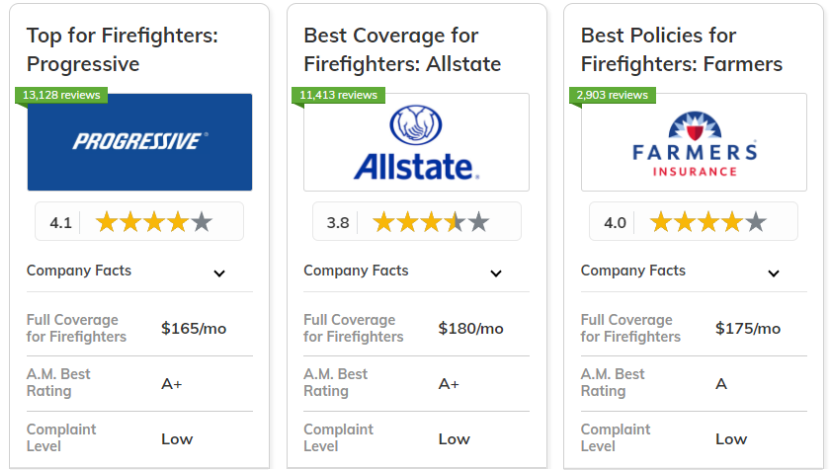

The best car insurance companies for firefighters are Progressive, Allstate, and Farmers, offering competitive rates and firefighter-specific discounts. Progressive stands out as the top pick for its affordable coverage options, with rates starting at $85 per month.

Allstate and Farmers also provide tailored policies that meet the unique needs of first responders, helping you understand what kind of car insurance do you really need. This article compares these top providers based on affordability, coverage, and firefighter-friendly benefits.

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Competitive Rates | Progressive | |

| #2 | 25% | A+ | Broad Coverage | Allstate | |

| #3 | 20% | A | Customizable Policies | Farmers | |

|

#4 | 20% | A+ | Reliable Service | Nationwide |

| #5 | 25% | A | Loyalty Rewards | American Family | |

| #6 | 25% | A++ | Affordable Pemiums | Geico | |

|

#7 | 25% | A+ | High Satisfaction | Erie |

|

#8 | 5% | A+ | AARP Benefits | The Hartford |

| #9 | 17% | B | Trusted Brand | State Farm | |

|

#10 | 25% | A | First-responder Discounts | Liberty Mutual |

Enter your ZIP code above into our free comparison tool to see how much is car insurance for teachers in your area.

What You Should Know

- Progressive offers the best rates starting at $85/month

- Up to 15% firefighter-specific discounts and tailored policy options

- Enhanced benefits for equipment loss and on-duty vehicle use

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: According to our Progressive insurance customer reviews, Progressive offers some of the lowest minimum coverage rates for car insurance companies for firefighters at $95 per month.

- Bundling Discount: Provides a 10% bundling discount, helping firefighters save on multiple policies.

- Flexible Payment Options: Offers flexible payment plans, making it easier for firefighters to manage their insurance costs.

Cons

- Limited Discount: The bundling discount of 10% is lower compared to other car insurance companies for firefighters.

- Coverage Options: Some coverage options might be limited unless upgraded to full coverage plans.

#2 – Allstate: Best for Broad Coverage

Pros

- Broad Coverage: Offers extensive coverage options tailored for firefighters, with minimum coverage rates starting at $110 per month.

- High Bundling Discount: Provides a substantial 25% discount for bundling multiple policies, as mentioned in many Allstate reviews.

- Strong Financial Rating: An A+ rating from A.M. Best assures reliability for firefighters seeking stable car insurance companies.

Cons

- Higher Minimum Rates: Minimum coverage rates at $110 per month are higher than some competitors offering insurance for firefighters.

- Policy Customization: Customizing policies can lead to increased premiums for firefighters looking for specific coverage needs.

#3 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Allows firefighters to tailor their coverage with minimum rates starting at $105 per month.

- Decent Bundling Discount: A 20% bundling discount provides notable savings for firefighters with multiple policies.

- Personalized Service: Known for its personalized service, catering to the specific needs of firefighters, read our Farmers review for more information.

Cons

- Above-Average Rates: Minimum coverage rates at $105 per month are slightly higher compared to other car insurance companies for firefighters.

- Limited National Availability: May not be available in all states, limiting options for some firefighters.

#4 – Nationwide: Best for Reliable Service

Pros

- Reliable Service: Our analysis of Nationwide review reveals Nationwide is known for dependable customer service, offering firefighters minimum coverage at $100 per month.

- Strong Bundling Discount: A 20% discount for bundling insurance policies offers savings for firefighters.

- Financial Stability: With an A+ rating, Nationwide is a reliable choice among car insurance companies for firefighters.

Cons

- Limited Discount Offers: Discount programs beyond bundling are not as comprehensive as some competitors.

- Higher Premiums for Full Coverage: While minimum coverage is competitive, full coverage rates can be higher for firefighters.

#5 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Provides excellent loyalty rewards for firefighters, with minimum coverage rates starting at $98 per month.

- Generous Bundling Discount: Firefighters can save with a 25% bundling discount on their car insurance policies. Find more details about this provider in our guide: American Family review.

- Multiple Discount Options: Offers various discounts, including safe driving and loyalty programs, making it an appealing choice for firefighters.

Cons

- Higher Rates for New Customers: New firefighter customers might not immediately benefit from loyalty rewards, affecting initial rates.

- Regional Availability: Coverage is limited to certain states, restricting access for some firefighters.

#6 – Geico: Best for Affordable Premiums

Pros

- Affordable Premiums: Offers some of the most affordable minimum coverage rates for firefighters at $85 per month. Refer to our guide titled "Top ways customers have saved money on car insurance rates."

- High Bundling Discount: Firefighters can benefit from a 25% discount when bundling policies.

- Exceptional Financial Strength: With an A++ rating from A.M. Best, Geico is one of the most financially secure car insurance companies for firefighters.

Cons

- Limited Local Agents: Primarily operates online, which might not suit firefighters who prefer in-person service.

- Discount Restrictions: Some discounts may have specific eligibility requirements that limit their availability for all firefighters.

#7 – Erie: Best for High Satisfaction

Pros

- High Satisfaction: Known for exceptional customer satisfaction among firefighters, offering minimum coverage at $90 per month, according to Erie reviews.

- Generous Bundling Discount: Firefighters can enjoy a 25% bundling discount, making it an affordable option.

- Comprehensive Policy Options: Offers a range of policy options tailored to meet the unique needs of firefighters.

Cons

- Limited Coverage Area: Not available nationwide, limiting its accessibility for firefighters in certain regions.

- Strict Eligibility: Certain discounts and policy options might have strict eligibility criteria for firefighters.

#8 – The Hartford: Best for Benefits Specialist

Pros

- AARP Benefits: Offers exclusive AARP benefits for senior firefighters, with minimum coverage rates starting at $103 per month.

- Unique Bundling Discount: A 5% bundling discount is available, providing savings for older firefighters seeking additional coverage options.

- Customized Coverage: Our The Hartford review indicates this provider offers tailored coverage plans for senior firefighters, ensuring adequate protection.

Cons

- Higher Minimum Rates: Minimum coverage rates at $103 per month are higher compared to some car insurance companies for firefighters.

- Lower Bundling Discount: The 5% bundling discount is less competitive compared to other companies offering discounts for firefighters.

#9 – State Farm: Best for Trusted Brand Name

Pros

- Trusted Brand: State Farm is a well-known name offering firefighters minimum coverage at $92 per month, as noted in many State Farm reviews.

- Moderate Bundling Discount: A 17% bundling discount provides reasonable savings for firefighters.

- Financial Stability: With a B rating from A.M. Best, State Farm remains a trusted option for many firefighters.

Cons

- Limited Discounts: Discount programs might not be as extensive as those offered by other car insurance companies for firefighters.

- Potential Higher Premiums: While minimum rates are competitive, full coverage premiums can be relatively higher for some firefighters.

#10 – Liberty Mutual: Best for First-Responder Discounts

Pros

- First-Responder Discounts: Offers special discounts for firefighters, with minimum coverage rates starting at $108 per month.

- High Bundling Discount: Based on our Liberty Mutual insurance reviews, Firefighters can save up to 25% by bundling policies.

- Comprehensive Coverage Options: Provides a range of coverage options to cater to the specific needs of firefighters.

Cons

- Higher Minimum Rates: Minimum coverage rates at $108 per month are on the higher side compared to other companies offering insurance for firefighters.

- Online Service Limitations: Some services and claims processes might be limited to online platforms, which may not suit all firefighters.

Car Insurance Companies for Firefighters: A Closer Look at Coverage Costs

Understanding car insurance and its cost are crucial for making informed decisions. This table provides a clear comparison of minimum and full coverage rates from various insurance companies, helping you evaluate which options may suit your budget. Geico offers the most affordable rates for both minimum and full coverage at $85 and $150, respectively.

Erie follows closely, with $90 for minimum and $160 for full coverage. State Farm also provides competitive pricing, particularly for full coverage at $158. American Family, Nationwide, and Progressive present moderate rates, with minimum coverage ranging from $95 to $100 and full coverage between $165 and $170.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $110 | $180 |

| American Family | $98 | $168 |

| Erie | $90 | $160 |

| Farmers | $105 | $175 |

| Geico | $85 | $150 |

| Liberty Mutual | $108 | $178 |

| Nationwide | $100 | $170 |

| Progressive | $95 | $165 |

| State Farm | $92 | $158 |

| The Hartford | $103 | $173 |

Companies like Allstate, Farmers, and Liberty Mutual offer slightly higher rates for both types of coverage, with minimum coverage reaching up to $110 and full coverage up to $180. This table offers a snapshot of the varying auto insurance rates available across different providers.

In summary, comparing insurance rates is key to finding the best coverage that fits your financial plan. While Geico appears to be the most cost-effective choice, other companies also provide competitive options, depending on your specific coverage needs.

Exclusive Car Insurance Discounts for Firefighters: Top Providers and Savings

Firefighters can benefit significantly from specialized car insurance discounts offered by top providers. Insurance companies often recognize the risks and dedication associated with firefighting, providing tailored discounts that can help lower your car insurance premiums.

For instance, providers like Allstate, Geico, and State Farm offer various discounts, including safe driver, multi-policy, and defensive driving discounts, highlighting the cost benefits to taking a defensive driving course. These discounts are designed not only to reward safe driving habits but also to accommodate the unique needs of firefighters.

The importance of obtaining multiple insurance quotes cannot be overstated; by comparing options from different insurers, firefighters can identify the most comprehensive coverage at the best price.

This process ensures they are not only receiving discounts but also adequate protection tailored to their profession.

In conclusion, firefighters should explore and leverage these discounts to maximize their savings on car insurance.

Seeking quotes from various providers is a crucial step in this process, as it allows firefighters to take advantage of competitive rates and choose the insurance plan that best suits their needs.

Case Studies: Real-Life Experiences of Firefighters With Car Insurance

Case Study #1 – Maximizing Savings With Multi-Policy Discounts: John, a firefighter in Texas, bundled his home and auto insurance with Progressive, resulting in a 20% discount on his premiums. This multi-policy approach helped him save over $17 monthly while maintaining comprehensive coverage.

Case Study #2 – Customizing Coverage for Unique Needs: Emily, a firefighter in California, opted for Farmers' customizable policies, allowing her to add roadside assistance and rental car coverage. This tailored plan provided peace of mind, knowing she was covered in all situations.

Case Study #3 – Affordable Premiums for New Drivers: Mike, a newly licensed firefighter in Florida, found Geico’s affordable rates perfect for his budget. With premiums starting at $85 per month, he secured essential coverage without straining his finances.

Case Study #4 – Loyalty Rewards Leading to Cost-Effective Coverage: Sarah, a longtime customer of American Family Insurance, leveraged loyalty rewards to receive reduced premiums. With what is considered a clean driving record over five years, she earned a 15% discount on her auto insurance.

Case Study #5 – Navigating First-Responder Discounts: James, a firefighter in New York, discovered Liberty Mutual's exclusive first-responder discount. This unique benefit reduced his monthly premium by 10%, providing both financial relief and coverage that understood his profession's risks.

These case studies underscore the importance of exploring different car insurance options to find the best fit for individual needs. Whether through multi-policy discounts, customizable coverage, or exclusive first-responder benefits, firefighters have access to a range of solutions designed for them.

By examining these real-life examples, first responders can gain insights into optimizing their insurance choices. Taking the time to research and compare options can lead to significant savings and comprehensive coverage, ensuring peace of mind on and off the job.

Making the Best Choice for Your Car Insurance Needs as a Firefighter

Selecting the right car insurance as a firefighter involves balancing affordability, coverage options, and the unique discounts available for first responders.

While the best car insurance companies for firefighters, like Progressive, Allstate, and Farmers, stand out for their tailored benefits and competitive rates, providers such as Geico and Erie offer some of the most affordable premiums.

Explore more details on what to consider when getting car insurance quotes online.

It's crucial to compare multiple quotes to find a policy that not only fits your budget but also provides comprehensive coverage suited to your needs. By leveraging exclusive discounts and carefully evaluating each provider's offerings, firefighters can secure the best possible insurance protection for their unique situation.

Frequently Asked Questions

What is the best car insurance company for first responders?

The best car insurance company for first responders is Progressive. It stands out for offering firefighter-specific benefits and competitive rates starting at $85 per month. Progressive provides tailored coverage options that address the unique needs of first responders, making it the top overall pick.

Which type of vehicle insurance is best for firefighters?

A comprehensive car insurance policy offers complete protection by covering both third-party liabilities car insurance coverage and damages to your vehicle. Additionally, if an accident results in your death, the policy provides compensation to your family members. This type of insurance ensures extensive coverage for a wide range of potential risks.

Who is the top 5 insurance companies for firefighters?

The top 5 insurance companies for firefighters are Progressive, Allstate, Farmers, Geico, and Erie. Progressive offers affordable premiums and tailored benefits. Allstate is known for its broad coverage and discounts. Farmers provides customizable policies, Geico offers some of the most affordable rates, and Erie is recognized for high customer satisfaction.

Who has the lowest insurance rates for firefighters?

Geico has the lowest insurance rates for firefighters, with premiums starting at $85 per month for minimum coverage. It also offers competitive full-coverage rates, making it an excellent option for those looking to save on their car insurance premiums.

Which insurance is best for car accident for firefighters?

Comprehensive insurance covers both the owner or driver for damage to their car and damage to other vehicles or property, regardless of fault. Check out more information on our guide titled "5 Steps to Take After a Car Accident."

What type of car insurance is cheapest for firefighters?

The cheapest type of car insurance for firefighters is usually minimum liability coverage. This basic level of coverage typically meets state legal requirements and offers lower premiums than full coverage. While it provides limited protection, it can be a cost-effective option for firefighters looking to save on their monthly insurance costs.

Which insurance company has the highest customer satisfaction for firefighters?

Erie Insurance has the highest customer satisfaction for firefighters. It consistently ranks well for its exceptional customer service, comprehensive policy options, and competitive rates, offering a positive experience for policyholders seeking a provider that understands their unique needs.

What is the lowest form of car insurance for firefighters?

The minimum amount of car insurance you'll typically need is state-required liability coverage, including how much bodily injury liability is needed. This helps pay for some or all injuries and damages you're liable for in an accident. Common limits are $25,000/$50,000/$25,000, meaning $25,000 in bodily injury per person.

What car insurance is the cheapest for full-coverage for firefighters?

Geico and Erie offer the cheapest full-coverage car insurance for firefighters. Geico provides full coverage starting at $150 per month, while Erie offers full coverage at $160 per month. Both companies balance affordability with comprehensive coverage, making them ideal choices for cost-conscious firefighters.

At what age is car insurance cheapest for firefighters?

Car insurance companies for high-risk drivers often charge the most for teens due to their higher risk of accidents. However, rates become cheaper as drivers age into their 20s and develop more reliable driving habits, with the lowest costs typically found between the ages of 35 and 55.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.