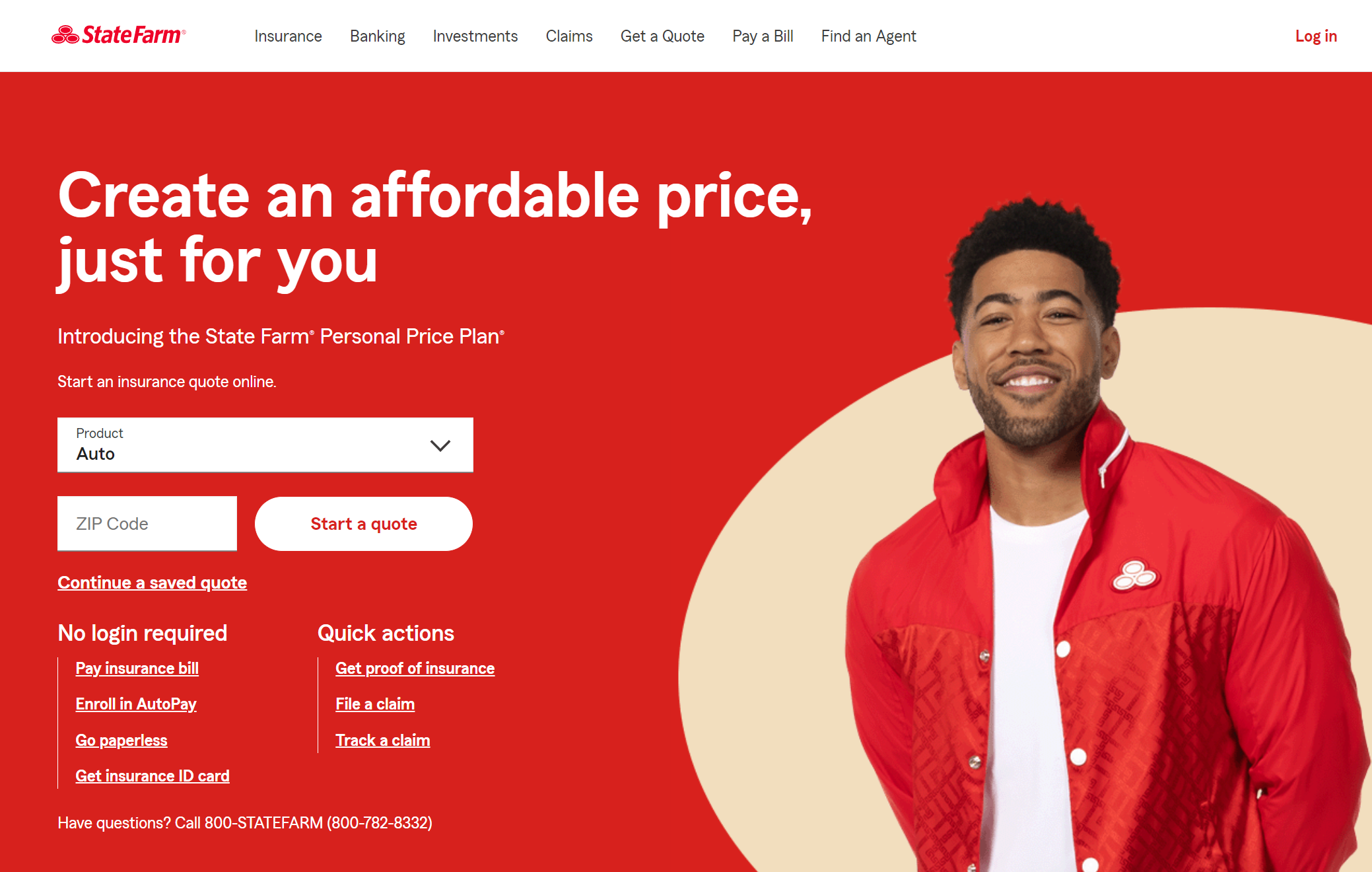

The best car insurance companies for families are State Farm, USAA, and Allstate, with State Farm leading as the top pick overall for its competitive rates starting at $45/month.

These providers offer family-friendly car insurance discounts, exceptional customer service, and comprehensive coverage.

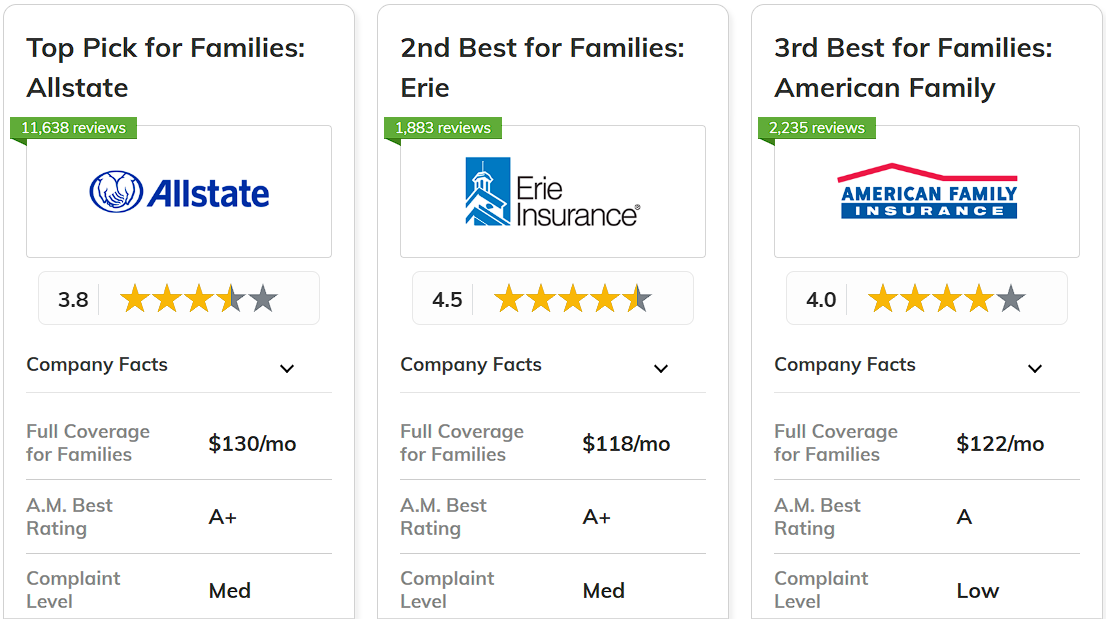

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Comprehensive Coverage | Allstate | |

|

#2 | 25% | A+ | Youth Discounts | Erie |

| #3 | 25% | A | Costco Members | American Family | |

|

#4 | 25% | A | Customizable Policies | Liberty Mutual |

|

#5 | 20% | A+ | Bundle Discounts | Nationwide |

| #6 | 20% | A | Policy Options | Farmers | |

| #7 | 17% | A++ | Family-Friendly Discounts | State Farm | |

| #8 | 13% | A++ | Flexible Policies | Travelers | |

| #9 | 10% | A++ | Customer Service | USAA | |

| #10 | 10% | A+ | Dividend Payments | Amica |

Choosing one of these top-rated companies ensures your family gets the best protection and value. Explore how these options can provide peace of mind and financial savings for your household.

Take the first step toward cheaper car insurance rates. Enter your ZIP code above to see how much you could save.

What You Should Know

- State Farm is the best car insurance company for families costing $45/month

- The best car insurance companies for families offer discounts for students

- Bundling discounts are the easiest way to save money on family auto insurance

#1 – State Farm: Top Overall Pick

Pros

- Family-Friendly Discounts: State Farm offers various discounts that specifically benefit families, such as multi-car and multi-policy savings.

- Affordable Rates: Competitive rates starting at $45/month make it an economical choice for family budgets.

- Safe Driving Discounts: Families with good driving records can benefit from additional savings. Review State Farm for comprehensive details.

Cons

- Limited Discounts: State Farm's family car insurance discount options might not be as beneficial for single-car families.

- Customer Service Variability: The quality of family auto insurance customer service can vary by agent and region.

#2 – USAA: Best for Customer Service

Pros

- Exceptional Customer Service: USAA is known for its high-quality customer service with family car insurance.

- 24/7 Assistance: Families can access car insurance customer support at any time, providing peace of mind in emergencies. Read our USAA review for more information.

- Personalized Service: USAA offers tailored family car insurance solutions that meet the specific needs of different drivers.

Cons

- Eligibility Restrictions: USAA car insurance is available only to military families.

- Limited Physical Locations: Families may find fewer physical locations for in-person support compared to other family car insurance companies.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Broad Coverage Options: Allstate offers comprehensive coverage that meets the diverse needs of families. Explore our Allstate review for the complete list.

- Family-Friendly Add-Ons: Options such as roadside assistance and rental car coverage benefit families during emergencies.

- Flexible Policy Terms: Drivers can choose from various family auto insurance coverage levels to suit their specific needs.

Cons

- Discounts May Not Always Apply: Some family insurance discounts and benefits might not apply to all situations.

- Customer Service Mixed Reviews: While family auto insurance coverage is comprehensive, some drivers report mixed experiences with customer service.

#4 – Nationwide: Best for Bundle Discounts

Pros

- Significant Bundle Discounts: Nationwide offers substantial savings on family insurance when you bundle multiple policies.

- Convenient Policy Management: Bundling insurance policies simplifies management for busy families. Check out our Nationwide review for more.

- Enhanced Coverage Options: Bundling can enhance family auto insurance coverage at a lower overall cost.

Cons

- Bundling Requirements: Families must meet specific criteria to qualify for bundle discounts.

- Limited Discounts for Single Policies: Those not interested in bundling may not qualify for cheap family car insurance rates.

#5 – Amica: Best for Dividend Payments

Pros

- Dividend Payments: Amica offers annual dividend payments on family car insurance policies to provide additional savings.

- Excellent Claims Service: In J.D. Power surveys, Amica ranks in the top ten for family insurance claims handling. Here are six tips for filing car insurance claims.

- Cheap Rates for Families: Amica family car insurance rates are competitively priced starting at $48/month.

Cons

- Eligibility and Requirements: Certain conditions must be met to qualify for dividend payments on family auto insurance.

- Dividend Payments May Be Small: The amount of dividend payments on car insurance might not significantly impact some family budgets.

#6 – Farmers: Best for Policy Options

Pros

- Variety of Policy Options: Farmers offers a wide range of family insurance policy options. See our Farmers review for a full list.

- Customizable Coverage: Families can tailor their car insurance policies to include specific protections that are important to them.

- Additional Coverage Choices: Farmers provides options like rental reimbursement and roadside assistance to enhance family insurance coverage.

Cons

- Complex Policy Options: The variety of family car insurance options can be overwhelming for some.

- Varied Policy Costs: Family car insurance costs for policy options can vary widely depending on where you live.

#7 – Travelers: Best for Flexible Policies

Pros

- Highly Flexible Policies: Travelers offers flexible family car insurance policies.

- Adaptable to Family Changes: Family insurance policies can be adjusted to accommodate life events like a new baby or teenage drivers.

- Flexible Payment Plans: Travelers provides flexible payment family insurance payment plans to help manage premiums. Read more in our Travelers review.

Cons

- Potential for Increased Premiums: Flexible family car insurance might lead to increased premiums depending on the choices made.

- Varied Customer Support Reviews: Farmers family car insurance customer experiences vary depending on where you live.

#8 – American Family: Best for Costco Members

Pros

- Special Discounts for Costco Members: American Family offers family car insurance discounts if you buy coverage through Costco.

- Additional Savings Opportunities: Membership discounts can lead to substantial savings on family auto insurance. Learn how in our American Family review.

- Competive Family Rates: AmFam car insurance quotes for families are cheaper than many other companies at $51/month.

Cons

- Limited to Certain Families: AmFam family insurance benefits are exclusive to Costco members.

- Membership Fees: The cost of maintaining a Costco membership might offset the family insurance discounts.

#9 – Erie: Best for Youth Discounts

Pros

- Youth Discounts: Erie offers discounts for families with young or new drivers. Get additional details in our Erie review.

- Family Bundle Discounts: Bundle auto, home, and other insurance policies to save money on family car insurance plans.

- Accident Forgiveness: Erie includes accident forgiveness in family auto insurance policies, which can be helpful for families with young or inexperienced drivers.

Cons

- Complex Policy Choices: The variety of family insurance policy options can be confusing to navigate.

- Potential for Rate Increases: Families may experience car insurance rate increases after claims, which can impact affordability.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- Multi-Policy Discounts: Liberty Mutual offers family car insurance discounts for bundling auto and home insurance. See savings in our Liberty Mutual review.

- Family Safety Programs: Liberty Mutual driving programs reward safe driving with cheaper family auto insurance rates.

- Teacher and Student Discounts: Drivers can tailor family car insurance policies for students and teachers with special coverages and discounts.

Cons

- Poor Claims Service: Liberty Mutual receives bad reviews from many customers for its family car insurance claims handling.

- Discount Limitations: Some may find the available family insurance discounts to be less generous compared to other providers.

Compare Family Car Insurance Rates for the Best Value

When it comes to monthly family auto insurance rates, USAA offers the lowest minimum coverage at $45 and full coverage at $110. Amica follows with competitive monthly rates at $48 for minimum and $115 for full coverage.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $130 | |

| $51 | $122 | |

| $48 | $115 | |

|

$49 | $118 |

| $54 | $128 | |

|

$56 | $132 |

|

$52 | $125 |

| $50 | $120 | |

| $53 | $126 | |

| $45 | $110 |

Each provider offers various benefits and features tailored to meet diverse family needs, so it's worth comparing their policies to find the best fit for your coverage requirements and budget.

Learn More: Liability vs. Full Coverage: Car Insurance Explained.

Savings Tips for Lowering Family Car Insurance Premiums

Discover top car insurance discounts for families with providers like Allstate, USAA, and State Farm. Our table highlights savings on multi-policy, safe driving, and good student discounts to help you get the best value.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Safe Driving Bonus, Good Student, Bundling | |

| Multi-Policy, Generational, Safe Driver, Good Student | |

| Loyalty, Multi-Line, Good Student, Bundling | |

|

Multi-Car, Safe Driver, Accident-Free, Multi-Policy |

| Multi-Car, Good Student, Safe Driver, Bundling | |

|

Multi-Policy, Bundling, Accident-Free, New Car |

|

Multi-Car, SmartRide®, Accident-Free, Family Plan |

| Multi-Car, Good Student, Safe Driver, Accident-Free | |

| Multi-Policy, Safe Driver, New Car, Good Student | |

| Multi-Policy, Family Legacy, Good Student, Safe Driver |

Seek out family-friendly discounts such as multi-policy, which is an easy way to reduce rates if you have home or renters insurance through the same car insurance company.

Lowering your car insurance costs with top providers for families involves comparing quotes from companies like State Farm, USAA, and Allstate to find the best rates.

Selecting the right coverage level and increasing your deductible can also lower premiums. Utilizing telematics programs, maintaining a good credit score, and driving a safe vehicle are the top ways customers have saved money on car insurance

Regularly review your family car insurance policy and look for discounts to ensure the best value.

Save with the Best Family Car Insurance Providers

To lower car insurance costs, compare quotes from the best car insurance companies for families. Top providers like State Farm, USAA, and Allstate offer family-friendly discounts such as multi-policy, safe driving, and good student discounts.

There are more ways to get cheap car insurance for families, such as comparing quotes from multiple companies and reviewing your policy to adjust coverage and take advantage of available discounts.

Finding affordable car insurance for families doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

What factors should I consider when choosing car insurance for my family?

When choosing family car insurance, consider factors such as coverage options, family-friendly discounts, customer service, and overall affordability. It’s also important to review the provider’s reputation for handling claims and their financial stability.

How can I find the best family car insurance rates?

To find the best rates, compare car insurance quotes from multiple providers, including top-rated companies like State Farm, USAA, and Allstate. Look for discounts such as multi-policy, safe driving, and good student discounts to maximize your savings.

What are the benefits of having State Farm as my family car insurance provider?

State Farm is known for its competitive rates starting at $45/month, family-friendly discounts, and excellent customer service. They offer a range of coverage options and have a strong reputation for reliability.

How does USAA customer service compare to other family car insurance providers?

USAA is highly regarded for its exceptional customer service, particularly for military families and veterans. They offer tailored coverage options and support that cater specifically to their members' needs. Compare State Farm vs. USAA car insurance to learn more.

What kind of coverage is typically included with Allstate family car insurance?

Allstate offers comprehensive coverage options, including liability, collision, and comprehensive coverage, as well as additional features like accident forgiveness and new car replacement.

What family car insurance discounts are available?

Families can benefit from various discounts, such as multi-policy discounts (for bundling auto and home insurance), safe driving discounts, good student discounts, and discounts for installing safety features in your vehicle.

Is it worth it to switch providers to save money on family car insurance?

Switching car insurance providers can be worth it if you find a company that offers better rates or more suitable coverage for your family. Find out how to switch car insurance companies

How can I reduce my family car insurance premiums?

Consider increasing your deductible, maintaining a good credit score, participating in telematics programs, and shopping around for the best rates. Also, review and adjust your coverage levels based on your current needs.

What role does my credit score play in determining my family car insurance rate?

How does my credit score affect my insurance premium? Your credit score can significantly impact your car insurance rate. A higher credit score often leads to lower premiums because insurers view you as less risky. Conversely, a lower credit score may result in higher rates.

How often should I review my family car insurance policy?

You should review your car insurance policy at least once a year or whenever significant life changes occur, such as buying a new car, moving, or changes in your family’s circumstances.