options, Farmers is among the best car insurance companies for married couples.

- Strong Industry Presence: Farmers' established presence in the industry supports its position as one of the most reliable insurers for married couples.

Cons

- Higher Rates for Younger Drivers: Farmers car insurance premiums might be elevated for younger married couples.

- Inconsistent Customer Feedback: Mixed reviews of Farmers’ customer service could be a factor for married couples looking for the best car insurance companies.

#6 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Customer Support: Based on our Liberty Mutual review, its 24/7 support makes it ideal for married couples needing insurance assistance.

- Substantial Savings: With a 25% bundling discount, Liberty Mutual offers notable car insurance savings for married couples.

- Broad Coverage Options: With a wide range of coverage options, Liberty Mutual is a top choice among the best car insurance companies for couples.

Cons

- Higher Premiums: Liberty Mutual’s premiums may be higher compared to other insurance companies for married couples.

- Limited Regional Coverage: Married couple insurance coverage options with Liberty Mutual can differ by location.

#7 – American Family: Best for Costco Members

Pros

- Special Member Benefits: American Family offers exclusive perks for married couples who are Costco members.

- Comprehensive Coverage: American Family is a top choice for married couples due to its coverage options. View additional details in our American Family review.

- Attractive Savings: The 25% bundling discount offered by American Family provides considerable insurance savings for married couples.

Cons

- Regional Availability: Insurance options for married couples might be limited since AmFam is only available in 26 states.

- Variable Service Quality: Customer service can differ, influencing married couples' choice of car insurance company.

#8 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage Options: Our Travelers review ranks it among the best car insurance companies for couples due to its specialized coverage options.

- Top Industry Performance: Known for its industry experience and financial strength, Travelers is one of the most relaible car insurance companies for married drivers.

- Bundling Savings: Travelers offers significant married couple insurance discounts when you bundle home and auto insurance.

Cons

- Higher Rates for Some Profiles: Premiums might be elevated for certain drivers, impacting married couples seeking the best car insurance companies.

- Mixed Customer Service: Married couples in some states report poor Travelers insurance claims processing.

#9 – The Hartford: Best for Exclusive Benefits

Pros

- Exclusive Benefits: The Hartford provides unique benefits for senior couples looking for the best auto insurance companies.

- Reliable Service: Known for dependable service, The Hartford ranks well among the best car insurance companies for couples.

- Competitive Bundling Savings: Offering a 5% bundling discount, The Hartford provides some savings for married couples. Read more in our The Hartford review.

Cons

- Lower Bundling Savings: The 5% bundling discount is lower compared to other car insurance companies for married drivers.

- Limited Coverage Options: The Hartford may offer fewer coverage options than some other best car insurance companies for married couples.

#10 – Auto-Owners: Best for Reliability Focused

Pros

- Focus on Reliability: Auto-Owners is known for its reliable coverage and service when it comes to married couple car insurance.

- Excellent Industry Standing: With top-tier performance, Auto-Owners is a top pick for married couples. Get full details in our Auto-Owners review.

- Bundling Savings: The 10% bundling discount offered by Auto-Owners helps married couples save on their insurance.

Cons

- Higher Rates for Some Drivers: Auto-Owners may have higher premiums for certain profiles, which could be a concern for married couples.

- Limited Discount Variety: Fewer discount options are available compared to other auto insurance companies for married drivers.

Married Couple Insurance Costs and Discounts Comparison

Comparing auto insurance rates can significantly impact your overall savings. The tables below provide a detailed look at average insurance costs for minimum and full coverage policies from the best car insurance companies for married couples.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $71 | $167 | |

| $63 | $154 | |

| $64 | $158 | |

| $74 | $172 | |

|

$79 | $178 |

|

$66 | $161 |

| $62 | $149 | |

| $67 | $153 | |

|

$76 | $171 |

| $68 | $159 |

For married couples seeking the best car insurance options, Progressive shines with the lowest rates starting at $62/month. American Family, Auto-Owners, and Nationwide also provide competitive premiums.

However, Liberty Mutual has the highest rates at $79/month. Why is car insurance so expensive? That depends on your driving record and the kind of vehicle you want to insure.

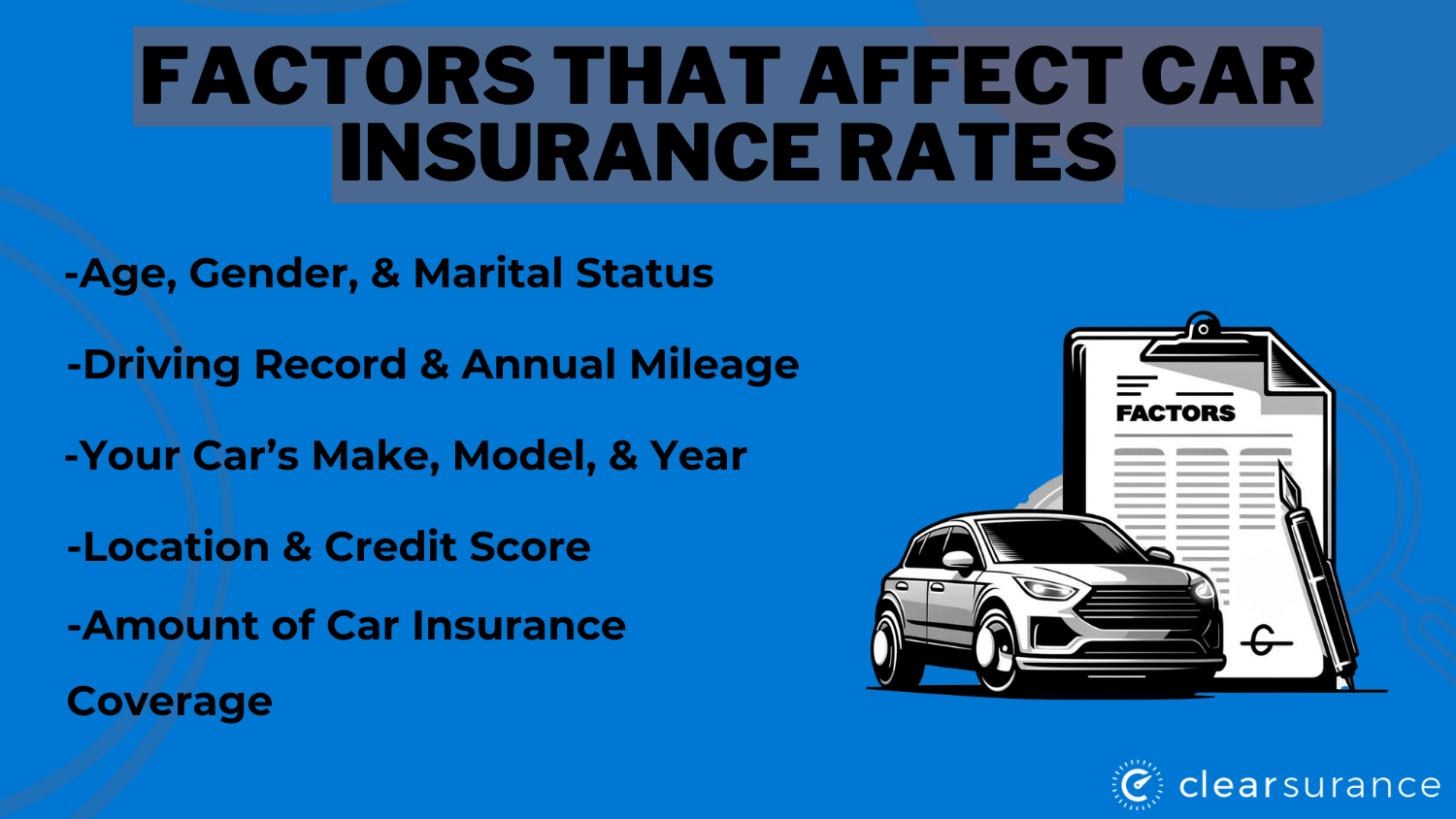

Marriage often leads to lower car insurance rates, primarily because insurers view married individuals as lower-risk drivers. Studies show that married people are less likely to be involved in accidents, which contributes to their reduced risk profile.

Unlocking Savings on Car Insurance for Married Couples

Consider several key discounts to save money on married couple car insurance. The multi-policy discount is a notable option, allowing you to bundle your car insurance with other policies, such as homeowners or renters insurance, for reduced rates.

Safe driver discounts are also available for those with clean driving records, as insurers reward accident-free histories. Additionally, many insurers offer lower premiums to couples with good credit histories.

If you and your spouse drive fewer miles than average, you might qualify for a low mileage discount, which is ideal for those with short commutes or remote work. Insuring multiple vehicles under the same policy can also lead to a multi-car discount.

Keep reading to learn more ways to save money on car insurance for married couples.

Getting the Best Car Insurance for Married Couples

The best car insurance companies for married couples are State Farm, Progressive, and Allstate.

Unlocking the best auto insurance rates as a married couple involves more than just choosing the first policy you find. By adopting a strategic approach, you can discover valuable savings and tailor your coverage to fit your unique needs.

Whether you’re seeking hidden discounts or reviewing your coverage, shop around and compare quotes from different insurers to find the kind of car insurance you really need.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers near you.

Frequently Asked Questions

What are the best car insurance companies for married couples?

The best car insurance companies for married couples often include providers like State Farm, GEICO, and Progressive. These companies offer competitive rates, multi-car discounts, and excellent customer service, making them top choices for married couples looking to save on their premiums.

How do married couples benefit from selecting the best car insurance?

Married couples can benefit from choosing the best car insurance companies through lower premiums, multi-car discounts, and enhanced coverage options. Many insurers offer special rates for married couples, recognizing that they often represent lower risk and a more stable household.

How does car insurance for married vs. single drivers compare?

Car insurance companies for married couples often provide lower rates to couples compared to single drivers. Additionally, insurers frequently offer more substantial discounts and better coverage options for married couples.

Do married couples get better car insurance rates?

Married couples do get cheaper auto insurance rates. This is due to the lower financial risk associated with married drivers.

What should married couples consider when choosing the best car insurance?

When selecting the best car insurance companies, married couples should consider factors such as discounts for multiple vehicles, bundling policies, coverage options, customer service, and financial stability. Comparing free insurance quotes from different providers can help find the best rates and coverage.

Which insurance is best for a car accident?

Having liability and full coverage car insurance covers you for damage done to another person's vehicle or property where you are at fault as well as damages to your own car.

Do the best car insurance companies offer discounts for married couples?

Yes, many of the best car insurance companies offer specific discounts for married couples. These can include multi-car discounts, bundling discounts for combining auto and home insurance, and loyalty discounts for long-term customers.

Can married couples save more by comparing car insurance quotes?

Yes, married couples can potentially save more by comparing quotes from different car insurance companies. Shopping around allows couples to take advantage of various discounts, find the best coverage options, and choose a provider that offers the most competitive rates.

What should married couples look for in car insurance customer service?

When choosing the best car insurance companies, married couples should look for excellent customer service, which includes responsive support, clear communication, and efficient claims handling. Positive customer reviews and high satisfaction ratings are indicators of a company's commitment to quality service.

How many times can you use car insurance?

You may claim car insurance multiple times, but your rates will increase, and your provider can refuse to renew your policy due to a high number of claims.